Part I – Macro outlook: Positive fundamentals outweigh risks

Fine wine’s track record of providing stability and diversified returns during different backdrops was on display during the tumultuous 2022 and will get tested again in 2023. Here we assess the risks to market and highlight why strong market fundamentals underpin our two-tier outlook: relative positivity in the near term and a more favourable long-term view.

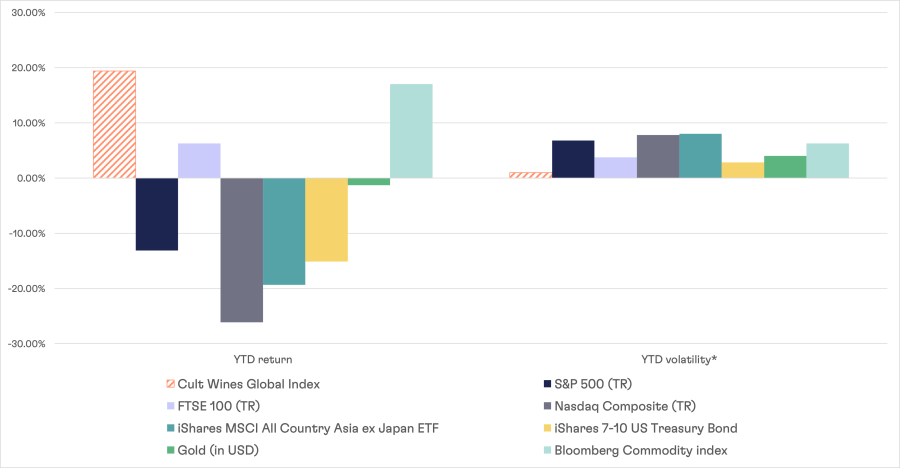

Figure 1 – Rare source of returns and stability in 2022

Cult Wines Global Index vs major financial assets - 2022 returns and volatility as of 30 Nov

Source: Pricing data from Wine Searcher and investing.com as of 30 Nov 2022. Volatility = standard deviation of monthly returns. Past performance is not a guarantee of future returns.

Reasons driving our positive outlook:

Benefits of real asset

Benefits of real asset

Demand for fine wine remained healthy throughout the challenging 2022 and has shown no notable signs of abating, meaning the imbalance that has driven the rally over the past two years is still intact.

It’s important to remember that the outlook is challenging for most financial markets and that fine wine has a history of relative stability during market turmoil (see Figure 1 above). Therefore, many investors will likely continue to seek real assets such as fine wine in 2023 and beyond as inflation remains at multi-decade highs in many countries. This demand adds to wine’s appreciation potential

Scarce Burgundy

Scarce Burgundy

Volumes of Burgundy’s 2021 wines, which will be released early in the year, are well below long-term averages. Some estates are reporting drops of 50%-80% below averages while others are not making certain Premier or Grand Crus in 2021. Even with the high prices in the region, this scarcity should keep upward pressure in place across back vintages even if the pace eases compared to the past two years.

Strong USD could support foreign demand

Strong USD could support foreign demand

Much of the global fine wine trade transits through the UK and many holdings, including those of Cult Wine Investment, are sterling denominated. The US dollar is expected to stay strong in 2023, and the British pound’s relative weakness makes fine wine cheaper for buyers using dollars (and many other foreign currencies). A boost in demand from foreign buyers should, in turn, encourage price to keep rising, making wine a potential hedge for both foreign and UK-based investors.

Diversity of wines

Diversity of wines

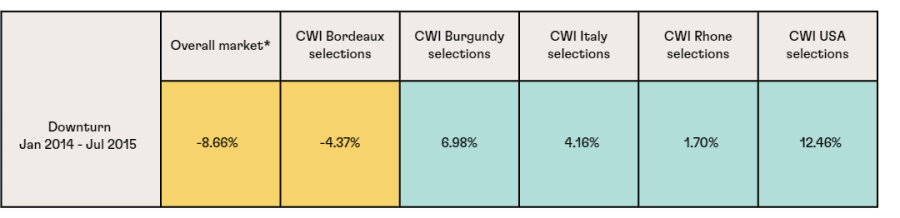

An active approach can uncover pockets of performance in the increasingly diverse global market even if the pace of fine wine performance moderates. We saw this in 2014-2015 when the overall market declined, partly due to a correction of inflated Bordeaux prices, but Cult Wine Investment’s specific selections in Burgundy, Italy, Rhone and US continued to perform.

