1

Tell us how much you plan to invest

You can start investing in a balanced, personalised wine portfolio from as little as £25k.

2

Share your investment parameters

Knowing your investment objectives, risk appetite, and term will help us recommend a portfolio best suited to your needs.

3

Fund account & asset allocation

Once agreed on your portfolio, you are required to fund your account.

Next, we allocate the wine into your name in our bonded warehouse.

4

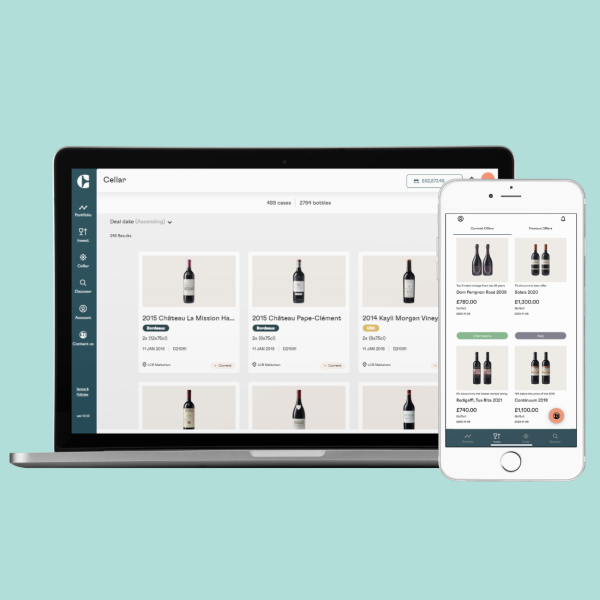

Access account & enjoy benefits

You receive a login to the Client Portal. With it, you can monitor your investment.

All investors gain access to a suite of exclusive benefits from events, to access to rare wines, to curated vineyard tours, and much more. The more you invest, the more you can unlock.

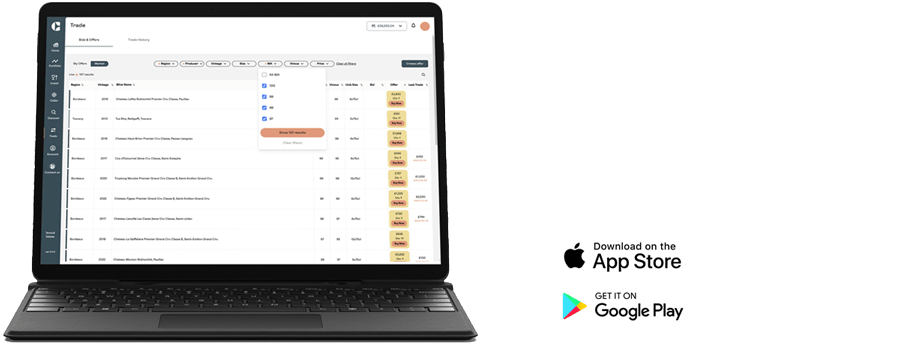

Wine management made simple

With the Client Portal, it’s easy for you to track your portfolio performance - every day.

Check historical transactions, current P&Ls, storage account information, and stay informed about live market pricing, bids and offers.

You can also track and request to sell your assets whenever you decide.

More than just investment

At Cult Wines, we are lucky to work with the greatest winemakers in the world. Their true understanding and passion for the trade is infectious. You can get a sense of the entire wine experience for yourself through bespoke events we organise together with renowned producers.

Do you already have a wine portfolio?

If you already invest in fine wine with another company, you can easily transfer the management and storage of your portfolio to Cult Wines.

Our process

We make investing in wine as effortless as drinking it. You don’t have to become a wine or financial expert to do it.