The Top Wines of 2025

A Year in Transactions: What Really Happened in the Secondary Market?

This report is based entirely on real transaction data available from CultX, the stock market for fine wine.

CultX is a peer-to-peer marketplace where collectors, investors, trade buyers and merchants buy and sell fine wine, with every completed transaction recorded and tracked.

In 2025, our database captured 36,526 individual trades across 9,902 wines, spanning retail, consumer, investor and B2B activity. Where relevant, this has been supplemented with publicly available transaction data from leading exchanges and auction platforms.

All price movements, volume trends and performance metrics in this report are derived from executed trades, not offer-side listings or indicative prices. As a result, the analysis reflects how the fine wine market traded in 2025, rather than how it was marketed.

Table of Contents

- The State of the Market in 2025

- A Market That Tested Conviction, Then Found Its Feet

- Overall Market Performance in 2025

- The Most Traded Wines of 2025: Liquidity Wins

- Top Performing Wines

- Velocity Wines: Where Liquidity Meets Appreciation

- Market Movers: Value Traded Tells the Story

- Top Momentum Wines

- The Q3 to Q4 Inflexion

- The CultX Liquidity Index

- Brand-Level Shifts: Liquidity Returns to the Leaders

- Late-Cycle Casualties or Future Recoveries?

- Conclusion & 2026 Outlook

The State of the Market in 2025

Who Was Active, Why It Mattered, and What Changed

By the time the fine wine market entered 2025, it had already endured one of the longest and most testing downturns in its modern history. Prices across many core regions were down as much as 30% from their 2022 peak, liquidity had thinned materially, and confidence among both collectors and investors remained fragile. Against that backdrop, 2025 was never likely to be a year of broad-based recovery. Instead, it became a year defined by transition, where behaviour shifted first, before prices followed.

Who Was Driving the Market?

At the start of the year, market participation was cautious. Traditional collectors and long-term investors remained largely on the sidelines, still digesting the magnitude of the preceding correction. Interest rates, while beginning to edge lower, remained high enough to suppress discretionary spending and reduce the relative appeal of alternative assets compared with outperforming markets such as US equities and gold. As a result, early 2025 did not see a resurgence of speculative capital or a meaningful influx of new money.

Instead, activity in the first quarter was driven disproportionately by the trade. In particular, there were early signs of restocking activity from Asia and North America, where buyers appeared willing to take advantage of pricing that had adjusted materially over the prior two years. This was most visible in more liquid, globally recognised wines, where price transparency and depth of market made entry decisions easier.

At the same time, consumer demand and on-trade purchasing proved more resilient than expected, with mature wines in or near their drinking window performing relatively well. This suggested that, while investment-led demand was muted, consumption-driven demand remained intact.

The middle part of the year, however, marked the weakest phase of 2025. The introduction of US tariffs and the uncertainty surrounding their implementation had an immediate and pronounced effect on trade flows, particularly between Asia and North America. Activity from these regions slowed sharply, almost overnight, as participants waited for clarity on landed pricing and currency impacts. This uncertainty was compounded by US dollar volatility, which further distorted buy prices for USD-dominated participants.

During this period, the 2024 En Primeur campaign failed to provide a catalyst. Pricing was widely regarded as uncompetitive relative to secondary market levels, while overall quality was perceived as uneven. As a result, the campaign did little to re-engage collectors or investors and reinforced caution across the market. Q2 and Q3, therefore, represented the low point of the year, characterised by subdued volumes and limited conviction.

The final quarter of 2025 marked a clear inflexion point. Activity began to improve in late summer and gathered momentum through September and October. The first beneficiaries were the most liquid, blue-chip wines, particularly Bordeaux first growths. Lafite Rothschild was emblematic of this shift, with both volumes and traded prices increasing as bids returned to the market. Enquiries and bid depth across these wines rose noticeably, signalling renewed engagement from buyers who had been absent for much of the year.

This improvement coincided with a more supportive macroeconomic backdrop. Two interest rate cuts from the US Federal Reserve, alongside easing policy from the Bank of England, helped improve sentiment towards consumer spending, luxury goods, and alternative assets. Having remained on the sidelines for an extended period, collectors and investors appeared increasingly willing to reassess opportunities, particularly where pricing felt realistic and downside risk had diminished.

High-profile auction results reinforced this shift in sentiment. In December, a bottle of 1886 La Tâche sold for £325,000, more than 2,200% above its low estimate. While clearly an exceptional case, the result demonstrated that demand for the rarest wines with impeccable provenance remained robust. Similar dynamics were visible earlier in the year with the William I. Koch collection sale in New York, which achieved US$28.8 million, nearly double its pre-sale estimate, and the Christie’s sale of Joseph Lau’s wines in Hong Kong, which exceeded low estimates by 159%. Together, these results suggested that while the broader market remained selective, confidence at the very top end had never fully disappeared.

By the end of the year, improvements were evident across most core channels. Collectors and investors were re-engaging, retail and consumer activity had stabilised, the on-trade remained active, auctions delivered strong results for top-tier consignments, and B2B trade flows began to normalise. Pricing remained competitive, but activity levels were meaningfully higher than earlier in the year.

Structural Change or Cyclical Pain?

The data suggests that 2025 represented the end of a cycle rather than the beginning of a new structural decline. The quarter-on-quarter analysis points to Q4 as the first period of stabilisation, and potentially the early stages of recovery. That said, the recovery is unlikely to be immediate or uniform. Elevated interest rates, while easing, continue to exert pressure on large stockholders, and the overhang of inventory accumulated during the boom years remains a constraint.

As a result, the initial phase of recovery has been concentrated in high-end, liquid, blue-chip wines. This is reflected clearly in the quarter-on-quarter growth data, where names such as Salon, Lafite, Haut-Brion, Clos des Lambrays, Solaia and Mouton dominate. These wines benefit from deep markets, global recognition, and strong secondary demand, allowing them to respond first as conditions improve.

Value, Liquidity, or Confidence?

Buyer behaviour in 2025 cannot be explained by a single motivation. Value-led buying was a consistent theme throughout the year, particularly among consumers and the on-trade, who actively sought out wines offering strong quality at adjusted prices. As the year progressed, however, liquidity became increasingly important. The wines that traded most frequently were also the first to benefit from improving sentiment, suggesting that confidence returned first where exit routes were clearest.

For much of Q1 to Q3, confidence remained the missing ingredient. Even when the value was evident, many participants hesitated to act. The improvement in Q4 suggests that confidence is returning, albeit selectively, and that this may underpin broader recovery in the next phase.

