The Top 100 Wines of 2023

Cult Wines' latest market analysis reveals pivotal shifts in the fine wine industry, offering new insights for buyers, collectors, and investors.

The CultWine100, powered by Wine-Searcher, the world's most extensive source of powerful wine pricing data, examines the top one hundred most searched wines, a significant portion of the investment-grade wine market. By analysing the price change of 2,700 wines in 2023, (all vintages released over past 30 years), Cult Wines provides an in-depth understanding of the market's movements and trends, shedding light on the evolving landscape of wine investment.

Contents

Investment grade wines lose their shine in 2023

2023 might stand out as an unfortunate year for the fine wine market. It ended a 3-year bull run by losing more than -6% in value. In contrast, 2022 witnessed wine as the top-performing asset class globally, delivering over +15% in price growth. This success came in a year when fixed income experienced its worst performance in 30 years. While the wine market is proven to be an uncorrelated asset, it tends to lag behind when it comes to reacting to macroeconomic factors. 2023 had threatened to be a year of consolidation, considering the challenging global economy and high interest rates.

As our report and analysis reveal, some of the most renowned names in the collectible wine world, which had ridden the wave of the past few years, gave back a significant portion of those gains in 2023.

In 2023, there were very few highlights but a notable commonality: prices were on the decline. Only 12 out of the top 100 wines we tracked (the 100 most searched-for wines on wine-searcher.com) across the last 30 vintages posted positive price appreciation from January 1st, 2023, to December 31st, 2023. Almost 90% of the wines in our list, considering the price changes of nearly 2,700 wines, saw average price decreases, with a quarter experiencing average price drops of over -10%.

Despite the poor performance in 2023, almost all wines showed positive returns over a 3-year and 5-year period, with only two wines displaying negative performance across all three measures. In fact, when analysing the top 100, the average price change over 3 years was +30.3%, and over 5 years, it was +42.5%. This suggests that performance over a longer time frame is still in line with the long-term trend. This could be positive news for investors and new entrants into the market, as it implies that some of the market's excesses have dissipated, bringing prices back in line with the historical trend.

DOWNLOAD THE FULL CULTWINE100 2023 LIST

Explore the 2023 wine market with the full CultWine100 List. Discover wines, rankings, and key data on 2023, including 1-year, 3-year, and 5-year performance. Perfect for investors and enthusiasts seeking insights into market trends and investment opportunities. Download now to enhance your wine knowledge and strategy.

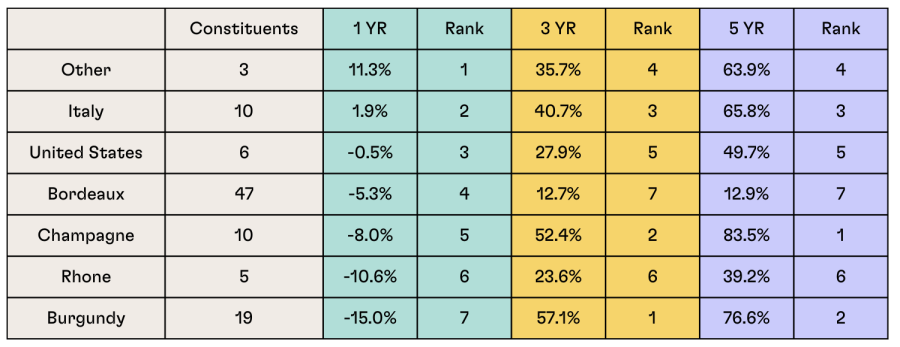

Regional reversal, as the bubble finally pops for Champagne and Burgundy

Regionally, the standout performers of the past few years, Burgundy (7th) and Champagne (5th), were at the bottom of the rankings in 2023, down -15% and -8%, respectively, across the wines tracked for the report. Burgundy, however, still showed the best 3-year return, reaching +57.1% for the 19 wines included in the list, despite a -15% decrease in 2023. On the other hand, Champagne showed the best performance over a 5-year period, with an average increase in value of +83.5% for the 10 brands tracked during that period.

Given the spike in demand, supply shortages, and high-quality vintages for both Burgundy and Champagne over the last few years (2020-2022), prices for certain brands had skyrocketed by the end of 2022. It's to be expected that this rapid pace of growth was unsustainable, especially in 2023 when we experienced a market with softer demand, increased supply, and higher capital costs. Consequently, these regions became the most susceptible to price declines.

