Fine wine’s credentials

Typically, the value of a bottle of wine is based on the following factors:

- Supply and demand

- Brand recognition and prestige

- Vintage quality and volume

- Critic scores

- Drinking window

- Relative value vs other wines

- Costs associated with production & distribution

These internal market dynamics are the primary drivers of fine wine prices, enhancing its suitability for many of the objectives of alternative asset investing in different macroeconomic environments. Fine wine’s main advantages include the following:

Return potential

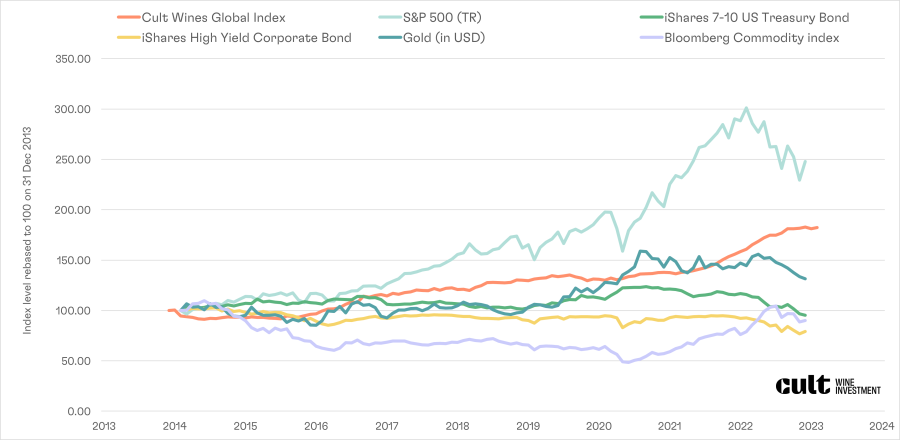

The primary purpose of investing is to create and build wealth by generating a return on investment. In this regard, fine wine has posted some appealing figures. The Cult Wines Global Index, a benchmark measurement of the global fine wine market, tracks wine prices going back to the beginning of 2014 and showed a return of 82.32% through the end of February 2023, equating to a compound annual growth rate of 6.77%.

Figure 1 - Healthy long-term performance

Cult Wines Global Index vs other financial assets

Source: Cult Wines Indices, pricing data from Wine-Searcher as of 28 Feb 2023. Performance was calculated in GBP and may vary in other currencies. Past performance is not a guarantee of future returns.

1 What makes fine wine prices rise?

Fine wine’s return potential stems from a supply-demand imbalance that increases over time after a wine is released. Investment-grade wine improves as it ages, meaning demand typically grows as it approaches its drinking window. Wines also become scarcer with time as bottles are drunk, broken or not stored properly. The combination of decreasing supply and stronger demand establishes the core engine of price appreciation.

An expanding global market can also fuel periods of enhanced growth. Technology and a greater awareness of fine wine (whether as a drink or investment) in new markets such as Asia can bring more potential buyers into the market. Supply of fine wine cannot easily increase to meet a jump in demand. Only a handful of certain regions around the world are recognised as top wine growing regions and production levels are tightly regulated by local appellation rules. An influx of demand alongside constrained supply drives prices higher leading to periods of strong returns for those holding the in-demand bottles, such as we’ve seen from Burgundy and Champagne wines from 2020 to 2022 (+70.12% and +54.08%, respectively, 31 Dec 2019-31 Dec 2022).[1]

Stability

Fine wine has also displayed relative stability alongside its rate of return. Figure 1 above shows that the S&P 500 (TR) has delivered higher returns since 2013. Other alternatives, at times, can also provide outsized returns, such as when commodity prices spike. However, fine wine’s pace of growth has come with lower volatility than many mainstream and other alternative assets.

