A Collector’s Guide to White Burgundy

Côte de Beaune: Where It All Began

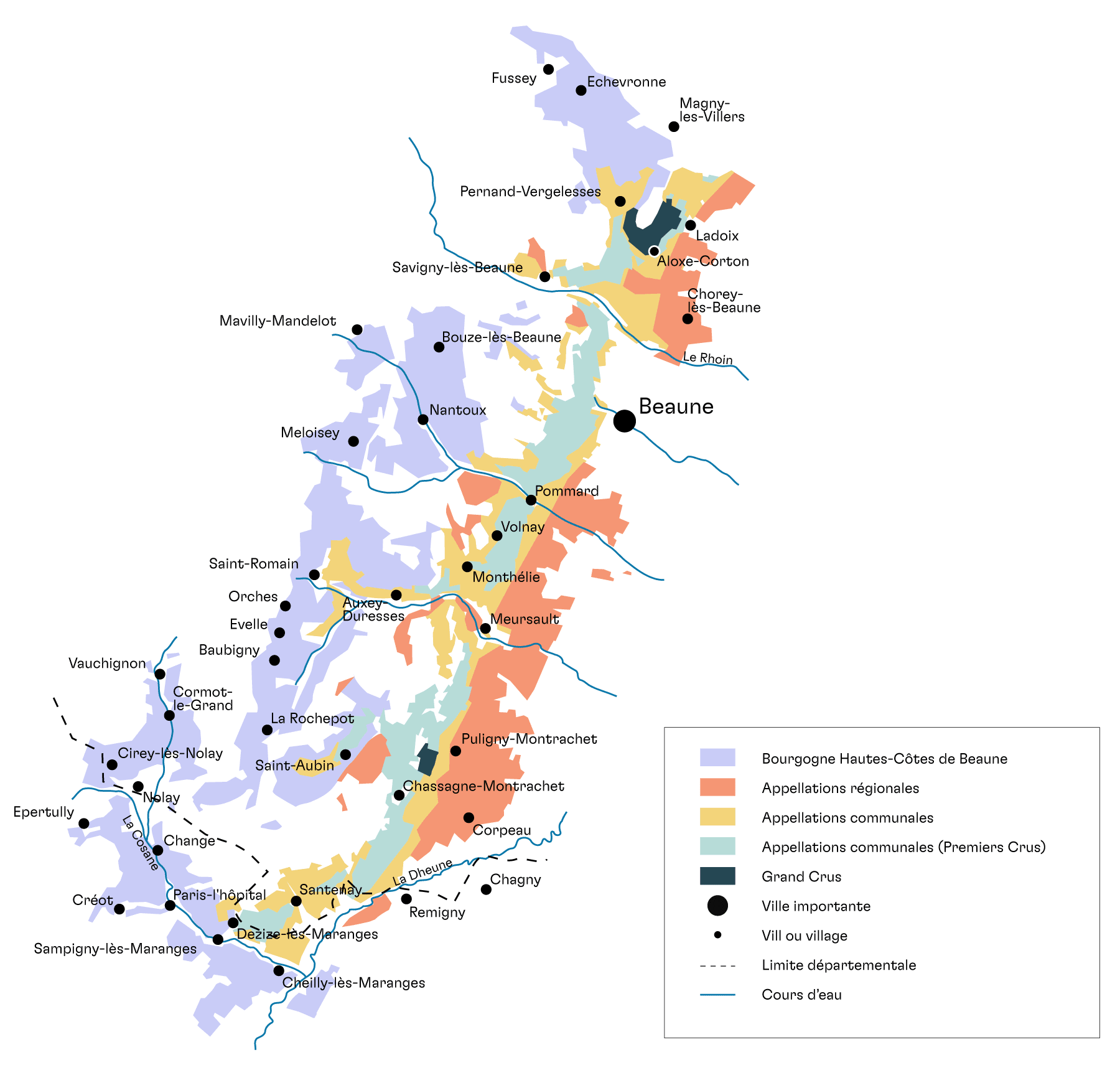

The Côte de Beaune, nestled in the southern half of Burgundy’s famed Côte d’Or, is the spiritual and actual home of great white wine. Here, in the storied villages of Puligny-Montrachet, Meursault, and Chassagne-Montrachet, Chardonnay reaches its highest expression. While stunning examples of Chardonnay are made around the world, Burgundy remains the benchmark, and Côte de Beaune, its undisputed heart.