Sellers, Buyers, and Market Balance

The combination of falling prices and rising trade volumes suggests a market gradually clearing. There remains significant sell-side pressure from private collectors and investors nursing paper losses after a three-year downturn. With prices still around 30% below their 2022 peak, many have chosen to exit or reduce exposure. However, the forced selling driven by acute cash needs, which was particularly evident in 2023 and 2024, appears to have eased.

Structural factors have also played a role. Higher interest rates significantly increased the cost of financing large inventories, prompting major stockholders to de-stock. This was especially visible in Bordeaux, where substantial volumes of 2021 and 2022 vintages entered the market, often at discounts to original release prices. While this added to short-term pressure, it also helped reset pricing and restore activity.

Existing Participants or New Entrants?

2025 was not a year characterised by new market entrants. The fine wine market remained in a phase of contraction and consolidation, with limited evidence of participant growth across most channels. The notable exception was the Middle East. The UAE continued to attract high-net-worth individuals relocating from Europe, Asia, and Russia, driving sustained demand for fine and mature wines across retail, collector, and on-trade channels.

Alongside this, a generational shift continued to play out. Iconic collections were coming to market through auctions as older collectors exited, while a new generation of buyers began to build collections using auction platforms and digital marketplaces such as CultX. At present, this transition remains uneven. The pace at which legacy collections are being released appears to exceed the rate at which the next generation is absorbing them, though the direction of travel is clear.

What This Means for the Market

Taken together, the 2025 data point to a market that has endured its correction and is now seeking equilibrium. Activity has returned before prices, liquidity is improving, and confidence is beginning to rebuild from the top down. While challenges remain, the foundations for a more stable and functional market are now firmly in place.

DOWNLOAD: TOP WINES OF 2025 DATASET

Want to dig deeper than the headline rankings? Download the full Top Wines of 2025 Dataset used in this report and explore exactly how each wine performed across every metric we analysed. Built for anyone who enjoys proper market context, whether you are investing, collecting, or simply curious.

You will get the data behind the 2025 rankings, including Unique Vintages Traded, Total Trades, Total Market Cap, Average Trade Value, Average Market Price and Trade Price Changes, 2024 vs 2025 trades, and year-on-year transaction growth, plus the combined ranking that forms the final list. Every wine included meets the qualifiers of at least 10 trades in 2025 and an average trade value of £500 or more.

A Market That Tested Conviction, Then Found Its Feet

2025 was a year of contrast for the fine wine market. Prices continued to correct across most regions, extending a downturn that began in late 2022. At the same time, participation, liquidity and trading activity quietly improved, particularly in the second half of the year.

Using 36,526 real transactions across 9,902 unique wines and vintages, this report looks beyond headline indices to examine what actually traded, where momentum built, and which wines finished the year stronger than they began. Every insight that follows is based on completed trades, not offer-side listings or theoretical pricing.

What emerges is a market that remained under pressure on price, but increasingly active beneath the surface, setting the foundations for recovery.

The Big Picture, Prices Down, Activity Up

Across wines that traded in both 2024 and 2025, average prices declined by 5.6% year-on-year. Every major region recorded negative price performance, with Bordeaux (-6.85%) and the Rhône (-6.8%) the weakest, while the Rest of World (-2.3%) and Champagne (-4.0%) proved more resilient.

Despite this, activity increased meaningfully:

- 9,902 individual wines traded in 2025, up 13.3% from 8,737 in 2024

- 2,524 unique wines traded, up from 2,496

- 36,526 total trades, a 7.2% increase year-on-year

This divergence, falling prices alongside rising participation, is a classic late-cycle signal. Buyers were more selective, value-driven and active, even as pricing continued to adjust.

Regional Breakdown

Overall

-5.6%

Bordeaux:

-6.85%

Burgundy:

-5.7%

Champagne:

-4%

Italy:

-5.2%

ROW:

-2.3%

Rhone:

-6.8%

USA:

-4.9%

Overall Market Performance in 2025

Slowing Declines, Shifting Demand, and Early Signs of Rebalance

At first glance, a 5.6% average price decline in 2025 may appear unremarkable. In isolation, it risks understating the significance of what actually occurred during the year. Set against the wider context, however, it represents a clear deceleration in the market’s downward trajectory and a meaningful shift in underlying dynamics.

Since the market peak in September 2022, fine wine prices have fallen by approximately 30%. By the end of 2025, following a noticeable improvement in the final quarter, that drawdown had narrowed to around 25% below peak levels. This matters. The annual declines of 14% in 2023 and 9% in 2024 gave way to a far more modest correction in 2025, signalling that the sharp phase of the adjustment is likely behind us. The data points less towards capitulation and more towards a market that is gradually finding its floor.

Regionally, price movements in 2025 were broadly consistent, but the headline averages mask important divergences beneath the surface. Bordeaux, which had been among the weakest performers over the full year, revealed a markedly different picture when viewed through a quarterly lens. While prices across the region declined on average, Q4 saw a clear rebound, particularly among first growths, where traded prices rose by 3–5%. Burgundy followed a similar pattern, with renewed resilience emerging towards the end of the year. These late-year improvements suggest that liquidity returned first to the most established and widely traded names.

One of the most persistent outperformers throughout the downturn, including 2025, was white Burgundy. Unlike many other segments, it continued to diverge positively from the market average, reinforcing the idea that scarcity, global demand, and drinkability can provide structural support even during periods of broader weakness.

Looking across price bands, declines were relatively consistent, but not uniform. Wines priced under £100 per bottle proved the most resilient, falling by an average of 4.9%. This reflects steady demand from consumers and the on-trade, where value and immediacy matter more than long-term capital appreciation. At the other end of the spectrum, wines priced between £250 and £500 per bottle (per bottle equivalent) saw the sharpest declines at 7.4%, suggesting greater sensitivity in this mid-to-upper tier, where discretionary investment demand had previously been strongest. Ultra-high-value wines showed more mixed behaviour, underscoring the importance of liquidity and provenance rather than price alone.

Crucially, the rise in trading volumes during 2025 was not driven by an increase in sellers. Oversupply had already characterised the market in 2023 and 2024. Instead, higher transaction counts point squarely to the return of buyers. After two to three years of retrenchment, several forces brought demand back: re-stocking by trade participants, renewed interest from investors anticipating a shift in the monetary cycle, collectors taking advantage of adjusted pricing, and a gradual re-emergence of demand from Asia and the Middle East. Anecdotally, this was reflected in more frequent opening of high-quality and mature bottles, a subtle but telling indicator of improved confidence.

