August 2023 Flash Report - Resilience of the wine market

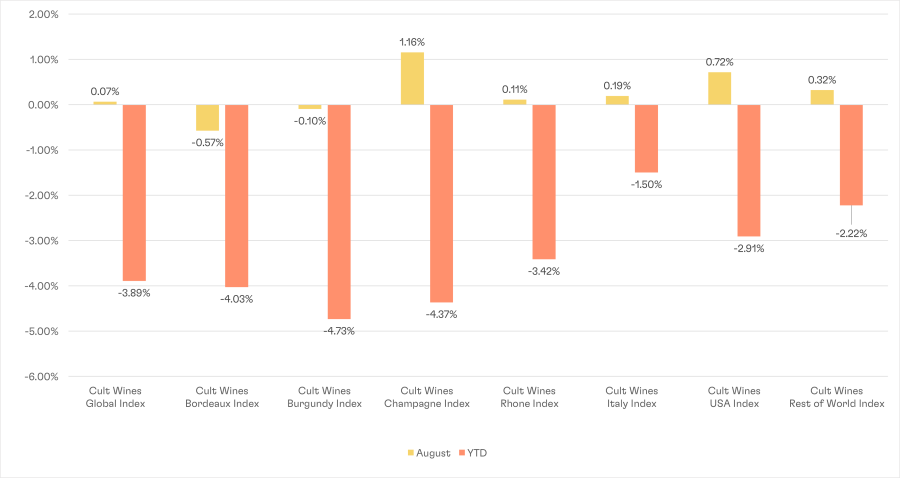

Cult Wines Indices – Returns as of 31 August 2023

Source: Pricing data as of 31 August 2023. Cult Wines Indices are an objective measure of the global fine wine market based on Wine-Searcher pricing data and rebalanced annually based on strict liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

The market showed signs of stabilisation in August after a few months of adjustments to the downside: the Cult Wines Global Index finished August on a flat note (+0.07%) with most sub-indices slightly up on the previous month.

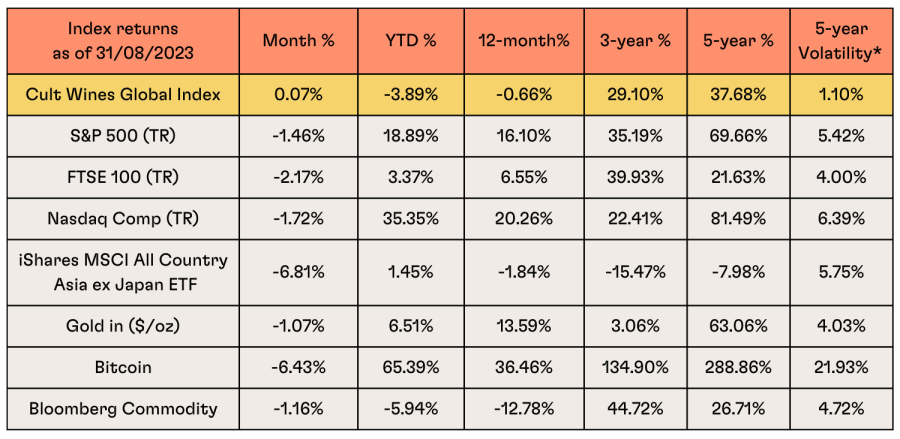

Macro market summary

Source: Investing.com, Wine-Searcher as of 31 August 2023. Past performance is not indicative of future returns.

*Volatility = Rolling 5-year standard deviation of monthly returns

Fixed income recorded negative returns in August, with the Bloomberg Global Aggregate Bond index losing 1.4% in August as sovereign yields rose, making it difficult for diversified investors to compensate for equity losses. The 10-year US Treasury yield rose to 4.2%.

Global stocks sold off, with S&P 500 losing 1.8% and the tech-heavy Nasdaq Composite dropped 1.2% in August as rising bond yields weighed on stocks.

Global oil prices remained relatively flat over the month, as growth risks in China offset the broader impact of production cuts. European gas prices increased on growing prospect of Australian LNG strike.

Chinese stocks were led lower by a weaker property sector, with the CSI 300 Real Estate index dropping 5.3% in the month. Other factors such as falling exports and geopolitics continue to weigh on the economy and consumer sentiment.

The UK economy surprised to the upside in the second quarter of 2023, rising by 0.2% versus a consensus expectation of flat growth. On inflation, UK headline CPI fell in line with expectations, down from 7.9% in June to 6.8% in July.

Regional wine performance detail

- The Cult Wines Bordeaux index experienced a modest drop of 0.57%. As explained earlier in Q2, the slow market likely stemmed in part from buyers pausing before the 2022 EP release. The two biggest declines came from Clerc Milon 2011 & L'Eglise-Clinet 2019. On the positive side, Palmer 2013 rose by 24% and Calon Segur 2020 climbed by 15% year-to-date. Both were always greatly anticipated wines during EP22. Elsewhere within Bordeaux, multiple vintages of Climens (2010, 2014 & 2007) are up on prices, averaging at 40% return YTD.

- The Cult Wine Italy index posted a positive return of 0.2%, reversing some of its year-to-date losses. Massolino, Barolo, Vignarionda Riserva 2012 & Casanova di Neri, Brunello di Montalcino 2008 were among the best performing wines of the region, gaining 40% and 31% year-to-date respectively.

- Burgundy saw a quiet month, with Cult Wines Burgundy Index remaining unchanged in August. Despite the muted performance, both Dugat-Py, Gevrey-Chambertin Premier Cru, Champeaux 2018 & Perrot-Minot, Chambertin Grand Cru, Vieilles Vignes 2018 managed to achieve noticeable returns of 15% over the month.

- The Cult Wines Champagne index is up 1.2%, reversing some of the decline seen so far this year led by Philipponnat, Clos des Goisses 2012 & Perrier Jouet, Belle Epoque Rose 2013. Within the grower champagne category, Egly-Ouriet is the name to watch, with multiple vintages of its Grand Cru Brut Millesime performing well over H1 2023.

- Both USA and Rest of World have been more active on the secondary market, with Cult Wine USA index and Cult Wines Rest of World index adding 0.72% and 0.32% respectively in August. Multiple vintages of Stag's Leap Wine Cellars (Fay in 2013 & S.L.V. in 2016 & 2018) from US have jumped in price on the month, according to Wine-Searcher pricing data.

Wine performance league table - YTD return % across vintages

Source: Pricing data from Wine-Searcher as of 31 Aug 2023. Based on average across all vintages of wines contained in Cult Wines Indices, which are rebalanced regularly based on strict, objective liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

- By region, Champagne was the clear winner over Q3, with Egly-Ouriet from the grower category topping the leader board in August, led by its 05’ & 07’ (Grand Cru Brut Millesime).

- Stag's Leap Wine Cellars, S.L.V. from US rose to the second position, with the 16’ & 18’ rising strongly in price YTD.

- Both Joh. Jos. Prum, one of the finest producers in Germany & Penfolds from South Australia made it to the list in August, adding 30% & 28% respectively in a year.

- Within Burgundy, Trapet Pere et Fils, Latricieres-Chambertin Grand Cru continued its rapid ascent, making it another new entrant to the league table.

- The previous leader, Artadi, Pagos Viejos from Rioja rose in price but at a slower pace and, hence, fell to 4th.

- The Loire Valley AOC Sancerre appeared in the standings in the form of Domaine Francis Cotat’s Les Monts Damnes’s complex, well-structured Sauvignon Blanc.

Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014. The Indices are separate from Cult Wine Investment Performance which tracks wines purchased by Cult Wine Investment.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.