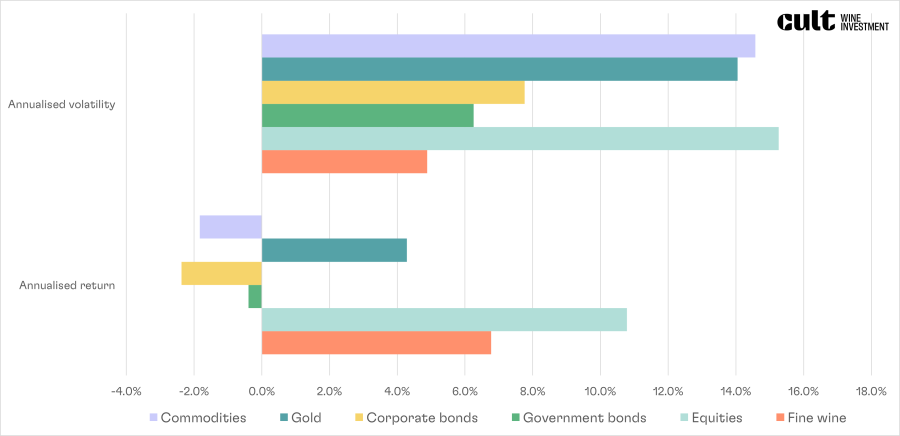

Figure 2 - Fine wine returns come with lower volatility

Annualised volatility and returns across financial assets (28 Feb 2018 – 28 Feb 2023)

Source: Investing.com, Wine-Searcher as of 28 Feb 2023. Fine wine = Cult Wines Global Index; Equities = S&P500(TR); Gov’t bonds = iShares 7-10 US Treasury Bond; Commodity = Bloomberg Commodity Index; Gold = USD/oz. Past performance is not a guarantee of future returns.

The three main factors that underpin fine wine’s stability are:

1

Real asset

Like other rare collectibles, fine wine benefits from scarcity and value as a consumer product and collectible, which helps support demand during different market environments.

2

Lower liquidity

Collectible alternatives are typically characterized by lower liquidity than mainstream markets or even other alternatives. This means they can be harder to quickly buy or sell. While this does have downsides, reduced liquidity can also provide an advantage by insulating assets from panic selling. Fine wine holdings are not typically sold off to the same degree when there is a shift in the macroeconomic outlook.

3

Not leveraged

The fine wine market does not use leverage. Therefore, investors are not forced to sell holdings to meet margin calls, limiting the degree of panic selling and removing a need to sell into a down market

These factors equate to a record of favourable risk-adjusted returns compared to both mainstream and other alternatives. This is demonstrated by fine wine’s higher Sharpe Ratio, which is a measure of the average return of an asset in excess of the risk-free rate and relative to its volatility.

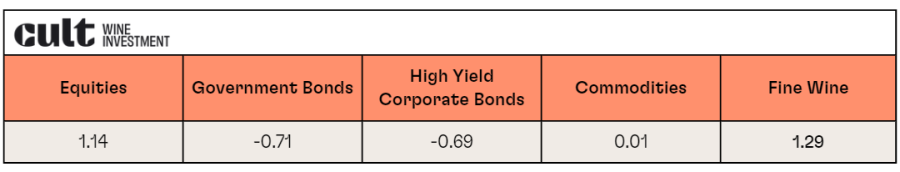

Sharpe ratio across asset classes (28 Feb 2018 - 28 Feb 2023)

Source: Investing.com, Wine-Searcher as of 28 Feb 2023. Fine wine = Cult Wines Global Index; Equities = S&P500(TR); Gov’t bonds = iShares 7-10 US Treasury Bond; High Yield Corporate Bonds = iShares High Yield Corporate Bond; Commodity = Bloomberg Commodity Index. Past performance is not a guarantee of future returns.

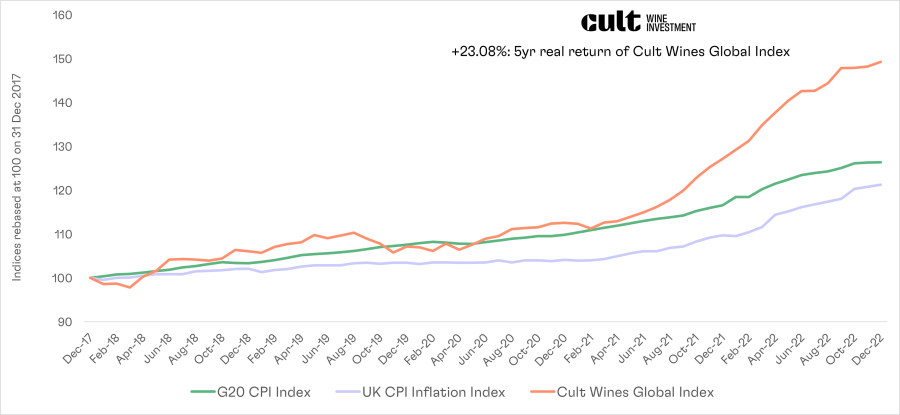

Real asset during inflation

Fine wine’s pace of growth has outpaced inflation rates during periods of both low and high inflation, which we saw in 2022. This is important because during periods of high inflation, some investors will chase higher returns with riskier investments. However, increasing your portfolio risk may not align with your long-term investment priorities, making real assets a useful option.

