Monthly Market Review: Sipping Through Stability and Volatility - February 2024

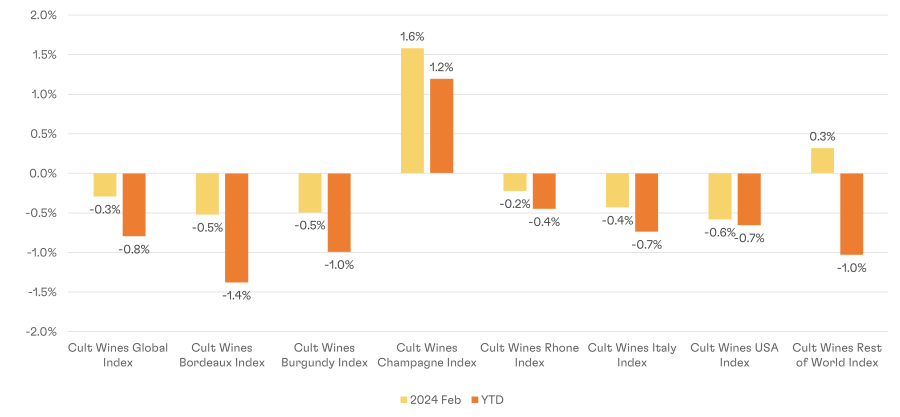

Cult Wines Indices – Returns as of 29 Feb. 2024

Source: Pricing data as of 29 Feb 2024. Cult Wines Indices are an objective measure of the global fine wine market based on Wine-Searcher pricing data and rebalanced annually based on strict liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

The CW Global Index experienced a slight decline of -0.29% for the month, contributing to a 12-month decline of -6.34%.

The CW Bordeaux and CW Burgundy indices both showed marginal decreases of -0.52% and -0.49% respectively, indicating ongoing stability in these renowned wine regions despite short-term fluctuations.

CW Champagne index notably outperformed with a robust monthly return of 1.58%, resulting in a positive YTD return of 1.19%.

The CW Rhone, CW Italy, and CW USA indices demonstrated relatively small declines, reflecting a generally stable performance across different wine-producing regions.

The CW Rest of World Index showed a modest increase of 0.32% for the month, though still reflecting a YTD decrease of -1.03%.

Overall, while some regions experienced slight downturns, the fine wine market exhibited resilience with mixed performance, emphasizing the importance of strategic investment decisions and long-term perspective in navigating market fluctuations.

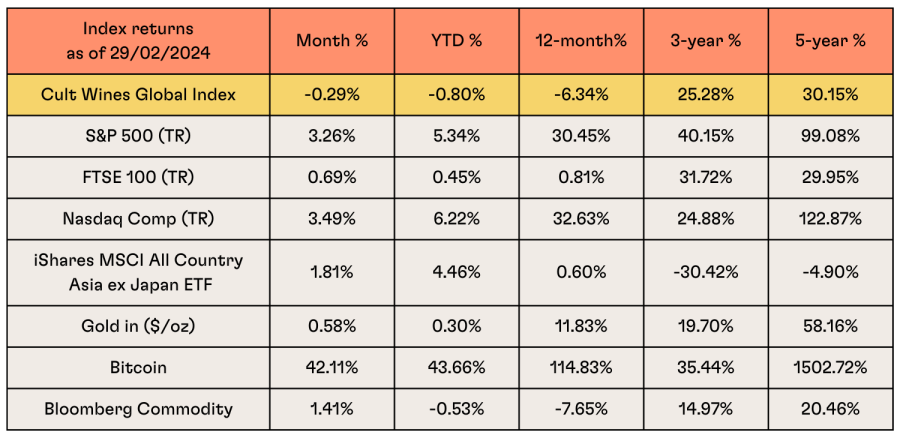

Macro market summary

Source: Investing.com, Wine-Searcher as of 29 Feb. 2024. Past performance is not indicative of future returns.

Stock markets performed well in February, driven by resilient economic data and strong earnings reports, resulting in year-to-date gains.

Emerging markets saw significant growth, up 4.8% for the month, largely due to a rebound in Chinese markets. Meanwhile, Japan's Nikkei 225 Index reached a new all-time high, contrasting with lagging performance in UK stocks.

Fixed-income markets faced pressure as investors postponed expectations for interest rate cuts in 2024, leading to a 1.3% decrease in US Treasuries.

High-yield bond markets, less sensitive to interest rate changes, performed relatively better, with euro high-yield bonds gaining 0.4%. Eurozone government bonds, including German Bunds, faced downward pressure in January, with a 1.4% decrease over the month. However, signs of economic recovery led to a narrowing of spreads between Italian and German sovereign debt.

Commodity markets experienced losses, with the broad Bloomberg Commodity Index falling by 1.4% over February, driven by declines in gas and agricultural prices.

