|

Problems viewing this

email? Please select 'always display images' or

click here |

|

|

|

INVESTMENT OFFER: LAFITE ROTHSCHILD 2013 (6x75cl CASE)

|

|

|

|

|

|

|

|

|

|

|

|

Lafite Rothschild 2013 (92-93 JS)

£1,450.00 per 6 bottle case

UK BEST MARKET PRICE - EX MANAGEMENT FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Points

|

|

|

|

|

• |

|

£1,450 per 6.

|

|

•

|

|

(92-93) score from James Suckling.

|

|

•

|

|

(91-93) score from Neal Martin.

|

|

•

|

|

95 score from Tim Atkin.

|

|

•

|

|

One of the five 1st Growths – the top classification of Bordeaux Left-Bank wines.

|

|

•

|

|

1st in value and volume traded on Liv-ex in 2013.

|

|

•

|

|

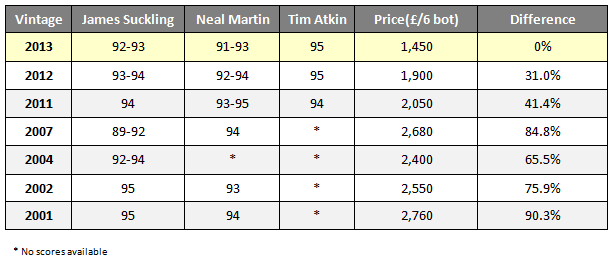

Comparable, physical vintages trade at a minimum of £1,900 per 6:

- 2012 @ £1,900

- 2011 @ £2,050

- 2007 @ £2,680

- 2004 @ £2,400

- 2002 @ £2,550

- 2001 @ £2,760

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"The Grand Vin is a blend of 98% Cabernet Sauvignon and 2%

Merlot. The latter was apparently difficult to assimilate

with the Cabernet, gradually adding 1% at a time and

finally, electing 2% as the optimal amount. As usual, I

spent 10+ minutes with my sample, as it is never as

immediate as say, Latour or Château Margaux. It has an

elegant bouquet with a fine violet scent that became more

accentuated with time. There is plenty of dark cherry and

blackcurrant fruit, a touch of pencil shavings that becomes

more pronounced with aeration. The palate is a little

austere because of the dominance of the Cabernet Sauvignon,

although that 2% Merlot does take the edge off the finish,

rounding out any edges. The aftertaste has that attractive

saline tincture, but here a little spicier and longer than

its peers. This is a traditional Pauillac; a success for the

vintage and a wine that I think will improve in bottle

rather than in barrel. A steadfast Lafite. Tasted April 2014."

Score: (91-93) |

|

|

|

|

|

|

|

Neal Martin,

eRobertParker.com

April 2014 |

|

|

|

Brand

From the early 18th century, Lafite found its market in

London. It appeared in the very official London Gazette of

1707 as being “sold at public auctions in the City of

London, after being offloaded from foreign merchant ships

seized by British corsairs as well as by the vessels of the

Royal Navy”. The London Gazette described the Lafite wine

and its counterparts as “New French clarets”. Between

1732-1733, Robert Walpole, the Prime Minister, purchased a

barrel of Lafite every three months. It was only much later

that France began to take an interest in Bordeaux’s red

wines.

At this time the winemaker was Marquis Nicolas Alexandre de

Ségur, who also owned Latour, Mouton and Calon-Segur. He

improved the winemaking techniques and above all enhanced

the prestige of fine wines in foreign markets and the

Versailles court. He became known as “The Wine Prince”, and

Lafite’s wine became “The King’s Wine”.

Lafite was one of the four Bordeaux originally rewarded 1st

Growth status in the 1855 Classification, but widely

considered the best of all. In 1868, Baron James de

Rothschild - of the banking dynasty - purchased Château

Lafite. As a welcome indication to the new owner, the 1868

vintage held the record for its high price for the entire

century.

The end of the 19th century and the first half of the 20th

century were turbulent for Lafite. A combination of the

phylloxera aphid catastrophe, two World Wars and severe

financial crisis led to a reduction in vineyard size, levels

of supply and quality of product.

