| If you are having issues reading this email please click here to view online |

|

| Wine Investment Offer |

| Krug 2002 |

|

|

Krug 2002 Severely Limited Availability of 6 bottle Cases on ALLOCATION basis. Stock will be allocated to clients against their historical purchases and future commitment to purchases of Champagne. 'The Krug 2002 is in another league.' Michael Edwards - Jan 2016 Key Investment Points

|

||

|

||||

|

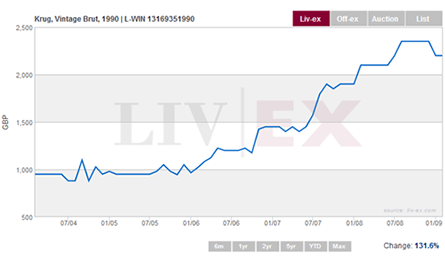

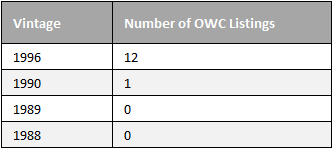

Testing Notes "This was tasted immediately after Krug 2003 and was so much more discreet and savoury than the 2003 on the nose. It is chock-full of acidity and life, is really muscular and much more intellectual. For the moment the 2002 is less obviously fruity than the 2003 - clearly a champagne for long ageing - like many other 2002s - but much more backward than any I can think of immediately. There is nothing in excess; a great example of the Krug art of assemblage. Very solid and concentrated but not heavy at all. The finish is notably dry. This may be an intellectual wine but it's certainly not hard work! For Julie Cavil of the Krug blending team, this wine is 'a racehorse'. 'You were still riding regularly then', winemaker Eric Lebel reminds her with a smile. For them '2002 is about the generosity of Nature. We had to work hard to limit the yield a bit. There was lots of richness in the base wines; each sample had great generosity'. I look forward very much to following the development of this exceptional wine." Jancis Robinson | Score: 19/20 Investment analysis There is no question that the 2002 vintage for Champagne sits alongside the great years of '96, '90, '89 and '88, and the latest release from Krug has the capacity to go beyond the aforementioned and set a new benchmark. As mentioned above, the value against previous years of an equal quality is obvious and it is the growth pattern witnessed during the period 5 years after release which make makes purchasing Krug upon release extremely attractive for investors. 1996; released in 2007 and witnessed growth of 68% during first 5 years on the market.  1990; Released in 2003 and witnessed growth of 132% during first 5 years.  The lack of availability highlights how important it is for collectors and investors to take advantage of the first release. It is clear that once they move into private cellars, they rarely resurface on the secondary market.  Krug under the Hammer A single bottle of the 1915 vintage sold for $116,800 at Sotheby's New York in September 2015 with bidding having started at $16,000. Summary Points

|

||

|

||||

|

Reg. Company No: 06350591 | VAT No. GB 129 9514 84 St Andrews House, Upper Ham Road, Richmond TW10 5LA. © 2016 All Rights Reserved. Cult Wines Ltd & Wineinvestment.com | You must be 18 or over to order. |