Don’t Try to Time the Markets, Follow the Tea Leaves

The best advice for investors often involves avoiding attempts to time the market. When things are going well, it’s easy to become overly confident, just as it's easy to become overly pessimistic during downturns. The inherently volatile nature of markets tends to favour a long-term perspective.

In practice, this is sound advice, but it's quite another matter when facing a market sell-off and an uncertain future outlook. The prosperous days of years past suddenly seem like distant memories.

Sometimes, you can’t help but wonder about the future direction of the market. It might not be about timing the market for financial gain, but rather seeking reassurance that better times are ahead.

Since the end of 2022, the wine market has experienced a significant downturn, leaving stakeholders analysing trends and indicators for signs of stabilization.

As we leave the challenging year 2023 behind and look forward to 2024, we seek objective, quantitative data to understand future market directions.

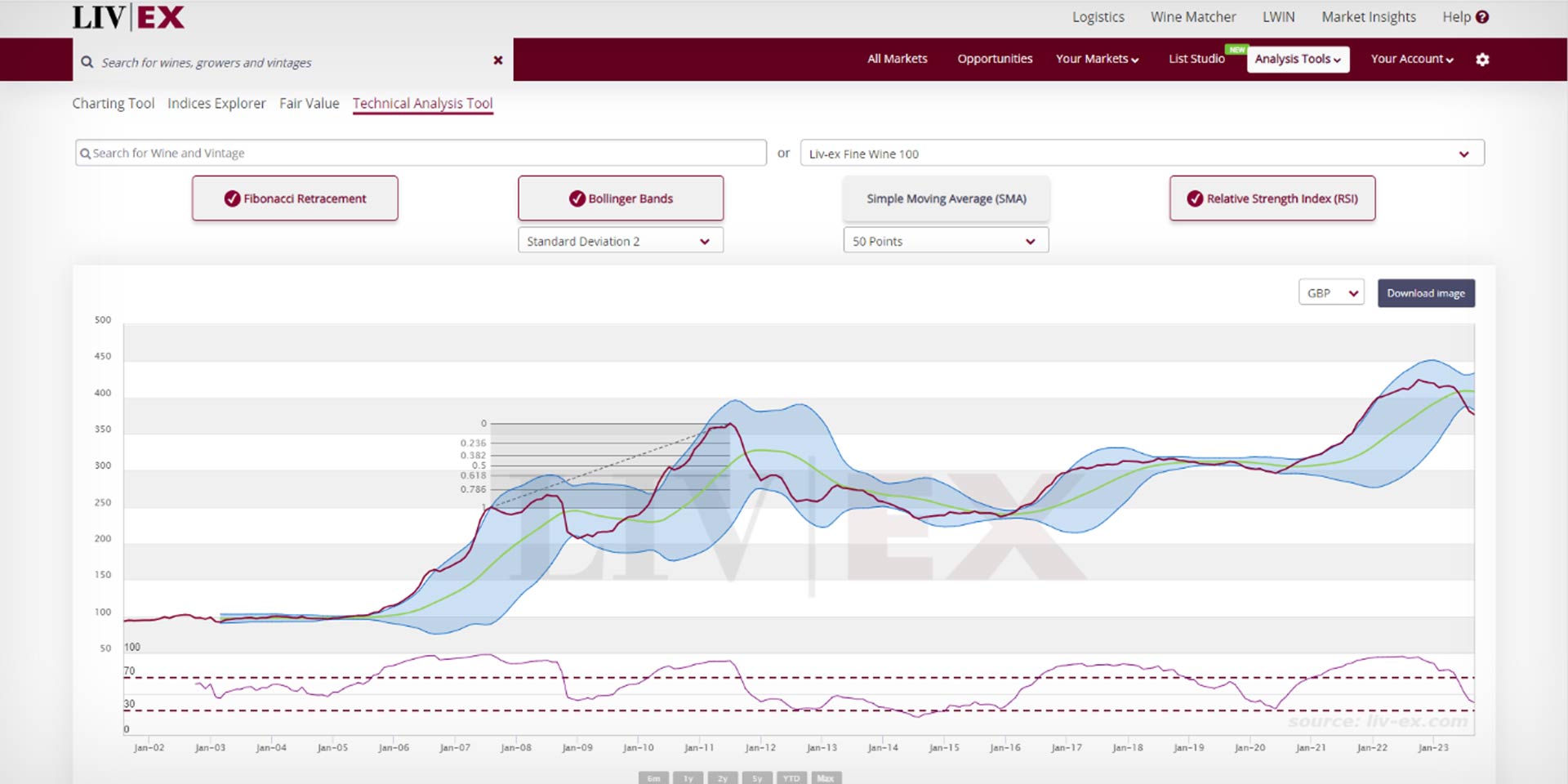

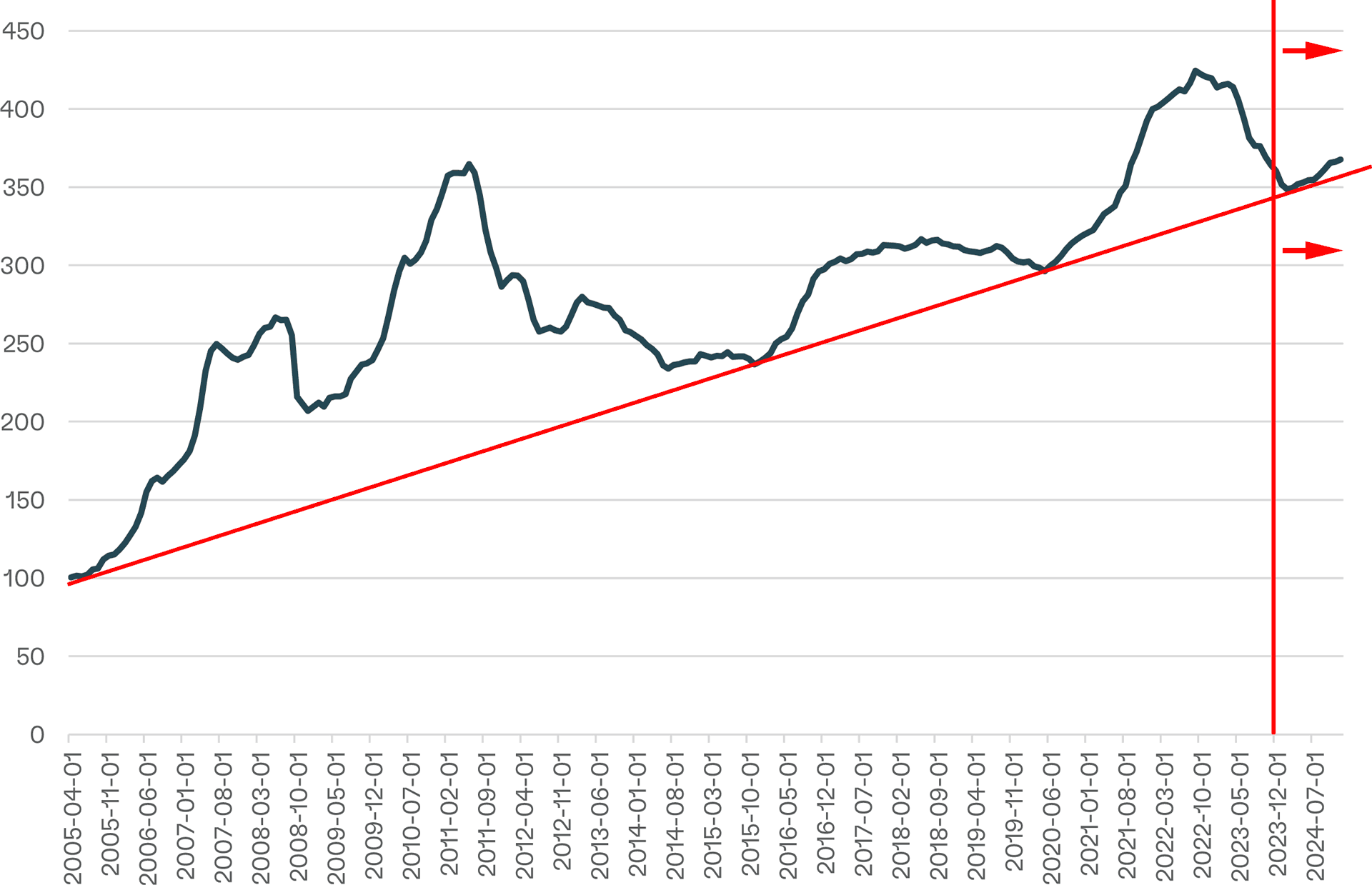

Liv-ex’s recent technical analysis, though inconclusive, offers insights into whether the market has reached its bottom. See graph below and visit their blog for more details.

