Fine wine and the troubled British pound

Key points:

- Although we believe fine wine can remain stable amid the current volatility, some impact from the weak British pound is expected.

- Fine wine denominated in pounds has become cheaper for foreign buyers, signalling a potential long-term investment opportunity.

- Increased global demand could help boost wine prices. However, exercising caution is essential as the short-term outlook for the pound is highly uncertain.

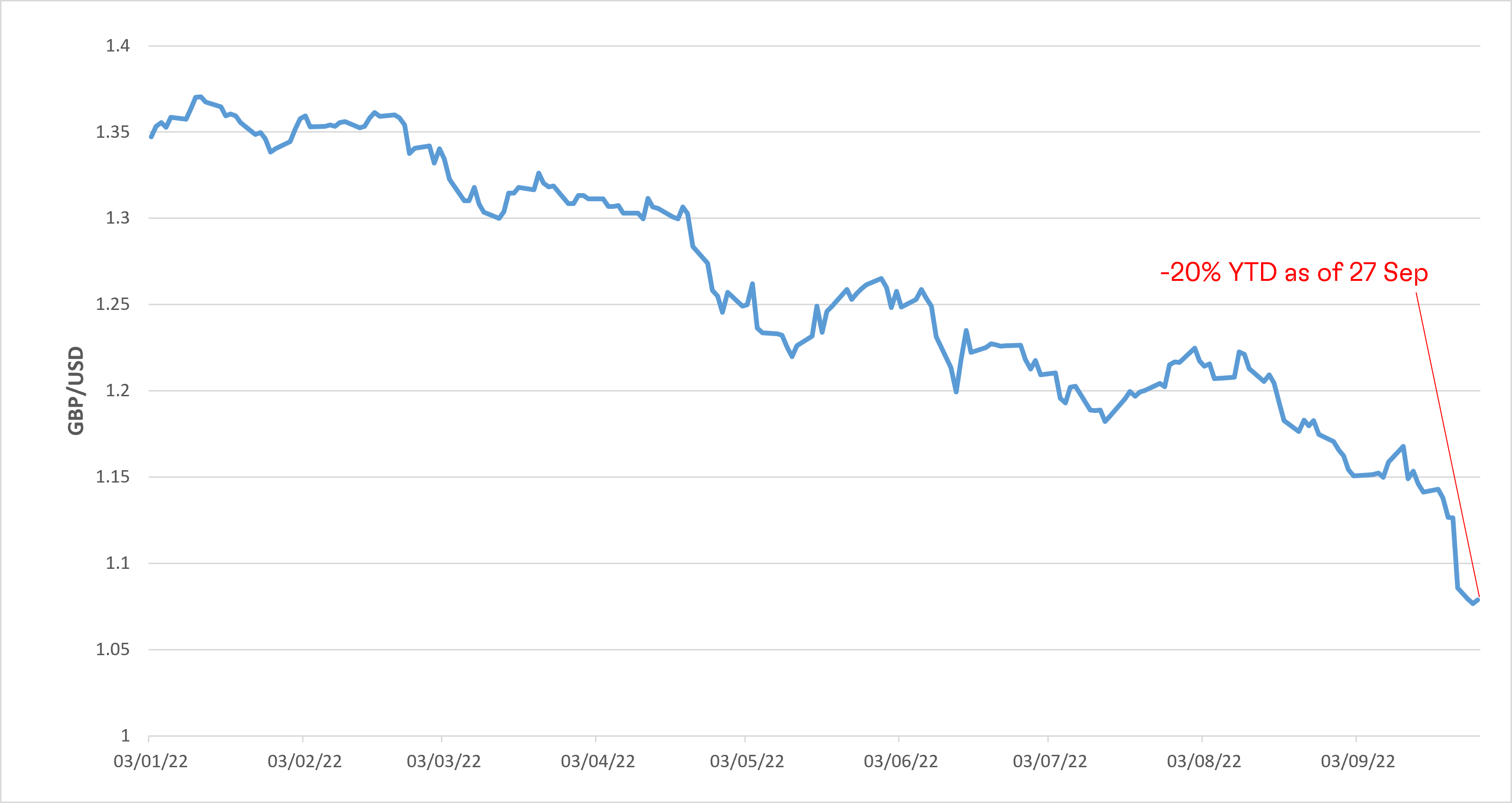

The British pound appears to be on an unpleasant, out-of-control roller coaster ride. The new UK government’s “mini-budget” tax cuts and borrowing plans triggered a sharp selloff in sterling, sending the pound to its lowest ever level against the US dollar with volatility expected to remain elevated for the foreseeable future.

