| If you are having issues reading this email please click here to view online |

|

| Cult Wines Offer |

| Chateau Latour 1996 (100 pts) @ £5,400 per 12x75cl |

|

|

Chateau Latour 1996 (100 pts) @ £5,400 per 12x75cl 'This is as good as it gets.' Lisa Perrotti-Brown - Wine Advocate Key Points

|

||

|

||||

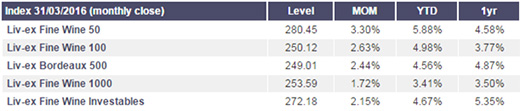

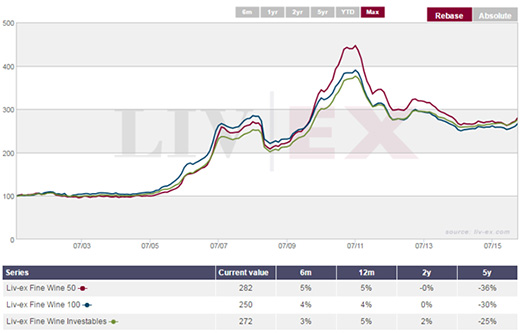

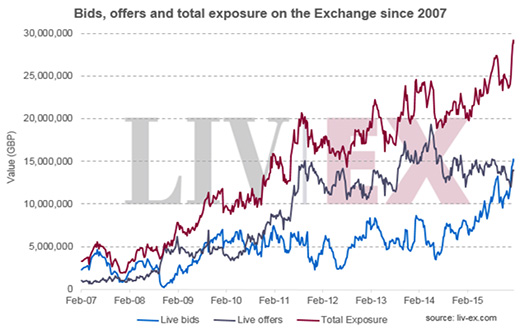

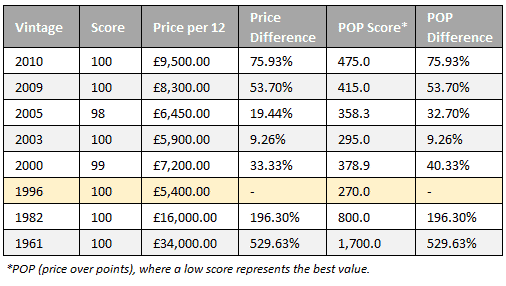

| Tasting Notes "Deep garnet-black in color [sic], the 1996 is classic Latour at its utmost. The nose offers a tantalizing array of complex notes including dried Chinese plums, toasted nuts, Indian spices and black olive tapenade over a core of dried cherries and aged meat. The palate is pure power that is stunningly balanced giving a generous level of fruit concentration perfectly offset by a high level of very finely grained tannins and seamless freshness. Possessing a finish that just goes on and on, this is as good as it gets." Lisa Perrotti-Brown | Score: 100 | In Asia #1112, Wine Advocate, Nov 2012 Investment Analysis Bordeaux is on a roll, with the Bordeaux 500 index gaining 2.4% over March; the biggest month-on-month gain since February 2011 (the peak of the market) when it gained 3.0%. This owed no small thanks to the Liv-ex Fine Wine 50 sub-index, which boasted 3.3% over the month having picked up pace following a 2015 low in November. The index has demonstrated 8.0% since then; and 5.9% year-to-date.  The table above illustrates performance of the major indices over the last 5 years, 1 year, YTD and MOM. This shows that the Liv-ex 50 (last 10 physical vintages of the five 1st Growths) is currently trading at the largest discount to the market peak (around mid-2011) but have seen the largest positive uptick this year. Latour 1996 features in the Liv-ex 100 and Investables indices, both of which are tracking similar trends, although have done so with arguably greater stability to the younger vintages.  All indices are valued well-below their long-term trend and have maintained consecutive, positive movement for four months now. One main driver behind this is the current level of demand versus supply existing on Liv-ex. At the start of the year - and for the first time since mid-2010 - the total value of bids on the exchange overtook the total value of offers:  Comparable Vintages Not only is the 1996 Latour trading at a significant discount from its own market peak price of £8,000 (over 30%), it represents the strongest value of all prime-vintages from the estate. The table below illustrates this with a simple POP comparison:  Summary

|

||

|

||||

|

Reg. Company No: 06350591 | VAT No. GB 129 9514 84 St Andrews House, Upper Ham Road, Richmond TW10 5LA. © 2016 All Rights Reserved. Cult Wines Ltd & Wineinvestment.com | You must be 18 or over to order. |