Bordeaux 2006 Investment Report

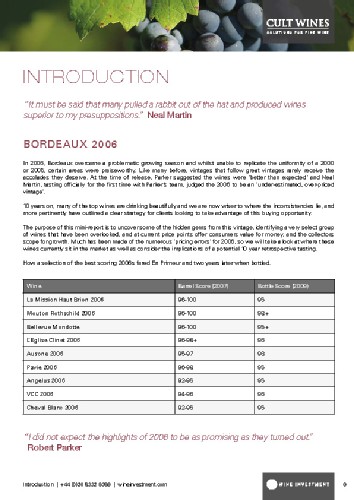

In 2006, Bordeaux overcame a problematic growing season and whilst unable to replicate the uniformity of a 2000 or 2005, certain areas were praiseworthy. Like many before, vintages that follow great vintages rarely receive the accolades they deserve. At the time of release, Parker suggested the wines were 'better than expected' and Neal Martin, tasting officially for the first time with Parker's team, judged the 2006 to be an 'under-estimated, over-priced vintage'.

10 years on, many of the top wines are drinking beautifully and we are now wiser to where the inconsistencies lie, and more pertinently have outlined a clear strategy for clients looking to take advantage of this buying opportunity.

The purpose of this mini-report is to uncover some of the hidden gems from this vintage, identifying a very select group of wines that have been overlooked, and at current price points offer consumers value for money, and the collectors scope for growth. Much has been made of the numerous 'pricing errors' for 2006, so we will take a look at where these wines currently sit in the market as well as consider the implications of a potential 10 year retrospective tasting.

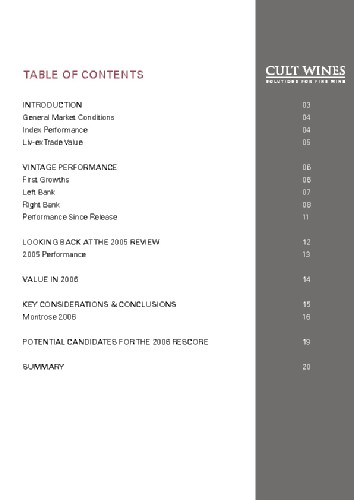

In this comprehensive 21 page report you will discover:

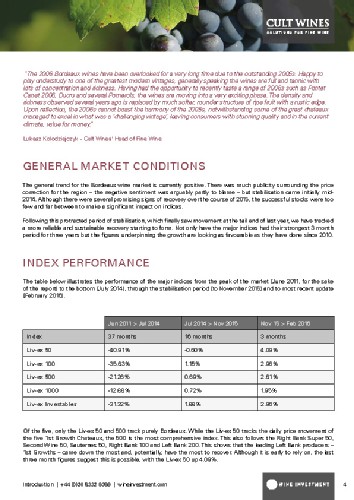

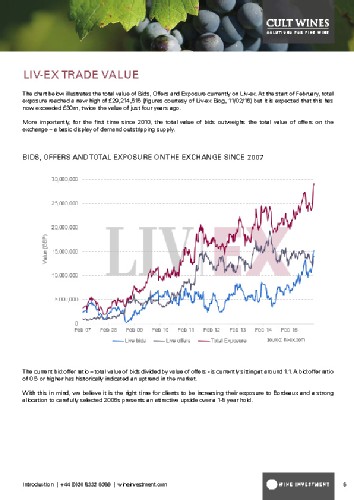

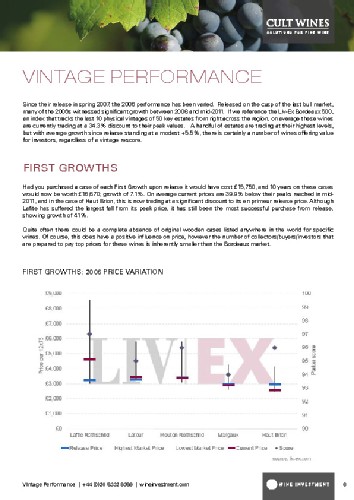

✓ Current Market Conditions, Historic Index Performance and Liv-ex Trade Values.

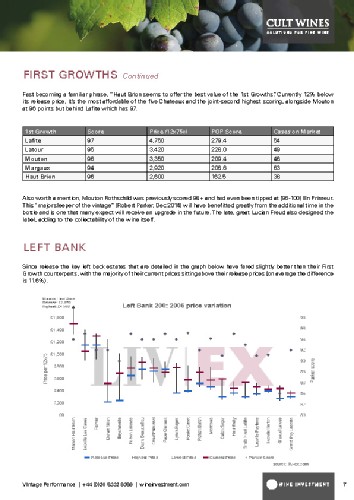

✓ Performance notes on the 2006 vintage, First Growths, Left Bank and Right Bank.

✓ A look back at the 2005 vintage including performance records.

✓ Potential Candidates for the 2006 rescore.

✓ Why now is the time to invest in Bordeaux 2006.

Cult Wines Ltd is one of the UK’s leading fine wine investment companies, with a highly trained team of specialists who bring with them a wealth of financial markets expertise and fine wine experience. A family business based in Richmond, with core values of openness and transparency, we are perfectly positioned to advise a global private client base on the full potential of investment in this market. One of our key strengths is our dynamic and forward-thinking approach to analysis and research, we are constantly engaged in developing leading edge market strategies and providing up to the minute market data.