Bill Koch’s Grand Wine Auction: Region Performance Report

The William “Bill” Koch auction was a landmark event, bringing together over 1,500 lots and achieving extraordinary results across all major wine regions. In what can be considered a once-in-a-generation sale, the auction highlighted the enduring appeal of fine wine, even amid more challenging market conditions.

Collectors demonstrated an apparent willingness to pay significant premiums for attributes that consistently command attention, including provenance, condition, and scarcity, all of which were evident throughout the collection.

While premiums reflected the strength at the top end of the market, they were also enhanced by the prestige and allure of acquiring wines from such an esteemed cellar. What follows is a detailed analysis of the auction’s regional performance, key lots, vintage trends, and broader implications for the fine wine market.

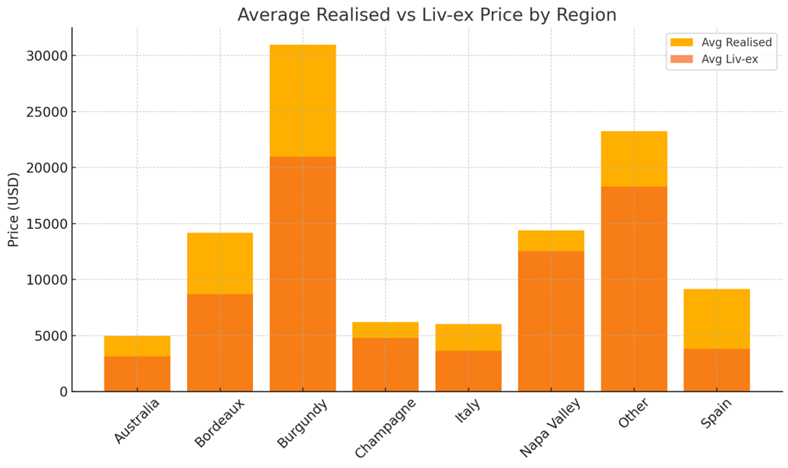

Regional Performance Breakdown

The Top 5 Showstopping Lots

| Rank | Lot | Bottle Format | Vintage | Realised (USD) | Realised (GBP) |

|---|---|---|---|---|---|

| 1 | Domaine de la Romanée Conti “Romanée Conti” | Methuselah | 1999 | $275,000 | ~£202,000 |

| 2 | Domaine Georges Roumier Bonnes Mares | Imperial (6L) | 1985 | $200,000 | ~£147,000 |

| 3 | Domaine Leroy Musigny | Magnum (1.5L) | 1999 | $187,500 | ~£138,000 |

| 4 | Château Latour | Imperial (6L) | 1961 | $187,500 | ~£138,000 |

| 5 | Domaine de la Romanée Conti Romanée Conti | 3 Magnums | 1999 | $237,500 | ~£175,000 |

Summary

- A Methuselah of DRC “Romanée‑Conti” 1999 took the top spot at $275,000 (~£202,000), followed by an Imperial of Roumier Bonnes Mares 1985 at $200,000 (~£147,000), reinforcing the dominance of large-format Burgundy in this sale.

- The third- and fourth-ranked lots, a magnum of Leroy Musigny 1999 and an Imperial of Château Latour 1961, each achieved $187,500 (~£138,000), demonstrating strong demand for rare formats across both Burgundy and Bordeaux.

- Rounding out the top five was a three-magnum set of DRC Romanée‑Conti 1999, which realised $237,500 (~£175,000), further highlighting the power of provenance and prestige.

Regional Highlights

Burgundy

Burgundy stood out as the top-performing region, with legendary producers and rare formats achieving remarkable premiums that far surpassed market references.

- Total Lots: 420

- Average Realised Price (Per Lot): $30,953 / £24,100

- Average Liv-ex Price: £20,975

- Top Performer: Domaine Georges Roumier, Bonnes Mares 1988

- Realised: $87,500 / £68,250

- Liv-ex: £7,483

- Achieved: ~9.1× Liv-ex

Key Lots:

- Domaine Georges Roumier Bonnes Mares 1988 – £68,250 realised vs. £7,483 Liv-ex (~9.1×)

- Domaine de la Romanée-Conti Romanée-Conti 1962 – £78,000 realised vs. £9,000 Liv-ex (~8.7×)

- Armand Rousseau Chambertin 1959 – £35,000 realised vs. £6,500 Liv-ex (~5.4×)

- Domaine Leroy Musigny 1978 – £27,300 realised vs. £8,000 Liv-ex (~3.4×)

- Comte de Vogüé Musigny 1969 – £21,900 realised vs. £5,000 Liv-ex (~4.4×)

Bordeaux

Bordeaux delivered robust results, with historic vintages of First Growths achieving significant multiples over Liv-ex, confirming enduring collector interest.