One takeaway evident throughout the list this year is that the wines that had performed the best previously were the ones that experienced the most significant price decreases.

Bordeaux had another year of stagnation, with prices down by an average of -5.3% across the board. However, when isolating the performance of the five first growths, prices declined by an average of -9.4%, almost double the average across the whole of Bordeaux. Despite the left bank first growths pulling down the average, the worst performer during this period was Petrus, which saw the average price of its wines from the past 30 vintages decrease by an average of -13.5%.

The past few years have been challenging for Bordeaux, as it was the only region that didn't benefit from the fine wine market bull run. Although there were pockets of success, as our regional breakdown shows, across the past 3 and 5 years, Bordeaux ranks last with an average price appreciation of +12.7% and +12.9%, respectively. The standout performers over the longer time periods generally came from the right bank, with wines such as Figeac, Lafleur, Petrus, Vieux Chateau Certan, and Le Pin posting increases ranging from +21% to +44% over the last three years, despite this year's retrenchment.

Italy and the USA fared somewhat better in 2023, with only a slight drop in prices of –0.5% on average for the 6 US wines that made the top 100. These were led by Caymus (+16.1%) and Harlan (+9.3%), but offset by declines from Screaming Eagle (-14.3%) and Dominus (-8.5%). Italy had a couple of standout performances, which enabled the 10 wines to post the second-best regional performance with a modest +1.9% gain on average. While Bartolo Mascarello and Sassicaia struggled, seeing prices drop by -9% and -7% respectively, the top 3 performers for Italy delivered an average price appreciation of +10.2%. Leading the pack was Le Pergole Torte, which, despite having a high average price per bottle of £262 ($330), saw prices increase on average by +15.2%. The Antinori family and iconic brands Tignanello and Solaia also managed to beat the market, with price rises across the last 30 vintages of +8.3% and +6.9%, respectively. Tignanello, in particular, showed remarkable consistency, with this year's more modest growth of +8.3% (beating the rest of the top 100 by +14%) following average 3-year price growth of +69.0% and 5-year price appreciation of +103.6%.

Finally, the rest of the world category, with just three representatives, found itself on top of the pile. Given the limited representation, the standout performance of the number 1 wine in the top 100 has skewed the overall results. Nevertheless, two of the three wines produced a positive overall price change: Lebanese wine Chateau Musar and Spanish icon Vega Sicilia. The latter saw prices increase on average by +2.9% over the last year. The former, however, was the number one performing wine from the top 100 most searched-for wines.

Musar may represent something of an anomaly. Despite averaging +34% average price growth across 26 vintages, it remains one of the most affordable wines on this list, with an average bottle price of £60 ($76). It also has the cheapest vintage of any of the 2,700 surveyed in this report, at just over £25 per bottle for the 2018 vintage. At the same time, this wine is relatively scarce, with a total of 991 offers in the market, placing it between the total number of offers for the Burgundy icon DRC's Romanee Conti and Grands Echezeaux. Factors like a lack of recent vintage releases, the recent passing of the long-term visionary behind the wine, Serge Hochar, and a new distribution strategy and appointment of a new agent in the UK market may have contributed to this elevated performance despite the troubles experienced in the rest of the market. Given the fact that the rest of the investment-grade wine market has consolidated after a sustained bull run, it's probably no surprise that the top performers this year were likely to be more esoteric names in this top 100 lineup, and when joined in the top 3 by Caymus and Le Pergole Torte, the results support this theory.

