|

Brand

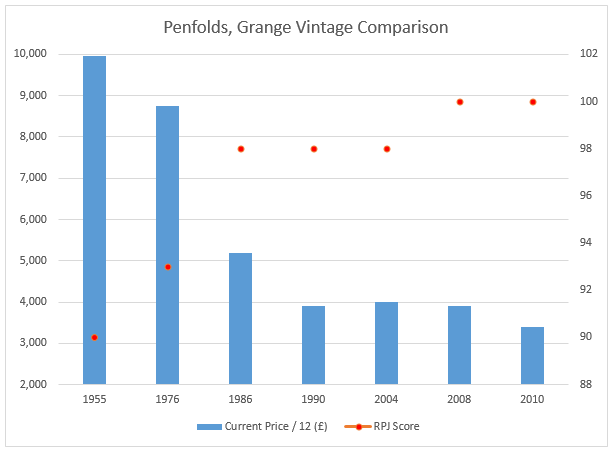

Penfolds, Grange is Australia’s most iconic brand and for those who are not familiar with the wine simply known world over as ‘Grange’, here as some key facts:

- Penfolds estate founded in 1844.

- Penfolds, Grange was first produced in 1951 by Max Schubert to rival Bordeaux’s Grand Cru Classé

- Was named Grange Hermitage until 1990.

- Grange is a multi-vineyard, multi-district wine. Grapes are sourced from various locations in South Australia.

- Estimated numbers of Grange are between 5,000 to 15,000 cases annually, depending on the vintage. (Penfolds never release actual production figures, hence estimate)

- Grange is regarded as one of the world’s leading estate, a First Growth from down under!

The release of the 60th vintage of Grange has coincided with a ‘luxury world tour’, which showcases the estate amongst a ‘big stakes’ clientele of wine enthusiasts in New York, LA, Canada, Singapore, Japan, Thailand & Shanghai all before Christmas. The value of diversification cannot be underestimated in this market, with different regions marketing their respective powerhouse wines in their own unique character. However, how does Grange match up against similar status wines from other regions?

Investment Analysis

|

Wine/Vintage

|

Price per 12

|

Critic Score

|

% Difference

|

|

Pingus 2004

|

$16,351

|

100

|

89.4%

|

|

Screaming Eagle 2010

|

$38,582

|

100

|

144.3%

|

|

Masseto 2006

|

$12,861

|

100

|

69.2%

|

|

Latour 2009

|

$16,535

|

100

|

90.3%

|

| Grange 2010

|

$6,247

|

100

|

|

As the comparison table above illustrates, Australia’s

leading wine is seriously undervalued by comparison to the top wines with the

highest scores from Bordeaux, Spain, Italy and California. An average price

difference of 98.3% without taking into consideration the top producers from

Burgundy.

|

|

|

|

The 2010 Grange arrives with much expectation and does not disappoint.

This is a powerhouse, structurally superior to both the 2009 and 2008 vintages

and breathtakingly dense, long and precise. The nose has cola, blackberry,

vanillin, hard brown spices of all kinds, coal smoke, meaty charcuterie

elements and a strong tarry, savory note that speaks of the 85% Barossa Valley

componentry. The palate has super deep tannins that fan out through flavorsome

black fruits. These are purposeful tannins; they bristle on the palate, tantalizing

and assertive yet playful, strong not aggressive. The power here is the thing;

this has mouth-coating density and terrific drive, so tightly coiled, it gives

enough away to suggest a very, very long cellaring wine is here. This is a

classic Grange that will please the serious collectors. A wine of genuine

pedigree. Better in 2026.

|

|

|

|

|

|

Score: 100

|

James Suckling, JamesSuckling.com, October 2014

|

The 2010 vintage for Grange is an indispensable addition to

a wine portfolio, given the global output of the brand and the long term

benchmark vintages. Grange has been a standout performer against the wider

market, the index of its last 10 vintages climbed 65% over a 5 year period at

the end of 2013. With growth of 50-100% anticipated over the next 5 – 10 years,

we would encourage all existing clients to consider allocating at least 1 case

at this first tranche release.

Key Points

- 100pts from James Suckling.

- 15% more affordable than the comparable 2008 –

rated at 100pts

- Australia’s First Growth equivalent.

- Limited availability at the UK best market

price.

|