The following decades strengthened Lafite’s position once

again. However, it wasn’t until 1994 - when the estate came

under the control of Charles Chevallier- that an admirable

level of consistency at the best level was achieved. The

average score (from Robert Parker) for the previous 10

vintages was 90.4 which sharply rose to 96.1 from the year

Chevallier took over until now.

|

|

|

|

Investment Analysis

Although Lafite slipped from the Top 10 Power Brands of 2012

in the wine industry down to the Top 20 for 2013, it still

topped the league for both Value and Volume traded on Liv-ex

throughout the year, accounting for 18.10% and 6.57%

respectively.

As the table below demonstrates, the 2013 represents the

best value of all comparable vintages and shows a clear

trajectory of price growth potential.

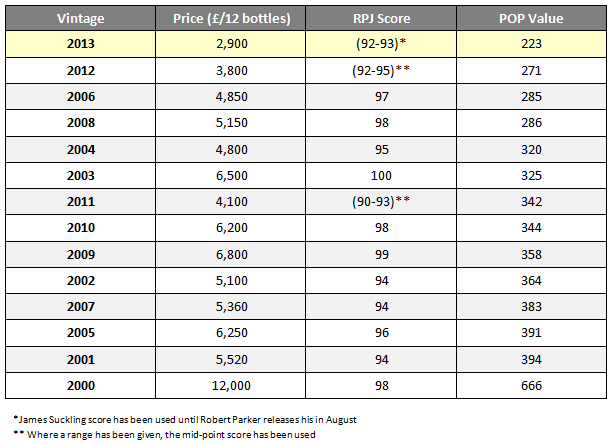

The following translates the previous data into a price over point value (POP Value), including all vitnages since 2000:

|

|

|

|

2013 Vintage

It has been more than well documented, that the 2013 vintage

certainly isn’t going to make its way in to the History

books alongside the 09/10 Vintages. This may be bad news if

you are a lover of Fine Wine for consumption, but in a few

cases, great news if you are an investor seeking value and

the chance to make some strong short to medium term gains.

With production levels on average down by 35-50%, there are

some clear investment opportunities within this Vintage.

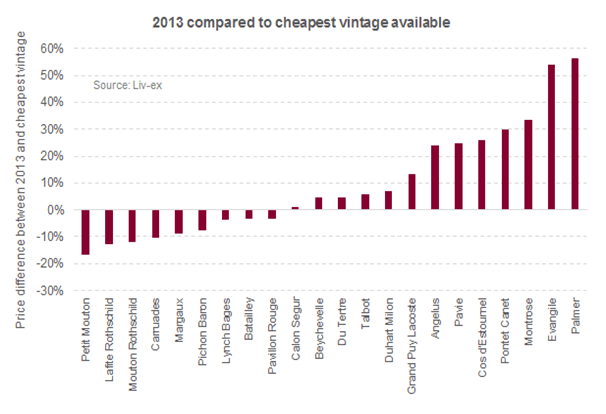

From the whole vintage we have so far only looked at Mouton

Rothschild, Lafite Rothschild and their repective second

wines – Petit Mouton and Carruades de Lafite. The graph

below illustrates the value that 2013 represents for these

four wines; highlighting the price compared to the next

cheapest vintage available.

Key Points:

• Low downside risk – most affordable Lafite vintage.

• Still the most traded wine in the industry, based on value and volume.

• Growth projection of 25-35% ahead of physical release in Spring 2016.

• Long-term potential of 60-80% over 5-8 years.

• Upside potential of 70-90% in 5 years if Liv-ex 50 recovers as expected.

• Very limited availability at this buy price.

• 10% below the UK market.

|

|

|

|

|

|

Reg. Company No: 06350591 | VAT No. GB 129 9514 84 | St Andrews House, Upper Ham Road, Richmond TW10 5LA.

© 2014 All Rights Reserved. Cult Wines Ltd & Wineinvestment.com | You must be 18 or over to order. |

|

|

|