Fortunately, we don’t expect any wild swings in fine wine prices like we’re seeing in other UK assets. It’s important to remember that fine wine is a sterling-denominated real asset and not the currency itself. This means fine wine is not a direct proxy for the value of sterling and should not be treated as an FX trading strategy. Solid market fundamentals – namely constrained supply alongside global demand from consumers and investors - remain in place.

Figure 1 - Sterling’s 2022 slide

GBP/USD rate from 01 January 2022 to 27 September 2022

Source: Investing.com as of 27 Sep 2022

However, fine wine is not entirely immune from forex swings with secondary market wine prices denominated in sterling. Much of the global trade transits through the UK and many investment holdings, including those of Cult Wine Investment, are domiciled in the country. Here, we look at what the volatile British pound means for the fine wine market.

Possible upside for foreign buyers

The immediate impact is that sterling-denominated fine wine is now cheaper for buyers with dollars and many other currencies. For example, a case of £1,000 wine would cost the equivalent of around $1,070 based on recent exchange rates[1]. But in January, a £1,000 case would have required far more, around $1,350. A jump in queries and deals from US and Asian buyers this week is a sign the market is already recognising this increased buying power for non-sterling currencies.

The weak pound may also increase the future returns of wine investments for foreign investors. Those who buy fine wine when sterling is low would realise FX gains in their home currencies if sterling recovers just some of its recent losses.

