Fine wine’s investment credentials: Source of stability

Here at Cult Wine Investment, we believe fine wine forms an attractive long-term alternative asset that can play an important role in a diverse investment portfolio alongside other assets. The main potential benefits of a fine wine allocation include:

- Strong returns

- Relative stability through different market environments

- Lower correlation with equity and other mainstream assets

The first part of our series on these potential benefits discussed fine wine’s return potential. Here, we address how fine wine’s stability during different market environments can reduce the volatility of an investment portfolio.

Source of stability

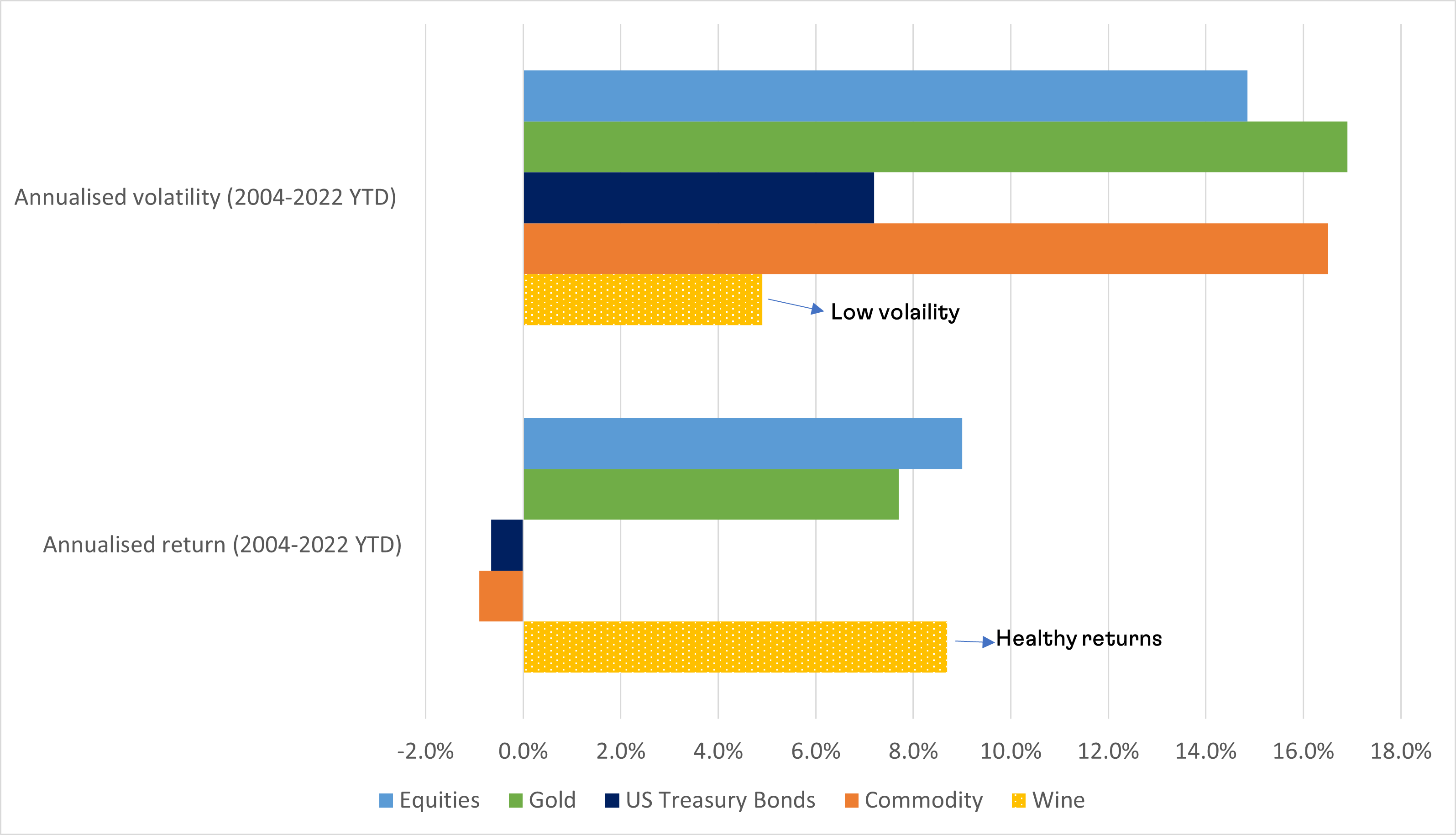

Fine wine investments have a track record of stability compared to several other assets, meaning an allocation to this real asset can help dampen the volatility of an overall investment portfolio. The chart below shows that the volatility of the Liv-ex 1000 fine wine index (since inception in Jan 2004) has been lower than some other mainstream financial assets, even though annualised returns have been similar or even higher.

Figure 1 – Strong returns alongside low volatility

Annualized volatility and returns of fine wine vs other assets (Jan 2004 – Oct 2022)

Source: Pricing data from Liv-ex and investing.com as of 31 Oct 2022. Volatility = annualised standard deviation of monthly returns. Wine = Liv-ex 1000, Commodity = Bloomberg Commodity Index, US Treasury Bonds = iShares 7-10yr, Gold = USD/oz, Equities = S&P500 TR. Past performance is not a guarantee of future results.