This article will be our attempt to add insight and analysis to the topic, by evaluating the price movements in the market and distilling this into a viewpoint for 2024.

Interest Rates and Money Supply

This period is unique due to the correlation between the wine market’s performance and drastic changes in the global money supply.

This is the first of the four major sell-offs since the turn of the century that has been so closely tied to global monetary policy. The pandemic’s impact, combined with supply chain constraints, led to high inflation, significantly influencing consumer spending.

As demonstrated in the accompanying graph, the wine market's performance was already waning by the end of 2019, showing increased downward pressure on pricing as we entered 2020. Despite the pandemic’s impact on global hospitality and travel, the market experienced a two-year bull run from May 2020 to June 2022.

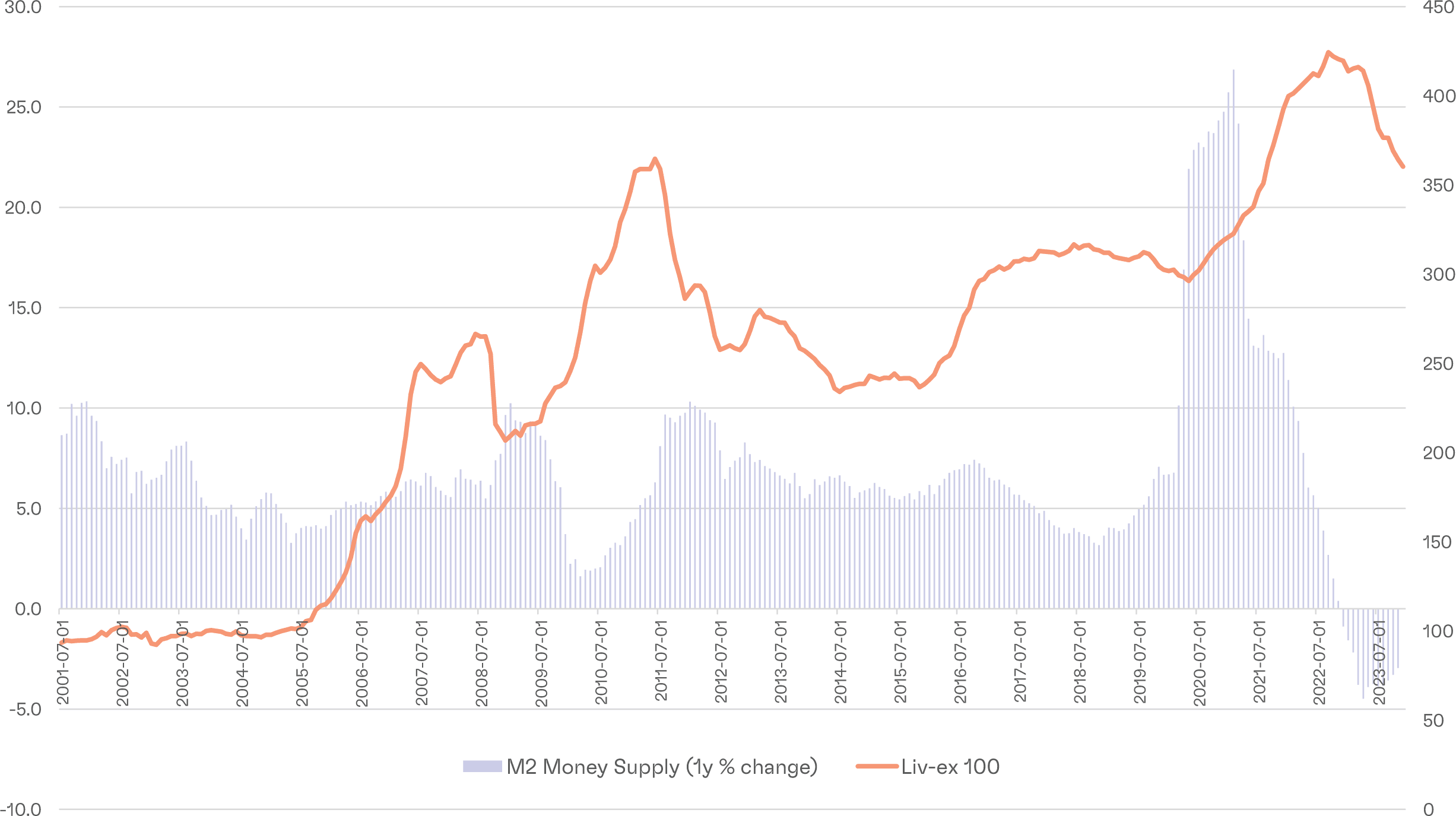

Global Money Supply (1Y % Change) vs Liv-ex 100

The relationship between the global money supply (M2) and the wine market reveals a clear correlation. The rate of change in Money Supply (M2) peaked in April 2021, coinciding with the wine market’s rapid ascent.

Central banks responded to spiralling inflation with significant interest rate hikes, squeezing global liquidity. This shift, starting in early 2022, saw rates rise from 0% to over 5% in a 12-18 month period.

This is reflected in the blue line graph, as you can see the rapid descent through the peak until November 2022, when it turned negative, and began to shrink for the first time in 74 years.

Despite this, the wine market was actually reaching it’s peak, whilst these historic changes were happening. But why is this so?

The effects of interest rate changes and the impact on global money supply and the broader economy lag behind. Fine wine, influenced by global disposable income and wealth, felt the impact months later.

This delay was evident in 2023. The first quarter continued the momentum from 2022, with stable prices and active trading. However, from Q2 onwards, a noticeable slowdown in liquidity, buyer activity, and increased supply became apparent.