Importantly, increased activity was not confined to a narrow subset of labels. In total, 1,554 wines saw an increase in trading frequency during the year. That said, the most immediate gains were concentrated in the market’s most liquid names, with brands such as Lafite, Mouton and Sassicaia leading the way. For a full and sustainable recovery to take hold in 2026, trading depth will need to broaden further. The early signs are encouraging, but the next phase will depend on participation extending beyond the market’s traditional anchors.

The Most Traded Wines of 2025, Liquidity Wins

Liquidity clustered around globally recognisable, highly tradable names.

Champagne dominated the top of the table, led by:

- Dom Pérignon 2008 with 193 trades

- Taittinger Comtes de Champagne 2006 with 154 trades

- Louis Roederer Cristal 2008 with 154 trades

Alongside Champagne, well-priced classics such as La Rioja Alta 904 Gran Reserva 2011 and Sena 2018 featured heavily, underlining a shift towards accessible, high-confidence buying.

Only 285 of the 1,535 wines that traded at least three times across both years recorded higher average prices in 2025. The message is clear: liquidity mattered more than label prestige, and buyers prioritised tradability over speculation.

Top Traded Wines in 2025

| Rank | Wine | Vintage | Region | Price per 12 | 2025 # of Trades |

|---|---|---|---|---|---|

| 1 | Dom Perignon | 2008 | Champagne | £1,790 | 193 |

| 2 | La Rioja Alta, 904 Gran Reserva, Rioja | 2011 | Other | £400 | 159 |

| 3 | Taittinger, Comtes de Champagne Blanc de Blancs Grand Cru | 2006 | Champagne | £1,000 | 154 |

| 4 | Louis Roederer, Cristal | 2008 | Champagne | £2,388 | 154 |

| 5 | Sena, Aconcagua Valley | 2018 | Other | £560 | 149 |

| 6 | Chateau Mouton Rothschild Premier Cru Classe, Pauillac | 2016 | Bordeaux | £5,200 | 136 |

| 7 | Chateau Pontet-Canet 5eme Cru Classe, Pauillac | 2019 | Bordeaux | £565 | 133 |

| 8 | Chateau d'Issan 3eme Cru Classe, Margaux | 2016 | Bordeaux | £375 | 128 |

| 9 | Sassicaia, Tenuta San Guido, Bolgheri | 2018 | Italy | £1,998 | 126 |

| 10 | Taittinger, Comtes de Champagne Blanc de Blancs Grand Cru | 2008 | Champagne | £1,560 | 123 |

Why Liquidity Concentrates at the Top of the Pyramid

Liquidity in the fine wine market is highly concentrated, and 2025 was no exception. A relatively small group of wines dominated trading activity, accounting for a disproportionate share of transactions. This is not a quirk of the data, but a structural feature of the market that becomes more pronounced during periods of stress or recovery.

Champagne’s prominence at the top of the liquidity rankings is rooted first and foremost in scale. Large prestige houses such as Dom Pérignon, Louis Roederer and Taittinger Comtes produce volumes that dwarf even the biggest Bordeaux estates. Dom Pérignon alone is estimated to produce between three and five million bottles in a declared vintage, compared with around 200,000 bottles for a First Growth such as Lafite. That depth of supply matters. Liquidity requires not just demand, but sufficient stock in circulation to facilitate repeated trades.

Volume, however, is only part of the story. These wines also benefit from exceptional brand recognition and global distribution. Champagne’s leading houses enjoy visibility across retail, on-trade, private collectors and auctions worldwide. That breadth creates a large and diverse buyer pool, making resale easier and pricing more transparent. In uncertain markets, participants gravitate towards wines they know they can sell again without friction.

The data illustrates this clearly. In 2025, just 75 wine brands traded more than 100 times, and the top 100 brands alone accounted for 59% of all trades. Beneath that, activity falls away sharply. Thousands of wines are traded only a handful of times, reinforcing the pyramid-like structure of fine wine liquidity. This is why ultra-rare producers such as Domaine de la Romanée-Conti or Leroy rarely appear near the top of “most traded” lists. Their scarcity, while desirable, inherently limits turnover.

Crucially, high liquidity does not imply speculative flipping. The most actively traded wines in 2025 were generally not those changing hands rapidly for short-term profit. True flipping tends to occur in allocation-driven markets, particularly for highly sought-after Burgundies or US cult wines, where access rather than price discovery drives behaviour. Much of this activity also happens off-market and is therefore underrepresented in transactional datasets.

An interesting exception in 2025 was Domaine de la Romanée-Conti’s 2022 vintage. Production volumes were approximately 1.8 times the ten-year average, leading to unusually high availability and, in turn, increased market trading. This serves as a reminder that even the rarest names can become more liquid when supply dynamics shift.

Champagne’s role in the trading ecosystem also reflects its defensive characteristics. It faces little true competition from other sparkling wines at the top end, benefits from centrally managed supply through the Champagne Comité, and is typically released only when ready to drink. Vintages are declared selectively, adding an element of controlled scarcity. Together, these factors contribute to lower volatility and strong downside protection, making Champagne a dependable anchor for both collectors and investors.

Finally, it is notable that speculative trading was largely absent in 2025. With prices still recovering from a prolonged downturn, most activity was driven by consumption, portfolio rebalancing, and selective value-led buying. Liquidity flowed to wines that offered trust, familiarity and ease of exit. As confidence continues to rebuild, whether this liquidity broadens beyond the market’s core brands will be one of the key questions for the year ahead.

DOWNLOAD THE DATA AND RUN YOUR OWN ANALYSIS

Prefer to make your own calls? Download the Top Wines of 2025 Dataset and slice the rankings however you like. Filter by activity, compare momentum, or focus on scale and liquidity to see which wines really stood out in 2025.

The dataset includes each wine’s ranking across the individual datapoints, plus the combined score used to create the final Top Wines list. You can also see the underlying measurements and rankings, so you can validate the results and explore your own angles.

Top Performing Wines

Based on a minimum of 3 trades per period, these wines recorded the largest year-on-year average price increases.

