Bordeaux En Primeur 2023 Vintage: A Huge Opportunity?

The Bordeaux 2023 vintage looks set to be the best opportunity to purchase En Primeur since the 2019 vintage (released 4 years ago). As our team embarks on our 14th successive En Primeur trip, we have been reliably informed that prices could be reduced by approximately 30%.

Unlike previous En Primeur releases, we are expecting an early and quick campaign with many of the top wines releasing their prices in a few weeks’ time, starting with Pontet Canet* and Leoville Las Cases on the 30th of April.

Wines to be released in early May: Lafite Rothschild, Carruades de Lafite, Mouton Rothschild, Petit Mouton, Cheval Blanc, Leoville Barton, Haut Brion, and La Mission Haut Brion.

*History repeating itself? It was Pontet Canet who were first out of the blocks in 2019, at a 30% discount to their 2018, setting the precedent for what was to come. The 2019 vintage increased by over 50% before it was bottled in Spring 2022!

Photo credit: Chateau Pontet Canet

Pricing analysis

Critic scores are yet to be released for the wines, so ahead of this, we have undertaken an initial analysis focusing on the price only.

At approximately 30% discount to the 2022 release, there are up to 70 wines that meet our strict selection criteria, on a price only basis.

Our approach is to carefully pick the wine we think have the best potential for medium to long-term appreciation based on statistical analysis, market knowledge and internal research.

We have established a list of the Best Buys for Bordeaux 2023 using a scoring system to rank the wines (best score is 9) based on the following criteria:

- Applying a 30% discount to the 2022 release price

- Comparing this to the lowest-priced vintage from 1996 to 2022

- The average price of all vintages from 1996 to 2022

- And comparing the projected 23 price to the current price of similar rated vintages (2008, 2011, 2012, 2014, 2017, 2019, 2021)

In addition to the above guidelines, we factor in liquidity, so the wine needs to have had 75 LX trades over the last 12 months.

Download the full Best Buys for Bordeaux 2023 wine list and analytics

The full list, including criteria price data, analytics and ranking is available to download as an Excel XLSX file and static PDF file.

*Price data and performance correct as of 19th April 2024

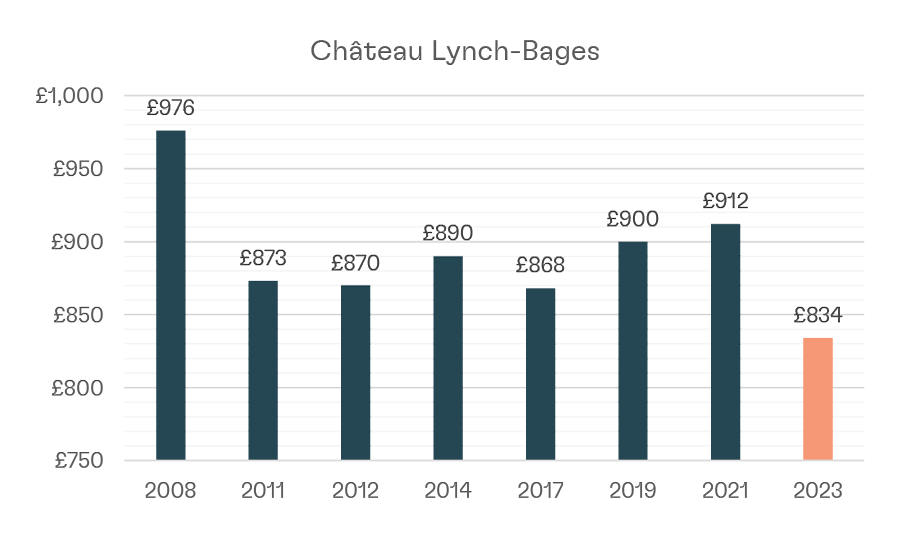

Example: Lynch Bages

If we apply a 30% discount to the release price of the 2022 vintage, factoring for the GBP/EUR exchange variance, then we would estimate that the 2023 would be released at £835 per 12.

At this price level, it would be cheaper than any other vintage of Lynch Bages on the market. The next cheapest is the 2017 at £868 per 12.

In this scenario, we score Lynch 9 out of 9, as the projected release price beats all over comparisons. With 973 trades across all vintages in the past year, it’s also one of the most liquid wines in the market. Making it look even more attractive at this price level.

