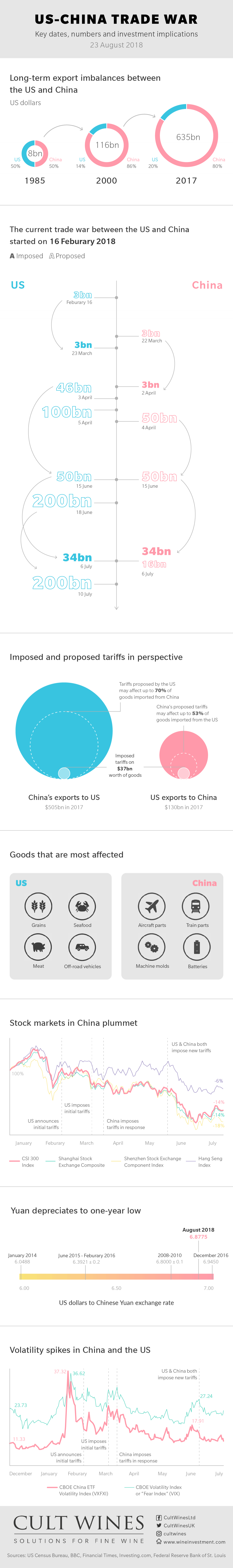

Four months have passed since the outbreak of the US-China trade war, when Donald Trump officially imposed tariffs on Chinese steel and aluminium on 23 March.

Since then, more than 5,000 items have been affected by the tariffs threatened or actually imposed by the US and Chinese governments. In total, the proposed tariffs affect up to 65% of trade in physical goods between China and America.

As a result, volatility has risen sharply in Chinese equity markets. Investors in China A-shares suffered considerable losses: at the beginning of August, the CSI 300 Index had dropped over 25% against its January high.

The following infographics present key market information on the ongoing US-China trade war, as well as the safe-haven potential of gold and fine wine in this uncertain market.

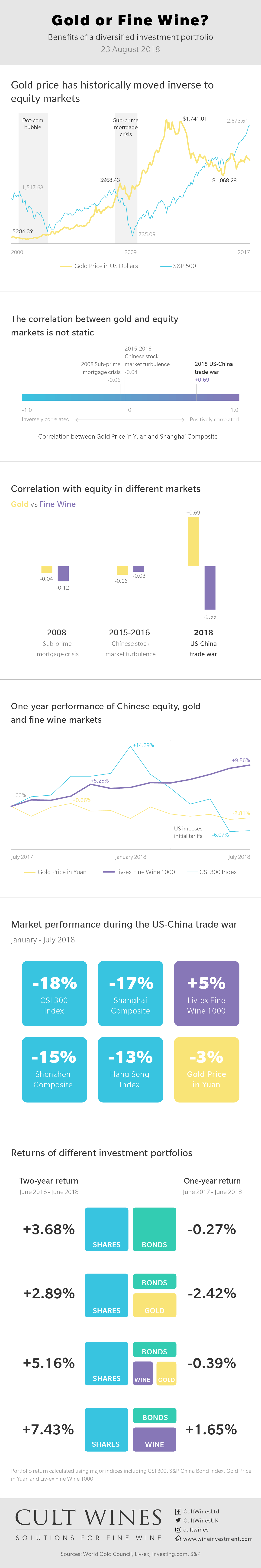

Historically, gold has moved inverse to equity markets. Therefore, many investors regard gold as a reliable portfolio diversification and hedging option.

However, the correlation between gold and stock market is not static. Gold’s performance in recent years has shown an increasingly positive correlation with stock markets, weakening its reputation and viability as a risk-hedging asset. More importantly, gold has suffered a negative return in the first half of 2018.

The following infographic compares the market performance of gold and fine wine against the backdrop of the 2018 US-China trade war. It asks an important investment question: Which alternative asset class can better safeguard your investment in the current Chinese bear market – gold or fine wine?

Gold’s correlation with the Chinese equity market has increased over time, which increasingly hinders its ability to provide diversification benefits for investors. On the other hand, the fine wine market has moved inversely to the Chinese equity market since the beginning of 2018.

In the short run, fine wine can offer better diversification benefits, reduce volatility and generates higher returns compared to gold. This is certainly the case for the current trade war between the US and China.

Is gold losing its hedging power? Will the correlation between gold and traditional equity markets continue to increase? Gold price in US dollars today is 4.5 times of what it used to be 20 years ago, and it had been growing at a speed that is hardly justifiable by that of the actual demand of physical gold.

Maybe this signals the beginning of a trend reversal that gold is losing its "safe haven" status. To safeguard their portfolios in an increasingly uncertain world, prudent and proactive investors may benefit from exploring more modern alternative investment options such as fine wine.

To learn more about the fine wine market and how to invest in fine wine, download Cult Wines' Fine Wine Investment Guide

Download Fine Wine Investment Guide

US-China Trade War, Bear Market in China, hedging risk and portfolio diversification

Four months have passed since the outbreak of the US-China trade war, when Donald Trump officially imposed tariffs on Chinese steel and aluminium on 23 March.

Since then, more than 5,000 items have been affected by the tariffs threatened or actually imposed by the US and Chinese governments. In total, the proposed tariffs affect up to 65% of trade in physical goods between China and America.

As a result, volatility rose sharply in Chinese equity markets. Investors in China A-shares suffered considerable losses: at the beginning of August, the CSI 300 Index had dropped over 25% against its January high.

The following infographic presents key market information on the ongoing US-China trade war, as well as the safe-haven potential of gold and fine wine in this uncertain market.

[infographic part I]

Historically, gold has moved inversely to equity markets. Therefore, many investors regard gold as a reliable portfolio diversification option.

However, the correlation between gold and stock market is not static. Gold’s performance in recent years has shown an increasingly positive correlation, weakening its reputation and viability as a risk-hedging asset. More importantly, gold has suffered a negative return in the first half of 2018.

This following infographic compares the market performance of gold and fine wine against the backdrop of 2018 US-China trade war. It asks an important investment question: which alternative asset class can better safeguard your investment in the current Chinese bear market – gold or fine wine?

[infographic part II]

Gold’s correlation with the Chinese equity market has increased over time, which increasingly hinders its ability to provide diversification benefits for investors. On the other hand, the fine wine market has moved inversely to the Chinese equity market since the beginning of 2018.

In the short run, fine wine can offer better diversification benefits, reduce volatility and generates higher returns and compared to gold. This is certainly the case for the current trade war between the US and China.

Is gold losing its hedging power? Will the correlation between gold and traditional equity markets continue to increase? Gold price in US dollars today is 4.5 times of what it used to be at the turn of the century, growing at a speed that is hardly justifiable by that of the actual demand of physical gold.

Maybe this signals the beginning of a trend reversal that gold is no longer a reliable “safe haven.” To safeguard his or her portfolio against uncertainties, a wise and responsive investor may consider more modern alternative investment options such as fine wine.

Analysis: Yijun Lu

Infographics: Kelly Liang