New vintages weigh heavily, while older vintages show resilience

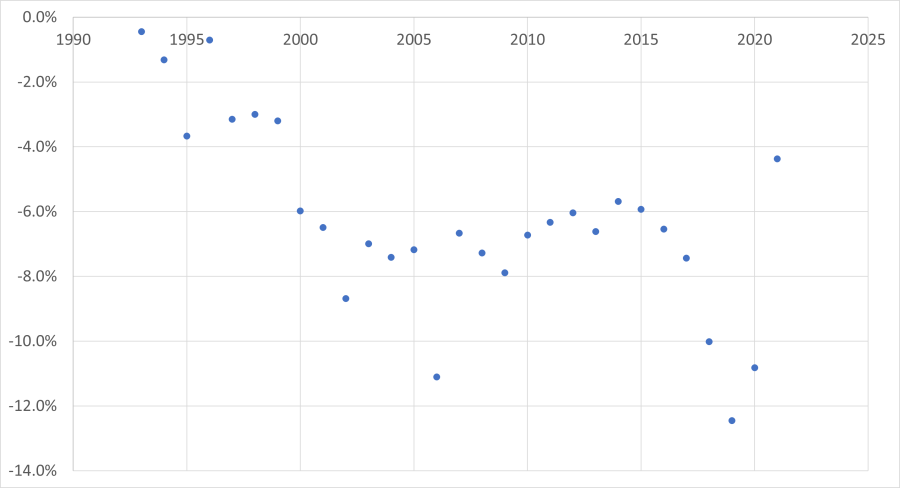

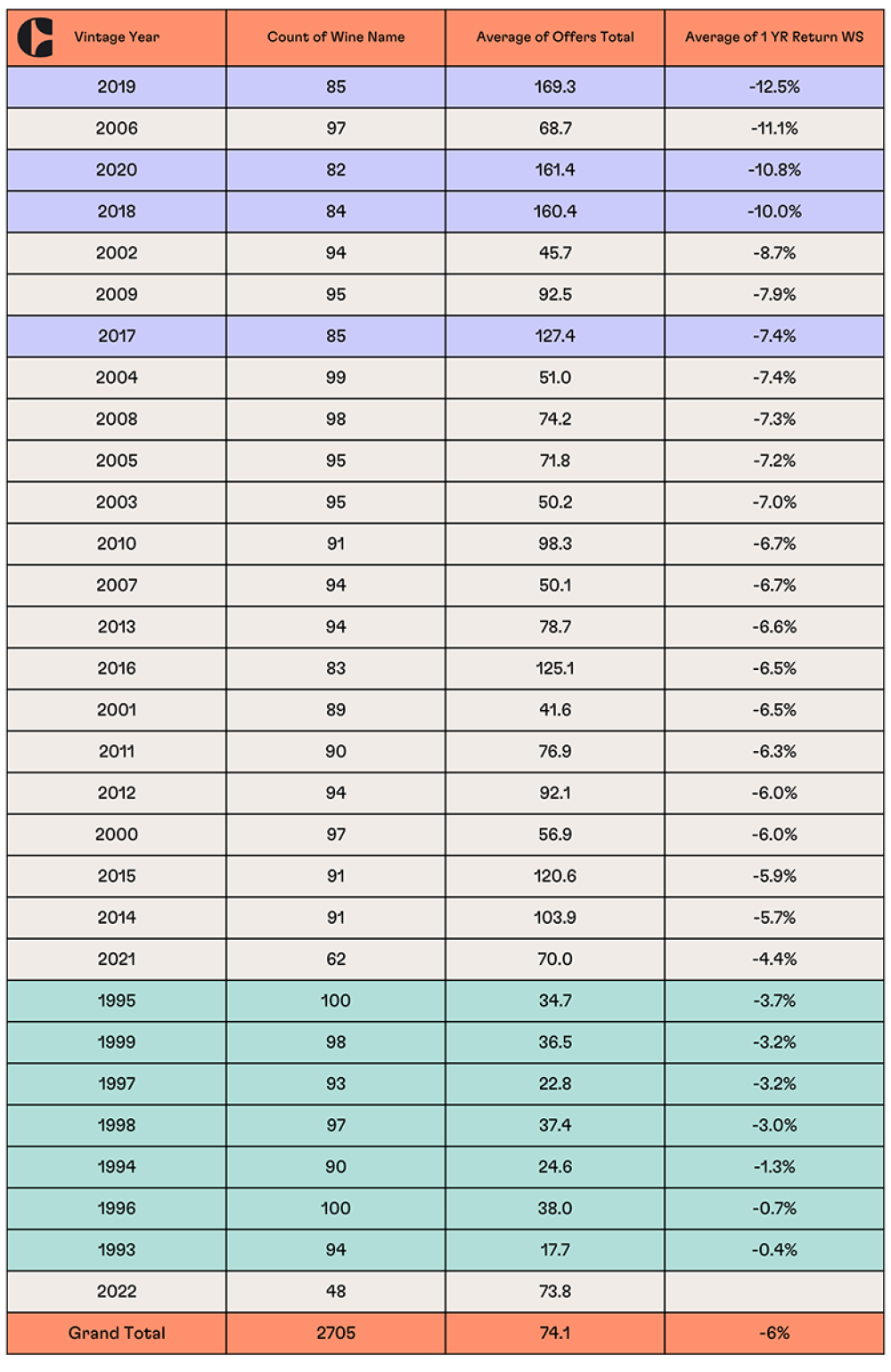

Average 1 Year Returns by Wine Vintage

Source: Cult Wines and Wine-Searcher, analysing performance from January 1st, 2023, to December 31st, 2023

When analysing the overall price changes in the market by vintage (age of the wine) rather than by producer or region, another interesting trend emerges. Across all vintages, there is a negative downturn in pricing, but the clear trend is that the youngest vintages have seen the largest decreases. In fact, all of the best performing vintages are from the 90s, while four of the worst performing vintages are the most recent, physical in-market vintages of 2017, 2018, 2019, and 2020, which on average saw prices decline by over -10% in 2023.