From grand crus like Montrachet and Bâtard-Montrachet to revered premiers crus such as Meursault Perrières, this region sets the gold standard. These vineyards - many first cultivated by Cistercian monks - are the crown jewels in a complex classification system of climats that define Burgundy’s allure and collectability.

While red Burgundy often steals the headlines, it’s white Burgundy that increasingly commands the attention of collectors and connoisseurs alike. Demand has surged, supply remains scarce, and prices for top producers - Coche-Dury, Leflaive, Roulot, Ente-have soared.

Climate change and poor harvests - like 2021 and potentially 2024 - have only heightened the squeeze. As collectors chase remaining stocks, smart capital is flowing into the undervalued corners of the Côte de Beaune. Opportunities still exist for collectors across the spectrum, from the most renowned appellations to rising stars like Saint-Aubin, and further afield to Chablis and the Maconnais.

Chardonnay may be grown everywhere but it’s only in Burgundy, and specifically the Côte de Beaune, that the grape transforms into something transcendent. A union of limestone soils, cool-climate precision, and deeply rooted winemaking culture. As William Kelley recently noted, climate change has become a permanent fixture in Burgundy’s reality. That means the bottles on offer today even at higher price points may be remembered as the last of a more generous era.

For wine lovers, this region isn’t just a place of origin. It’s a reference point. A benchmark. And for collectors, it’s the starting line in the race for white wine greatness.

In this strategy report, we’ll explore why now is an especially compelling moment to consider white Burgundy from an investment perspective, drawing on performance data, key producer case studies, and clear arguments to support portfolio allocation. We’ll also highlight emerging trends and where forward-looking collectors may find the next wave of opportunity.

Market Snapshot

Data Analysis

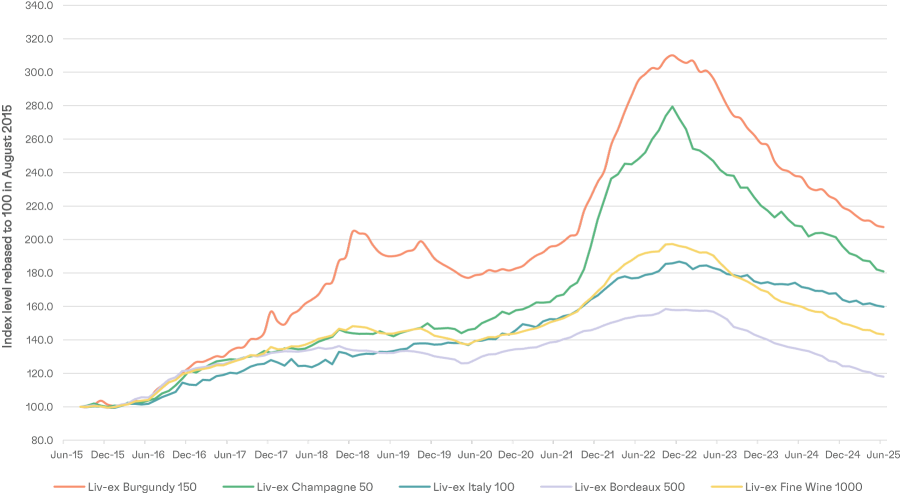

Burgundy as a region is currently witnessing a notable correction in the prices, particularly of its Grand Cru wines, marking a pause that had been anticipated for some time having outperformed most other fine wine regions over the last decade.

Exhibit 1:

Liv-ex Indices 10-year Performance

Source: Pricing data from Liv-ex as of 1 July 2025.

The region's relatively small production, coupled with the ongoing challenges posed by climate change and increasingly unpredictable harvests has further intensified the scarcity of top Burgundy wines. Increased global demand for top wines, particularly from growing markets in Asia and the US, combined with the finite nature of production has driven Burgundy prices to new heights over the past decade.

The region has experienced price corrections in the past, notably a significant period of adjustment occurring from January 2019 to May 2020, which was ultimately followed by a strong rebound in the market. While the current market correction may reflect a temporary price retreat, the underlying fundamentals of scarcity and continued global demand suggest that Burgundy remains an attractive long-term proposition.