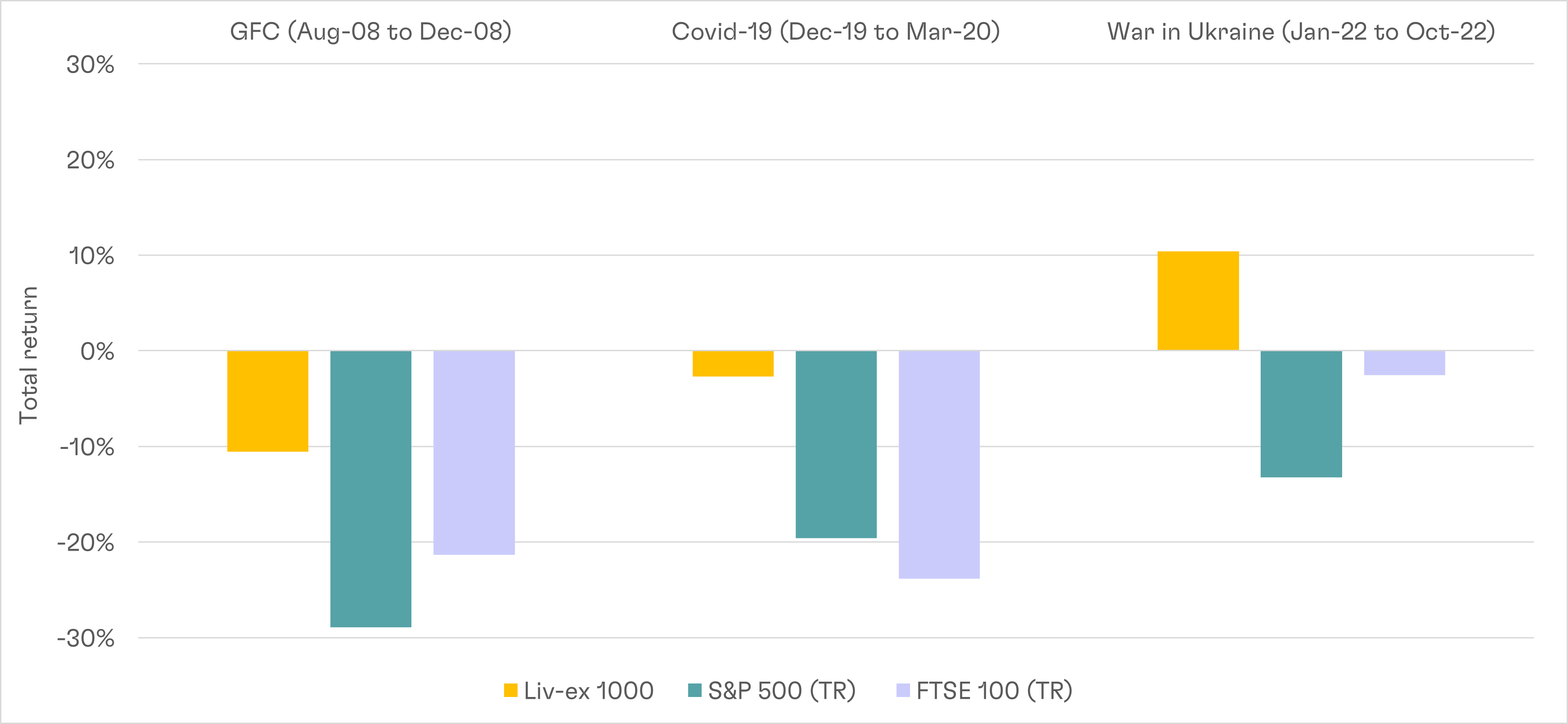

A large part of this long-term stability stems from fine wine’s ability to remain a store of value during macroeconomic downturns. We’ve seen this during the 2022 inflation-driven volatility, but fine wine also remained relatively stable during the initial COVID-19 outbreak and the 2008 global financial crisis. The below chart shows fine wine, as measured by the Liv-ex 1000, at its respective lowest point in each of the historic downturns as well as the year-to-date total in 2022.

Figure 2 – Fine wine’s downside protection

Fine wine vs equity returns during peak of recent downturns

Source: Pricing data from Liv-ex and investing.com as of 31 Oct 2022. Past performance is not a guarantee of future results.

This does not mean fine wine will always remain immune to downturns, but the three main factors that contribute to fine wine’s stability are:

- Real asset - Similar to other rare collectibles, fine wine benefits from scarcity and value as a passion asset, which helps support demand during different market environments. This is especially important during periods of inflation – as a consumer product, wine prices tend to see upward price pressure.

- Lower liquidity – Fine wine holdings are not typically sold off to the same degree as traditional assets when there is a shift in the macroeconomic outlook.

- Not leveraged – The fine wine market does not use leverage. Therefore, investors are not forced to sell holdings to meet margin calls, limiting the degree of panic selling and removing a need to sell into a down market.

These characteristics do not mean fine wine will always remain immune to downturns, but when held as part of a diverse portfolio of mainstream and alternative assets, fine wine can reduce volatility over the long term.

Past performance is not indicative of future success. All returns were calculated in GBP and may vary depending on exchange rates. Any investment involves risk of partial or full loss of capital. The Cult Wine Investment Index is a hypothetical tool. The results depicted here are not based on actual trading and do not account for the Cult Wine Investment annual management fees. There is no guarantee of similar performance with an investor’s particular portfolio.

Related Articles