Figure 3 - Fine wine’s returns

Cult Wines Global Index and CPI Inflation (31 Dec 2017 – 31 Dec 2022)

Source: OECD.com, UK Office of National Statistics, Wine-Searcher as of 28 Feb 2023. Real return based on Cult Wines Global Index returns in excess of UK CPI inflation 31 Dec 2017 - 31 Dec 2022. Returns calculated in GBP and may vary in other currencies. Past performance is not a guarantee of future returns.

1 Why can fine wine perform during periods of higher inflation?

Wine’s ability to form a stable store of value during inflation and other market shocks stems from its nature as a collectible and a consumer product. Demand for fine wine goes beyond just market speculation – rare, quality wine has an intrinsic value as a high-end beverage.

Additionally, the associated costs with of producing a bottle of wine – packaging, transport, etc – filter through to the price of the wine. Consequently, when prices of these elements are rising due to inflation, the price of wine can also trend higher. Wine holdings are more likely to absorb periods of inflation than other assets whose inherent value is more speculative.

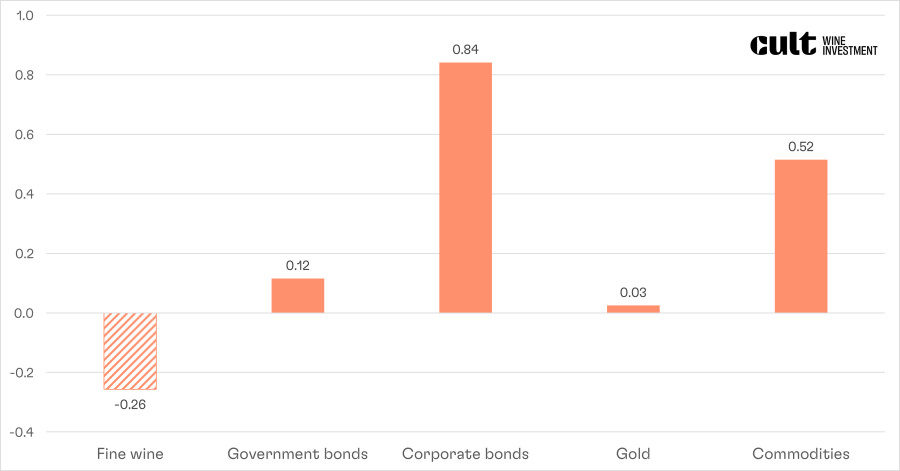

Low correlation

Fine wine holdings can help de-link a portfolio with swings in wider financial markets. The primary drivers of fine wine prices are the internal market dynamics (listed above), meaning prices don’t necessarily rise and fall in line with wider sentiment. This contributes to the Cult Wines Global Index’s negative correlation with equities and other risk assets (investments that do well during times of positive macroeconomic sentiment).

Not all alternatives offer the same diversification; some assets are more closely linked to macro sentiment than others. For example, oil and other commodities are directly impacted by geopolitical events and the economic outlook (low growth expectations typically leads to lower oil prices due to falling demand and vice versa).

Figure 4 - Fine wine goes its own way

5-year correlation to the S&P 500 (TR) across asset classes (28 Feb 2018 – 28 Feb 2023)

Source: Investing.com, Wine-Searcher as of 28 Feb 2023. Fine wine = Cult Wines Global Index; Equities = S&P500(TR); Gov’t bonds = iShares 7-10 US Treasury Bond; Corporate bonds = iShares High Yield Corporate Bond; Commodity = Bloomberg Commodity Index; Gold = USD/oz. Past performance is not a guarantee of future returns.

1 How correlated is your portfolio?

Traditionally, bonds have been viewed as a portfolio diversifier in a 60-40 portfolio based on the old axiom that bond prices will rise when stocks fall. However, the two assets can also be positively correlated, which is what we saw in 2022, when both declined, or earlier in the mid-2010s when central bank stimulus buoyed both stock and bond prices.

If stocks and bonds are positively correlated, investors will need to look elsewhere to provide true diversification. Fine wine’s lack of correlation to equities and its track record of consistent positive returns makes it an appealing diversifier in different market backdrops.

[1] Source: Cult Wines Indices, pricing data from Wine-Searcher as of 28 Feb 2023. Past performance is not a guarantee of future returns.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.