| If you are having issues reading this email please click here to view online |

|

| Cult Wines Offer |

| The Time to Buy 1st Growth: Haut Brion 1995 (96pts) |

|

|

Haut Brion 1995 @ £3,250 per case (12x75cl) Key Investment Points

|

||

|

||||

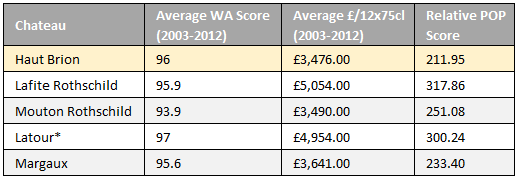

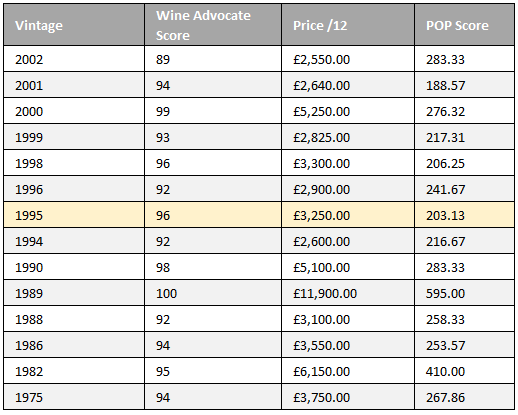

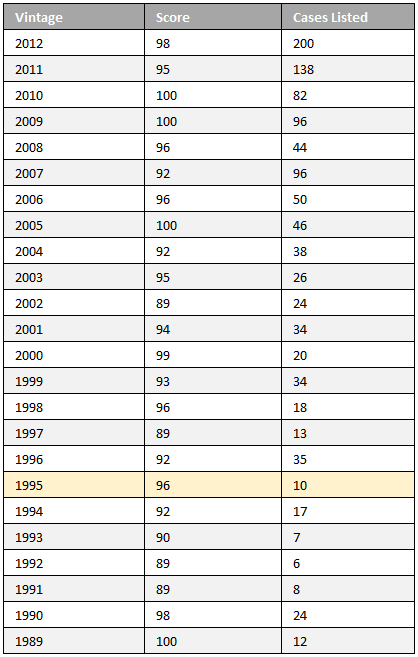

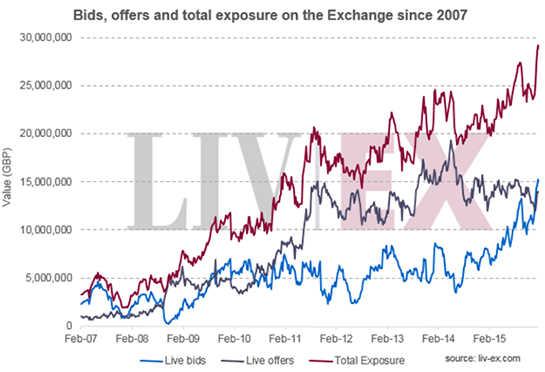

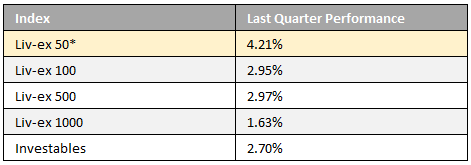

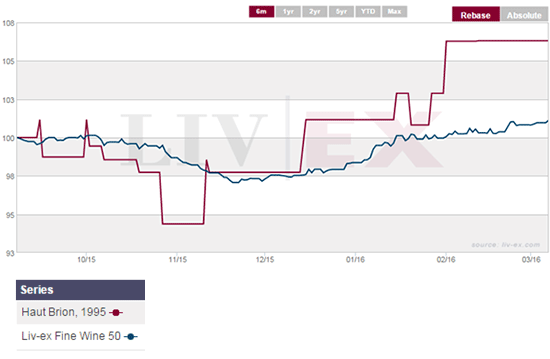

| Tasting Notes "It is fun to go back and forth between the 1995 and 1996, two superb vintages for Haut-Brion. The 1995 seems to have sweeter tannin and a bit more fat and seamlessness when compared to the more structured and muscular 1996. Certainly 1995 was a vintage that the brilliant administrator Jean Delmas handled flawlessly. The result is a deep ruby/purple-colored wine with a tight but promising nose of burning wood embers intermixed with vanilla, spice box, earth, mineral, sweet cherry, black currant, plum-like fruit, medium to full body, a high level of ripe but sweet tannin, and a finish that goes on for a good 40-45 seconds. This wine is just beginning to emerge from a very closed state where it was unyielding and backward." Robert Parker | Score: 96 | Anticipated maturity: 2006-2035 | Tasting Date: Jan 2003 Investment Analysis Broadly speaking, Haut Brion currently offers the best value of the five 1st Growths. The table below illustrates the average Wine Advocate scores and 12 bottle prices of the last 10, physical vintages of each. Haut Brion has a fractionally lower average score than Latour and above the rest, yet has the lowest average price of all five.  * Latour vintages 2002-2011, as 2012 is yet to be released Focussing on Haut Brion's value, the 1995 offers the lowest POP score of all vintages with similar maturation - i.e. at least 5 years into (but still within) drinking window.  The 1995 vintage is now around half-way through its drinking window of 2000-2035 and is certainly benefitting from a lack of availability on the secondary market. Shown below, there are currently only 10 cases listed on the global marketplace, highlighting the short supply.  Time to Buy 1st Growth From the peak of the market in 2011, where it was trading above £4,600 per 12, the 1995 has softened by over 30%, which is very attractive for re-engaged First Growth buyers. To reinforce the current market position and the timing for buying, we can look at supply/demand and how recent prices for Bordeaux - particularly the 1st Growths - have picked up. On the second week of February, Liv-ex published a blog explaining that total exposure on exchange was already at record levels and fast approaching £30m - double its value from just four years ago. It's conceivable that this landmark has now been passed. More importantly, for the first time since 2010, the total value of bids on Liv-ex outweighs the total value of bids which is the most basic indicator of supply being outpaced by demand:  Liv-ex Bids (value of demand) has been steadily increasing since mid-2014, while value of offers has been slowly declining. They crossed paths around three months ago and the change in prices was noticeable immediately.  * Liv-ex 50 tracks price movement of the five 1st Growths. Since this point, around December last year, Liv-ex 50 has recovered 4.21%. Haut Brion 1995 has more than doubled this with 8.8%:  Sommelier's Word "Dedication to quality is second to none with 3rd generation winemaker Jean Delmas, whose family have produced these wines from 1920. There is exceptional consistency in their wines that goes a great length in making sure that their wines are memorable. 1995 is an exciting vintage: accessible and open with saturated deep ruby aromatics of mostly black fruit, vanilla, dry earth and - typical for Pessac-Leognan - wood-fire smoke. Palate has great refined flavours; medium to full with striking roundness and depth of flavour. Moving into tertiary flavours characteristic, you can drink it now however it will developed further for another 15-20 years." Lukasz Kolodziejczyk | Cult Wines Head of Fine Wine Summary

|

||

|

||||

|

Reg. Company No: 06350591 | VAT No. GB 129 9514 84 St Andrews House, Upper Ham Road, Richmond TW10 5LA. © 2016 All Rights Reserved. Cult Wines Ltd & Wineinvestment.com | You must be 18 or over to order. |