The Top Performing Wines, Selectivity Rewarded

A smaller group of wines delivered meaningful price appreciation despite the broader market decline. Standouts included:

- Chapoutier Ermitage Le Pavillon 2008 (+47.3%)

- Château Grillet 2020 (+32.7%)

- Jean Foillard Morgon Côte du Py 2020 (+30.9%)

- Il Marroneto Brunello di Montalcino 2016 (+27.3%)

These results reinforce a recurring theme: quality, maturity and scarcity outperformed scale. Many of the strongest performers came from Rhône, Italy and Burgundy, rather than Bordeaux.

| Wine | Region | Vintage | 2024 No Trades | 2025 No Trades | 2024 Avg Price | 2025 Avg Price | 2025 Price Change |

|---|---|---|---|---|---|---|---|

| M. Chapoutier, Ermitage, Le Pavillon | Rhone | 2008 | 3 | 3 | £917 | £1,351 | 47.3% |

| Chateau Grillet | Rhone | 2020 | 3 | 3 | £2,513 | £3,335 | 32.7% |

| Jean Foillard, Morgon, Cote du Py | Other | 2020 | 7 | 3 | £282 | £369 | 30.9% |

| Domaine Denis Mortet, Gevrey-Chambertin, Mes Cinq Terroirs | Burgundy | 2019 | 6 | 4 | £856 | £1,112 | 29.8% |

| Dominio de Pingus, Flor De Pingus | Other | 2012 | 3 | 3 | £570 | £732 | 28.3% |

| Marroneto, Brunello di Montalcino | Italy | 2016 | 8 | 8 | £721 | £919 | 27.3% |

| Chateau Pape Clement, Blanc | Bordeaux | 2019 | 3 | 3 | £669 | £850 | 27.1% |

| Quintarelli Giuseppe, Rosso Ca' del Merlo | Italy | 2016 | 8 | 3 | £703 | £857 | 22.0% |

| Giuseppe Rinaldi, Barolo, Brunate | Italy | 2020 | 3 | 4 | £1,824 | £2,214 | 21.4% |

| Petrolo, Galatrona | Italy | 2011 | 4 | 4 | £525 | £637 | 21.2% |

| Chateau L'Evangile | Bordeaux | 2013 | 7 | 3 | £794 | £962 | 21.2% |

| Chateau Ausone | Bordeaux | 2010 | 5 | 6 | £5,400 | £6,530 | 20.9% |

| David Leclapart, L'Artiste Premier Cru | Champagne | 2010 | 3 | 3 | £2,133 | £2,568 | 20.4% |

| Emidio Pepe, Trebbiano d'Abruzzo | Italy | 2020 | 4 | 5 | £461 | £549 | 19.3% |

| Chateau Les Carmes Haut-Brion | Bordeaux | 2022 | 6 | 54 | £1,067 | £1,271 | 19.1% |

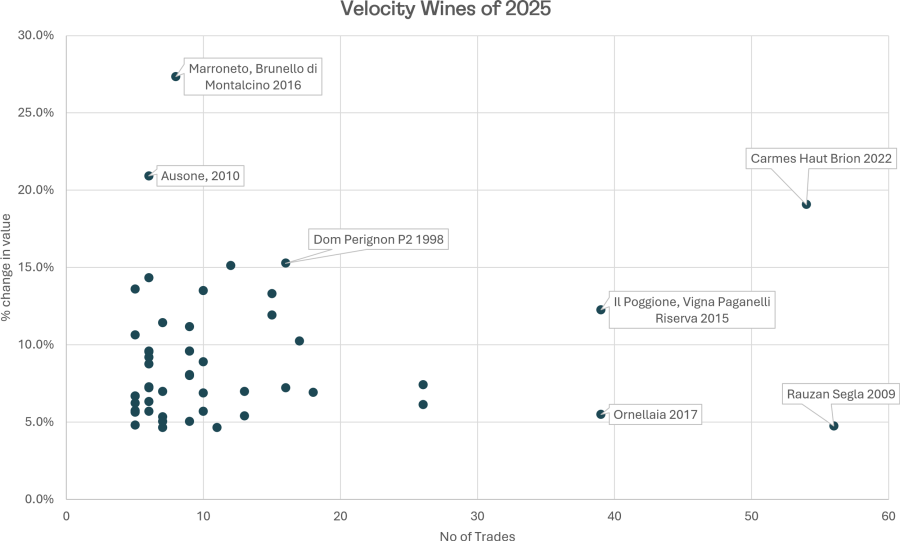

Velocity Wines: Where Liquidity Meets Appreciation

Applying a stricter filter of at least five trades in both years, 970 wines qualified as velocity candidates. Within this group, several names appeared repeatedly across performance tables.

Il Marroneto Brunello 2016 and Les Carmes Haut-Brion 2022 ranked among both top performers and top velocity wines, combining price appreciation with consistent trading. The latter established itself as the wine of the year for 2025, defying the market and posting impressive results.

This intersection of liquidity and growth is where sustainable momentum tends to form.

Top 20 Velocity Wines of 2025

| Wine & Vintage | 2025 No Trades | % Change |

|---|---|---|

| Marroneto, Brunello di Montalcino 2016 | 8 | 27.3% |

| Chateau Ausone, Saint-Emilion Grand Cru 2010 | 6 | 20.9% |

| Chateau Les Carmes Haut-Brion, Pessac-Leognan 2022 | 54 | 19.1% |

| Dom Perignon, P2 1998 | 16 | 15.3% |

| Antinori (Castello della Sala), Cervaro della Sala, Umbria 2017 | 12 | 15.2% |

| Joseph Drouhin, Chassagne-Montrachet Premier Cru, Morgeot Marquis de Laguiche 2020 | 6 | 14.4% |

| Marques de Murrieta, Castillo Ygay Gran Reserva Especial, Rioja 2010 | 5 | 13.6% |

| Salon, Le Mesnil Grand Cru 1997 | 10 | 13.5% |

| Echo de Lynch-Bages, Pauillac 2019 | 15 | 13.3% |

| Il Poggione, Brunello di Montalcino, Vigna Paganelli Riserva 2015 | 39 | 12.3% |

