Fine Wine Investment Prospectus

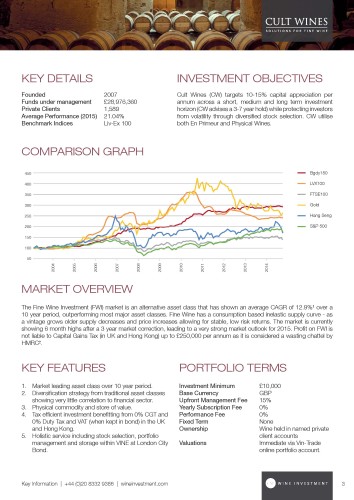

The Fine Wine Investment (FWI) market is an alternative asset class that has shown an average CAGR of 12.9% over a 10 year period, outperforming most major asset classes. Fine Wine has a consumption based inelastic supply curve - as a vintage grows older supply decreases and price increases allowing for stable, low risk returns. The major market index (Liv-ex FW 100) ran fl at in 2015 after a 3 and a half year market correction, leading to a very positive market outlook for 2016. Profit on FWI is not liable to Capital Gains Tax (in UK and Hong Kong) up to £250,000 per annum as it is considered a wasting chattel by HMRC.

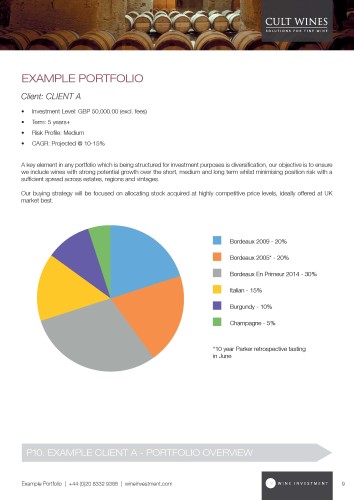

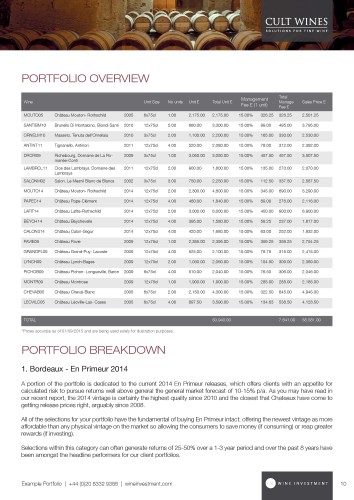

Cult Wines (CW) targets 10-15% capital appreciation per annum across a short, medium and long term investment horizon (CW advises a 3-7 year hold) while protecting investors from volatility through diversified stock selection. CW utilise both En Primeur and Physical Wines.

Cult Wines Ltd is one of the UK’s leading fine wine investment companies, with a highly trained team of specialists who bring with them a wealth of financial markets expertise and fine wine experience. A family business based in Richmond, with core values of openness and transparency, we are perfectly positioned to advise a global private client base on the full potential of investment in this market. One of our key strengths is our dynamic and forward-thinking approach to analysis and research, we are constantly engaged in developing leading edge market strategies and providing up to the minute market data.