Monthly Market Review: Navigating the Nuances - November 2023

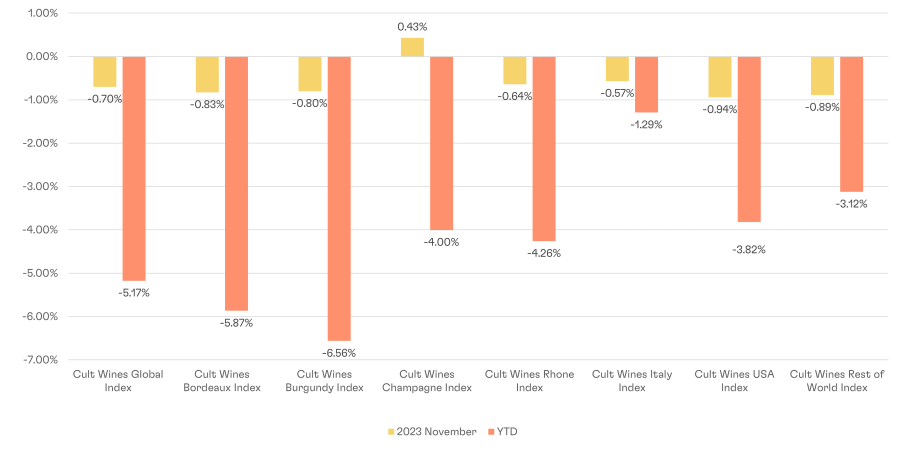

Cult Wines Indices – Returns as of 30 November 2023

Source: Pricing data as of 30 Nov 2023. Cult Wines Indices are an objective measure of the global fine wine market based on Wine-Searcher pricing data and rebalanced annually based on strict liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

Overall, the fine wine market saw a slight dip of 0.7%, as measured by the Cult Wines Global Index, reflecting nuanced trends and highlighting the need for strategic investment considerations.

Champagne stood out with a positive gain of 0.4%, offering resilience amidst varied market performances.

There are still adjustments taking place in the two biggest regions, Bordeaux and Burgundy, following the sustained rally in prices from mid-2020 to the end of 2022.

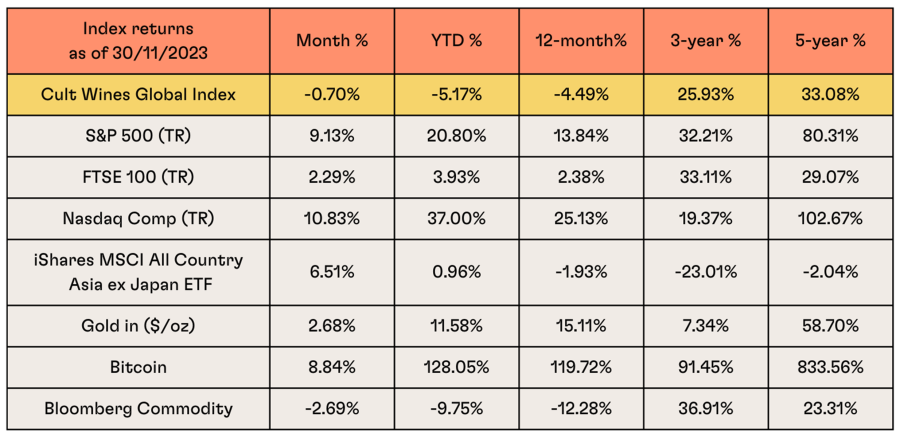

Macro market summary – Economic growth outlook improving

Source: Investing.com, Wine-Searcher as of 30th Nov. 2023. Past performance is not indicative of future returns.

Markets closed November positively, driven by signs of economic moderation in the US and decreasing inflation across developed markets.

The US Consumer Price Index (CPI) for October, cooler than expected, raised hopes of inflation touching 2% before the end of 2024.

Major stock indexes, notably the US S&P 500, posted gains, with a 9.1% increase in November. Growth stocks, especially in the technology sector, outperformed their value counterparts globally.

Government bond yields, including the US 10-year Treasury yield, decreased, reflecting a potential easing of monetary policy.

Commodity prices, such as Brent crude oil, contracted from October peaks due to increased US supply and OPEC+ members' failure to adhere to production quotas.

China's macro data was positive, with retail sales up, but challenges in the housing market persisted, prompting potential fiscal stimulus. The meeting between Chinese and US presidents hinted at reduced tensions with positive implications for global markets.

