| If you are having issues reading this email please click here to view online |

|

| Wine Investment Offer |

| Cristal Louis Roederer 2002 - £1,050 per 6 x 75cl |

|

|

Cristal Louis Roederer 2002 - £1,050 per 6 x 75cl 'The 2002 Cristal is a gorgeous, sculpted wine of extraordinary elegance' Antonio Galloni 'Louis Roederer's 2002 Cristal is quickly becoming a legendary champagne you need to know about' James Suckling Key Investment Points

|

||

|

||||

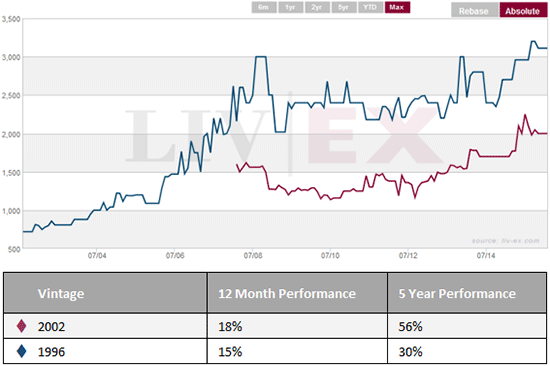

| Tasting Notes "An exceptional vintage with the same piercing drive and precision as the scintillating 1996. Intensity and fine concentration are the hallmarks of this fine Champagne; chalky aromas, fine citrus and tight, minerally restraint, some quite concentrated stone fruits here, peach and nectarine, really assertive, some flint and mineral too. The palate is needle-like in its precision, piercing acidity and fine floral notes, clean and long. Not one to be missed. A concentrated vintage with wind dehydrating the grapes ahead of harvest. An exotically flavoured, yet tightly structured Cristal." James Suckling | Score: 99 | June 2014 Cristal, Louis Roederer's key facts OwnerThe Roederer family Avg Annual Production300,000 - 400,000 bottles P/A Standard BlendPinot Noir (55%) and Chardonnay (45%) Other WinesCristal Rose Estate Overview Founded in 1776 Louis Roederer remains an independent family business. Many inspirational figures have helped this famous house along the way to world renown none more so than Jean Caude Rouzaud who instigated the creation of a group of brilliant winemakers around the central Champagne house, taken to further heights by his son and current director Frederic Rouzaud. Roederer has gleaned great success by courting a worldwide audience, particularly in Russia where its wines were appointed official supplier to the Imperial Court. Tsar Alexander II so enamered a unique flat bottomed bottle was commissioned to house his own blend... Cristal Champagne. Investment Analysis See price graph for 1996 vs 2002  The 2002 vintage was released onto the market in January 2008, 8 years on we are at the beginning of a fascinating cycle. Cristal 2002 has revealed a familiar price pattern. Post release, prices softened as there was a surplus of stock and subsequently pricing reached a status quo for a 2 to 3 year period. Now, a significant proportion of the 3.5 million bottles produced by Cristal have found their way into personal cellars or more likely have now been consumed, leaving a strong consumer market with very little stock (circa. 60 cases visible). Evidently, the 2002 has plenty more room for growth and we suspect that this will be accelerate as the lust for 2002s continues. Long Term Benchmarks

The longer term benchmarks suggest that a champagne built in the style of Cristal 2002 can offer investors longevity over a 10 year (+) hold, not many vintages of champagne can boast such an extended period of pure enjoyment. It is fair to say that with an anticipated maturity of 2030+, the increased rarity over the next 10 years will see the 2002 eclipse its predecessors. We are advising clients to take up their allocation whilst stock is available. Limited cases. |

||

|

||||

|

Reg. Company No: 06350591 | VAT No. GB 129 9514 84 St Andrews House, Upper Ham Road, Richmond TW10 5LA. © 2016 All Rights Reserved. Cult Wines Ltd & Wineinvestment.com | You must be 18 or over to order. |