In fact, there is evidence to suggest we are currently at a rare entry point, particularly for white Burgundy, which has shown strong, consistent returns relative to red Burgundy in recent years:

Exhibit 2:

Liv-ex Burgundy 150 Index Red Components vs White Components

Source: Pricing data from Liv-ex as of 1 July 2025.

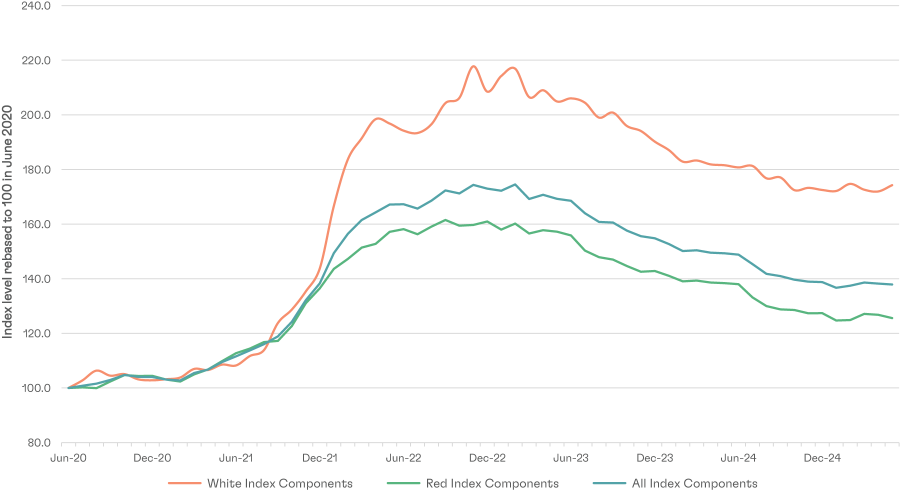

The above chart compares the performance of the red wine and white wine components of the Liv-ex Burgundy 150 index, highlighting how White Burgundy significantly outperformed red Burgundy during the market rally up to the October 2022 market peak.

Despite a period of correction, white Burgundy prices remain well ahead of their red counterparts, having seen a comparatively smaller percentage decline from peak value.

This divergence in performance creates a compelling case for selective re-entry, especially into white Burgundy, which has not only delivered higher returns but also displayed greater resilience. Alongside indications that White burgundy prices may be stabilising, the current dip may represent a strong value opportunity for investors with a long-term outlook

What’s Driving Demand

Exhibit 3:

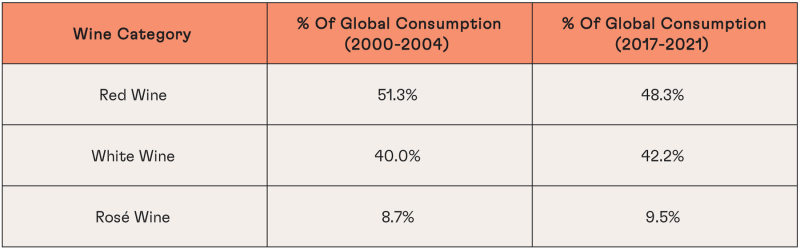

Wine Consumption by Colour (averages 2000-2004 & 2017-2021)

Source: Market data from OIV as of 1 July 2025.

Global wine consumption patterns are shifting, with a notable and sustained rise in the popularity of white and rosé wines. Alongside the UK, a key driver of this trend has been the USA, which has seen a 64.9% increase in overall white wine consumption over the period 2000-2021. As the leading import market for Burgundy Wine, this trend of increasing consumption of white wines in the USA is particularly relevant for the long-term outlook of White Burgundy wines.

White Burgundy, in particular, aligns well with modern consumer preferences: wines that are fresher and more approachable in youth, and with generally lower alcohol levels than their red counterparts, yet still offering the depth and structure to age gracefully.

The comparatively stronger performance of white Burgundy over their red counterparts in recent years indicates that collector behaviour is evolving alongside these wider consumption trends, with an increasing number of collectors favouring white over red.