Essentially, the market has shown more resilience in older, more mature vintages with lower supply. This aligns with common sense: where stock levels are higher and more abundant due to recent releases, there are likely to be more sellers. In a buyer's market, there is less interest in supporting prices if they are moving downwards. Another interpretation is that in 2023, due to increased interest rates, holding younger stock (less appealing for immediate consumption, requiring storage and aging) became less attractive to buyers while the cost of capital rose. If the market in 2023 was more driven by demand for immediate consumption, consumers were more inclined to purchase ready-to-drink vintages and avoid stocking up on newer, younger ones.

Furthermore, due to supply constraints, global inflation, and rising prices at the cellar doors, most recent vintages were released at high prices across all major wine regions. This likely compounded and exacerbated the downward price pressure on the newer releases. In essence, younger vintages, abundant in supply, released at high prices, and not ready for immediate consumption, were negatively affected, with the largest average price decreases occurring in this segment.

DOWNLOAD THE FULL CULTWINE100 2023 LIST

Explore the 2023 wine market with the full CultWine100 List. Discover wines, rankings, and key data on 2023, including 1-year, 3-year, and 5-year performance. Perfect for investors and enthusiasts seeking insights into market trends and investment opportunities. Download now to enhance your wine knowledge and strategy.

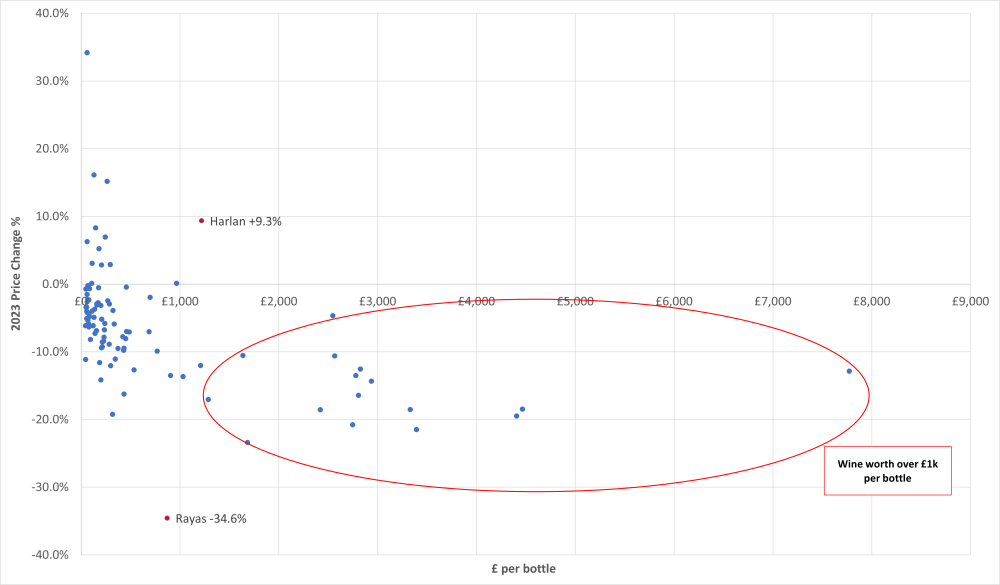

Pricing: expensive bottles leave an even bigger hole in the pocket in 2023

Average 1 Year Returns by Bottle Price (GBP)

Source: Cult Wines and Wine-Searcher, analysing performance from January 1st, 2023, to December 31st, 2023

Another trend observed in the 2023 table is the relationship between the average bottle price and performance. Among the top 20 most expensive bottles in the list, their average performance rank (1 being the best and 100 the worst) across the 100 wines is 77. There are only two outliers in the list, ranking at 4 (Harlan) and 8 (Leroy, Musigny). When removed, the remaining 18 have an average rank of 86.