| Guado Al Tasso, Bolgheri 2018 | 15 | 12.0% |

| Chateau Montrose 2eme Cru Classe, Saint-Estephe 2000 | 7 | 11.4% |

| Domaine Bournet-Lapostolle, Clos Apalta, Apalta 2016 | 9 | 11.2% |

| Billecart-Salmon, Brut Reserve 1000 | 5 | 10.7% |

| Biondi-Santi, Brunello di Montalcino 2017 | 17 | 10.2% |

| Pagodes de Cos, Saint-Estephe 2016 | 9 | 9.6% |

| La Rioja Alta, 904 Gran Reserva, Rioja 2010 | 9 | 9.6% |

| Conti Costanti, Brunello di Montalcino 2019 | 6 | 9.6% |

| Guidalberto, Tenuta San Guido, Toscana 2021 | 6 | 9.6% |

| Bollinger, Rose 1000 | 6 | 9.2% |

Where Liquidity Meets Conviction

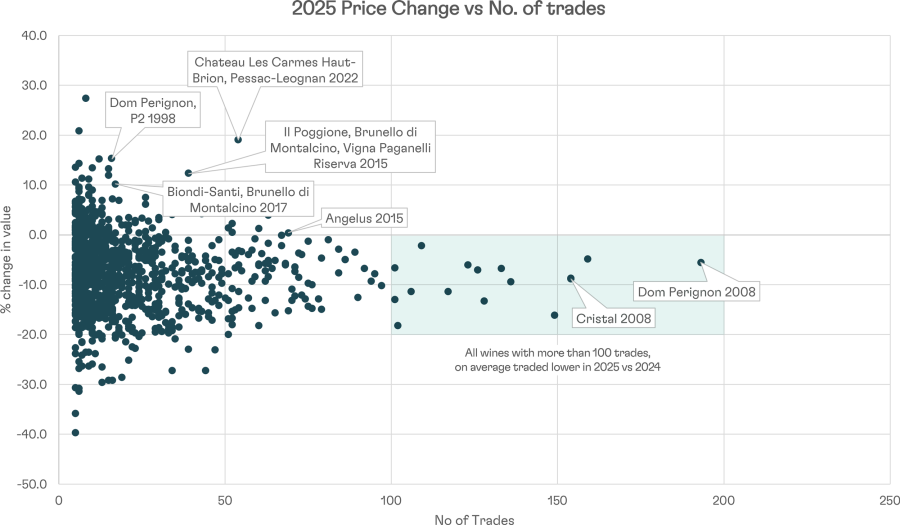

Headline price gains can be misleading in fine wine, particularly in weak or transitional markets. Thin trading, distressed selling or one-off transactions often exaggerate performance. Velocity offers a more robust signal. By combining price appreciation with a minimum level of trading activity, it isolates wines where price movement is supported by genuine market participation.

That distinction matters in 2025. One of the more revealing observations from the data is that wines trading more than 100 times on average declined in price versus 2024. In other words, the most heavily traded wines in the market were still under pressure. This reinforces that broad-based recovery had not yet taken hold, and that volume alone did not protect prices. Against that backdrop, wines that managed to combine rising prices with meaningful trading activity stand out all the more.

Carmes Haut-Brion 2022 is the clearest example. It is the only young vintage in the velocity list, trading 54 times while appreciating close to 20%. The catalyst was its reassessment to 100 points by The Wine Advocate, prompting the market to reprice the wine collectively rather than through isolated trades. This is velocity at work, volume confirming conviction.

The rest of the list is notably mature. Wines such as Salon 1997, Dom Pérignon P2 1998, Montrose 2000, Ausone 2010, Biondi-Santi 2017 and Il Marroneto 2016 reflect buyer preference for established wines with proven quality, clear drinking windows and reliable secondary market demand. These are not speculative flips, but wines that collectors and professionals are comfortable trading repeatedly.

Price bands are equally telling. Velocity wines cluster between sub-£250 and roughly £500–£700 per bottle. They are expensive enough to signal quality, yet liquid enough to trade consistently. Ultra-rare, ultra-expensive wines are largely absent, not because they lack prestige, but because scarcity limits turnover.

In a year where the most liquid wines still fell in price, velocity highlights a narrower but more meaningful recovery. It shows where liquidity and price appreciation intersect, offering one of the clearest indicators of emerging confidence within a cautious market.

Market Movers, Value Traded Tells the Story

When ranking wines by the increase in total value traded, a different picture emerges.

Here, mature, iconic wines dominated:

- Mouton Rothschild 1982 (+43% traded value, +43% price)

- Dom Pérignon P2 1998 (+157% traded value)

- Salon 1997 (+201% traded value)

These wines benefited from scarcity, global recognition and renewed interest in mature stock, particularly in the final quarter of the year.

Top 20 Market Movers

| Wine Name | Vintage | Region | % Change in Traded Value | 2025 Price Change % |

|---|---|---|---|---|

| Chateau Mouton Rothschild Premier Cru Classe, Pauillac | 1982 | Bordeaux | 43% | 43% |

| Chateau Grillet, Chateau-Grillet | 2020 | Rhone | 33% | 33% |

| Domaine Anne Gros, Richebourg Grand Cru | 2012 | Burgundy | 29% | 29% |

| Giuseppe Rinaldi, Barolo, Brunate | 2020 | Italy | 62% | 21% |

| Domaine Armand Rousseau, Chambertin Grand Cru | 2018 | Burgundy | 137% | 18% |

| Prieure Roch, Nuits-Saint-Georges Premier Cru, Clos des Corvees | 2015 | Burgundy | 64% | 18% |

| Dom Perignon, P2 | 1998 | Champagne | 157% | 15% |

| Soldera Case Basse, 100% Sangiovese, Toscana | 2012 | Italy | 14% | 14% |

| Salon, Le Mesnil Grand Cru | 1997 | Champagne | 201% | 14% |

| Il Poggione, Brunello di Montalcino, Vigna Paganelli Riserva | 2015 | Italy | 159% | 12% |

| Masseto, Toscana | 1999 | Italy | 11% | 11% |

| Bouchard Pere et Fils, Montrachet Grand Cru | 2017 | Burgundy | 11% | 11% |

| Domaine Francois Raveneau, Chablis Grand Cru, Valmur | 2019 | Burgundy | 11% | 11% |

| Egly-Ouriet, Brut Millesime Grand Cru | 2013 | Champagne | 47% | 10% |

| Chateau L'Eglise-Clinet, Pomerol | 2016 | Bordeaux | 25% | 9% |

| Pol Roger, Sir Winston Churchill | 2000 | Champagne | 4% | 9% |

| Vega Sicilia, Unico, Ribera del Duero | 2009 | Other | 56% | 7% |

| Chateau Haut-Brion Premier Cru Classe, Pessac-Leognan | 2000 | Bordeaux | 55% | 7% |

| Gaja, Barbaresco | 2015 | Italy | 5% | 7% |

| Coche-Dury, Meursault | 2022 | Burgundy | 56% | 7% |

EXPLORE THE TOP WINES OF 2025 DATASET

If you are assessing what drove the market in 2025, this download is for you. Get the full dataset behind our Top Wines of 2025 rankings, built from multiple datapoints designed to reflect market activity, scale, and pricing movement.