At the same time, climate volatility and unpredictable weather patterns are contributing to reduced yields, particularly for white wines in Burgundy as Chardonnay is generally acknowledged to be more susceptible to spring frosts than Pinot Noir. As lower volumes become the norm, the balance of constrained supply and growing global demand points to continued upward pressure on prices creating favourable long-term opportunities for collectors and investors alike.

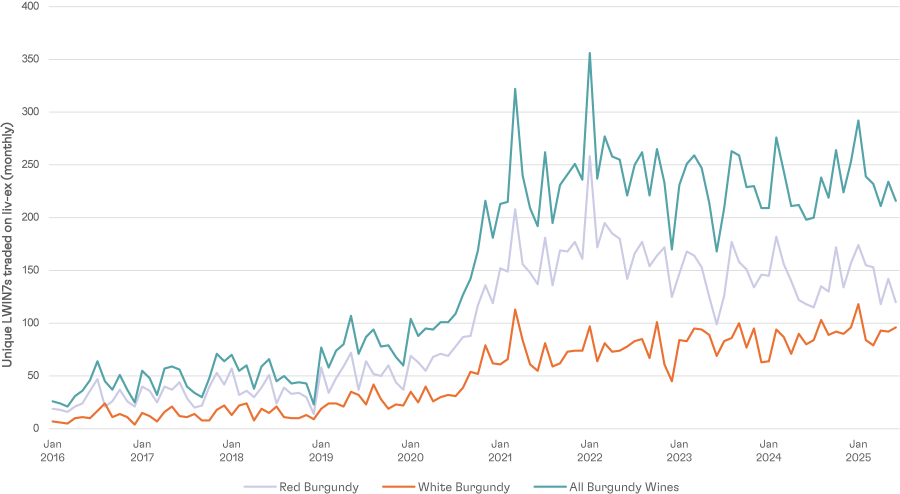

Exhibit 4:

Unique LWIN7s traded monthly on Liv-ex by colour

Source: Trading data from Liv-ex as of 1 July 2025

The above chart highlights the number of unique LWIN7s (unique wines, irrespective of vintage) traded on the Liv-ex platform. This trading data highlights a significnt rise in the range of market activity for both red and white Burgundy wines, correlating with the period of rapid price appreciation 2021-2022.

While red Burgundy has historically dominated in volume of unique LWIN7s traded, white Burgundy has shown gradual but steady growth throughout, narrowing the gap significantly since the beginning of 2022. This serves to indicate that the increasing consumption and demand for white wines generally is being mirrored by increased demand for collectible and age-worthy white Burgundy wines.

Exhibit 5:

Wine Advocate vintage scores for White Burgundy (2000-2022)

Source: Vintage Scores from The Wine Advocate as of 1 July 2025.

Throughout the 21st century, rising collector demand and escalating prices for Burgundy wines have spurred significant investment in both vineyards and winemaking facilities. This, along with advances in winemaking knowledge and technology more broadly, has driven a notable uplift in quality across the region. It’s important to recognise that much of Burgundy’s top wine is produced by small domaines, many of which, until relatively recently, lacked the resources to invest meaningfully in equipment, infrastructure, or skilled personnel. The result is a region whose wines are not only more sought-after, but also more refined and consistent than ever before.

Looking at the scores, it’s clear that white Burgundy has hit some impressive highs over the past decade, as three vintages have earned an exceptional rating of 97 points from the Wine advocate. With an average score of 93.1 awarded to vintages since 2010 vs 89.5 for the years beforehand, it is apparent the general trend points upward. Consistency too appears to have improved, with only one vintage out of the 13 rated since 2010 earning a score below 90 points, vs four in the previous 10.

It is our view that White Burgundy has never been better, and the critics seem to agree. This notable step up in quality enhances its appeal to collectors and investors and reinforces the upward trend in global demand.

Producer Focus

Established Benchmark - Coche-Dury

Domaine Coche-Dury was established in the 1920s by Léon Coche, who began with scattered vineyard parcels around Meursault. Initially selling to négociants, the domaine started bottling more of its own wine under his son Georges, who also acquired prime plots including Meursault 1er Cru Perrières. In 1973, Georges passed the reins to Jean-François Coche, who added his wife’s surname, Dury, and expanded the domaine to nine hectares across Meursault, Puligny-Montrachet, Auxey-Duresses, Monthelie and Volnay. His meticulous vineyard and cellar work gained international acclaim, with critic Robert Robert Parker calling him “one of the greatest winemakers on planet Earth.” Even after a 1998 helicopter crash damaged rows in their prized Corton-Charlemagne vineyard, Jean-François’ calm leadership preserved the domaine’s standing. He retired in 2010, handing over to his son Raphaël, who continues the legacy with the same rigour and focus.