There are likely to be good opportunities outside of this evaluation methodology and if release prices aren’t at the required levels, then we’ll seek the right investment choices for our clients in back vintages. As we’ve reported over the last few months, Bordeaux First Growth and other top labels offer outstanding value since the market has drifted. These shouldn't be overlooked!

What do we know about the quality of 2023s?

In terms of quality, our expectation is that there will be some excellent wines with high scores despite the challenging growing season. The CIVB has rated 2023 as a ‘good vintage’. As always, we’re reserving judgement until we taste the wines this week. Here are some soundbites from critics and producers:

‘In many ways I like them better than many of the highly touted 2022s because they are so Bordeaux in their nature’

James Suckling

‘I would compare these 2023s to 2019 or 2001 – even 1990 – for their freshness and balance of ripe fruit’

Jane Anson

‘2023 is fresh and subtle, much more Cheval Blanc’

Pierre-Olivier Clouet, Managing Director of Cheval Blanc

‘It gives a lot of surprises. 2022 is more a ‘bon bon bon.’ It’s really fruity. 2023 has much more complexity. But it is really a question of taste. 2022 is great but I like 2023 more’

Noemie Durantou Reilhac, the head of Chateau L’Eglise Clinet

What have we heard about the price?

‘If you don’t (drop price) you can’t sell. It could be 20 percent or more, but it depends on the name of the chateau’, Hubert de Bouard of Angelus

The recent Latour 2017 release at a 24% discount is usually a good barometer for the mood in Bordeaux ahead of En Primeur.

Bordeaux 2023: Could be just what Bordeaux needs!

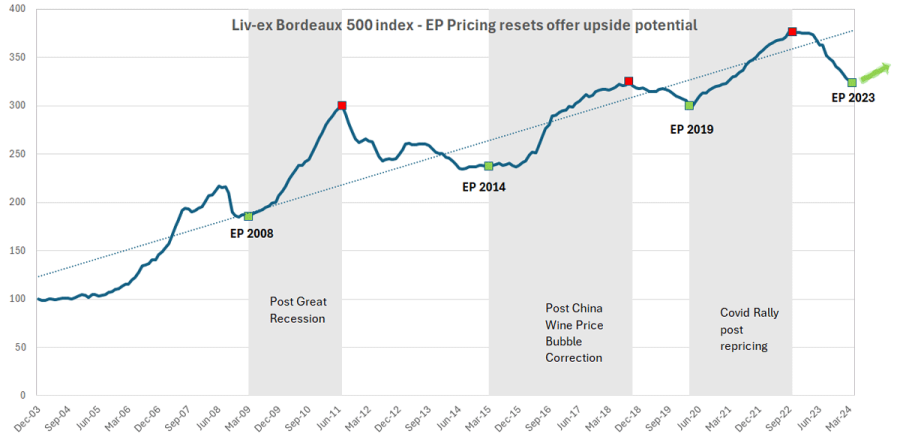

The 2008, 2014 and 2019 En Primeur were released at very attractive prices relative to their respective prior vintages. Like 2023, they were good vintages but not perceived as exceptional. All three campaigns triggered a significant rally in Bordeaux wine prices.

- 2008 released after the Global Financial Crisis

- 2014 release after China-led bubble in wine prices

- 2019 release during Covid-19

- Ep 2023 release after steepest wine market correction in last 10 years

We are at somewhat of an inflection point with regards to the negociant system in Bordeaux. There has been a lot of very high-quality wine made over the past 10 years, some priced at levels which has seen it sell through to private cellars, but a huge amount has not sold and remains in warehouses in the city, at increasing costs with interest rates higher than previous years. There is mounting pressure on the estates to release their latest offering at a level that creates a compelling incentive for buyers to re-enter the market.

A successful and compelling en primeur campaign can reinvigorate the entire market and act as a catalyst for a significant growth cycle – we have been here before. Successful Bordeaux EP campaigns create global excitement and newcomers to the market. News of the compelling releases will be reported in major global outlets, and liquidity coming into the market will increase considerably.

There are numerous factors working in favour of EP buyers this year and the difficult backdrop has created an opportunity, which are well positioned to take advantage of.

With the first major releases around the corner, our EP Smart Allocation programme will open from Monday 22nd April.

Interested in investing in Bordeaux En Primeur 2023?

Register your interest to speak one of our experts and discuss this opportunity today!

Related Articles

Bordeaux 2024 En Primeur Roundup: A Vintage with Something to Prove

By Aarash Ghatineh

Bordeaux En Primeur 2024 Vintage: A Detailed Analysis

By Tom Gearing