You will be able to explore how each wine ranks across Unique Vintages Traded, Total Trades, Total Market Cap, Average Trade Value, Average Market Price and Trade Price Changes, 2024 vs 2025 trades, and year-on-year transaction growth, plus the combined ranking that determines the final list. All wines included meet the minimum thresholds of at least 10 trades in 2025 and an average trade value of £500 or more.

Top Momentum Wines

Looking at the wines that ended the year on a high, comparing the last trade versus the first trade,

min of 5 trades, and ranking from the highest appreciation.

| Region | Wine Name | Vintage | First Trade Price | Last Trade Price | Trade Count | Trade Price % Change |

|---|---|---|---|---|---|---|

| Champagne | Agrapart & Fils, Minéral Blanc de Blancs Extra Brut Grand Cru | 2014 | 414 | 1,022 | 5 | 147% |

| Other | Bell Hill, Pinot Noir, Canterbury | 2016 | 1,010 | 1,900 | 12 | 88% |

| Italy | Marroneto, Brunello di Montalcino | 2016 | 666 | 1,130 | 8 | 70% |

| Italy | Antinori (Castello della Sala), Cervaro della Sala, Umbria | 2017 | 516 | 774 | 12 | 50% |

| Italy | Sassicaia, Tenuta San Guido, Bolgheri | 2006 | 2,240 | 3,180 | 7 | 42% |

| Burgundy | Domaine Louis Latour, Corton-Charlemagne Grand Cru | 2021 | 1,266 | 1,700 | 5 | 34% |

| Bordeaux | Château Ausone, Saint-Émilion Grand Cru | 2015 | 5,000 | 6,684 | 5 | 34% |

| Italy | Ornellaia, Bolgheri | 2013 | 1,512 | 2,000 | 35 | 32% |

| Champagne | Dom Pérignon P2 | 2000 | 2,996 | 3,872 | 10 | 29% |

| Rhône | Château Rayas, Châteauneuf-du-Pape | 2012 | 7,100 | 8,900 | 5 | 25% |

| Burgundy | Domaine Armand Rousseau, Chambertin Grand Cru | 2013 | 17,496 | 21,624 | 6 | 24% |

| Italy | Sassicaia, Tenuta San Guido, Bolgheri | 2005 | 2,850 | 3,463 | 7 | 22% |

| Italy | Ornellaia, Bolgheri | 2016 | 1,908 | 2,294 | 48 | 20% |

| Italy | Tignanello, Toscana | 2017 | 1,058 | 1,262 | 65 | 19% |

| Italy | Biondi-Santi, Brunello di Montalcino | 2010 | 1,040 | 1,240 | 84 | 19% |

| Other | Vega Sicilia, Único, Ribera del Duero | 2010 | 2,888 | 3,440 | 12 | 19% |

| Bordeaux | Château Lafite Rothschild Premier Cru Classé, Pauillac | 2014 | 3,842 | 4,536 | 52 | 18% |

| Burgundy | Domaine Leflaive, Chevalier-Montrachet Grand Cru | 2022 | 13,000 | 15,308 | 5 | 18% |

| Bordeaux | Château Mouton Rothschild Premier Cru Classé, Pauillac | 1998 | 3,834 | 4,488 | 32 | 17% |

Where Confidence Returned First

Momentum Wines track a different signal to most performance tables. Rather than comparing annual averages, this view looks at acceleration within the year itself, measuring how prices evolved from the first trade of 2025 to the last. In doing so, it captures the wines that benefited earliest and most clearly from improving sentiment as the year progressed.

Unsurprisingly, many of the strongest momentum names reflect where confidence first re-entered the market. As conditions improved in Q4, capital flowed back into blue-chip, internationally recognisable wines. Super Tuscans stand out in particular.

Multiple vintages of Sassicaia, Ornellaia and Tignanello appear on the list, reflecting renewed demand for globally traded, highly liquid icons as buyers became more willing to re-engage. Similar patterns were visible in First Growth Bordeaux and prestige cuvée Champagne.

Momentum was not driven by a single factor. In some cases, it reflected regional narratives and price anchoring after a prolonged correction. Rayas is a good example. Following one of the sharpest resets of the downturn, prices had fallen materially below peak levels. The passing of Emmanuel Reynaud, combined with renewed interest in Rhône icons, brought attention back to the estate just as market conditions stabilised.

More interestingly, the top of the momentum table is not dominated by traditional blue chips. Agrapart & Fils Minéral leads the list, underlining the growing appeal of grower Champagne. High critical acclaim, strong demand for Blanc de Blancs, and pricing that looked undervalued at the start of the year combined to drive sharp appreciation as buyers returned.

Bell Hill Pinot Noir from Canterbury offers a similar lesson. With prices rising from around £1,000 per 12 to £1,900, it highlights sustained demand for top-tier Pinot Noir outside Burgundy, particularly where quality is perceived to be comparable.

Momentum Wines, therefore, reveal where conviction returned first. They suggest that recovery, when it comes, will not be uniform but will be led by a mix of trusted icons and selective, high-quality alternatives.

The Q3 to Q4 Inflexion

| Q3 Avg Price | Q3 Trades | Q4 Avg Price | Q4 Trades | QoQ Price Return | Wine Name | Vintage | Producer | Region |

|---|---|---|---|---|---|---|---|---|

| £1,821 | 2 | £2,265 | 4 | 24% | Domaine des Lambrays, Clos des Lambrays Grand Cru | 2016 | des Lambrays | Burgundy |

| £2,858 | 5 | £3,534 | 8 | 24% | Solaia, Toscana | 2015 | Antinori | Tuscany |

| £7,869 | 10 | £9,198 | 11 | 17% | Salon, Le Mesnil Grand Cru | 2002 | Salon | Champagne |

| £4,656 | 11 | £5,195 | 22 | 12% | Chateau Mouton Rothschild Premier Cru Classe, Pauillac | 2005 | Mouton Rothschild | Bordeaux |

| £4,034 | 16 | £4,449 | 14 | 10% | Chateau Haut-Brion Premier Cru Classe, Pessac-Leognan | 2016 | Haut-Brion | Bordeaux |

| £2,646 | 5 | £2,900 | 6 | 10% | Opus One, Napa Valley | 2018 | Opus One | California |

| £4,292 | 3 | £4,694 | 3 | 9% | Clos de Tart, Clos de Tart Grand Cru | 2016 | Clos de Tart | Burgundy |

| £2,462 | 17 | £2,665 | 14 | 8% | Chateau Angelus, Saint-Emilion Grand Cru | 2016 | Angelus | Bordeaux |

| £3,765 | 9 | £4,034 | 20 | 7% | Chateau Lafite Rothschild Premier Cru Classe, Pauillac | 2021 | Lafite Rothschild | Bordeaux |

| £2,129 | 7 | £2,263 | 5 | 6% | Domaine des Lambrays, Clos des Lambrays Grand Cru | 2018 | des Lambrays | Burgundy |

When Sentiment Finally Turned

The comparison between Q3 and Q4 provides one of the clearest signals in the report. After nearly three years of contraction, Q4 marked a decisive change in direction, not just in prices, but in behaviour. Buyers returned, bids reappeared, and trading activity picked up in a way that had been absent for much of the year.