Coche-Dury’s wines, particularly the Corton-Charlemagne, are among the most sought-after and expensive white wines in Burgundy. Parker’s 98–100 point score for the 2001 helped drive a >50% price increase between 2010 and 2014. Their Meursault bottlings—especially Perrières, Caillerets, Genevrières and Rougeot—are just as admired, often outperforming grands crus in critic rankings and showing growth of 130–500% over five years depending on vintage. While yields are low, the winemaking is traditional: old vines, careful barrel ageing, and zero clonal selection, favouring purity, minerality and longevity.

Highlights include the Corton-Charlemagne, planted in 1960, which combines fleshy power with spice and pear aromatics; the Meursault Perrières, from a 0.5ha plot of 65-year-old vines, noted for limestone tension and Puligny-like precision; and Genevrières, a rich, layered Chardonnay with ageing potential. Caillerets is praised for its saline finish and tight acidity, while Puligny-Montrachet les Enseigneres, from vines dating to 1930, offers focused minerality and can age for two decades. Meursault Rougeot is broader and complex, often described as opulent but structured, developing beautifully with time.

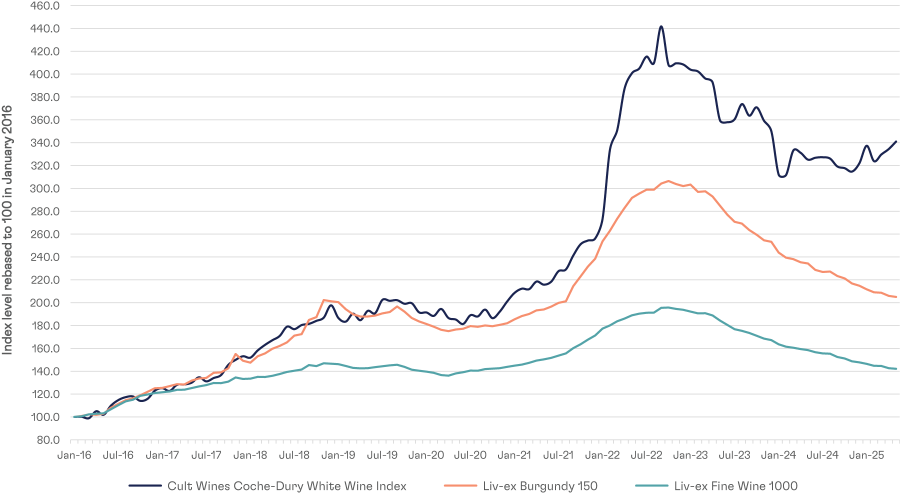

Exhibit 6:

Coche Dury performance vs Liv-ex Indices

Source: Pricing data and indices from Liv-ex as of 1 July 2025, Cult Wines Coche-Dury White Wine index comprised of vintages 2010-2020 of Coche Dury wines: Bourgogne Chardonnay, Corton-Charlemagne Grand Cru, Meursault, Meursault 1er Cru Les Caillerets, Meursault 1er Cru Perrieres, Meursault Les Rougeots, Puligny-Montrachet Les Enseigneres.

Since 2016 through to the 2022 market peak, the performance of Coche-Dury’s white wines has closely mirrored the trajectory of the wider burgundy market, though some outperformance was already evident during the period of rapid market growth 2021-2022.

A clear divergence has since emerged during the current period of market correction. While the Burgundy region as a whole and the wider fine wine market have continued to trend downward through 2024 and the start of 2025, prices for Coche-Dury’s white wines from have shown signs of stabilisation, even hinting at a modest recovery since early 2024.

This disconnection suggests that white Burgundy from producers with cult/iconic status may be finding firmer footing in the current market, underpinned by their relative scarcity, consistent critical acclaim, and increasing demand from collectors seeking standout whites.