General Characteristics of Wine Market Downturns

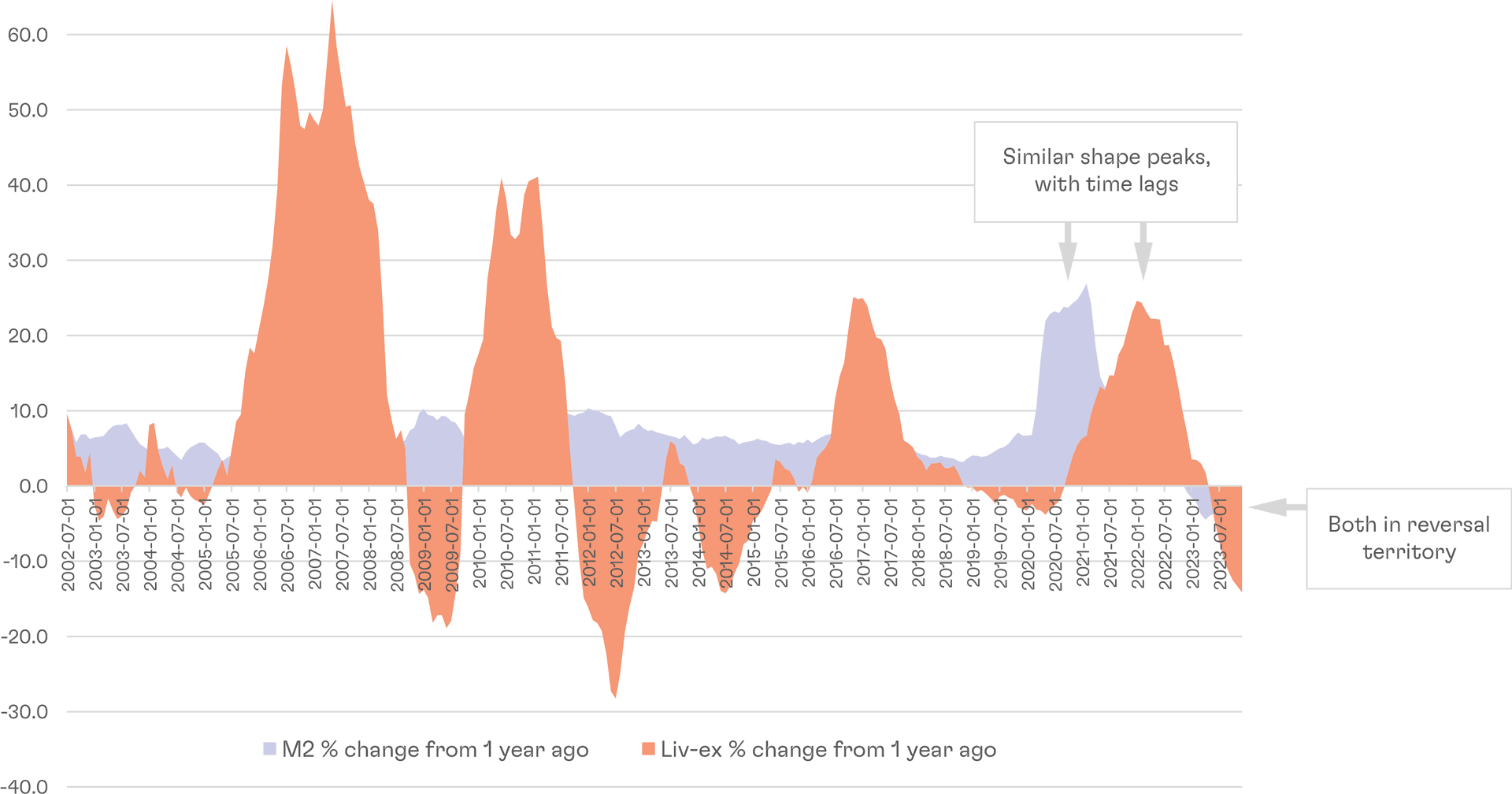

The accompanying graph shows the 1-year % change in the Liv-ex 100 alongside the 1-year % change in the M2 Global Money Supply. The first observation is the clear correlation post-2020. Secondly, the similarities in the shape and time lag between the peaks (far right) and reversals are notable.