Several factors converged. Further interest rate cuts in the US and UK eased pressure on discretionary spending and alternative assets. Asia, which had been notably quiet through much of 2024 and early 2025, began to re-engage, particularly on the trade side. At the same time, consumers and drinkers returned to the market, restocking cellars after a prolonged period of restraint. Confidence, once it reappeared, proved self-reinforcing.

That said, the recovery in Q4 was not broad-based. Activity remained concentrated in the most liquid, recognisable names. Wines such as Opus One and Salon were among the first to trade higher, reflecting a clear “safety first” approach from returning buyers. These are wines with deep markets, global demand and well-established price references, making them the natural entry point as sentiment improved.

Crucially, this does not feel like seasonal noise. While year-end activity is typically stronger, the pattern observed in Q4 went beyond a normal seasonal uplift. Prices moved higher alongside volumes, and buyer behaviour shifted in a way that suggests a change in the cycle rather than a temporary spike.

Looking ahead, Q1 2026 will be the real test. Modest, sustainable growth, perhaps around 2%, spread across a wider range of wines and regions, would be a healthier confirmation than another sharp rebound. The direction is encouraging, but the depth of recovery still needs to be built.

The CultX Liquidity Index

Tracking the Fine Wine Market’s Core

To complement the wine-by-wine analysis, we constructed a monthly traded index designed to track the price evolution of the most liquid wines in the market.

The index comprises 52 wines, each of which traded at least once in every month of 2025, making them the most consistently active and representative segment of the secondary market.

The index is equal-weighted and calculated using average executed trade prices, not offer-side data. This means it captures how prices actually moved for wines that matter most to market liquidity, across Bordeaux, Champagne, Italy, Spain and select New World benchmarks.

What the index shows is telling. From January through September, the trend is broadly downward, reflecting the continued pressure felt across the market in the first three quarters of the year. Prices softened steadily, with the index reaching its low point in September at just over 95, down from a base of 100 at the start of the year. This aligns with the broader narrative of persistent caution, tariff-related uncertainty and thin buyer participation during this period.

The inflexion comes in Q4. From October onwards, the index reverses direction sharply, rising to 100.3 in November, before a modest pullback in December. The December adjustment is largely technical, reflecting fewer trading days and seasonal disruption rather than a deterioration in underlying demand.

Crucially, this rebound is driven by the market’s most liquid names: first-growth Bordeaux, prestige Champagne, and Super Tuscans such as Lafite, Mouton, Dom Pérignon, Cristal, Sassicaia, and Tignanello. These wines tend to be the first beneficiaries when confidence returns, acting as bellwethers for broader market sentiment.

The index reinforces a central conclusion of this report: the recovery began at the core.

While depth remains thinner than in prior cycles, the most traded wines stabilised first and moved higher in Q4, suggesting the market is transitioning from decline to early-stage recovery, rather than experiencing a short-lived bounce.

| Increase | ||||||

| Wine Name | Producer | Region | Unique Vintages Traded | Prior Year Trades | Current Year Trades | Transaction Growth |

|---|---|---|---|---|---|---|

| Château Mouton Rothschild Premier Cru Classé, Pauillac | Mouton Rothschild | Bordeaux | 28 | 634 | 849 | +215 |

| Château Figeac Premier Grand Cru Classé A, Saint-Émilion Grand Cru | Figeac | Bordeaux | 18 | 337 | 550 | +213 |

| Sassicaia, Tenuta San Guido, Bolgheri | Tenuta San Guido | Tuscany | 20 | 464 | 622 | +158 |

| Château Lafite Rothschild Premier Cru Classé, Pauillac | Lafite Rothschild | Bordeaux | 26 | 775 | 920 | +145 |

| Château Pavie Premier Grand Cru Classé A, Saint-Émilion Grand Cru | Pavie | Bordeaux | 18 | 333 | 426 | +93 |

| Decrease | ||||||

| Wine Name | Producer | Region | Unique Vintages Traded | Prior Year Trades | Current Year Trades | Transaction Growth |

|---|---|---|---|---|---|---|

| Château Pontet-Canet 5ème Cru Classé, Pauillac | Pontet-Canet | Bordeaux | 19 | 927 | 835 | −92 |

| Château Montrose 2ème Cru Classé, Saint-Estèphe | Montrose | Bordeaux | 23 | 489 | 411 | −78 |

| Cos d’Estournel 2ème Cru Classé, Saint-Estèphe | Cos d’Estournel | Bordeaux | 20 | 493 | 443 | −50 |

| Château Léoville Las Cases 2ème Cru Classé, Saint-Julien | Léoville Las Cases | Bordeaux | 23 | 267 | 218 | −49 |

| Pol Roger Sir Winston Churchill | Pol Roger | Champagne | 11 | 143 | 100 | −43 |

Brand-Level Shifts

Liquidity Returns to the Leaders

Brand-level data shows a clear pattern emerging in 2025: capital returned first to the most recognisable, liquid names. First Growth Bordeaux and Super Tuscans, particularly Sassicaia, saw trading activity increase as confidence improved. These wines benefit from global brand recognition, deep markets and consistent demand, allowing them to act as reference points when sentiment turns.

This phase of the cycle favours what might be described as “index wines”, brands that trade regularly enough to anchor pricing and liquidity across the market. Historically, this leadership has tended to filter down.

As Lafite, Mouton and Sassicaia move first, attention and liquidity typically spread to the next tier, supporting mid-level producers as buyers begin to seek value beyond the obvious names.

TAKE THE RANKINGS HOME: DOWNLOAD THE DATA

Loved the article and want to explore what is happening under the surface? Download the Top Wines of 2025 Dataset and see the full picture behind the wines that led the market this year.

This dataset lets you explore the story behind the rankings, from the most traded wines to those with the strongest transaction growth. You will see every datapoint used, including Unique Vintages Traded, Total Trades, Total Market Cap, Average Trade Value, Average Market Price and Trade Price Changes, 2024 vs 2025 trades, and year-on-year growth, plus the combined ranking used for the final Top Wines list. It only includes wines that cleared the list qualifiers, with at least 10 trades in 2025 and an average trade value of £500 or more.