Cult Momentum - Etienne Sauzet

Founded in the early 1900s in the esteemed Puligny Montrachet terroir, Domaine Sauzet spans around 15 ha across Puligny Montrachet, Chassagne Montrachet and Cormot le Grand, including several top premiers and grands crus. After founding patriarch Etienne Sauzet (1903–1975), the estate remained in family hands—through Gérard Boudot in the 1970s and later his daughter Emilie and her husband Benoît Riffault, who now manage the domaine, embracing biodynamic viticulture since 2010.

Still bottling 100% of its production since the 1950s, Sauzet practices estate fermentations in oak barrels (up to 40% new for grands crus) with lees aging to bolster texture. The wines are celebrated for their textbook white Burgundy style: elegant, flavourful, with ample fruit to balance oak and supportive acidity. Critic Robert Parker has dubbed Domaine Etienne Sauzet it “one of the most serious estates in Burgundy” and the soaring prices of its Chevalier Montrachet and Bâtard Montrachet lines reflect its peerless status.

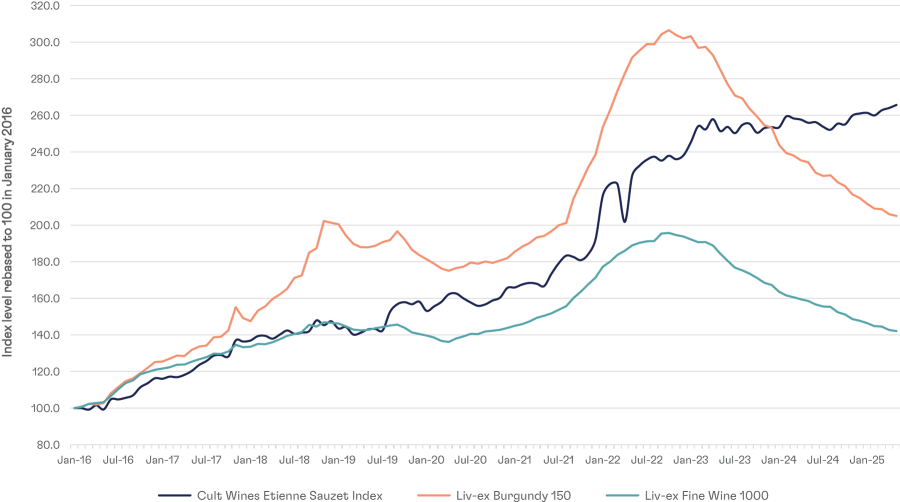

Exhibit 7:

Etienne Sauzet performance vs Liv-ex Indices

Source: Pricing data and indices from Liv-ex as of 1 July 2025, Cult Wines Etienne Sauzet Index comprised of vintages 2010-2020 of Etienne Sauzet Wines: Puligny-Montrachet, Puligny-Montrachet 1er Cru Champ Canet, Puligny-Montrachet 1er Cru La Garenne, Puligny-Montrachet 1er Cru Les Combettes, Puligny-Montrachet 1er Cru Les Folatieres, Puligny-Montrachet 1er Cru Les Perrieres, Batard-Montrachet Grand Cru, Bienvenues-Batard-Montrachet Grand Cru, Chevalier-Montrachet Grand Cru, Montrachet Grand Cru.

Sauzet prices have continued to appreciate during the current period of market correction, a notable outlier in current fine wine market conditions. While a few other top white Burgundy producers have delivered comparable or greater performance over a 5-year period, Sauzet in particular stands out for the strength and reliability of its trajectory throughout a variety of market conditions.

Notably, Sauzet’s Village-tier Puligny Montrachet was amongst the top-performing Burgundy wines through 2024, returning +31.4% across vintages 2016-2022. This serves to highlight the depth of demand for the brand throughout the entire range of wines.

