Fine wine as an alternative asset: Long-term returns

Fine wine is gaining increased attention as an alternative investment asset. The deteriorating growth outlook in 2022 alongside inflation and rising interest rates is triggering many to rethink the traditional 60-40 stock-bond portfolio by considering different options for growth and diversification. But here at Cult Wine Investment, we believe fine wine is not just an investment option for the current environment but an attractive long-term alternative asset.

The potential benefits of a fine wine allocation include:

- Strong returns

- Stability through different market environments

- Low correlation with equity and other mainstream assets.

We will look closer at each of these three ‘category benefits’ to fine wine as an alternative asset in a short series of articles starting here with its return potential.

Return potential

No investment is attractive if it can’t deliver strong returns. In this regard, fine wine boasts appealing long-term figures. Cult Wine Investment’s total return since tracking began in October 2009 is 205.7%, equating to a compound annual growth rate of 9.35% (as of 30 September 2022).

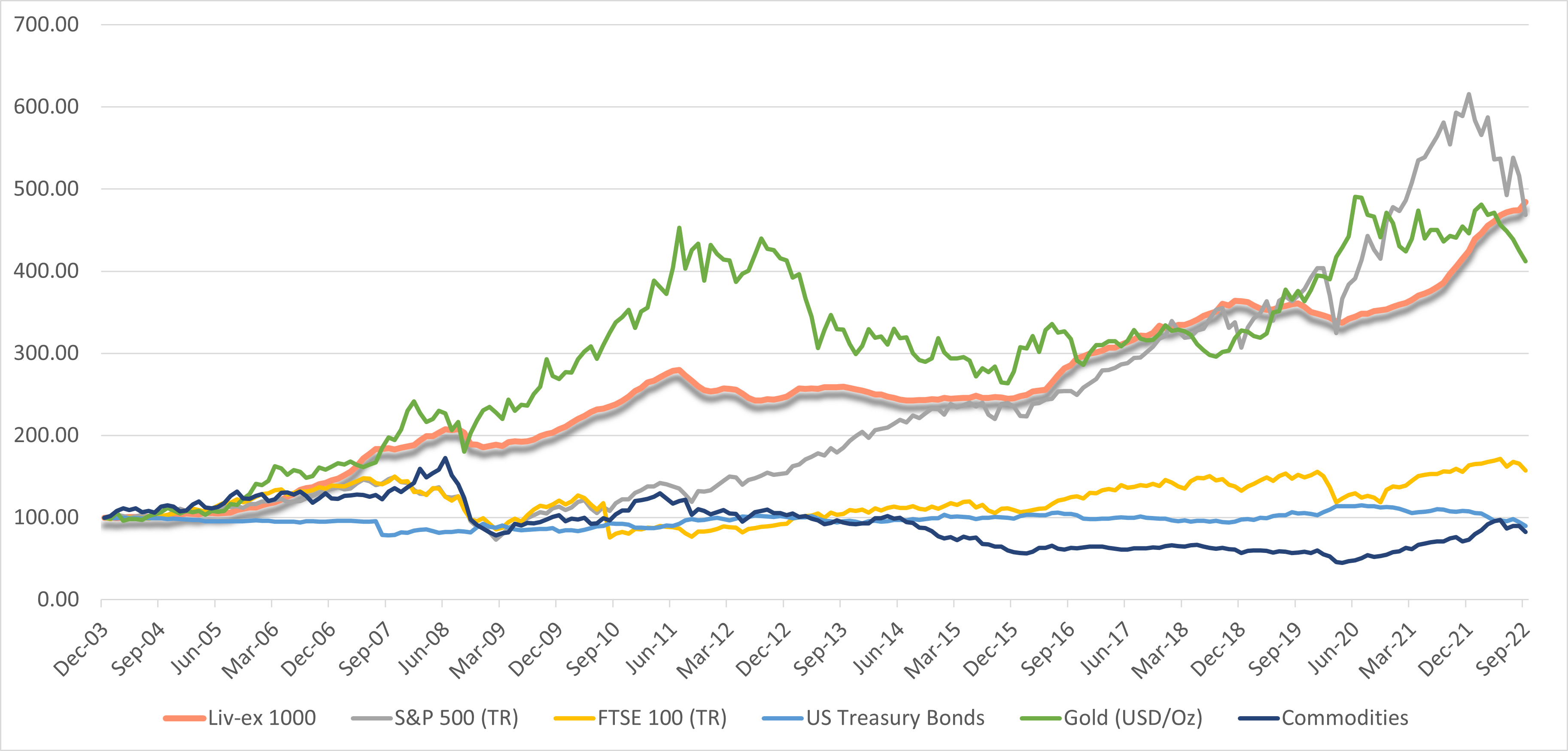

The Liv-ex 1000 benchmark index, a core set of the world’s most sought-after and traded fine wines, goes back further to the beginning of 2004 with a 384% return (as of 30 September 2022), equating to a 8.8% compound annual growth rate. This compares favourably to returns in some equity markets as shown below.

Healthy long-term performance

Liv-ex 1000 vs other financial assets

Source: Liv-ex and investing.com as of 30 September 2022. US Treasury bonds = iShares 7-10 US Treasury Bond. Commodities = Bloomberg Commodity Index. Past performance is not a guarantee of future returns.

Fine wine’s return potential stems from the structure of the market, which features an increasing supply-demand imbalance. Investment-grade wine improves as it ages, meaning demand typically grows with time as it approaches its drinking window.

This characteristic combined with inverse supply curve – scarcity increases with time as bottles are drunk, broken or not stored properly – creates the basic dynamic that drives prices higher.

But fine wine’s return potential often exceeds this core trend, spurred on by an expanding global market. As awareness spreads of fine wine’s usefulness as an investment, demand can increase either for the market at large or for a particular region or producer. Supply of fine wine cannot easily increase to meet a jump in demand. Only a handful of certain regions around the world are recognised as top wine growing regions and production levels are tightly regulated by local appellation rules. Greater demand alongside constrained supply is a recipe for price appreciation.

Recent sky-high returns from Burgundy and Champagne highlight this potential for outsized price growth when demand jumps for rare wines. Cult Wine Investment’s Burgundy holdings have returned 44.1% over a one-year period ending 30 September 2022 while our Champagne selections jumped 35.8%.

Past performance is not indicative of future success. All returns were calculated in GBP and may vary depending on exchange rates. Any investment involves risk of partial or full loss of capital. The Cult Wine Investment Index is a hypothetical tool. The results depicted here are not based on actual trading and do not account for the Cult Wine Investment annual management fees. There is no guarantee of similar performance with an investor’s particular portfolio.

Related Articles