Sources of growth during a downturn:

*Overall market = Cult Wines Global Index. Regional selections based on Cult Wine Investment performance. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wines customer which ranges from 2.95% to 2.25% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio. Pricing data from Wine Searcher and Liv-ex as of 30 Nov 2022. The performance was calculated in GBP and will vary in other currencies.

Risks to our view:

Cost-of-living concerns, tightening monetary policy, slowing growth and geopolitical turmoil all pose risks to investment markets. Although fine wine has a history of relative stability, long recessions in multiple countries would likely impact wine consumption, potentially denting performance potential of the investment/collector’s market.

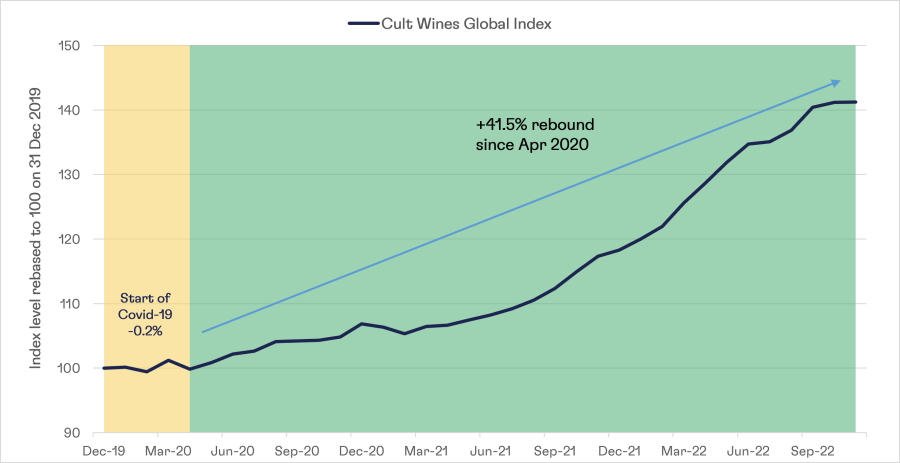

High valuations of some fine wines also add reason for caution. The sustained rally (Cult Wines Global Index +41.5% since April 2020) means prices are more expensive, especially among top Burgundy and Champagne wines. Demand still outweighs supply, but valuations could limit upside potential.

Takeaways:

Near-term - Relative performance can add stability

On balance, we believe the positives outweigh the downsides in the fine wine outlook. Consequently, fine wine should sustain positive performance and reduce the volatility of an overall investment portfolio, especially as there are few other places to turn amid high inflation and slow growth.

However, caution is warranted in the near-term outlook. Certain wine regions may slow down, meaning regional and producer allocation could take on greater importance (see our regional outlook for more).

Longer-term - Staying the course should reap rewards

Ultimately the potential benefits of fine wine are best realised over the long term, and the outlook still looks healthy. The world’s best and rarest wines make solid investments as demand consistently outstrips supply. The inverse supply curve (supply reduces as wines are drunk) drives appreciation with time.

Some investors and collectors may be tempted to cash in on the recent rally. However, as with any asset, timing the market is a challenging game. Fine wine’s track record suggests macro-driven downturns are typically short and give way to sustained rebounds. Investors may struggle to buy back in time to benefit from a rebound and might not access the best candidates for returns.

Figure 2 – Short slowdown; big rebound

Cult Wines Global Index (31 Dec 2019 – 30 Nov 2022)

Source: Pricing data from Wine Searcher as of 30 Nov 2022. Past performance is not a guarantee of future returns.

Traditional 60-40 portfolios took a beating in 2022, emphasizing the role alternative assets can play in adding diverse sources of return over a full market cycle. More interest in alternatives should benefit fine wine performance long term.

Disclaimer: Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The Cult Wines Global Index is a representative benchmark for the fine wine market. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wines customer which ranges from 2.95% to 2.25% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.

Related Articles

Bordeaux 2024 En Primeur Roundup: A Vintage with Something to Prove

By Aarash Ghatineh