You trust us, we deliver.

Find out below about the performance of Cult Wine Investment and the wine investment market for this latest quarter.

Cult Wine Investment Overview Q1 2024

Fine wine market Q1 2024 summary

Q1 2024 Performance Highlights

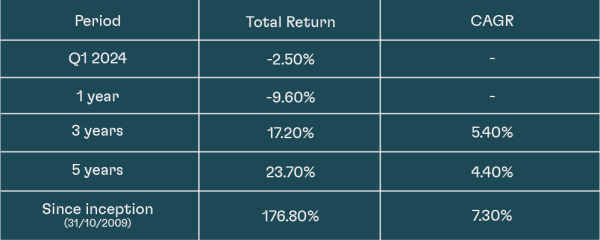

In Q1 2024, the Cult Wine Investment team navigated a volatile global economy, balancing challenges with strategic opportunities. The fine wine market continued its repricing, and we saw a -2.52% decline in the Cult Wine Investment Performance, reflecting investor caution and subdued consumer demand amid ongoing economic uncertainties and higher interest rates.

Market performance was affected by geopolitical tensions and fluctuating conditions in key global economies, leading to reduced buying in both established markets like Bordeaux and Burgundy, and emerging regions. Despite these challenges, our deep understanding of the fine wine market facilitated strategic responses focused on long-term value and portfolio stabilization. We continued to diversify our investments to lessen risks, rebalanced portfolios, and seized opportunities in oversold assets offering discounted valuations.

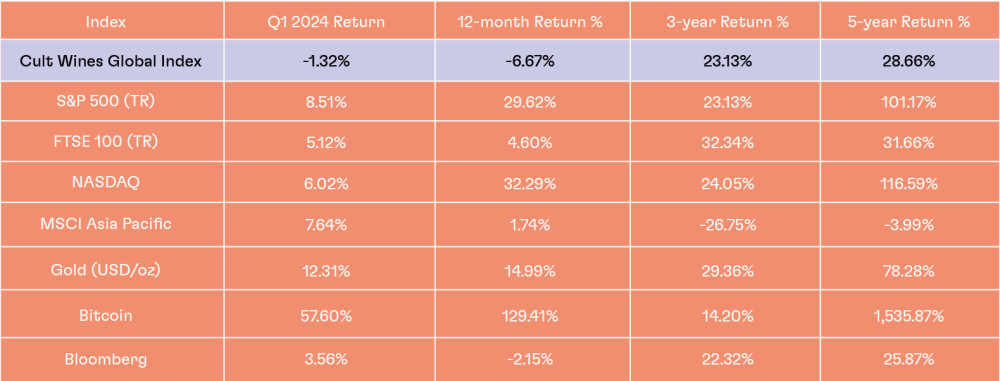

Despite negative performance, fine wine remains largely uncorrelated to the more volatile traditional financial asset class and continues to offer diversification and long-term gains. Our approach, combining in-depth market analysis with broad industry insights, positions us well to identify opportunities for the recovery phase of the cycle and adapt to shifting consumer preferences across various regions and producers.[

-2.52%

Cult Wine Investment Performance observed a decrease of -2.52% in Q1 2024, reflecting the cautious investor sentiment and challenging market conditions prevalent during the quarter.

+17.2%

Cult Wine Investment’s 3-Year Return, which evidences a solid long-term growth rate of 5.4% CAGR, highlighting our capability to deliver robust risk adjusted returns through diversification and tactical portfolio management over a volatile period.

+7.30%

Cult Wine Investment’s compound annual growth rate since inception (2009) driven by a focus on sustained long-term performance supported by our extensive fine wine knowledge and proprietary quantitative analysis.

Data-driven investment

To reach investment goals, we identify wines with the best relative value and growth prospects. We do that by using proprietary AI-driven statistical models derived from millions of data points.

Macro market summary

In Q1 2024, buoyant economic indicators boosted investors’ confidence, with the US economy surpassing growth expectations. Global equities soared, as evidenced by the 8.5% increase in the S&P 500 (TR), while volatility remained low, with the VIX Index around 14. Conversely, fixed-income investors faced challenges, grappling with persistent inflation, robust economic activity, and a less dovish stance from the Federal Reserve. This led to negative bond returns, as market expectations for interest rate cuts diminished.

Developed market equities, particularly growth stocks, performed well. The US market, led by the top-performing 'magnificent seven' stocks, saw the Nasdaq Composite (TR) rise by 6.0%, driven by remarkable earnings growth in Q4 2023.

Japan outperformed all markets, with the Nikkei 225 Index soaring by 16.8% despite the Bank of Japan's commencement of monetary policy normalization in March. European equities, while some indexes hit record highs, lagged behind the US and Japan, with the FTSE 100 (TR) returning 5.1%.

However, Europe's relatively cheaper valuations and potential economic growth alignment with the US may attract global investors seeking diversification.

