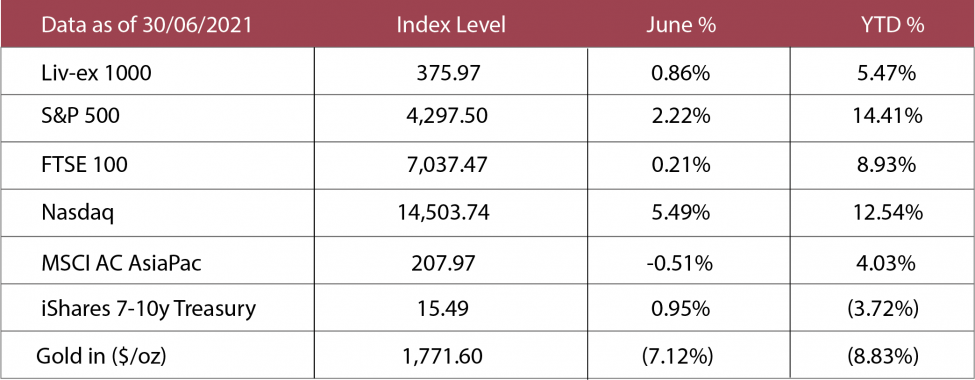

Source: Liv-ex, investing.com, investing.com, gold.co.uk, MSCI

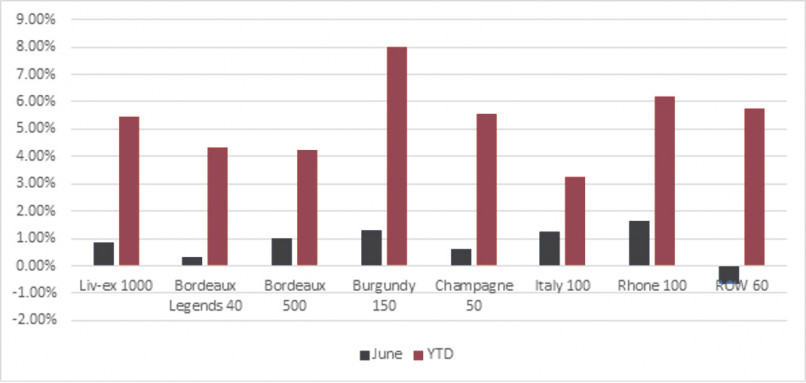

Fine wine, as measured by the Liv-ex 1000, rose 0.86% in June, reaching all-time highs for the fourth consecutive month as part of a very strong first half of 2021. June’s gains came from a broad cross-section of the market with most regions enjoying healthy returns as major economies continued to reopen and recover.

Ongoing demand for real assets amid a rising inflation outlook also supported fine wine, particularly the core regions of Burgundy and Bordeaux. A five-year trade truce between the US and EU announced in June also boosted the outlooks for these two core regions. This backdrop helped the success of Bordeaux’s 2020 en primeur campaign that was just winding down as the month ended.

In financial markets, June saw swings in sentiment although most equity indices ended the month higher. Governments in several major economies continued to relax COVID-19-related restrictions, allowing activity to increase. Monetary policy tightening in China did weigh on Asian equity markets to a degree. The UK’s FTSE underperformed US equities as the Delta variant of the virus delayed full the ‘reopening’ in the UK and continues to weigh on the wider European travel industry.

Concerns about higher inflation also remained but no imminent shifts in monetary policies by US or European central banks are expected. Inflation expectations could push investor demand toward some real assets, such as fine wine, which can provide a hedge against rising prices.

The US dollar appreciated against most major currencies on the month, primarily due to the Federal Reserve’s more hawkish than expected policy meeting. This also pushed developed market government bond prices higher on the month.

Fine wine regional breakdown

The EP campaign for the third instalment of Bordeaux’s trilogy of high-quality vintages was the focal point of the fine wine world in June. Release prices remained mixed with some big names toward the end of the campaign coming with notable increases over last year’s EP prices. However, a selective approach revealed several compelling opportunities at different price points as well as shined light on attractively valued back vintages. Overall, the positive macro backdrop kept the regional index trending higher. Liv-ex’s broader Bordeaux 500 (1.02%) outperformed the first growth-only Bordeaux Legends 40 index on the month (0.30%).

Burgundy extended its torrid run with a 1.29% monthly gain, pushing its annual rise to 8.00%, the highest regional figure. With the ingredients for the strength of Burgundy prices still in place, we think the region’s rally can continue in the second half of the year.

The Rhone 100 took the prize as the top regional performer in June with a 1.63% jump. Liv-ex reported a rise in its trade-by-value share in late June, part of a broad expansion of Rhone’s secondary market this year.

The Rest of World 60 was the only region in the red in June, but this is likely price consolidation following a spike of over 3% the previous month.

Burgundy flexes its muscles

Source: Liv-ex