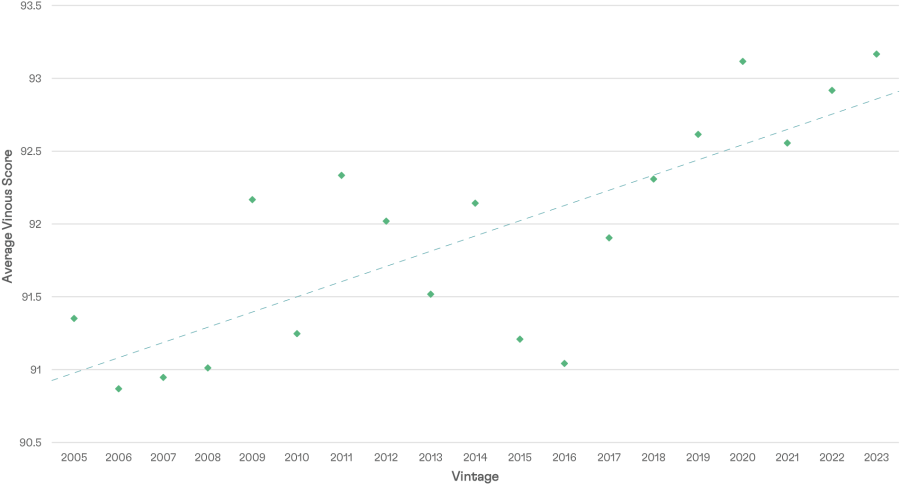

Exhibit 8:

Average Vinous Score awarded to Etienne Sauzet wines (vintages 2005-2023)

Source: Scores from Vinous as of 1 July 2025, Average Vinous score comprised of Etienne Sauzet wines: Puligny-Montrachet, Puligny-Montrachet 1er Cru Champ Canet, Puligny-Montrachet 1er Cru Champs Gain, Puligny-Montrachet 1er Cru Les Combettes, Puligny-Montrachet 1er Cru Les Folatières, Puligny-Montrachet 1er Cru La Garenne, Puligny-Montrachet 1er Cru Hameau de Blagny, Puligny-Montrachet 1er Cru Les Perrières, Puligny-Montrachet 1er Cru Les Referts, Puligny-Montrachet 1er Cru Les Truffières, Bâtard-Montrachet Grand Cru, Bienvenue-Bâtard-Montrachet Grand Cru, Chevalier-Montrachet Grand Cru, Montrachet Grand Cru

Sauzet’s performance is underpinned by a clear improvement in both quality and consistency. Over recent vintages, the domaine has delivered increasingly refined wines that reflect precision in both vineyard work and cellar practices. In a region where quality can vary markedly vintage to vintage, Sauzet’s impressive consistency over the past few vintages also serves to explain its position it as a producer outperforming many of its peers in recent years.

The upward momentum in both prices and scores for these wines strongly suggests growing recognition from both critics and collectors, reinforcing Sauzet’s status as one of the most compelling names in Puligny-Montrachet today.