1Y % Change Comparison

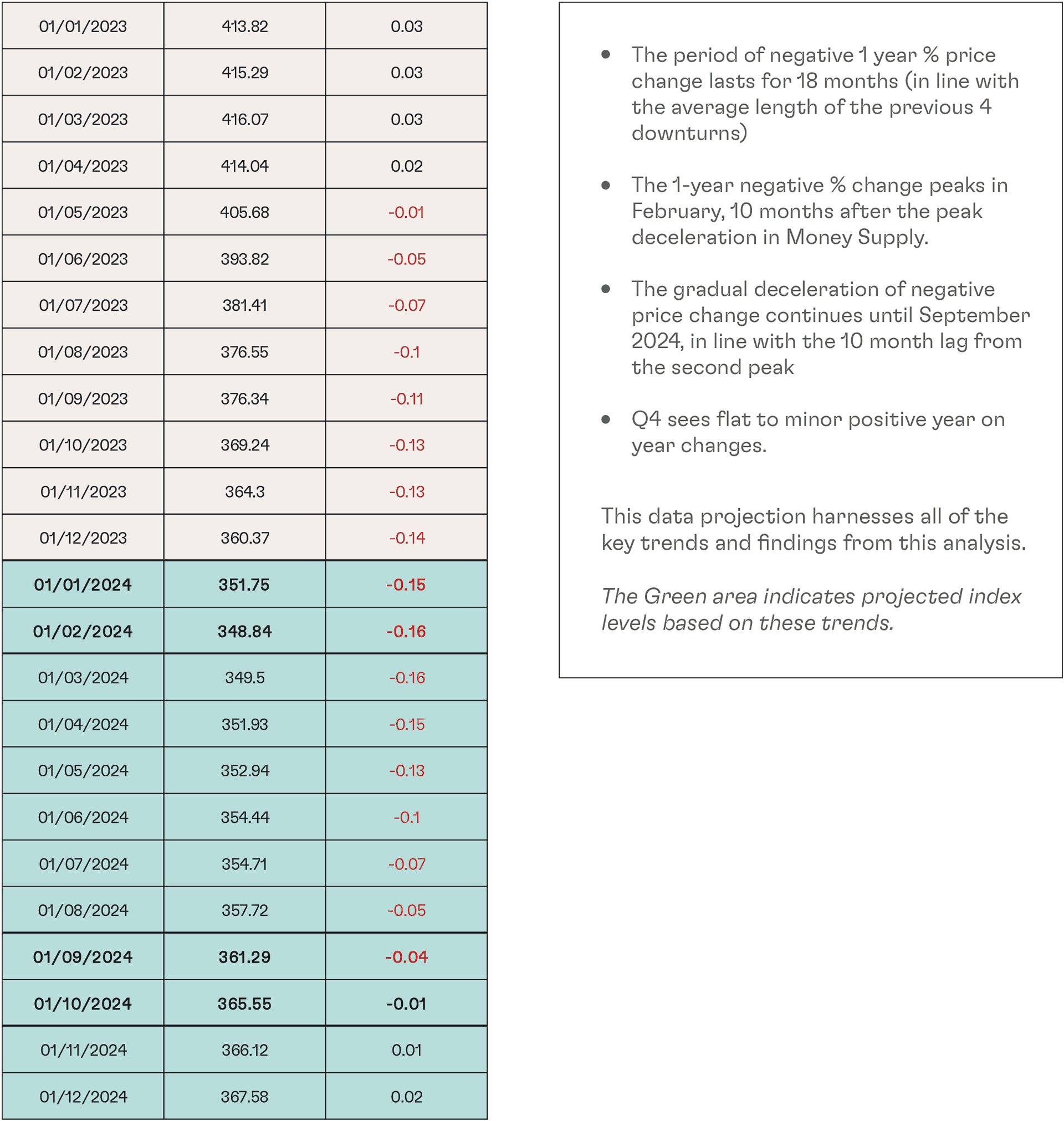

Typically, downturns in the wine market, given its long-term positive characteristics, are shorter and less severe than upturns. The average cycle of negative change has lasted between 12 to 22 months, with an average duration of 18 months. Currently, we are in month 9 of the current downturn.