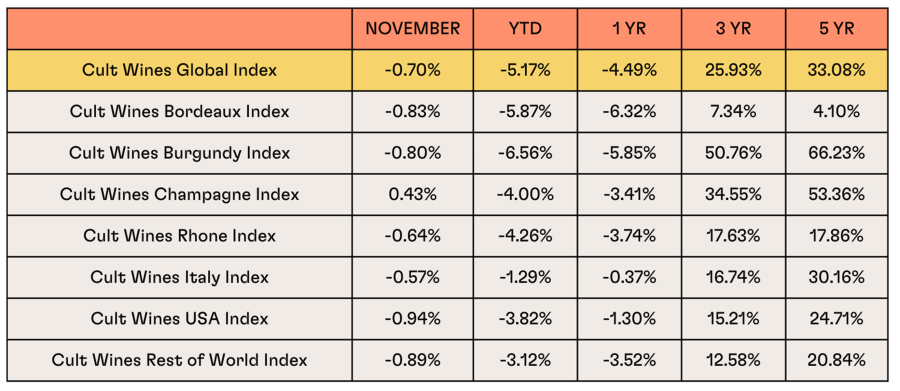

Regional Wine Market Performance

- November witnessed varied performance across regions in the fine wine market. CW Bordeaux index and CW Burgundy index both experienced a marginal decline of 0.8%, reflecting a balanced market sentiment. Despite an overall decline in the Bordeaux region, specific wines demonstrated notable positive performances, contributing to a nuanced market scenario. Calon Segur showcased robust performance, with both the 2010 & 2015 vintages gaining 10% YTD, while negative returns were mainly concentrated on the 2019 & 2017 vintages among iconic Bordeaux producers.

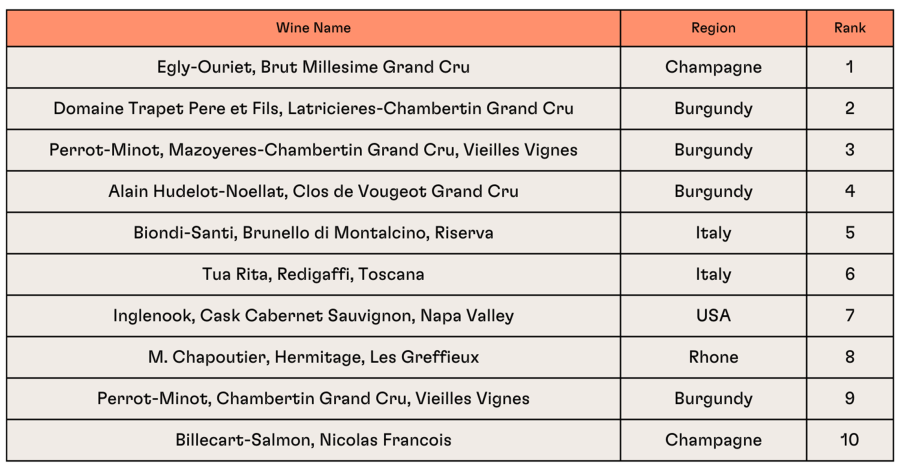

- Moving to Burgundy, the standout performance of Domaine Trapet Pere et Fils' Latricieres-Chambertin Grand Cru is noteworthy, with an increase of approximately 15% year-to-date across its recent five vintages, highlighting the enduring appeal and market recognition of Domaine Trapet.

- Champagne, on the other hand, emerged as a positive outlier with a modest gain of 0.4%, contributing to its resilience. Egly-Ouriet, Brut Millesime Grand Cru with both 2006 & 2007 vintages experienced an impressive 20% increase YTD, reflecting the enduring desirability of its Grand Cru offerings. Philipponnat, Clos des Goisses 2012 exhibited robust growth, boasting a 17% increase YTD.

- The Rhone region & Italy faced slight setbacks, with CW Rhone index and CW Italy index recording decreases of 0.64% and 0.57%, respectively. Notable top performers from Rhone included the M. Chapoutier, Hermitage, Les Greffieux 2014, showing an impressive increase of 19%, and the Auguste Clape, Cornas, Renaissance 2014, surging by 20% YTD. On the other hand, the Domaine Jean Louis Chave, Hermitage experienced a decline of 11.2% year-to-date, indicating challenges for this specific label.

- CW USA index witnessed a decline of 0.94% in November. Among the winners, Opus One demonstrated strong performance across multiple vintages (e.g., 2007, 2008 & 2011), registering positive gains throughout the year 2023. The returns across these vintages showcased the consistent appeal and market demand for Opus One wines. Similar to Opus One, Cardinale exhibited positive gains across its recent vintages, reflecting the enduring popularity of this producer in the market. Unfortunately, Quintessa, Rutherford 2018 & Verite Desir 2017 faced challenges, experiencing a notable decline of over 20% year-to-date.

- Investors navigated through nuanced trends, with Champagne providing a bright spot amidst broader market adjustments. The marginal downturn in Bordeaux and Burgundy suggests a stabilization in these prominent regions. Attention remains crucial as global factors impact fine wine values. As we conclude November, monitoring regional dynamics and considering diverse investment strategies will be pivotal for navigating the evolving fine wine landscape.

Wine Performance League Table – YTD Return % Across Vintages

Source: Source: Pricing data from Wine-Searcher as of 30 Nov. 2023. Based on average across all vintages of wines contained in Cult Wines Indices, which are rebalanced regularly based on strict, objective liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014. The Indices are separate from Cult Wine Investment Performance which tracks wines purchased by Cult Wine Investment.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.