Interest rate-sensitive assets like real estate faced challenges due to higher interest rates. Commodity markets saw a marginal quarterly increase of 3.6% in the broad Bloomberg Commodity Index, as lower gas prices were counteracted by higher oil prices fuelled by ongoing supply cuts and geopolitical tensions.

As we move into the second quarter of 2024, market observers will remain vigilant regarding central bank policies, inflation figures, and geopolitical shifts, which could influence market dynamics. Investors are advised to uphold diversified portfolios and remain attentive to changing global economic circumstances to effectively navigate potential obstacles and prospects in the upcoming months.

*Fine wine = Cult Wines Global Index.

Source: Wine-Searcher, Investing.com as of 31 March 2024.

Past performance does not guarantee future results.

During the first quarter of 2024, the wine market faced moderate declines across various indices. The overall Cult Wine Investment portfolios experienced a decrease of -2.52%, reflecting the downward trend in wine investments.

Specifically, our holdings in Bordeaux (-2.81%), Burgundy (-2.82%), Champagne (-2.45%), and the US (-2.27%) all saw decreases in value. Italy (-1.87%) and the Rhone (-1.26%) regions also experienced negative returns, albeit to a lesser extent. The Rest of the World (RoW) category declined by -2.38%, further contributing to the subdued performance.

Despite these challenges, it's important to remember that wine investments are cyclical and may present opportunities for tactical and dynamic portfolio management to position for a turnaround.

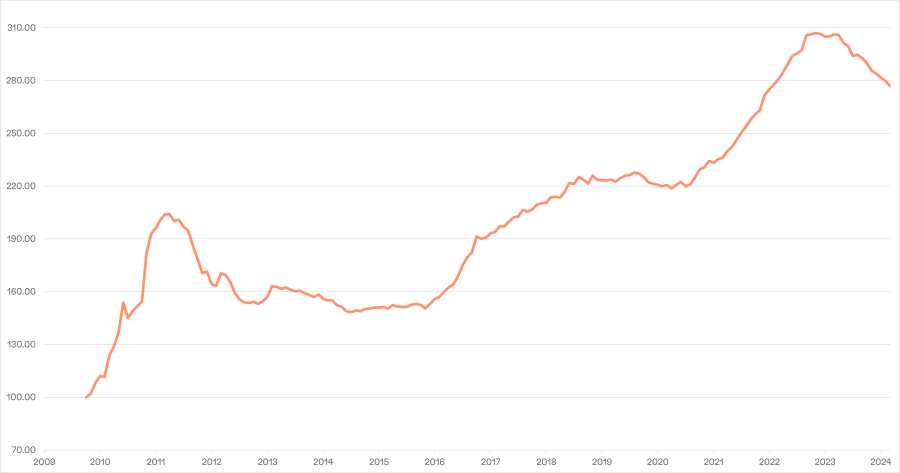

Cult Wine Investment Performance

The index level was rebased to 100 in October 2009.

CAGR = Compound Annual Growth Rate

Source: Pricing data from Liv-ex as of 31 March 2024.

Analysis by Cult Wine Investment. Past performance does not guarantee future results.

Cult Wine Investment Performance Q1 2024: -2.8%

In Q1 2024, the CWI Bordeaux displayed a consistent downward trend, reflecting ongoing pressure in the Bordeaux wine market despite slight increases in February and March. Several significant factors contributed to Bordeaux's subdued performance. Weaker demand from both traditional markets like China and emerging markets exerted downward pressure on Bordeaux prices. As Bordeaux wines are typically the most liquid, their prices have been particularly sensitive to the recent downturn.

In particular, Left Bank's 1st growth names experienced significant declines in recent vintages, with some in 2018 & 2019 dropping by over 20% in the past year. However, we strongly believe that this situation also presents appealing opportunities for investors to enter the market at advantageous prices.

Elsewhere in the region, wines like Carmes Haut Brion 2007 (+13%) and several vintages of Smith Haut Lafitte (including 2011, 2013 & 2015) achieve positive returns, outperforming the regional benchmark. The successful release of Latour 2017 at £2400 per 6 demonstrates there is still an appetite for the top wines at the right price.

Cult Wine Investment Performance Q1 2024: -2.82%

Burgundy wines, renowned for their rarity and allure, exhibited varied performance. Within the Grand Cru segment, certain producers, such as Anne-Francoise Gros and Domaine Faiveley, demonstrated resilience, benefiting from strong global demand and brand recognition. Standout performers include Domaine Anne-Francoise Gros, Richebourg Grand Cru 2017 from our Tier 1 category and Domaine Faiveley, Latricieres-Chambertin Grand Cru 2017 from Tier 2 producers, showing gains of 9% and 10% respectively in Q1 2024. In addition, multiple vintages (2012, 2013, 2016 & 2018) of Dugat-Py, Charmes-Chambertin Grand Cru, Vieilles Vignes, one of the Iconic labels in the region, have rebounded in Q1 from previous losses, resulting in gains.