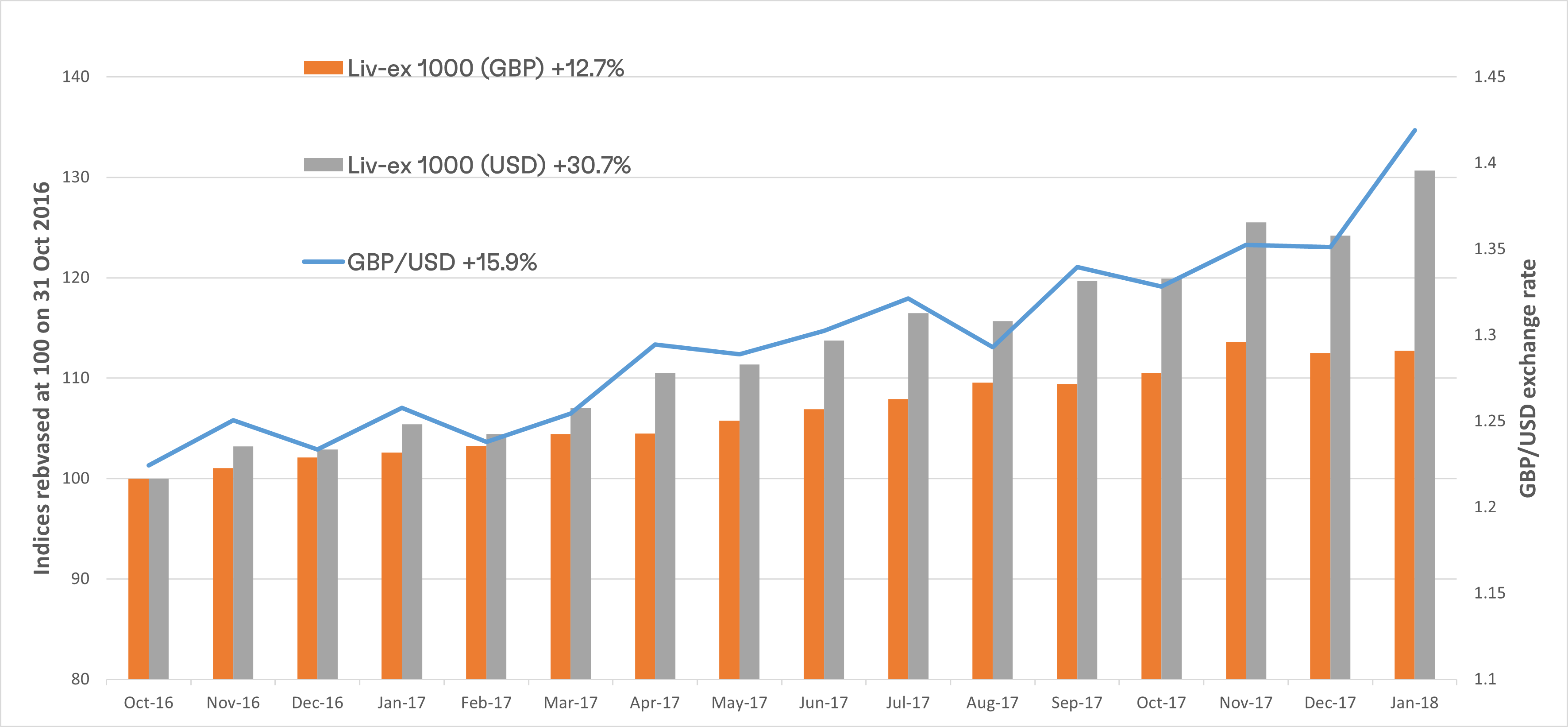

We saw this in the wake of the 2016 Brexit vote when sterling declined sharply, but then recovered some of its losses starting in October 2016. The Liv-ex 1000 rose 12.7% from October 2016 through January 2018 but in US dollar terms, the fine wine index was up 30.7%. Although the Liv-ex is not an investable index, this illustrates how the pound’s recovery can magnify gains for USD-based investors.

Figure 2 – Gains magnified in USD when GBP recovers

Fine wine index performance and GBP/USD rate – Oct 2016 to Jan 2018

Source: Liv-ex, investing.com as of 31 Aug 2022. The index is a hypothetical tool for illustrative purposes only. Past performance is not a guarantee of future results.

The current outlook for the pound suggests it will likely stay volatile in the near to medium term, meaning caution and a long-term perspective are necessary. The value of a fine wine holding in an investor’s home currency remains less on a currency-adjusted basis as long as the pound is depressed.

However, even though the current government has no clear path to rectifying the selloff, there is certainly a desire across most of the UK political spectrum to see a return to a more stable, stronger pound. The Bank of England is expected to step in with rate hikes to protect the currency.

Fine wine – a potential hedge against ongoing GBP weakness

A boost in demand from foreign buyers could, in turn, cause wine prices to rise, making wine a potential hedge for both foreign and UK-based investors, who have few places to turn to amid the current volatility.

