The Coronavirus has continued to spread rapidly beyond China. There is now little doubt that the impact of the Coronavirus outbreak will be global but the extent will largely depend on how much it will spread, when/if a vaccine is found and government and institutions response. The degree of damage, beyond the human cost, will vary by industry. In China, industries such as tourism, transportation and consumer product are hit the hardest as the government strictly prevents citizens to go out and forces businesses to stay closed. For example, our office in Shanghai is currently closed, with staff working from home. If any of our staff wanted to visit the office, we have to submit to the authorities a request which would need approval before they would be allowed to enter the building, this is currently managed through the building manager. Until this situation changes and restrictions are lifted, we are likely to keep our office shut. As the virus spreads to the rest of world, there is widespread fear of a global slowdown and impact on consumer spending and supply chains.

Within the context of financial markets, there has been a huge flight to safety: defensive assets have gained whilst “risky” ones have plummeted. Government bonds have rallied, gold has gone up massively and high Yield bonds have seen a huge price adjustment in the fastest sell off since the 2008 financial crisis.

For wine investors, it is important to stay focused on the defensive characteristics that fine wines possess and the long-term investment objective. We obviously expect the Coronavirus to have a negative impact on demand of the retail wine market as hospitality and entertainment sectors are affected and therefore wine consumption. We do expect some impact on the demand for investment grade wines in China (and the rest of the world) but limited sale of collections or portfolios

Understandably fine wine demand from Hong Kong and mainland China was subdued in January at the height of the Coronavirus outbreak. Over the past week the trading activity and routine requests for stock from Asia has increased significantly. Could this be a sign of business returning to normal? Or larger trading firms taking advantage of a reserved market place? Either way we see this as an encouraging signal of how the wine market in Asia is set to react once Coronavirus has passed.

The last 10 days has highlighted and reminded us that investments returns are intrinsically linked to risk, and that when volatility increases, it pays to have a diversified portfolio to cushion against violent market movements.

We believe that wine as an asset class, provides diversification, reduces risk and enhances long term returns when added to an investment portfolio. Wine has both long term appreciation potential as well as wealth preservation characteristics.

We do not pretend to know the extent of the impact of Coronavirus on the market, nor can we predict the future: at this point what we don’t know is greater than what we do! But as investment managers we want to balance what’s actually happening, what people believe is happening and the lesson that we can learn from previous episodes of market turmoil to make the best-informed decisions. What we know though is that the best investment strategy when in doubt is diversification and a cool head.

How does fine wine perform during a financial crisis?

S&P 500 dropped more than 15% in 7 days on fears of the spread of Coronavirus, representing the worst week for global equities since the 2008 financial crisis and the fastest sell off ever. It feels natural to us to compare the historical performance of equity index, gold and fine wine during that turbulent period and its aftermath to get insight:

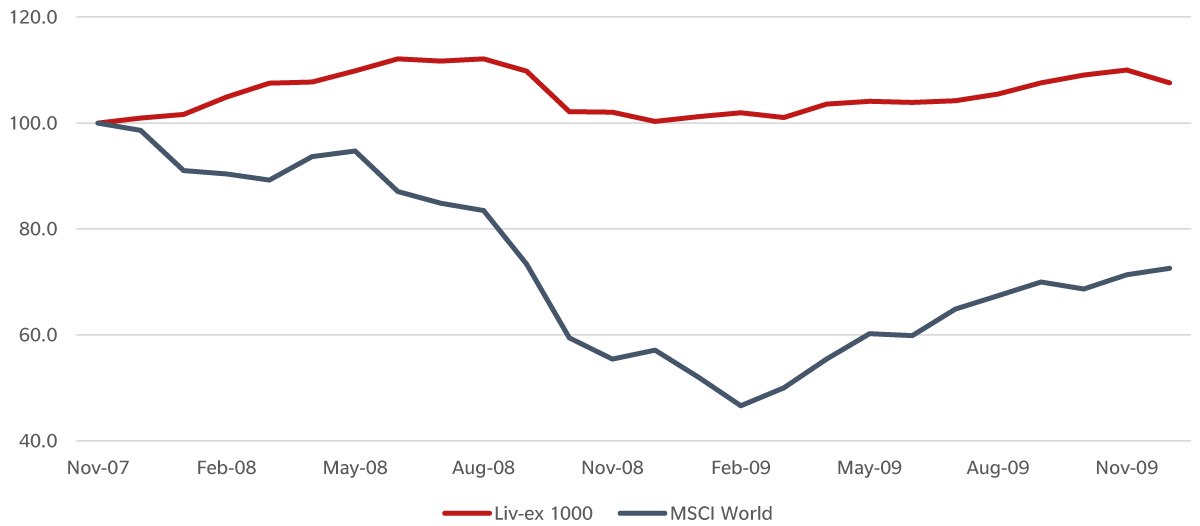

- Fine wine, with historical returns is less correlated to the traditional capital market, outperformed MSCI World index during the 2007 -2009 financial crisis period (exhibit 1)