Common sense suggests that this should be the case. In a declining market with softer demand, wines with the highest prices (often experiencing the biggest recent rises) tend to see the most significant falls, and that's exactly what happened in 2023. Interestingly, despite the downturn in prices for the most expensive bottles, the 3-year performance of the top 20 still averages +53.8%. This suggests that these wines remain strong investments, even after a negative year in 2023. While it's possible that price appreciation may slow down, it also indicates that these wines continue to be some of the best investments in the market.

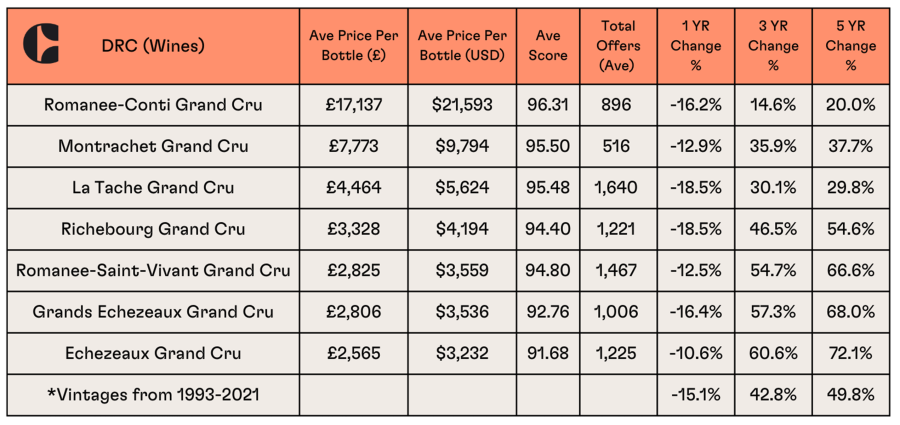

Wine Spotlight Number 1: Domaine de la Romanee Conti (DRC)

If any one wine exemplified the challenges facing the fine wine market in 2023, it was DRC. DRC, which is cherished by collectors, has a consistent presence in the auction circuit, and boasts the most iconic name in the world of fine wine, experienced a tough year across the board in terms of price depreciation. On average, the top 7 grand cru wines decreased in value by an average of -15.1%, with Richebourg and La Tache performing the worst with price drops of -18.5%.

It's impossible to overlook the influence of China on DRC, especially considering its prominence in the Asian wine market. However, 2023 did not see the anticipated resurgence of China's wine market after the post-Covid slump, largely due to concerns within the Chinese UHNW community in light of the Jack Ma incident. This retrenchment from the Chinese UHNW community has cast a shadow over wines like DRC, which are closely linked to their fortunes.

Out of the 186 wines we tracked, only 11 saw a positive price change in 2023. Remarkably, 4 of these were vintages of DRC Montrachet. This trend aligns with the surprising resilience of white Burgundy in the market compared to red Grand Cru Burgundy, despite price increases.

Given the current price levels, it wouldn't be surprising to witness a slowdown and consolidation in the DRC market in early 2024. However, considering its iconic status, record-breaking auction prices, and a five-year average return of +49.8%, 2024 might present a favourable opportunity to re-enter the market.

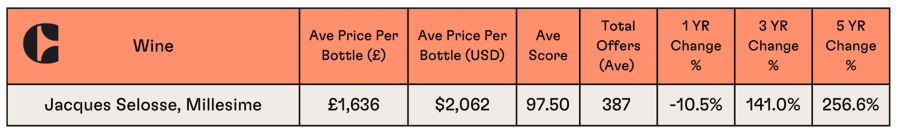

Wine Spotlight Number 2: Jacques Selosse, Millesime

Jacques Selosse's rise in recent years has been nothing short of meteoric, making it the only grower champagne in the top 100. Priced at an average of £1,636 per bottle ($2,062) across 15 vintages, it commands a premium of over £600 per bottle compared to the next highest, Salon, averaging £1,030 per bottle for the 11 vintages we tracked.

With only an average of 387 offers for the Millesime cuvée in the market, it stands as not only the scarcest Champagne among our constituents but also the second rarest wine on our list after Leroy Musigny. Additionally, boasting an average critic score of 97.5, it secures the third-highest average score in the top 100, trailing only behind Screaming Eagle and Harlan, renowned for consistently receiving 100 points.

Selosse has capitalised on the growing demand and pricing for Champagne between 2020-2022, coupled with the increasing popularity of grower champagne. As a result, it dominated the 3-year and 5-year price change rankings in 2023, though some vintages, such as the 100-point 2008, witnessed significant declines after reaching over £3k per bottle.