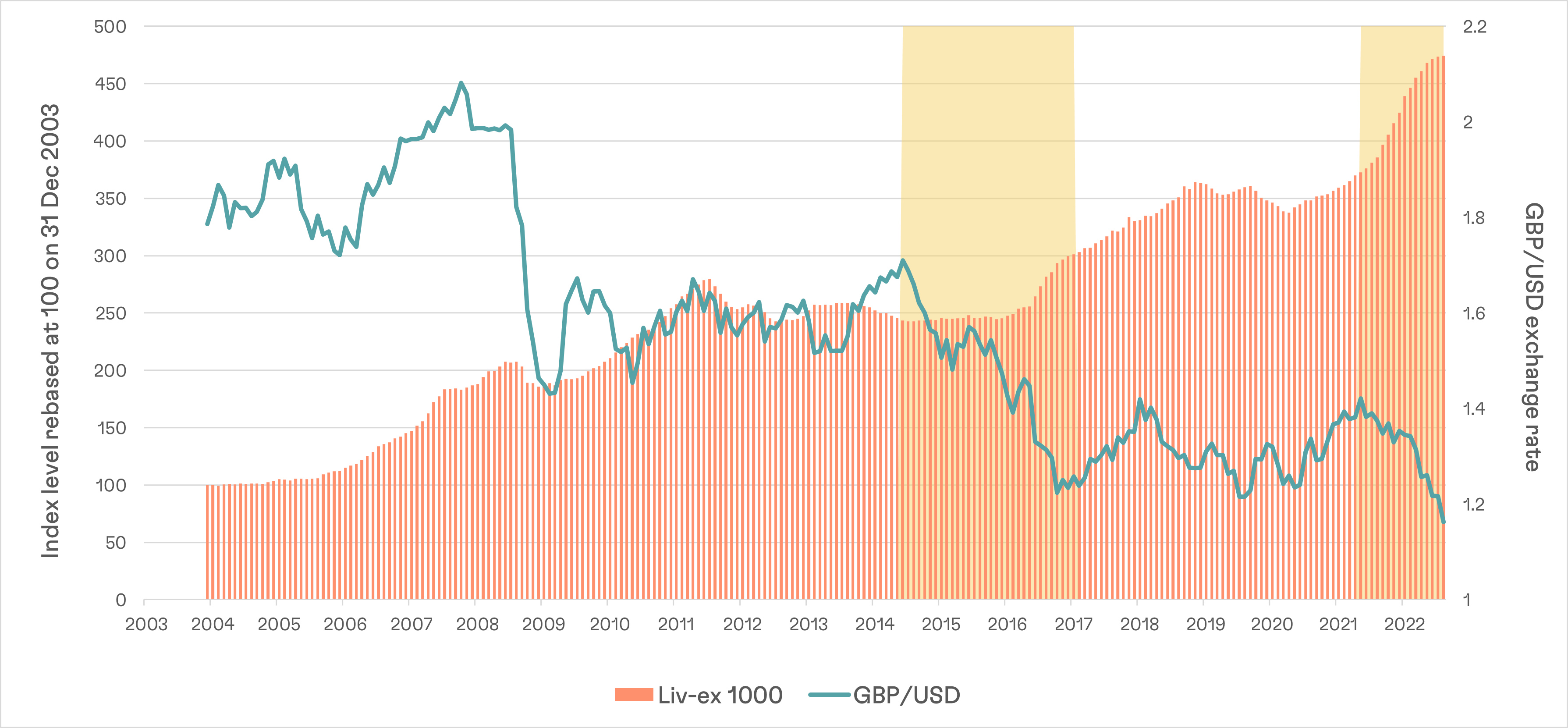

Fine wine’s track record lends support to its potential during periods of sterling weakness. The chart below shows rallies in the Liv-ex 1000 that came during weak spots for the pound, including the period following May 2016 Brexit vote. In fact, the Liv-ex gained 21% in the 12 months after the vote while the pound dropped by 11%. Although it’s important to remember correlation does not equal causation (there are times when both wine and the pound moved in the same direction), this track record, at minimum, shows that fine wine’s potential remains in place even during sterling slumps.

Figure 3 – Fine wine can perform during sterling slumps

Liv-ex 1000 index performance vs GBP/USD exchange rate since 2004

Source: Liv-ex, investing.com as of 31 Aug 2022. Past performance is not a guarantee of future results.

But the unstable economic outlook in the UK as well as the ongoing US Federal Reserve hawkish rate hiking cycle, which boosts the appeal of fixed income investments, may moderate any rush to invest in sterling-denominated assets.

Ultimately, the pound’s uncertain direction as well as the fine wine market structure mean we view fine wine as a long-term investment. Some investors may opt to buy to take advantage of the potential opportunity created by a soft pound but long-term, we believe fine wine’s main benefit stems from its degree of separation from macroeconomic policy rather than a potential option to play the currency outlook.

[1] GBP/USD 1.07 on 26 Sep 2022; 1.35 on 03 Jan 2022. Source investing.com

Disclaimer: Past performance is not indicative of future success. Returns were calculated in GBP and may vary depending on exchange rates. Any investment involves risk of partial or full loss of capital. The index is a hypothetical tool. The results depicted here are not based on actual trading and do not account for the Cult Wine Investment annual management fees. There is no guarantee of similar performance with an investor’s particular portfolio.