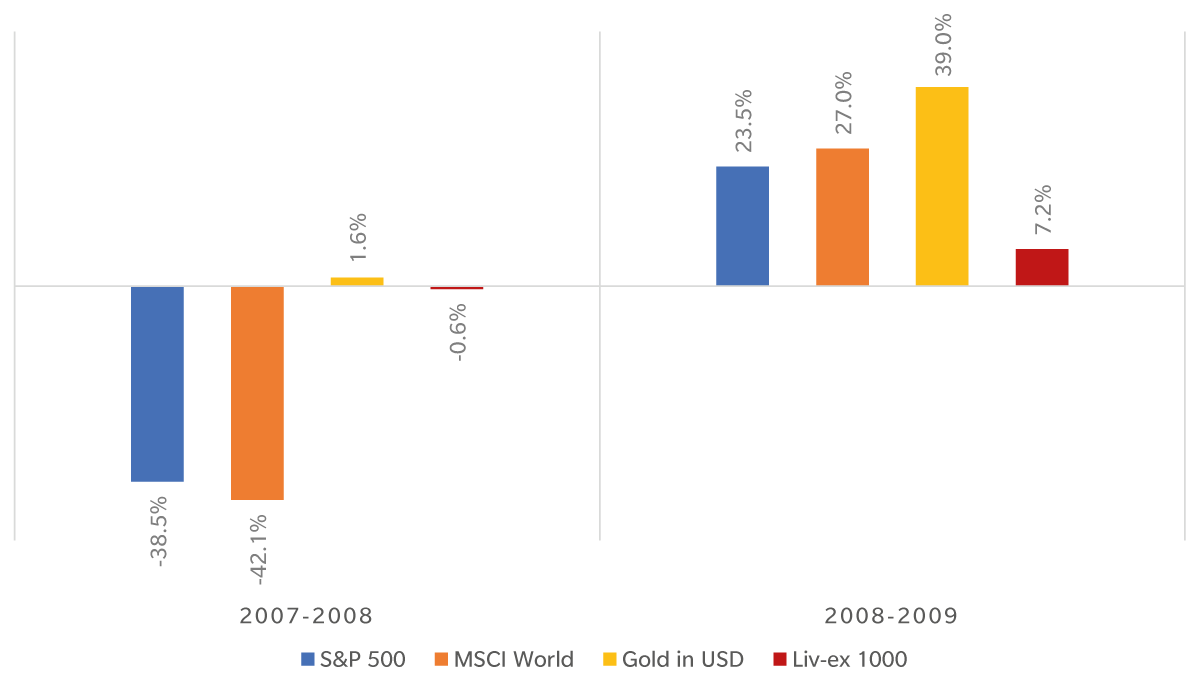

- Equity, as represented by global indices, was hit the most during the 2008 financial crisis, while Gold – often considered as a safe haven asset in uncertain time – managed to deliver positive gain of 1.6% (exhibit 2)