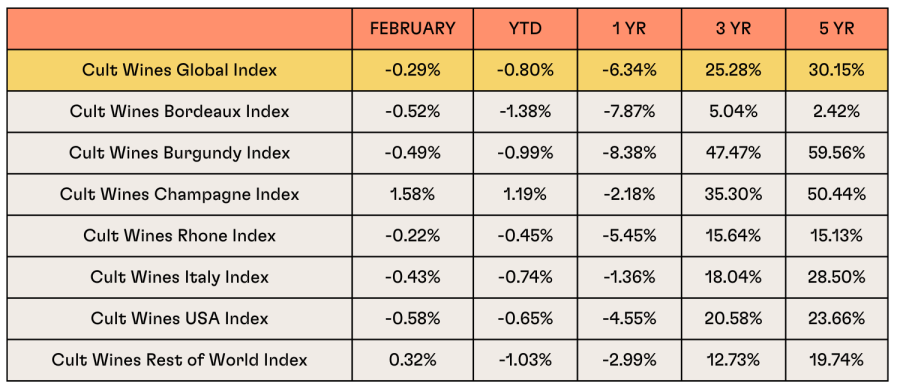

Regional Wine Market Performance

The CW Bordeaux Index experienced a slight decline of -0.52% for the month, contributing to a 12-month decline of -7.87%. Despite this, Bordeaux led trade on Liv-ex over the last week of February, accounting for 41.1% of the regional trade share by value. In terms of best-performing wines, Carmes Haut Brion 2011 saw a notable increase of 20%, while Clinet 2015 rose by 18% monthly. Additionally, Rauza Segla 2017 demonstrated positive momentum, up by 13%. However, older vintages such as d’issan 2006 and Clerc Milon 2007 were among the worst performers, down more than 20% in February.

Burgundy saw a marginal decrease of -0.49% in February, leading to a 12-month decline of -8.38%. Some iconic producers continued to drop in price, such as recent vintages of Domaine Ponsot, Corton Grand Cru, Cuvee du Bourdon, and Jacques-Frederic Mugnier, Nuits-Saint-Georges Premier Cru, suggesting potential entry opportunities for investors. On the contrary, there were notable movements within the region, particularly among specific wines and producers. On best-performing wines, Domaine Jean Grivot, Nuits-Saint-Georges Premier Cru, Aux Boudots 2016 showed exceptional growth, up by more than 30%. Similarly, Perrot-Minot, Nuits-Saint-Georges Premier Cru, La Richemone Ultra 2018 rose by 20%. In terms of vintage performance, 2016 had a positive run, with many Tier 1 producers like Fourrier and Joseph Drouhin experiencing a rise of 10%. Additionally, multiple vintages of Domaine Trapet Pere et Fils, Latricieres-Chambertin Grand Cru, including 2016 and 2019, showed gains in February, with the former up by 30% and the latter by 14%.

Champagne performed positively in February, with a 1.58% increase. Notable movements were observed within the Champagne market, particularly regarding specific wines and producers. On best-performing wines, Vilmart & Cie, Grand Cellier d'Or Premier Cru 2012&2013, along with Louis Roederer, Cristal 1997, and Dom Perignon, Rose 2009 stood out among the best-performing names, showcasing strong market demand for these prestigious labels. Regarding producers, multiple vintages of Louis Roederer, Rose experienced gains in February, with the 2013 vintage leading the way with a 13% increase, followed by the 2008 vintage with an 8% rise. In terms of volume traded on Liv-ex, wines from Egly-Ouriet and Jacques Selosse were particularly popular, contributing to Champagne’s trade share in February.

The CW Italy Index saw a decrease of -0.43% in February, resulting in a YTD decrease of -0.74%. While certain wines within the Italian market demonstrated notable growth, there were also movements observed among specific wines, indicating varied performance across the region. On best-performing wines in Italy, both Giuseppe Mascarello e Figlio, Barolo, Monprivato and Massolino, Barolo, Vignarionda Riserva from the 2012 vintage experienced a significant increase of 20%. Additionally, Gaja, Barbaresco, and Costa Russi 2015 rose by 12%. Moreover, the newly released Sassicaia 2021 led weekly trade on Liv-ex, topping the league tables. This wine, released in the UK on February 8th at £2,500 per case, received a perfect rating of 100 points from the Wine Advocate’s Monica Larner, further enhancing its appeal to collectors and investors. However, it's important to note that some wines experienced declines in value. Masseto 2017, for example, saw a decrease of 8%, while Bruno Giacosa, Barolo, Falletto Vigna Le Rocche Riserva 2016 declined by 6%.

US experienced a decline of -0.58% in February. On best-performing wines in the US, Dalla Valle, Cabernet Sauvignon, Napa Valley 2012 & 2013, and Harlan Estate, The Maiden, Napa Valley 2013 showed remarkable growth, up by more than 20% according to WS listing. Moving to trade activity, the US recorded a considerable uptick, led by Screaming Eagle, with several vintages of both the Cabernet Sauvignon and the Sauvignon Blanc changing hands. Joseph Phelps’ Insignia 2019 emerged as the most-traded wine on Liv-ex by value from the region, highlighting continued market activity and investor interest in US wines.

Wine Performance League Table – YTD Return % Across Vintages

Source: Pricing data from Wine-Searcher as of 29 Feb. 2024. Based on average across all vintages of wines contained in Cult Wines Indices, which are rebalanced regularly based on strict, objective liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014. The Indices are separate from Cult Wine Investment Performance which tracks wines purchased by Cult Wine Investment.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.