|

Problems viewing this email? Please select 'always display images' or

click here |

|

|

|

INVESTMENT OFFER: MOUTON ROTHSCHILD 2012

|

|

|

|

|

|

|

|

|

|

|

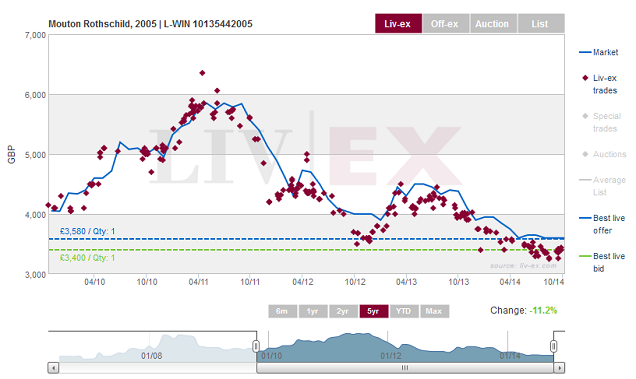

Mouton Rothschild 2005

£3,600 per 12x75cl case

|

|

Previous peak price was in June 2011 when this vintage was trading at £5,850.00 per case.

|

|

|

First Growth market certainly represents good value given the quality of the wines and recent price correction.

|

|

|

Mouton 2000 96 points trades at £11,200 per case.

|

|

|

96+ pts from Parker from arguably one of the three top vintages alongside 2009 & 2010.

|

|

|

2005 vintage set to re-score by Parker next year, a lot of commentators feel that many wines could be upgraded.

|

|

|

5 Year Target Price: £6,000 / 12 (£500 per bottle)

|

|

|

66.67% Growth Projection

|

|

|

In 5 years, the 2005 vintage will be 14 years old – the same age currently as the 2000 – which is worth c. £1,000 per bottle.

|

|

|

Top performing First growth estate in 2014 and as this area of the market picks up, we expect the well-received brand output to be leading the resurgence.

|

|

|

|

|

|

|

|

|

‘Tasted blind againstits peers, this brilliant Mouton-Rothschild

trumped both Latour and Lafite!’

Neil Martin – Wine Advocate

As the graph above quite clearly demonstrates the current position of theMouton 2005 represents very strong investment potential. With demand firmly

back in favour for First Growth wines we would expect the price to return to

the level we saw in 2011 and gradually continue in line with older back

vintages as supply diminishes further.

Recent auction results also confirm our sentiment and confidence in

Mouton as a brand with many lots far outstripping their pre-auction estimates.

As the table below demonstrates Mouton Rothschild is still a highly desirable

brand amongst consumers and collectors alike, and will undoubtedly continue to

provide investors with a stable return over the medium to long term.

|

|

|

|

|

|

|

|

|

|

The 2005 Mouton Rothschild will have to take a back seat to the prodigious 2006, but administrator Philippe Dalhuin deserves considerable credit for pushing Mouton to higher quality levels over recent years. A blend of 85% Cabernet Sauvignon and the rest mostly Merlot, the dark purple-hued 2005 exhibits a restrained but promising nose of cedar, tobacco leaf, creme de cassis, and toasty oak. Full-bodied,

tannic, and extremely backward, with the vintage’s tell-tale acidity, it appears to be even more closed in the bottle than it was from barrel. It does possess a long finish and multilayered mouthfeel. This is an undeniably outstanding, yet restrained, shy wine for a Mouton Rothschild. Anticipated maturity: 2018-2040+

|

|

|

|

|

|

|

Robert Parker, Wine Advocate (176), April 2008

Score: 96 pts

|

|

|

|

|

Tasted blind against its peers, this brilliant Mouton-Rothschild trumped both Latour and Lafite! If it lacked the same level of breeding out of barrel, then it sure as hell is making up for its now. The nose is incredibly ripe and is perhaps more accessible than those aforementioned Pauillacs. Dark cherries, kirsch, cedar and some lovely vanillary new oak – sleek and sophisticated. Great definition. The palate has a viscous entry, fat round tannins, voluptuous, generous and sensuous. Great depth with blackberry, raspberry, a touch of black olive tapenade. Sensuous, feminine finish. Sublime. Drink 2017-2040+ Tasted January 2009.

|

|

|

|

|

|

Neal Martin, July 2009

Score: 98 pts

|

|

|

Auction Results - Sotheby's 4th October 2014

|

Vintage

|

Point Score

|

Auction Estimate

|

Sale Price

|

Over Estimate %

|

|

2000

|

96

|

£7175 - £10,350

|

£14,650

|

41%

|

|

2001

|

89

|

£1915 - £2550

|

£3,350

|

31%

|

|

2002

|

93

|

£1915 - £2550

|

£3,350

|

31%

|

|

2003

|

91

|

£2230 - £2870

|

£3,520

|

22%

|

|

2006

|

98

|

£2710 - £2870

|

£3,910

|

36%

|

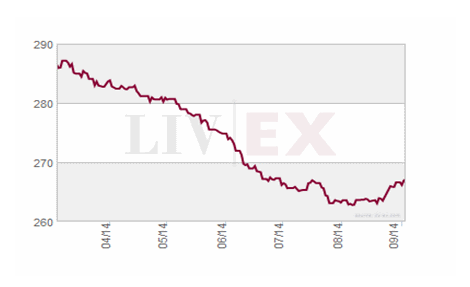

First Growth Market Analysis

Taking a closer look at

the First Growth market as a whole, one of Cult Wines Directors Thomas Gearing

wrote an article analysing the current position of the market and the subsequent

investment opportunities investors are presented with. Please follow the link

below to read the full article -

http://www.wineinvestment.com/wine-blog/2014/09/are-bordeaux-first-growths-currently-mispriced/

The graph below taken directly from Liv-ex illustrates

the uplift in demand we have witnessed over the past month, and further cements

our confidence that sentiment has returned for the top end of the market.

|

The Great Vintages of Mouton Rothschild

|

Current Market Value per 12x75cl

|

Price difference to 2005

|

|

1961

|

£21,500

|

142.6%

|

|

1982

|

£10,200

|

95.6%

|

|

2000

|

£11,200

|

102.7%

|

|

2005

|

£3,600

|

|

|

2009

|

£4,850

|

29.6%

|

|

2010

|

£4,800

|

28.6%

|

The table above is designed to show the price disparity

between the 2005 vintage and other ‘great vintages’ from Mouton Rothschild. The

2005 vintage is widely regarded as one of the top 5 vintages from Bordeaux in

recent times, and with Parkers 10 year retrospective looming the Mouton is

highly tipped to have improved since its last official tasting.

Investment Summary

• Blue Chip medium to long term opportunity

• 60+% growth over a 5 year period

• Minimal downside risk over 5 year hold

• Currently available at the same price as EN PRIMEUR.

|

|

|

|

|

|

|

|

Reg. Company No: 06350591 | VAT No. GB 129 9514 84 | St Andrews House,

Upper Ham Road, Richmond TW10 5LA.

© 2014 All Rights Reserved. Cult Wines Ltd & Wineinvestment.com | You

must be 18 or over to order. |

|

|

|