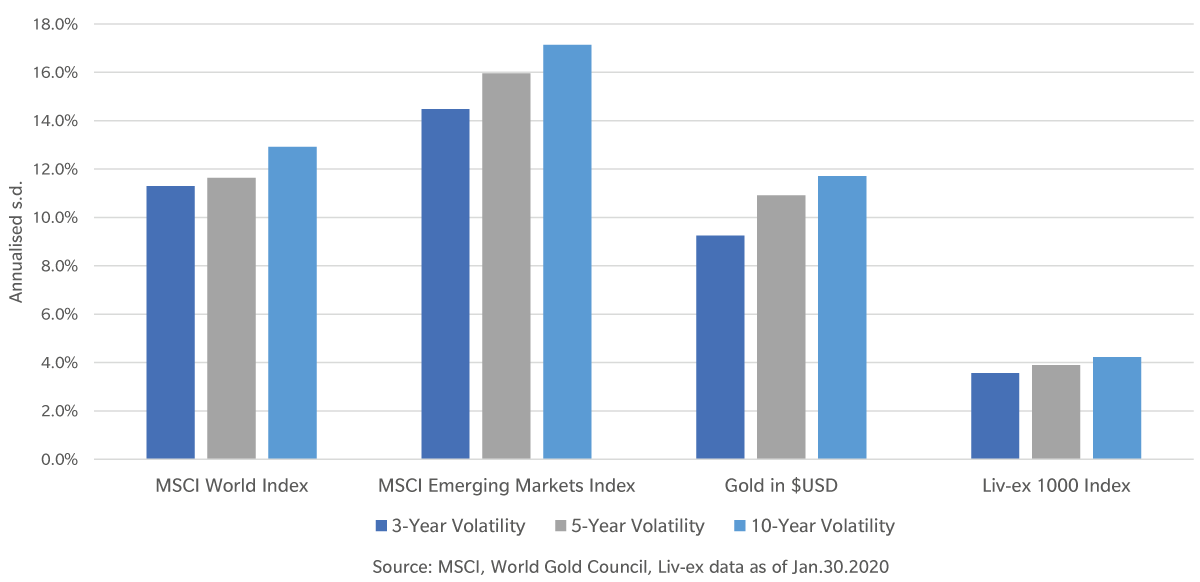

- Both Fine Wine and Gold are considered to be less risky in generating the income (exhibit 2 &3)

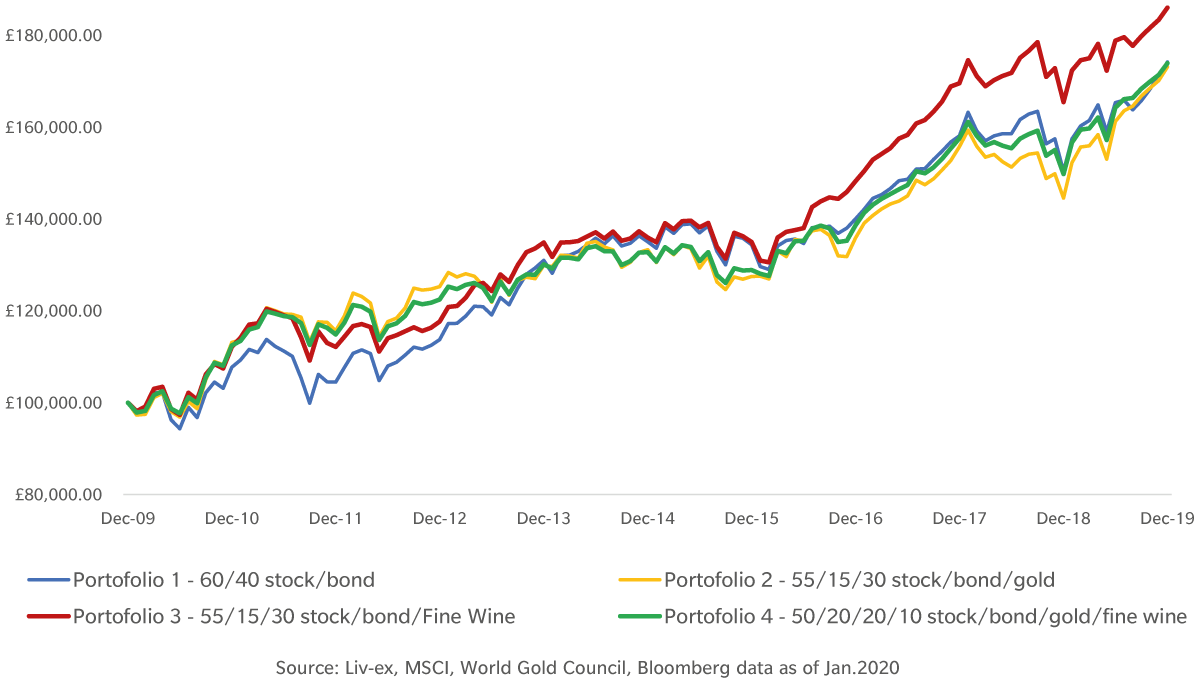

- Over the long-term, the inclusion of fine wine reduces risk and provide diversification benefits to portfolio. In addition, allocation to fine wine increases a portfolio’s long-term risk-adjusted returns (exhibit 4)

Exhibit 1: Fine Wine Vs. Equity During 2008 Financial Crisis

Exhibit 2: Various Asset Classes Performance During 2008 Financial Crisis

Exhibit 3: Fine Wine Market Shows Lower Volatility Compared To Equities and Gold (2009-2020)

Exhibit 4: Hypothetical Returns of £100,000 invested in 4 diversified portfolio Dec.2009 - Dec.2019

Based on the above, we are confident that Fine Wine will provide investors both shelter from extreme short-term volatility and long-term capital appreciation.