Fine wine’s impact on a portfolio

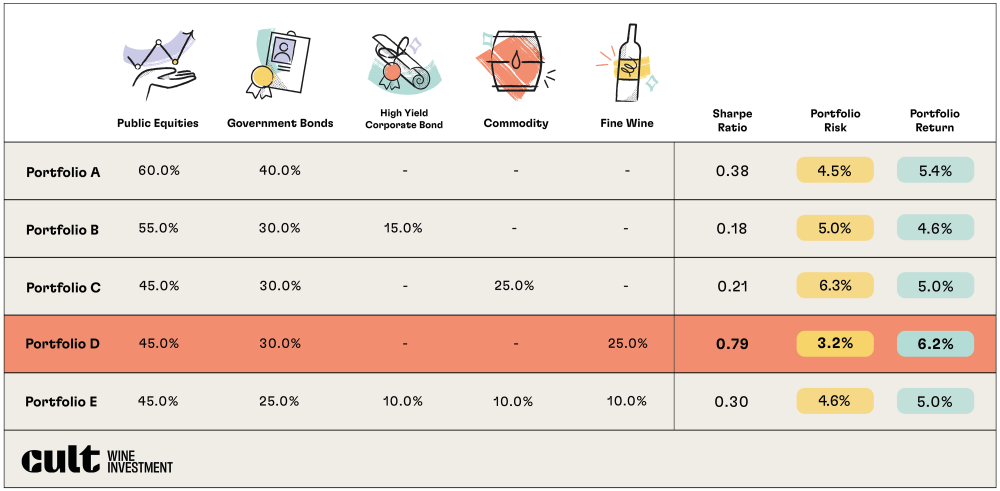

We’ve created a series of model portfolios to illustrate the benefits of including fine wine in an investment portfolio. Portfolio modelling can shine light on how fine wine holdings have impacted a diverse portfolio rather than just show its track record in isolation.

“And defensive alpha strategies delivering both negative correlation to stocks and positive expected returns over cash represent even more favorable alternative portfolio diversifiers in this environment of zero to positive stock/bond correlation.” [1]

BlackRock

We believe fine wine can satisfy this description of a favourable alternative investment. Its stability and low correlation make an investment portfolio more defensive against market risks. Fine wine’s track record of providing returns through different market backdrops demonstrates its ability to generate alpha, a term describing an investment’s outperformance versus the wider market.

Inclusion of fine wine improves risk-adjusted returns

Model portfolio performance 28 Feb 2018 – 28 Feb 2023

Source: Investing.com, Wine-Searcher as of 28 Feb 2023. Fine wine = Cult Wines Global Index; Equities = S&P500(TR); Gov’t bonds = iShares 7-10 US Treasury Bond; Corporate bonds = iShares High Yield Corporate Bond; Commodity = Bloomberg Commodity Index. Model portfolios are for illustrative purposes only. Actual performance may vary. Past performance is not a guarantee of future returns.

Of course, fine wine and other alternatives bring unique investment challenges, such as lower liquidity, storage, or fixed increments to invest. However, compared to some other alternatives, fine wine can offer relative flexibility.

For one, wine offers a relatively accessible entry point; investors can gain access to fine wine markets from as little as a few thousand pounds or even less to begin. Even other collectibles such as art or classic cars come with larger increments of investment. Many other real assets must be sold at once, whereas wine investments can easily be sold in variable sizes at different times.

As with any investments, past performance does not mean results will be replicated in the future. The Cult Wines Global Index history shows that fine wine does experience performance ups and downs and will do again like any investment.

But the reasons we outlined in the Fine Wine’s Credentials article indicate why we believe fine wine can continue to enhance the return potential and reduce risk in a diversified portfolio over a long-term period. Rather than increasing or decreasing exposure depending on the prevailing outlook, fine wine works best as a long-term component of a portfolio through shifts in macroeconomic conditions.

| Asset class | Benefits of Investing | Challenges/Risks |

|---|---|---|

| Real Estate | • Diversification • Relatively stable income return • Relatively low volatility (if holding direct real estate) |

• Substantial initial investment • Mismatch between pricing and valuation • Limited transactional information • Involves substantial operational and maintenance fees |

| Commodities | • Diversification • Inflation protection |

• Volatility • Risk in losing more than initial amount invested (derivatives) |

| Hedge Funds | • Diversification across multiple hedge fund strategies available | • Long-term commitment required • Unfamiliarity with different strategies • Management fees |

| Fine Wine | • Long-term stability in different macro environments • Less correlated to equity market • Unique supply and demand mechanism • Possible tax benefits • Real asset |

• Possible difficulties securing allocation • Market still in early stage of development • Liquidity |

| Art | • Diversification • Possible tax benefits |

• Liquidity • Price discovery • Limited market data • Unregulated market • Price realisation |

| Crypto currencies | • Potential for rapid growth • Easy to access and trade |

• High risk due to significant swings in pricing • Limited track record • Highly speculative |

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.

Related Articles