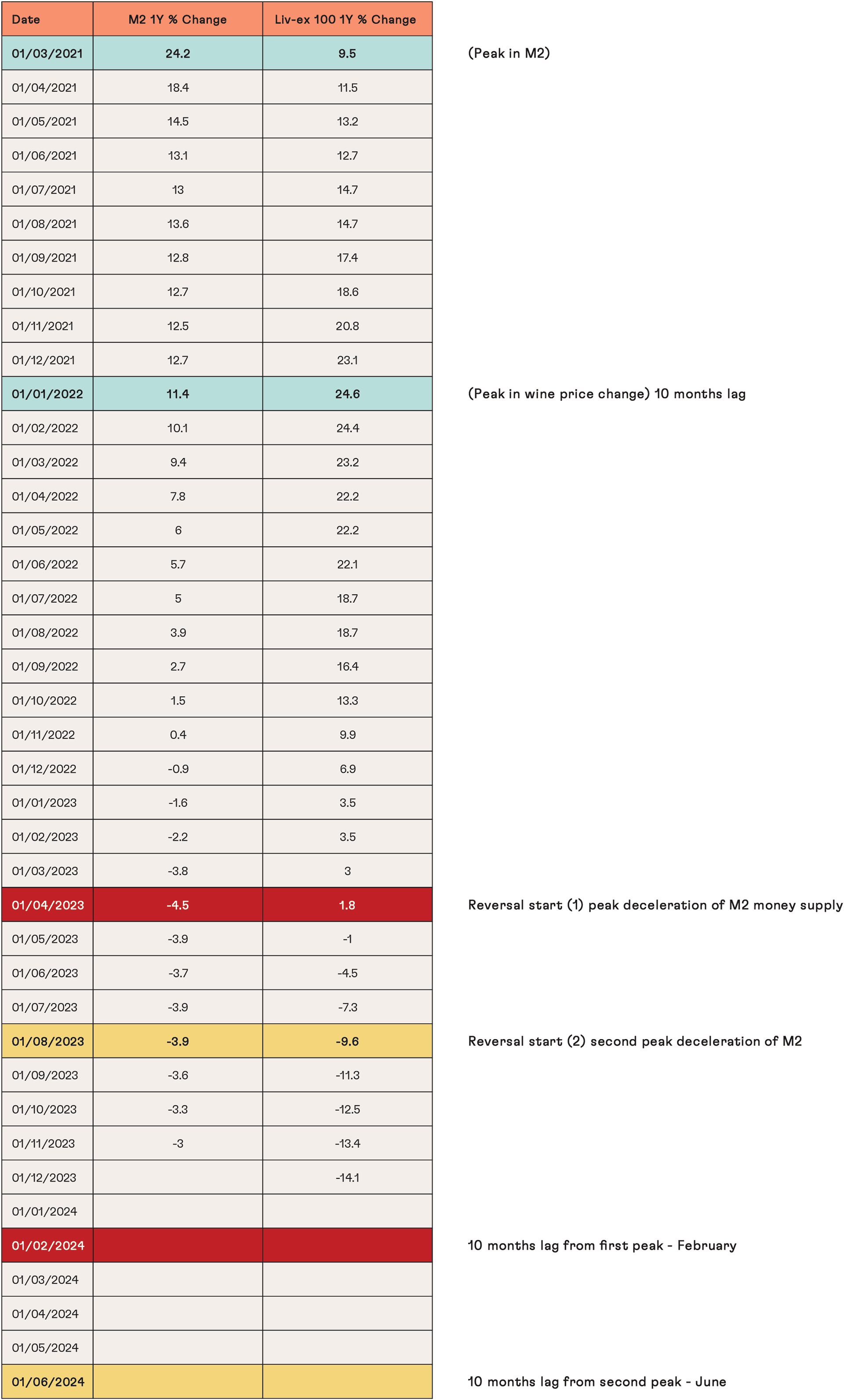

Analysing the time lag between the peak of the M2 and the peak of the wine market, as well as their respective bottoms, offers insights into future trends. The M2's rate of negative change peaked in April 2023. Assuming a similar time lag, the wine market's peak deceleration might occur around February 2024.

Combining these methodologies suggests the market may not turn positive until Q4 2024, with peak deceleration occurring between February and June this year.

As an illustration, the below table plays out those trends in 2024.

Summary

Given the wine market’s strong correlation with global money supply and monetary policy since 2020, we are likely close to peak deflation in the wine market. The market downturn should gradually slow down over the next 6-9 months.

Historic trends suggest that downturns are shorter and less severe than upturns. As we are 9 months into this downturn, another 9 months might pass before the market starts to turn positive.

Our forecasts, aligning with the long-term support lines of the Liv-ex 100, suggest a 3-6 month period of deceleration and price stabilization, followed by gradual improvements by the end of 2024.

Potential forecast for the Liv-ex 100 in 2024

Market Sentiment Analysis: A Glimpse into Buyer and Seller Perspectives in the Fine Wine Market

As we navigate through the early stages of 2024, the fine wine market exhibits a blend of cautious optimism and strategic manoeuvring among buyers and sellers. Here’s an overview of the current sentiment:

- Cautious Optimism Among Buyers and Investors: There is a noticeable shift in mood among buyers and investors. While still treading carefully, many are showing a budding sense of optimism about the future of the wine market. This change in attitude, though not yet fully reflected in market activity, suggests that stakeholders are beginning to see light at the end of the tunnel.