Cult Wine Investment Performance Q1 2024: -2.45%

The Champagne market experienced a period of ups and downs in the last quarter, marked by a decline in both global demand and price performance overall but with variations from month to month. While smaller Champagne producers were more affected by the downturn, premium vintage Champagnes from well-established houses displayed greater resilience in terms of price performance.

The top three performers were Bollinger, R.D., Champagne, 2007, and Krug, Vintage Brut 2004, all experiencing their second consecutive monthly increase. Additionally, Louis Roederer, Rose Vintage 2013 showed notable gains. March saw the successful releases of Krug 2011 at £1485 per 6 and Bollinger La Grande Annee 2015 at £549 per 6.

Cult Wine Investment Performance Q1 2024: -1.87%

Italy, renowned for its diverse wine offerings, encountered mixed performance in Q1 2024. Within the region, Barolo demonstrated resilience, buoyed by demand for prestigious labels like Bartolo Mascarello and Bruno Giacosa, which maintained positive returns. Among Barolos, Bruno Giacosa, Falletto was one of the top performers of the CWI Italy, with its 2008 & 2014 vintage up more than 10% in Q1.

In addition, the recent launches of Sassicaia and Ornellaia in 2021, along with the upcoming release of Tignanello, have also sparked curiosity in back vintages of Tuscan wines. Sassicaia 2018 & 2019 have particularly stood out, showing a notable increase of 5% and 6%, respectively, since the release of its 2021 vintage. Conversely, certain producers such as Fontodi experienced difficulties in recent vintages (e.g., 2014 & 2020), grappling with sluggish brand recognition and competition from other regions, resulting in a lacklustre performance.

Cult Wine Investment Performance Q1 2024: -1.3%

The Rhone wine market saw a moderate decline in Q1 2024, and this downward trend has been initiated by sales below the prevailing market prices, as sellers have slashed their prices to clear their stock, creating a favourable chance for buyers. Price declines affected various appellations and different vintage years, with examples including a -25% decline for the Domaine du Pegau, Chateauneuf-du-Pape, Cuvee Reservee Rouge, 2014, and a 20% decrease for Chateau Rayas, Chateauneuf-du-Pape, 2005.

Historically, Rhone wines have offered consistent returns even during economic downturns, making them a more secure investment choice. This trend might prompt renewed investor interest in the region in the upcoming months.

Cult Wine Investment Performance Q1 2024: -2.4%

Emerging wine regions like Chile and Australia also experienced the market downturn, with notable brands like Sena and Penfolds seeing declines in Q1 2024. Although certain specific labels and vineyards displayed resilience, the overall performance remained lacklustre. While renowned labels from Argentina continued to draw attention, the growth in prices remained moderate. Meanwhile, in Spain, Vega Sicilia showcased resilience, benefiting from strong brand recognition and growing global demand, particularly with its Unico 2010 & 2011 and Alion 2008, 2013 & 2016 performing well year-to-date.

Cult Wine Investment Performance Q1 2024: -2.27%

In line with trends seen across various regions, our managed portfolios of U.S. wines saw a decline in Q12024. This period highlighted a recurring pattern where producers and wines that had previously thrived during the market's upswing were hit hardest in 2023, leading to notable price corrections. As seen in Q1, prices continued to decline, although liquidity improved, particularly for sought-after brands like Opus One and Screaming Eagle, which demonstrated resilience at attractive price levels. This has led to expectations of market stabilization in early to mid-2024.

While the quarter had few highlights, notable performance was observed among key producers in our portfolio. Several vintages from Colgin, Cariad in Napa Valley have experienced gains in Q1 2024, with the 2006 vintage increasing by 20% and the 2015 vintage rising by 10%. Harlan 2010 & 2017 showed gains, extending its trend of outperformance over the past year, attributed to its robust brand reputation and growing popularity. This resilience amid broader market adjustments underscores potential strategic opportunities in the U.S. wine segment as conditions normalize.'

While the fine wine market continued to face headwinds in Q1 2024, the devil is in the detail. The performance is mixed across all regions and far from uniform across our selection of producers and wines.

It’s also fair to say that this is a quarter when each month had a different tone, with some notable improvement in conditions in March which leads us to indicate a cautious yet optimistic outlook.

Recent price adjustments have created real opportunities for buyers, and with other asset classes reaching some peaks and a more favourable interest rate outlook, we believe we could see some reallocation to physical and tangible assets such as Fine Wine. We are still in a buyer’s market, and we advise tactical allocation to wines with strong fundamentals and depreciated values to take advantage of the current conditions.

Regional Q2 2024 outlook

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The Cult Wines Global Index is a hypothetical tool. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wines customer which ranges from 2.95% to 2.25% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.