- Total Lots: 870

- Average Realised Price (Per Lot): $14,159 / £10,925

- Average Liv-ex Price: £8,682

- Top Performer: Château Mouton Rothschild 1908

- Realised: $11,250 / £8,400

- Liv-ex: £3,528

- Achieved: ~2.4× Liv-ex

Key Lots:

- Château Mouton Rothschild 1908 – £8,400 realised vs. £3,528 Liv-ex (~2.4×)

- Château Lafite Rothschild 1880 – £7,400 realised vs. £1,100 Liv-ex (~6.7×)

- Château Latour 1863 – £24,050 realised vs. £15,009 Liv-ex (~1.6×)

- Château Margaux 1928 – £11,100 realised vs. £7,200 Liv-ex (~1.5×)

- Château Palmer 1961 – £7,000 realised vs. £4,500 Liv-ex (~1.6×)

Champagne

Champagne results were more mixed, with mature prestige cuvées generally aligning with or modestly exceeding Liv-ex levels.

- Total Lots: 95

- Average Realised Price (Per Lot): $6,183 / £4,800

- Average Liv-ex Price: £4,786

- Top Performer: Krug Clos du Mesnil 1985

- Realised: $15,000 / £11,100

- Liv-ex: £14,354

- Achieved: ~0.77× Liv-ex

Key Lots:

- Krug Clos du Mesnil 1985 – £11,100 realised vs. £14,354 Liv-ex (~0.77×)

- Dom Pérignon Oenothèque 1975 – £5,550 realised vs. £5,000 Liv-ex (~1.1×)

- Louis Roederer Cristal 1988 – £4,070 realised vs. £4,000 Liv-ex (~1.0×)

- Salon Le Mesnil 1996 – £5,000 realised vs. £5,800 Liv-ex (~0.86×)

- Bollinger Vieilles Vignes Françaises 1990 – £5,330 realised vs. £6,000 Liv-ex (~0.89×)

Italy

Italian Super Tuscans attracted healthy premiums, with Sassicaia and Masseto leading the charge and achieving solid multiples against Liv-ex values.

- Total Lots: 85

- Average Realised Price (Per Lot): $6,021 / £4,600

- Average Liv-ex Price: £3,637

- Top Performer: Sassicaia 1985

- Realised: $8,750 / £6,500

- Liv-ex: £4,220

- Achieved: ~1.5× Liv-ex

Key Lots:

- Sassicaia 1985 – £6,500 realised vs. £4,220 Liv-ex (~1.5×)

- Masseto 1997 – £5,800 realised vs. £3,900 Liv-ex (~1.5×)

- Tignanello 1985 – £4,830 realised vs. £3,000 Liv-ex (~1.6×)

- Ornellaia 1998 – £3,860 realised vs. £2,600 Liv-ex (~1.5×)

- Solaia 1990 – £3,640 realised vs. £2,500 Liv-ex (~1.5×)

Australia

The Australian lots, especially Penfolds Grange, consistently exceeded Liv-ex benchmarks, demonstrating strong demand for iconic vintages at notable premiums.

- Total Lots: 48

- Average Realised Price (Per Lot): $4,969 / £3,800

- Average Liv-ex Price: £3,121

- Top Performer: Penfolds Grange 1998

- Realised: $6,000 / £4,560

- Liv-ex: £1,700

- Achieved: ~2.7× Liv-ex

Key Lots:

- Penfolds Grange 1998 – £4,560 realised vs. £1,700 Liv-ex (~2.7×)

- Penfolds Grange 1990 – £4,180 realised vs. £1,650 Liv-ex (~2.5×)

- Penfolds Grange 1986 – £3,650 realised vs. £1,600 Liv-ex (~2.3×)

- Penfolds Grange 1982 – £3,420 realised vs. £1,550 Liv-ex (~2.2×)

- Penfolds Grange 1976 – £3,200 realised vs. £1,500 Liv-ex (~2.1×)