- Seller Strategies Amid Liquidity Squeezes: Some sellers continue to face challenges due to liquidity constraints. In an effort to attract buyers, they are offering wines at discounted prices. This scenario underscores the ongoing need for strategic pricing and market positioning to stimulate buyer interest.

- Chinese New Year as a Demand Indicator: Traditionally, the Chinese New Year serves as a significant benchmark for gauging demand in Asia. The tail-off in demand witnessed in 2023 seems to be correcting somewhat. January 2024 saw buying levels surpass those in 2023, signalling a return to more normal conditions. However, the keen pricing levels observed indicate that it is still very much a buyer's market.

- The Burgundy 2022 Vintage – A Potential Market Catalyst: The release of the high-quality Burgundy 2022 vintage, marked by high volumes and positive critic reviews, presents an opportunity to invigorate the market. With prices seemingly stable and no substantial increases, this vintage could act as a catalyst for increased market activity, drawing both seasoned collectors and new buyers.

- Opportunities for Astute Investors with ‘Dry Powder’: Investors holding liquid assets are strategically positioned to capitalize on price dislocations and distressed sellers. While the market's distress seems less acute than in Q4 of the previous year, attractive investment opportunities remain available.

- The Upcoming Bordeaux En Primeur and Market Recovery: The Bordeaux En Primeur for the 2023 vintage, set for release in May and June, is poised to play a crucial role in the market's recovery. Its success hinges on attractive pricing; another lacklustre campaign could dampen the market's nascent recovery and impede momentum.

In summary, the current market sentiment is cautiously optimistic, with a keen eye on strategic opportunities and upcoming releases. The ability of sellers to attract buyers through competitive pricing, coupled with the potential impact of new vintages and market campaigns, will be pivotal in shaping the fine wine market's trajectory in 2024.

Related Articles