Late-Cycle Casualties or Future Recoveries?

These are the wines that have seen the largest declines in price and trading volume in 2025.

| Region | Wine Name | Market Price Change | Average Trade Price Change | Total Traded 2024 | Total Traded 2025 | Change in Trades | % Change |

|---|---|---|---|---|---|---|---|

| Bordeaux | Chateau Pontet-Canet 5eme Cru Classe, Pauillac | -5.8% | -6.3% | 927 | 835 | -92 | -10% |

| Bordeaux | Chateau Montrose 2eme Cru Classe, Saint-Estephe | -0.9% | -2.8% | 489 | 411 | -78 | -16% |

| Bordeaux | Cos d'Estournel 2eme Cru Classe, Saint-Estephe | -4.8% | -5.6% | 493 | 443 | -50 | -10% |

| Bordeaux | Chateau Leoville Las Cases 2eme Cru Classe, Saint-Julien | -4.5% | -3.2% | 267 | 218 | -49 | -18% |

| Tuscany | Montevertine, Le Pergole Torte, Toscana | 5.3% | -2.2% | 62 | 31 | -31 | -50% |

| Bordeaux | Chateau Palmer 3eme Cru Classe, Margaux | -1.7% | -4.5% | 180 | 150 | -30 | -17% |

| California | Joseph Phelps, Insignia, Napa Valley | -10.7% | -6.3% | 77 | 48 | -29 | -38% |

| Bordeaux | Ducru-Beaucaillou 2eme Cru Classe, Saint-Julien | 0.7% | -5.3% | 163 | 138 | -25 | -15% |

| Piedmont | Luciano Sandrone, Barolo, Vigne | -8.7% | -4.2% | 55 | 38 | -17 | -31% |

| Bordeaux | Chateau La Fleur-Petrus, Pomerol | -4.5% | -5.6% | 84 | 68 | -16 | -19% |

| Piedmont | Luciano Sandrone, Barolo, Aleste | 0.4% | -4.6% | 28 | 14 | -14 | -50% |

| Burgundy | Domaine Taupenot-Merme, Mazoyeres-Chambertin Grand Cru | -11.4% | -1.3% | 25 | 11 | -14 | -56% |

The wines that lagged in 2025 largely reflect the final stages of a prolonged market correction rather than structural decline. Notably, over half of the list comprises top Second Growth Bordeaux estates, wines that are widely held in private cellars and therefore more exposed during periods of forced selling. In weaker markets, these highly owned, mid-to-upper tier wines tend to see greater price pressure as collectors rebalance or exit positions.

Examples such as Pontet-Canet illustrate this dynamic clearly. One of the most collected and traded wines in the market. These wines often sit just behind the First Growths in the recovery cycle, typically following with a lag of one or two quarters once confidence returns. Other underperformers, including Joseph Phelps Insignia, appear more exposed to regional demand shifts. With a strong domestic US following but weaker international traction, trading softness outside the US has been more pronounced during the downturn.

Overall, these laggards look less like broken assets and more like late responders. A sustained recovery in liquidity and broader buyer confidence would likely be the catalyst for stabilisation and eventual recovery.

DOWNLOAD THE SOURCE DATA FOR THIS REPORT

We believe rankings are most useful when you can see what sits behind them. Download the Top Wines of 2025 Dataset for free and review the exact data used to build the Top Wines lists.

You will receive the ranked results for each metric and the combined ranking that forms the final list, covering Unique Vintages Traded, Total Trades, Total Market Cap, Average Trade Value, Average Market Price and Trade Price Changes, 2024 vs 2025 trades, and year-on-year transaction growth. The dataset follows strict eligibility rules, with every wine included achieving at least 10 trades in 2025 and an average trade value of £500 or above.

Conclusion & 2026 Outlook

From Stabilisation to Sustainable Recovery

By the end of 2025, the fine wine market no longer resembled a market in freefall. Trading activity recovered meaningfully in the second half of the year, pricing pressure eased, and select segments began to post clear gains. However, calling this a full recovery would be premature. The evidence instead points to a market that has stabilised and is cautiously entering a new phase, one defined by selectivity rather than broad-based momentum.

The clearest risk to the recovery thesis would be a failure for price stabilisation to extend beyond the most liquid wines. While Q4 delivered positive signals, a meaningful recovery requires modest, repeatable growth through Q1 2026 and, critically, greater depth across a wider universe of wines. Another risk lies on the supply side. After three years of falling prices, many collectors remain materially underwater. If improved conditions prompt a renewed wave of selling, excess supply could once again cap upside and stall progress.

Early indicators in 2026 will therefore matter. The most traded wines act as the market’s bellwether. In 2025, wines trading more than 100 times still declined on average year-on-year, a pattern unlikely to persist if the recovery is genuine. A reversal here would be one of the strongest confirmations that sentiment has shifted. Burgundy’s 2024 release, while tiny in volume, will also be telling. Demand for these scarce allocations may redirect attention toward back vintages, offering insight into the broader appetite for Burgundy. Likewise, the extended Chinese New Year period in February will be closely watched. A strong Asian buying season would materially improve market confidence and liquidity.

Macro conditions remain supportive. Further interest rate reductions would lower the opportunity cost of holding inventory and encourage renewed allocation to alternative assets. Combined with pricing that remains roughly 25% below the 2022 peak, fine wine enters 2026 with risk-reward more balanced than at any point in the last three years.

Importantly, this recovery is not uniform. At the very top end of the market, confidence has already returned, evidenced by strong auction results and renewed demand for the rarest wines, even where transactional data is thin. Below this tier, recovery is occurring first where liquidity and value intersect. The market remains two-speed but not fragmented. Instead, capital is returning cautiously, prioritising visibility, pricing discipline, and resale confidence.

For long-term collectors and investors, inaction is not necessarily risky. However, the greater risk may lie in missing a window where pricing still reflects downturn conditions, but momentum has begun to build. A modest 2–3% annualised recovery sustained across 2026 would represent a healthier outcome than a sharp rebound and help rebuild confidence across the ecosystem.

Ultimately, a successful 2026 will depend on several aligned factors: sensible new releases, a credible En Primeur campaign, continued recovery in secondary market liquidity, and the re-engagement of Asian and US buyers. If these conditions hold, the market can move beyond stabilisation and return to what matters most, a vibrant, functioning ecosystem where collecting, trading, drinking, and investing once again feel rewarding rather than defensive.