The fine wine outlook in uncertain times

Fine wine can bring stability and diversification during market crises

There is no clear precedent for how the current conflict will impact the economy and financial markets, let alone the fine wine asset class. While recognising this high level of uncertainty, we believe fine wine’s track record of stability and low correlation to macro volatility mean it can still form a useful investment in the weeks and months ahead.

Initially, financial markets saw a flight to safety with equity markets plummeting last week while government bonds, gold and commodity prices surged. However, recent days have seen investors returning to some risk assets even as the conflict escalates, Western sanctions on Russia increase, and energy prices rise higher.

The economic impact from the conflict could mean major central banks adopt a more cautious, potentially slower, approach to their planned rate hikes and stimulus withdrawals this year, which in turn could support risk assets. However, inflation could rise further due to higher energy prices, and the overall backdrop remains highly uncertain and fluid. We expect heightened market volatility to persist in the coming weeks and likely longer and some investors may opt to keep liquid assets to maintain flexibility.

Fine wine in the near term

The near-term impact on fine wine markets may be less direct or severe. The Liv-ex 1000 index, the broadest measure of the market, climbed 1.6% in February, maintaining a rally in place since mid-2020. The current uncertainty could interrupt or moderate performance in the weeks ahead, but we don’t expect to see significant week-by-week market swings as we might in other assets.