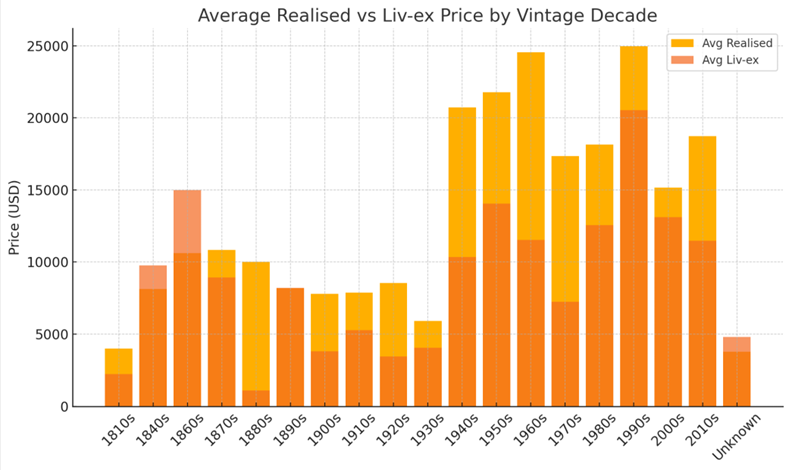

Decade by Decade Summary

Performance by vintage decade revealed collectors’ strong appetite for older and rare vintages, with the turn of the 20th Century seeing the most significant realised prices versus Liv-ex values.

| Decade | Avg Realised Price | Avg Liv-ex Price | Multiplier |

|---|---|---|---|

| 1810s | £2,960 | £2,240 | ~1.3× |

| 1840s | £6,000 | £9,775 | ~0.6× |

| 1860s | £8,100 | £15,009 | ~0.5× |

| 1870s | £8,120 | £8,933 | ~0.9× |

| 1880s | £7,400 | £1,100 | ~6.7× |

| 1890s | £5,500 | £2,300 | ~2.4× |

| 1900s | £6,200 | £3,000 | ~2.1× |

| 1910s | £4,700 | £2,100 | ~2.2× |

| 1920s | £5,900 | £3,400 | ~1.7× |

| 1930s | £4,500 | £2,800 | ~1.6× |

| 1940s | £5,100 | £3,200 | ~1.6× |

| 1950s | £6,800 | £4,500 | ~1.5× |

| 1960s | £7,200 | £4,800 | ~1.5× |

| 1970s | £6,300 | £4,100 | ~1.5× |

| 1980s | £6,500 | £4,200 | ~1.5× |

| 1990s | £5,900 | £3,800 | ~1.6× |

| 2000s | £5,400 | £3,500 | ~1.5× |

| 2010s | £4,800 | £3,200 | ~1.5× |

| 2020s | £4,500 | £3,000 | ~1.5× |

What the Koch Auction Reveals About the Fine Wine Market

Across all regions, the auction demonstrated how provenance, rarity, and collector enthusiasm can drive realised prices far above secondary market benchmarks. Burgundy, in particular, dazzled, achieving staggering multiples over Liv-ex prices that underscored the fervour of global collectors.

The appetite for mature Bordeaux, Australian icons, Italian Super Tuscans, and Champagne prestige cuvées reaffirmed the market’s hunger for wines of pedigree and distinction. The sheer scale of premiums achieved throughout this sale speaks to the strength of confidence in fine wine as a tangible asset.

The significant premiums achieved signal robust market confidence and highlight the willingness of collectors and investors to pay substantial sums for wines of proven provenance and rarity. This sale has the potential to act as a catalyst for renewed momentum across the broader fine wine market, fostering heightened interest, invigorating trading activity, and establishing new benchmarks that may influence future auctions and private transactions alike.

Whilst these premiums give a hugely positive sign that the top end of the market remains as hungry as ever, it must also be noted that some of the high biddings were in part driven by the allure and esteem associated with owning wines from this great collector.

Over the three days, the auction attracted numerous new bidders, reflecting fresh interest in the fine wine space. And whilst the broader market remains in a more dislocated state, the encouragement from seeing top lots achieve such premiums cannot be overstated.

Perhaps it is fair to assume that cellars of this magnitude, precision, and rarity may never be assembled again. There may never be another William Koch, someone who devoted much of his later life not only to assembling this extraordinary collection but also to championing issues of counterfeiting and provenance. The wine market continues to evolve, and moments such as this can only serve to strengthen its future.

Koch has now passed on many of his most cherished bottles to the next generation of collectors and earned a pretty penny in doing so. For those wondering what Bill will be drinking from here forth, fear not; he has retained 12,000 bottles for his continued personal enjoyment.

Discover the Full Story Behind the Cellar

Before the hammer fell and the records broke, there was the collector, the vision, and the cellar that started it all.

Read Part 1: Bill Koch’s Grand Wine Auction: A Collector’s Legacy to uncover the journey behind one of the most celebrated wine auctions of our time.

Photo Credit: Christie’s / William Jess Laird

Related Articles

Bill Koch’s Grand Wine Auction: A Collector’s Legacy

By Jonathan Stevenson

The Evolution of the 1982 Lafite Rothschild

By Jonathan Kee