Anticipating no change in the underlying demand and iconic status of Selosse, and considering its fixed and dwindling supply, some price adjustments in 2023 were foreseeable. For collectors and consumers, this could signal a favourable opportunity to explore this wine again in 2024, especially given its potential to influence the market with relatively minimal activity.

Wine Spotlight Number 3: Tignanello

Just a decade ago, the average ex-cellar price for a new Tignanello vintage was approximately 35 euros per bottle. And at the time, these vintages would change hands in the retail and secondary markets for £50 per bottle, with prices maintaining a consistent structure as they age. Tignanello produces around 30,000 cases annually, making it one of the highest production wines on this list. It's available in every duty-free shop in major airports, prominent hotels, restaurants, and establishments associated with affluent individuals. The wine has consistently been solid, if not spectacular, with the unique ability to be enjoyed young while aging gracefully.

In a year when major wine brands struggled due to economic and interest rate pressures, Tignanello defied gravity by posting an average price increase of +8.3%. This is in addition to an astounding +69% average return over the past 3 years and an impressive +103.6% return over the past 5 years.

Even more remarkable is the fact that as the average price of this wine steadily climbed over the past decade, with the average bottle now priced at £146 for the past 30 vintages, demand has not only remained steady but has grown. This proves the brand's resilience even in the face of challenging market conditions. It's as close as one can get to a guaranteed success. In fact, if you had purchased every Tignanello vintage upon release over the past 30 years, you would have enjoyed a substantial profit, irrespective of vintage quality.

DOWNLOAD THE FULL CULTWINE100 2023 LIST

Explore the 2023 wine market with the full CultWine100 List. Discover wines, rankings, and key data on 2023, including 1-year, 3-year, and 5-year performance. Perfect for investors and enthusiasts seeking insights into market trends and investment opportunities. Download now to enhance your wine knowledge and strategy.

Summary and Outlook for 2024

Clearly, 2023 was not a favourable year for the prices of the world's most popular fine wines. After a three-year bull run, during which prices appeared to ascend endlessly, particularly for Burgundy and Champagne, a dramatic reversal occurred, resulting in much-needed price consolidation. Predictably, wines that had performed exceptionally well in the past were the hardest hit, particularly younger vintages and the most expensive bottles.

The only areas of success, either in terms of price stabilisation or growth, were observed in more niche parts of the world, lesser-known icons, and wines that were moderately priced with some age and limited availability.

What does this mean for 2024? While wine investors may want to forget 2023, it's important to note that the overall average price appreciation of the top 100 wines over a 3-year and 5-year period remains impressive, even after this year's setback. Many wines are still in line with or above the long-term trend of 8-10% annualised returns.

From a trend perspective, the market seems poised to support new price levels, as they realign certain wines and market segments with normalised levels and long-term expectations. Looking at the macroeconomic environment, 2023 was undoubtedly challenging for luxury goods due to the weak global economy and high-interest rate environment. However, with central banks hinting at substantial interest rate cuts in 2024, coupled with most banks forecasting negative yield on interest rates, this could encourage investors to move away from holding cash and seek returns in alternative assets, providing a potential boost to the wine market.

The supply side of the market will undoubtedly be affected, regardless of the wealth and profitability of the large conglomerates and individuals that own some of the wines in the top 100, which make up a significant portion of the fine wine market. We witnessed several disappointments in 2023, including the Bordeaux 2022 vintage, which sold poorly despite its quality. Expectations are for a bountiful Bordeaux 2023 vintage and sizeable yields of 2022 Burgundy currently entering the market. All these factors are likely to push prices down to meet demand.

As interest rates decrease, capital may flow back into alternatives, and price decreases in 2023, along with distressed sellers, should provide an attractive entry point for buyers. New supply is expected to be abundant, of high-quality, and attractively priced. If these factors align as expected, the underlying trends and themes of 2024 could signify a potentially positive year for the wine market, potentially rejuvenating the landscape and building momentum heading into 2025.

Performance Trends and Takeaways

Region Trends and Takeaways

Vintage Trends and Takeaways

DOWNLOAD THE FULL CULTWINE100 2023 LIST

Explore the 2023 wine market with the full CultWine100 List. Discover wines, rankings, and key data on 2023, including 1-year, 3-year, and 5-year performance. Perfect for investors and enthusiasts seeking insights into market trends and investment opportunities. Download now to enhance your wine knowledge and strategy.