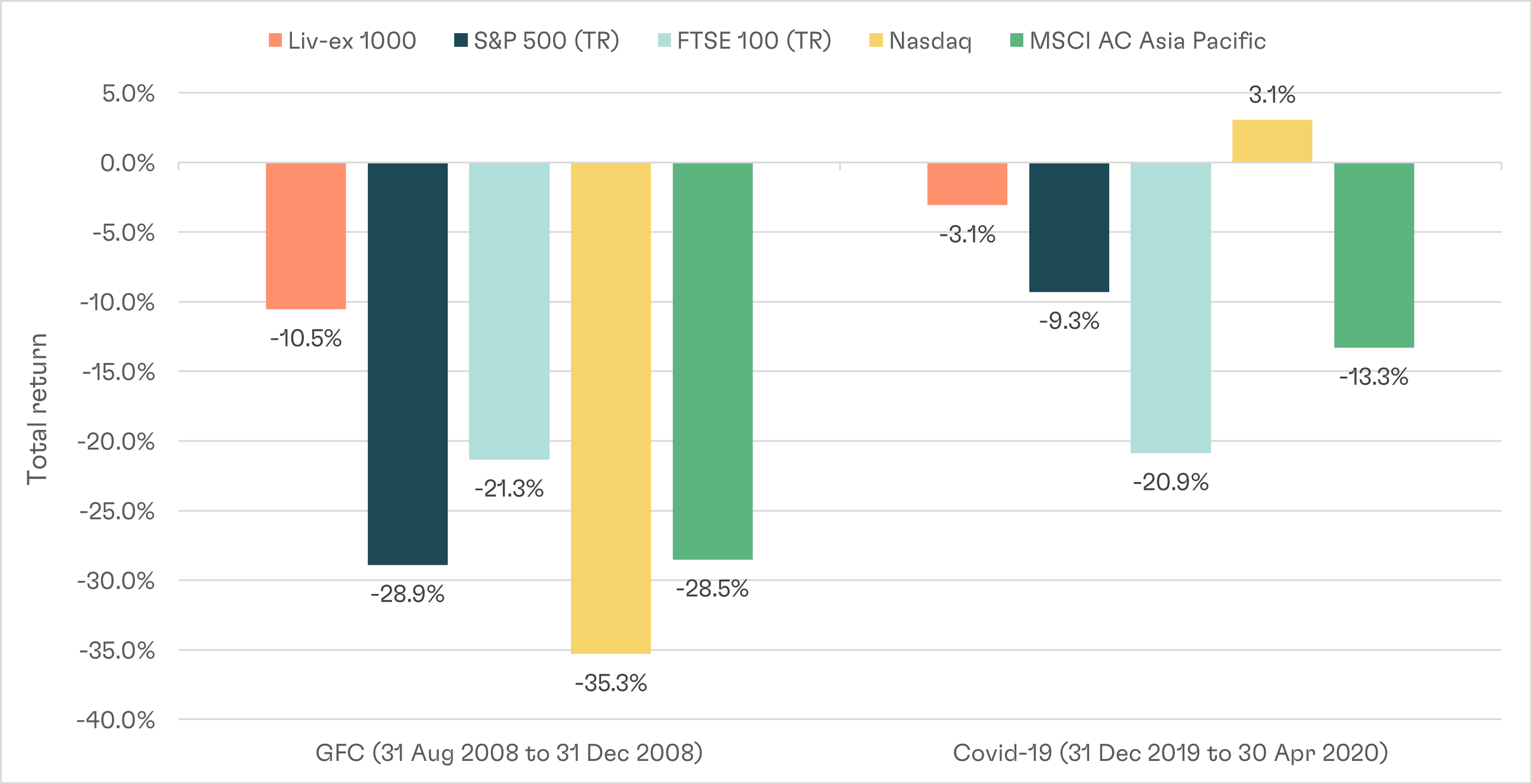

This is because fine wine is characterised by a degree of separation from sudden shifts in the macro environment. Fine wine held up relatively well during the largest market crises in recent memory, as shown in the below image that covers the lowest point of fine wine’s downturn during the Global Financial Crisis and the COVID-19 outbreak.

Fine wine’s defensive nature stems in part from the fact it is less liquid than stocks or bonds. Assets that cannot typically be sold as quickly amid a market shock helps insulate them from sharp selloffs. Consequently, they can form a more reliable store of value than highly liquid assets.

Relative calm during a crisis

Downturns of fine wine vs other asset classes during previous market crises

Source: Liv-ex, investing.com. Past performance is not a guarantee of future returns.

Looking ahead

We do recognise fine wine may not remain entirely immune from the volatility in the medium to long term. The extent of the conflict as well as its impact on commodity prices and inflation are some of the key areas we are monitoring.

The uncertainty may prompt some investors to adopt a ‘wait-and-see’ approach, avoiding any new investments and hoping to buy equity or other risk assets cheaper or when things improve. Although this could temper the ongoing rally in fine wine by reducing inflows into the asset class, we don’t expect any prolonged slowdown.

Cautious investors might find comfort in fine wine’s favourable long-term real returns through different inflationary backdrops. Even prior to the conflict, fine wine’s performance, as measured by the Liv-ex 1000, accelerated as inflation in most major economies hit multi-year highs in late 2021. With the rising energy prices expected to further fuel inflation, fine wine’s status as a real asset could support sustained demand.

