| If you are having issues reading this email please click here to view online |

|

| Cult Wines Offer |

| Haut Brion 2012: The Best Value First Growth |

|

|

Ch. Haut Brion 2012 @ £2,850.00 per case (12x75cl) 'This is an absolutely remarkable effort from the Dillon family and their winemaking team of the two Jean-Philippes.' Robert parker - April 2015 Key Investment Points

|

||

|

||||

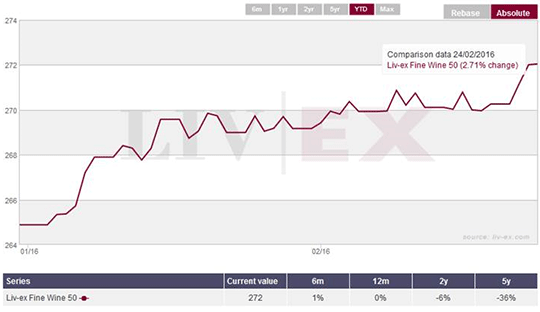

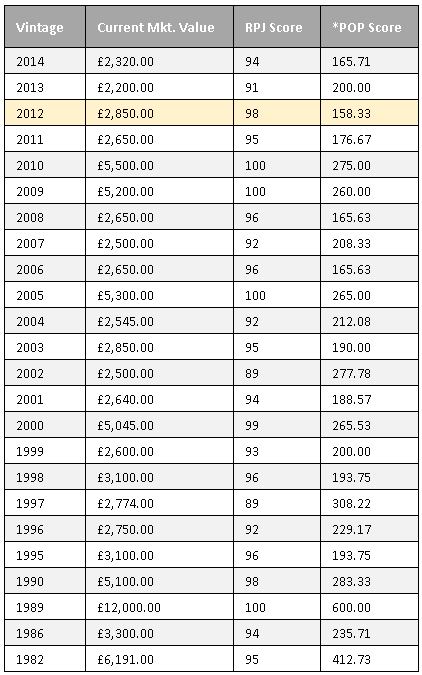

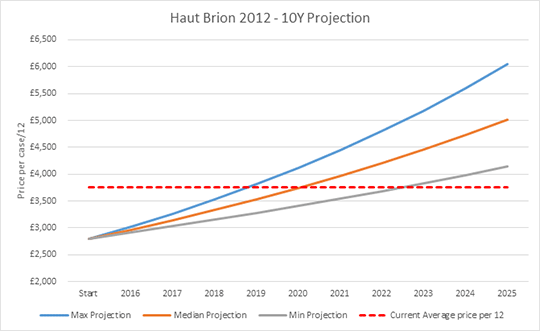

| Estate Overview Having produced some of the best wines in the First Growth classification over the past 4 En Primuer campaigns, Haut Brion seems to be one of the few estates able to adapt adequately when needed. In fact, Haut Brion and Latour have the joint highest average scores across the ten most recent physical vintages - 96.4 pts. Alongside Mouton, Haut Brion is placed at the more affordable end of the First Growth market and appeals to a far wider global audience from a consumption point of view. This naturally leads to a more active secondary market and over the medium term will certainly prove an important factor in the continued success of this legendary estate. Tasting Notes "The 2012 Haut Brion (65% Merlot, 33% Cabernet Sauvignon, 2% Cabernet Franc) is certainly one of the candidates for the wine of the vintage, with a dense purple color, classic nose of crushed rock, lead pencil shavings, black raspberry, blueberry and flowers. The wine shows subtle barbecue smoke notes in the background, but is full-bodied, stunningly concentrated and builds incrementally, yet finishes with luxurious, almost extravagant amounts of fruit and intensity. From only 46% of the production, this is an absolutely remarkable effort from the Dillon family and their winemaking team of the two Jean-Philippes. Drink it over the next 30-40 years." Robert M. Parker, Jr | Score: 98 | Drink: 2015 - 2055 | Tasting Date: Apr 2015 Parkers View on the 2012 Vintage What stands out about the bottled 2012 Bordeaux is that they performed as well, if not better, than the barrel-tastings, which is always a great sign. The most successful sectors in 2012 were Pomerol, Pessac Leognan and parts of St.-Emilion. Low yields and a rather surprising ripeness (alcohol levels run from 13.5%-15% across the board) was not far off the record level of alcohol achieved in the two great vintages of 2009 and 2010. However, the acidities were low and the wines made from yields in Bordeaux that were the lowest since 1991. This has translated into some surprisingly big, rich, concentrated Pomerols, Pessacs and St. Emilions that are low in acidity, high in alcohol and loaded with flavor. Investment Analysis Following a sustained period of stabilisation for the Liv-ex FW50 in 2015, the headline index for the last 10 (2003-2012) First Growth vintages is tracking up at 2.71% YTD, which suggests that there is a growing appetite for a group of wines that remain undervalued.  Buyers seeking value from the market really ought to look at Haut Brion 2012. It is the superstar of the vintage at 98pts and based on the data compiled by our in-house price matrix, the 2012 boasts the lowest POP score of all First Growth wines from 1982-2014. Therefore this stands out as the best value First Growth available to investors from 117 lines of data - quite incredible. Since the start of the year, there has been a noticeable increase in buyers on the quest for the low entry points of the top Bordeaux brands. In the table below, we have isolated Haut Brion in order to demonstrate the value the 2012 against other vintages.  *POP A wine's POP score is its price-over-points ratio, our loose measure of value. It is calculated by dividing the price of a nine-litre case of wine by a shortened 20-point score. We have calculated this 20-point score by simply subtracting 80 from the official rating (for barrel-score spreads we use the mid-point of the score), on the basis that any wine under 80 points is unlikely to attract a secondary market. In theory, the lower the POP score the better value a wine is. Whilst it is perhaps over-zealous to compare the 2012 with past legends such as 2005, 2009 and 2010, it is currently at a price point where we expect to see a continued upward trend over the next 5 years. The graph below demonstrates the range of returns an investor can expect when holding this wine over a 10 year period. The current average 12 bottle case price for 24 vintages is £3,780.00 - a 35% premium on the 2012.  This is undeniably the greatest value for money First Growth available in the market and should drink well in a few years' time, placing additional strain on the supply. Please note that there is limited availability at this price point due to the inherently low production for the 2012 (only 46% of the production), and we would therefore encourage clients to place their orders in good time to avoid missing out on this tremendous option. Summary

|

||

|

||||

|

Reg. Company No: 06350591 | VAT No. GB 129 9514 84 St Andrews House, Upper Ham Road, Richmond TW10 5LA. © 2016 All Rights Reserved. Cult Wines Ltd & Wineinvestment.com | You must be 18 or over to order. |