|

| | | Cult Wines Fine Wine Offer | | | |

Chateau Angelus 2014 - £1,950.00 per 12

| | |

|

|

|

|

|

|

|

|

Chateau Angelus 2014 - £1,950.00 per 12

Price exclusive of management fee

Key Points

- Behind Lafite and Latour, Angelus is one of the most popular wines in Asia. Some attribute this to the estates' feature in recent Bond film; Casino Royale but the golden bell on their label is also regarded as a symbol of good luck in China.

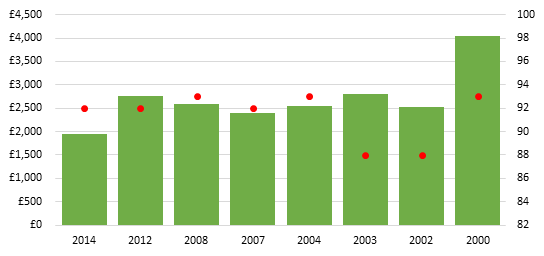

- 2014 vintage remains undervalued and with increases on most 2015s, as a sub-prime strategy a number of 2014s look very attractive.

- Potential for improved score upon bottling (Spring 2017) - indication that initial reviews were a little conservative.

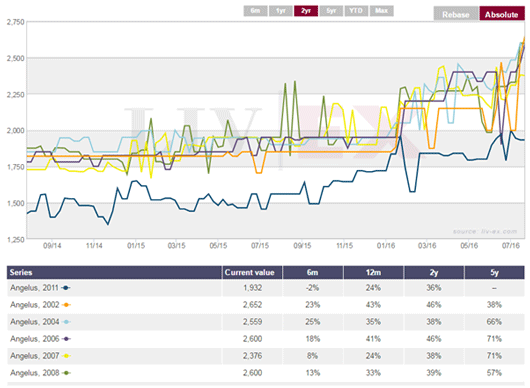

- Average two year performance of post millennium vintages (2000-2013) has been 24.8%; average one year performance of the same vintages has been 17.2%.

- Moved up the Liv-ex Power 100 rankings from 28th in 2014 to 3rd in 2015.

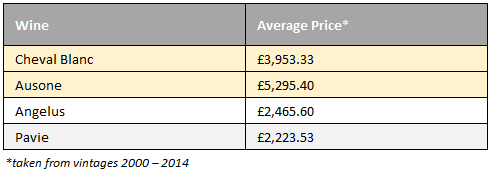

- Angelus & Pavie's elevation to Premier Cru Classe A still not totally priced into the market, especially when one considers the prices for their counterparts Ausone & Cheval Blanc.

- Average annual production < 10,000 cases.

- Becoming increasing difficult to source stock as very little is released En Primeur.

Tasting Notes

The Chateau Angelus 2014, a blend of 50% Cabernet Franc and 50% Merlot was picked between 2 and 22 October over a 3-week period. It has a surprisingly bashful nose at first, not one that comes racing out of the blocks to greet you. But there is plenty of fruit here, beautifully defined, a little more introverted than usual possibly due to the higher percentage of Cabernet Franc. The palate is medium-bodied with fine tannin, linear in style with a saline note complementing that lattice of black fruit. It gently builds towards the spicy, slightly compact finish but never fully let's go, the Cabernet Franc lending a slight savoury edge on the aftertaste. This will probably need three of four years in bottle as this is slightly harder compared to recent vintages with more backbone. Yet it still constitutes an admirable Saint Emilion even if it does not ignite the same pyrotechnics as say, Pavie or Ausone.

Neal Martin - 91-93 pts

|

|

|

|

|

|

Interested in purchasing Chateau Angelus 2014? Please contact your portofolio manager or...

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Brand

Until the era of management under Hubert de Bouard de Laforest, Chateau Angelus could not really claim to be making as fine a wine as its terroir allowed. Forward-thinking Hubert set about making many changes, including the early adoption of open-topped vats for fermenting and barrel maturation - both techniques which were picked up on by Hubert in his trips to Burgundy. Another bold and progressive change was that of the name, which went from L'Angelus to Angelus, as Hubert observed this would lead the chateau to the top of alphabetical directories.

The attention to detail in the handling of Chateau Angelus, has led to an increase in quality, reflected most obviously in its promotion in the 2012 St emilion Classification to Premier Grand Cru Classes A status, placing it in the top 4 chateaux in the region. The promotion of Pavie and Angelus to Premier Grand Cru Classe (A) in September 2012 brought these estates alongside Ausone and Cheval Blanc as the pinnacle of wine producers in St Emilion. These new rankings replaced a classification in force since 1996 and whilst these brands have inevitably re-positioned as a result of this, there remains plenty of scope for growth.

Chateau Angelus enjoyed valuable product placement in Casino Royale, in which Daniel Craig's 007 is seen enjoying a glass- a move which Hubert de Bouard told decanter.com led to a substantial sales spike. While prices for fine French wine are expected to stabilise in coming years, forecast for growth remains strong due to current brand strength following its St emilion reclassification and thanks to strong sales to China- where the bell that appears on every bottle of the Grand Vin is considered a lucky symbol.

Angelus is probably the best marketed and known brand in Asia - Petrus aside - from the right bank. Neal Martin's barrel score could be regarded as conservative but his notes clearly suggest it needed a little more time for a proper reassessment and with a re-score upon bottling in spring, a favourable outcome would further enhance the possibilities for growth over the next 1-5 years.

Critic Appraisal

A triumphant comeback beginning in the 1980s, following the appointments of Hubert de Bouard and Michel Rolland, became a meteoric rise, with Angelus currently considered among the very top wine producers, not merely in St emilion but in the entire Bordeaux region. Critic Neal Martin has praised the consistency in quality of wines produced and even in 2007, a washout year with many disappointing vintages, Angelus was delighting critics. 1990, 1995 and 2001 have all been singled out as 'outstanding' vintages and the 2009 vintage received a near perfect score of 99-points, demonstrating the upward trajectory in quality the wines of this chateau are enjoying. In fact, for the vintages 2000-2015 the average Parker score is 94.89pts which is marginally higher than Cheval Blanc (94.68pts) and just below Pavie and Ausone.

|

|

|

|

|

|

Interested in purchasing Chateau Angelus 2014? Please contact your portofolio manager or...

|

|

|

|

|

|

|

Interested in purchasing Chateau Angelus 2014? Please contact your portofolio manager or...

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary Points

- 2014 as a vintage is underrated and wines such as Angelus have potentially been under-scored.

Potential for an upgrade in Spring 2017.

- 2014 has the lowest POP value of the 'sub-prime' vintages

Best value and strong scope for growth.

- Angelus expected to close the gap on Cheval Blanc and Ausone given the power of the brand and consistent output of quality wines over the past 15 vintages.

- Only the second vintage wholly produced as a 'First Growth'.

Expecting release prices to increase year-on-year.

- Du Buoard suggested that their target in the medium-term is to reach release price parity with Haut Brion.

Haut Brion 2015 was released ex-London at £4,250.00 per 12.

- Limited stock available, first-come first served.

|

|

|

|

|

|

If you are interested in buying this wine we therefore encourage you to place an order or contact your portfolio manager promptly to avoid any disappointment.

|

|

|

Reg. Company No: 06350591 | VAT No. GB 129 9514 84

St Andrews House, Upper Ham Road, Richmond TW10 5LA.

© 2016 All Rights Reserved. Cult Wines Ltd & Wineinvestment.com | You must be 18 or over to order.

|

| |