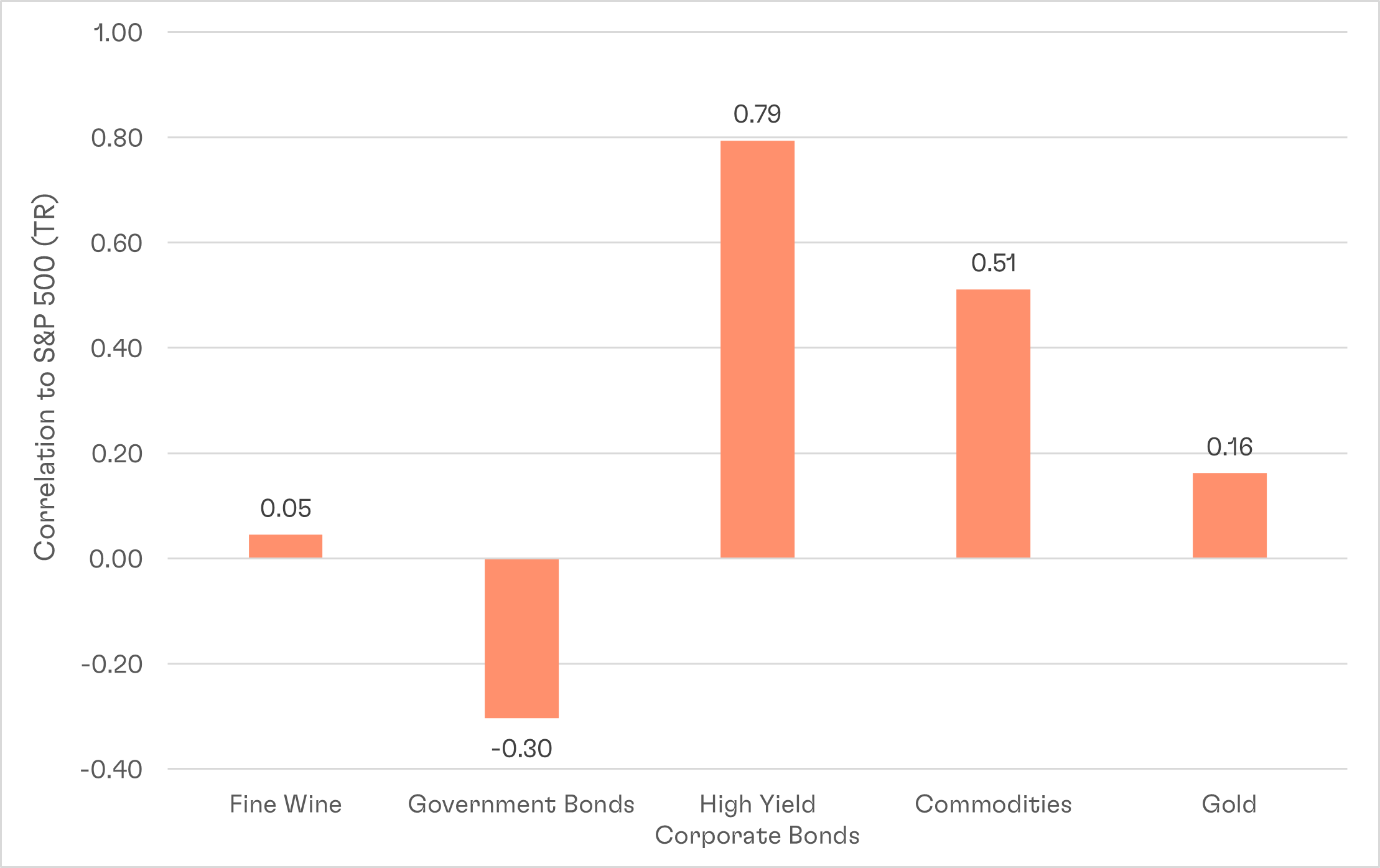

Fine wine could also provide an important source of diversification during this very uncertain time. Fine wine has maintained a low correlation to equity markets due to its internal supply-demand dynamic being the primary driver of prices. We believe holding diverse sources of potential returns becomes even more important amid an unprecedented backdrop when the outlook for all assets, from equities through to alternatives, is unclear.

Fine wine’s low equity correlation

Correlation levels of major asset classes vs S&P 500 (31 Jan 2017 – 31 Jan 2022)

Source: Fine wine = Liv-ex 1000; Government Bonds = iShares 7-10 US Treasury Bond; High Yield Corporate Bonds = iShares High Yield

Corporate Bond; Commodities = Bloomberg Commodity index; Gold = USD/ounce. Source: Liv-ex, investing.com as of 31 Jan 2022. Past

performance is not a guarantee of future returns.

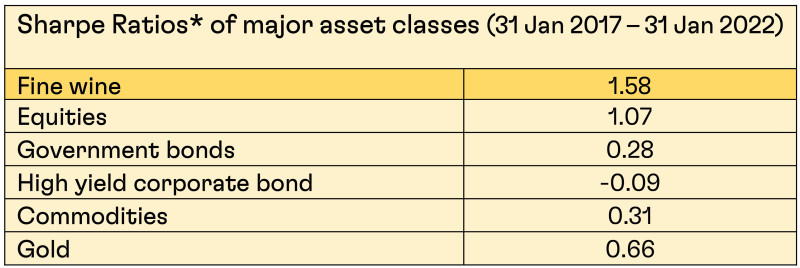

Over time, fine wine’s defensive nature during downturns combined with this potential to deliver returns in different market backdrops has helped it provide better risk-adjusted returns, as shown in its higher Sharpe Ratio, which is a measure of the average return of an asset in excess of the risk-free rate and relative to its volatility. In short, the higher the Sharpe Ratio, the higher an asset’s risk-adjusted return.

* Sharpe Ratio: (annualised 5-year return – 10-year Treasury yield) / annualised volatility of 5-year monthly returns.

Source: Liv-ex, investing.com as of 31 Jan 2022. Past performance is not a guarantee of future returns.

Internal fine wine outlook

Within fine wine, the uncertain outlook could spur a shift in focus with more investors seeking stable, long-term regions, producers and wines. The past year saw soaring prices for many iconic wines, including several Burgundy names. If the current backdrop results in a more measured pace to the fine wine market, the price rises at the top could moderate.

Instead, undervalued regions and producers overlooked during the rally in 2021 could play a bigger role in the year ahead. This is something we thought likely anyway and recently pointed to Bordeaux and Italy as regions where relative value improved over the past year. Just as the current uncertainty may boost the appeal of low-risk asset classes, these lower-risk fine wines could see increased interest.

But any portfolio construction cannot provide certainty in the current environment. Ultimately, our view is that fine wine investing is a long-term endeavour and keeping this perspective remains the best approach. We believe fine wine is not an asset that investors need to shift in and out of depending on the prevailing macro backdrop and our focus on delivering for investors over a long time frame remains unchanged.

* Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The Cult Wine Investment Performance is a hypothetical tool. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wines customer which ranges from 2.95% to 2.25% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.