The 10 Best-Performing Fine Wines of 2025 (So Far)

The fine wine market has shown mixed signals in 2025. Headline data points to softer conditions, but dig beneath the surface and you’ll find pockets of real strength. In fact, some labels are delivering double-digit gains this year, proving that demand is still alive and well for the right wines.

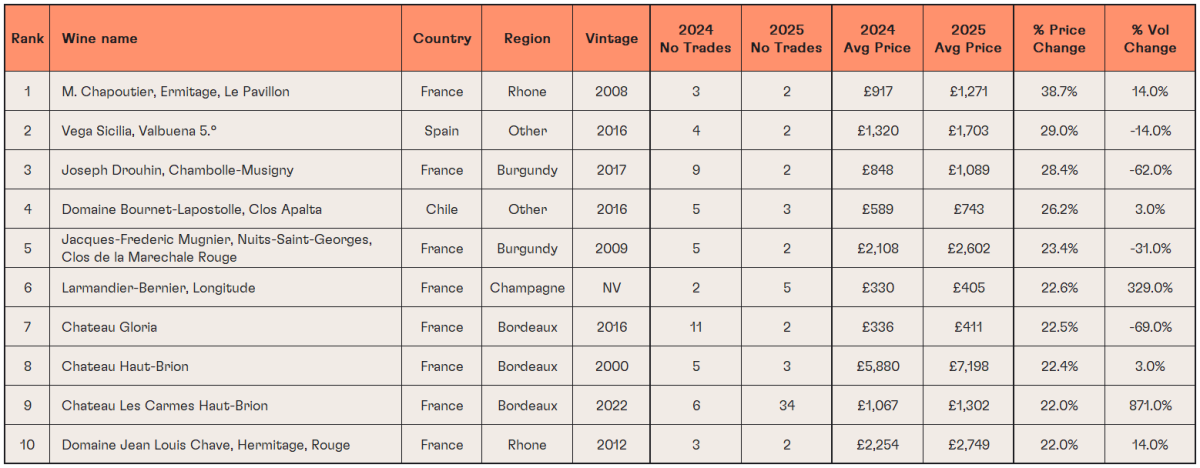

Drawing on 15,000+ real trades recorded so far this year, here are the top 10 best-performing wines of 2025 to date. Each of these names has posted impressive price growth compared to their 2024 average trading price, making them standouts in a selective market.

1. M. Chapoutier, Ermitage Le Pavillon 2008 (Rhône, France) +38.7%

The clear leader of 2025 so far, Chapoutier’s Le Pavillon 2008 has surged almost 40% year-on-year, with the average price jumping from £917 to £1,271. Rhône has often been viewed as undervalued compared to Burgundy, and this result suggests collectors are recognising the potential of top Hermitage wines.

2. Vega Sicilia, Valbuena 5°, 2016 (Ribera del Duero, Spain) +29.0%

Spain’s most iconic estate continues to deliver. The Valbuena 5° 2016 climbed 29%, breaking through the £1,700 mark on average. While volumes dipped slightly, the consistent rise underlines how Vega Sicilia remains one of the few Spanish producers able to command global attention.

3. Joseph Drouhin, Chambolle-Musigny Premier Cru 2017 (Burgundy, France) +28.4%

Burgundy remains at the heart of the fine wine conversation, and even at the Premier Cru level, demand is pushing prices up. Drouhin’s Chambolle-Musigny 2017 rose by more than a quarter in value, despite a significant drop in trading volumes, showing how scarcity continues to drive prices higher.

4. Clos Apalta 2016 (Apalta, Chile) +26.2%

Chile is not traditionally a powerhouse in the fine wine investment space, but Clos Apalta is breaking the mould. Up 26% this year, with steady trading activity, it shows how New World labels are carving out a role in diversified portfolios.

5. Jacques-Frédéric Mugnier, Clos de la Maréchale 2009 (Nuits-Saint-Georges, Burgundy) +23.4%

Another Burgundy star, Mugnier’s Clos de la Maréchale, has risen 23% to an average of £2,602. The reduced number of trades suggests supply is tightening, which could keep upward pressure on prices going forward.

6. Larmandier-Bernier Longitude NV (Champagne, France) +22.6%

Champagne has been one of the most active regions for trading in recent years, and here’s proof it still has momentum. Longitude NV saw prices climb from £330 to £405, while volumes skyrocketed by 329%. Clearly, more collectors and investors are buying into grower Champagne.

View/Buy on CultX

7. Château Gloria 2016 (Saint-Julien, Bordeaux) +22.5%

Often considered a value play in Bordeaux, Château Gloria is enjoying a moment. Prices rose 22.5%, even as trade volumes dropped sharply. For savvy buyers, this could signal rising demand meeting a lack of available stock.

8. Château Haut-Brion 2000 (Pessac-Léognan, Bordeaux) +22.4%

One of Bordeaux’s First Growths makes the list, with the millennium vintage of Haut-Brion pushing beyond £7,000 per bottle on average. That’s a healthy 22% gain, highlighting how truly iconic vintages continue to attract long-term capital.

9. Château Les Carmes Haut-Brion 2022 (Pessac-Léognan, Bordeaux) +22.0%

Perhaps the most eye-catching story of 2025: Les Carmes Haut-Brion 2022. Prices are up 22%, but what stands out is the sheer explosion in trading volume, up an astonishing 871% compared to 2024. This is the kind of breakout data that signals a label moving from insider favourite to global must-have.

10. Domaine Jean-Louis Chave, Hermitage Rouge 2012 (Rhône, France) +22.0%

The Rhône bookends our top 10, with Chave’s Hermitage Rouge 2012 posting a 22% gain. With limited trading but steady price appreciation, this reinforces the Rhône’s role as one of 2025’s quiet outperformers.

Key Takeaways

- Rhône Renaissance – Both Chapoutier and Chave make the list, with Hermitage proving it can rival Burgundy in performance.

- Burgundy Strength – Even with lower volumes, Premier Cru labels from Drouhin and Mugnier are climbing fast.

- Champagne Momentum – Larmandier-Bernier shows how grower Champagne continues to attract buyers, with a huge jump in activity.

- Bordeaux Icons + Newcomers – From Haut-Brion 2000 to Les Carmes 2022, Pessac-Léognan is showing depth across both established and emerging names.

- Diversification Works – With Chile and Spain represented alongside France, the best gains are not confined to one region.

The message is clear: while the overall fine wine market may feel subdued, opportunities still exist for those with access to the right data.

The Half-Year Wine Market Review: What the Data Says & What’s Next?

Explore our full Half-Year Wine Market Review for deeper insights into trading volumes, pricing trends, and regional highlights from 2025 so far. You can also download the complete dataset for a detailed look at the underlying analysis.