January 2023 Flash Report - Fine wine rally on pause to open the year

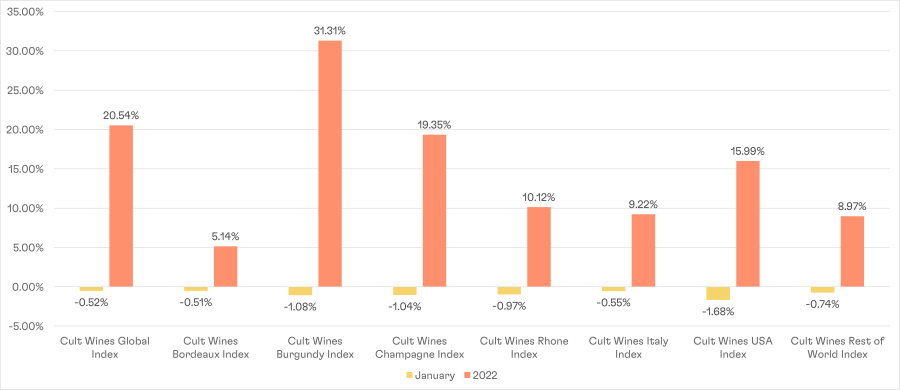

Fine wine markets experienced a bout of the January blues with a 0.52% monthly decline, according to the Cult Wines Global Index.

Price consolidation in Burgundy and Champagne likely factored into the soft start to the year. These regions had led the sustained rally since the beginning of 2021 but saw some of the larger regional drops in January, according to the Cult Wines Regional Indices.

Cult Wines Indices – January 2023 and Annual 2022 Returns

Source: Pricing data as of 31 Jan 2023. Cult Wines Indices are an objective measure of the global fine wine market based on Wine-Searcher pricing data and rebalanced annually based on strict liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

FX moves may have had an impact on US wines, leading to the Cult Wines USA Index experiencing the biggest monthly fall. A larger proportion of US wine prices will be denominated in US dollars, which would equate to a lower figure in GBP as the pound strengthens (Cult Wines Indices are calculated in pounds sterling). However, US wines underperformance also likely stemmed from price consolidation after their strong 15.99% annual gain in 2022.

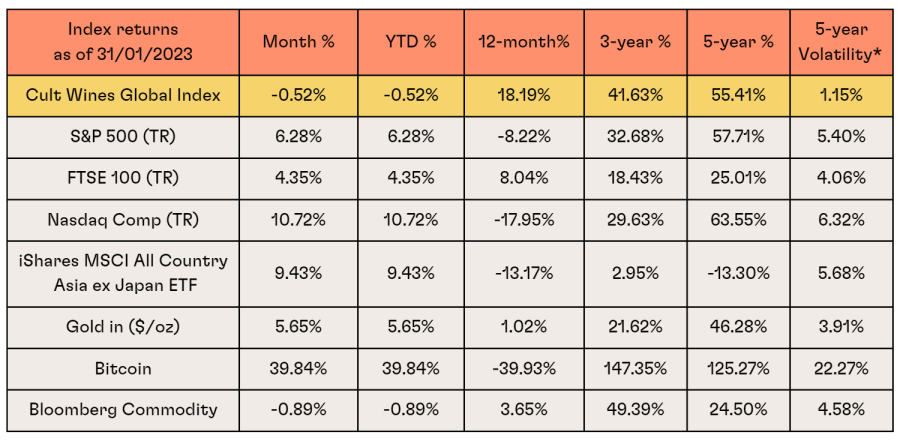

Macro market summary – equities rebound amid improving economic outlook

Source: Investing.com, Wine-Searcher as of 31 Jan 2023. Past performance is not indicative of future returns.

*Volatility = Rolling 5-year standard deviation of monthly returns.

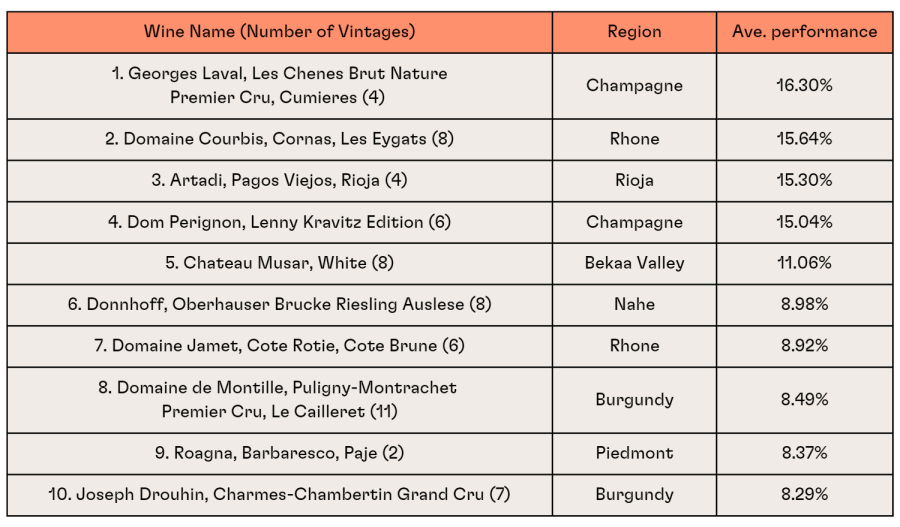

Wine performance detail – Diverse set of top performers

Source: Pricing data from Wine-Searcher as of 31 Jan 2023. Based on average across all vintages of wines contained in Cult Wines Indices, which are rebalanced regularly based on strict, objective liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

The first month of 2023 featured wines from a range of regions among the lead performers, a sharp contrast to 2022 when Burgundy and Champagne names dominated the list. Although just one month, this diversity backs up our view that wines that offer better relative value may play a larger role in the coming year amid the high prices in core regions.

Champagne still claimed the top performer as Georges Laval, Les Chenes Brut Nature Premier Cru, Cumieres wines rose on average 16.30%. Dom Perignon’s Lenny Kravitz Editions also averaged above 15%. However, other Champagne prices fell including Pierre Gimonnet & Fils, Millesime Collection Special Club Brut (-10.10%) and Joseph Perrier, Cuvee Josephine (-9.87%).

Stag’s Leap Artemis prices (-9.21% average across vintages) contributed to the underperformance of the Cult Wines USA Index.

Attention in Burgundy focussed on the new 2021 releases during the month. The top performing secondary market wines primarily came from Cult Wine Investment’s Tier 1 producer category, such as Joseph Drouhin and Perrot-Minot.

Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014. The Indices are separate from Cult Wine Investment Performance which tracks wines purchased by Cult Wine Investment.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.