Key Highlights:

- As the global economy improves and reopens, Bordeaux and Burgundy fine wines could be the big beneficiaries and drive further growth of the fine wine market.

- Macro conditions favour a continuation of the current rally in the Burgundy market while the Bordeaux EP campaign is opening up opportunities in both old and new vintages.

- From a buyer’s perspective, now is the right time to increase exposure to these prestigious fine wine sectors whether through identifying attractive new EP releases or finding relative value among back vintages.

Bordeaux’s en primeur (EP) campaign couldn’t have got its timing any better! Both Bordeaux and Burgundy are enjoying strong starts to 2021 with Liv-ex’s Bordeaux 500 index posting a healthy 3.20% gain while Burgundy’s 6.62% rise is the highest among all regional indices (through end of May). The Fine Wine 50 index, a measure of Bordeaux first growths only, had returned 4.23% as of 23 June.

But we think Bordeaux and Burgundy, the engines of the fine wine market, are just getting revved up! As the recovery gains pace, investors are seeking out real assets such as fine wine for diversification of returns or a hedge against possible inflation. A financial system awash with cash from the massive monetary and fiscal stimulus to combat the effects of the COVID pandemic is adding to the demand. It follows that the most established sectors within fine wine will absorb a large portion of people’s increasing fine wine exposures.

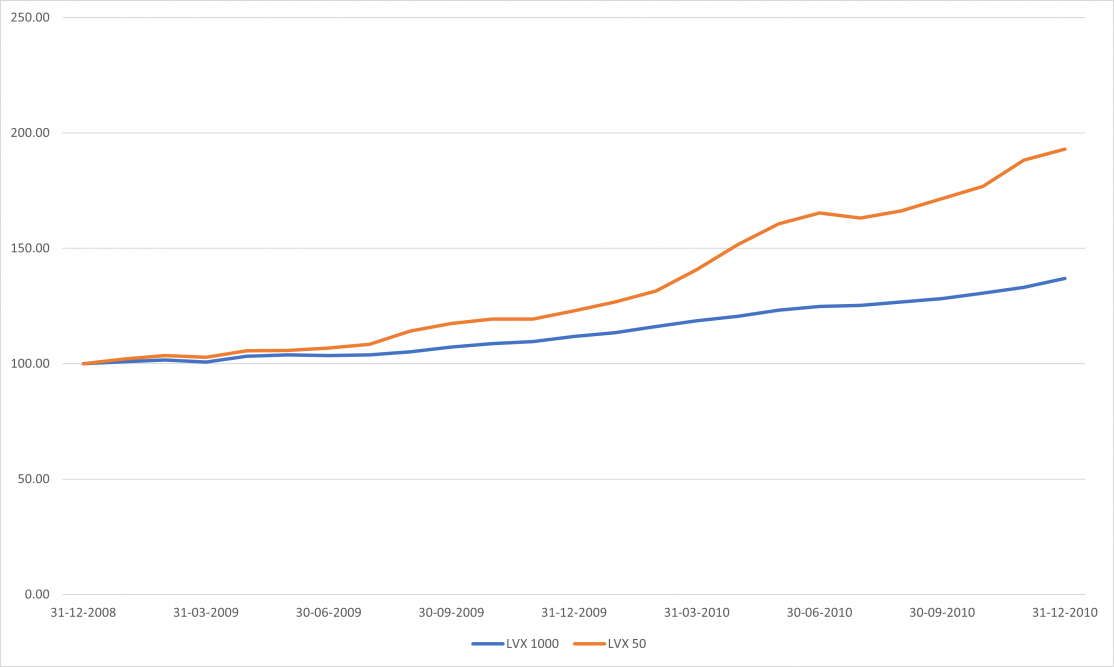

We find a similar trend in the wake of the Global Financial Crisis over a decade ago. As economies slowly recovered starting in 2009, the Liv-ex Fine Wine 50 outperformed the wider fine wine market with an eye-catching return over 90% in the 2009-2011 period compared to the Liv-ex 1000’s 37% return.

Bordeaux first growths topped post-GFC recovery

Fine Wine 50 vs Liv-ex 1000 (Index prices rebased to 100 at 31 Dec 2008)

Source: Liv-ex, as of 31 May 2021

Today, we see several reasons why Bordeaux and Burgundy can lead fine wine’s continued recovery.

Supportive macro conditions

With uncertainty still high even as the global economy recovers, Bordeaux and Burgundy’s longer track records of stable returns can boost their appeal in the current environment relative to less-established sectors. The more in-demand Bordeaux and Burgundy wines are, the more their prices will see upward pressure.

Additionally, Bordeaux and Burgundy are now free of the burden of US tariffs. Both regions were among those hurt by a 25% tariff on some European still wines since 2019, while other regions, including Champagne and Italy, enjoyed exemptions. However, the suspension of tariffs in March of this year spurred renewed activity in Bordeaux and Burgundy and the recent news that the US and EU agreed on a five-year truce in trade relations adds a tailwind to these regions’ outlooks.

Room to run for Burgundy

A closer look reveals that Burgundy’s strong start to 2021 could turn into a sustained rally. The Liv-ex’s Burgundy 150 outperformance so far in 2021 has been part of a rebound following a period of price consolidation in 2019 and early 2020. However, the index still sits below its peak in the second half of 2018, indicating the rebound has room to run.

The current rally doesn’t yet compare to previous Burgundy growth cycles as shown in the below chart. We interpret the lower return in the current market as a sign that the market has not yet reached its peak. Factor in the supportive macro backdrop and you have a recipe for ongoing gains.

Burgundy’s bigger potential

Comparison of Burgundy bull markets of six months or longer

Source: Liv-ex, as of 31 May 2021

Bordeaux opportunities old and new

The improving global backdrop combined with attention generated by new EP campaign could provide the needed spark to trigger a rally across the Bordeaux market.

The new Bordeaux EP wines form a natural entry point to a region primed for strong performance as the economy improves. This positive outlook finds support from the widely held view that the 2020 wines are of excellent quality in most places with many exhibiting more ‘classic’ Bordeaux character than recent years.

A selective approach is the best way to approach the Bordeaux market as quality and pricing can vary. Alongside the best-valued new wines, our analytical approach is currently finding many back vintages with considerable room for price appreciation. Pandemic lockdowns, economic concerns and the US tariffs may have hindered many excellent-quality wines released in recent years from reaching their full price potential.