Target List

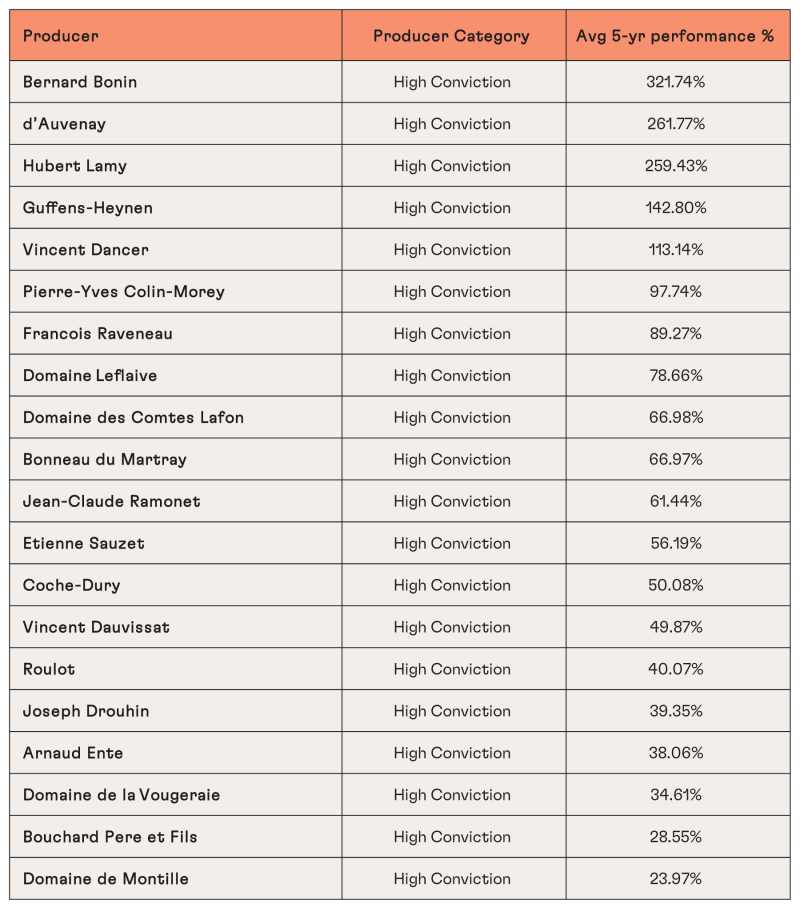

High Conviction

Key producers where we already hold stock or are actively recommending.

Source: Pricing data from Liv-ex as of 1 July 2025

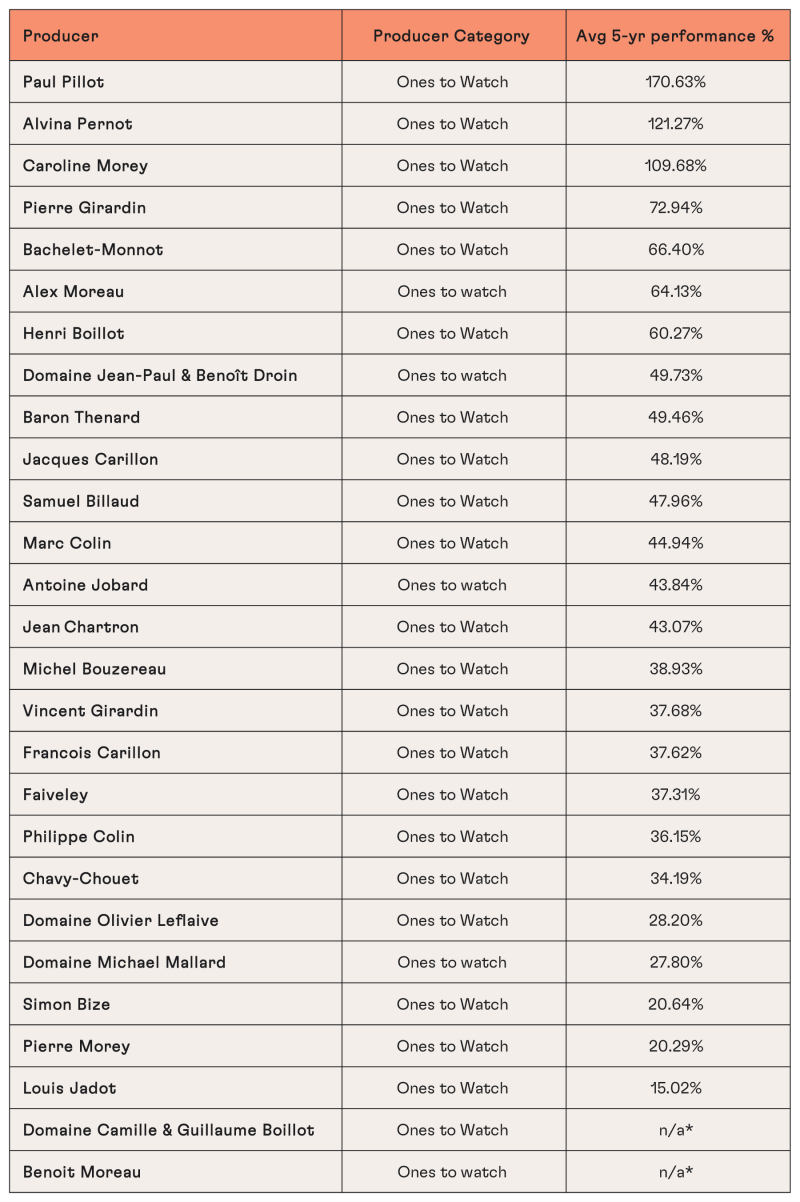

Ones to Watch

Emerging domaines we think could gain traction in the next 5 years.

Source: Pricing data from Liv-ex as of 1 July 2025.

*Wines from these up-and-coming producers have only entered the market relatively recently, and do not yet have enough available market data to produce an averaged 5-year return figure.

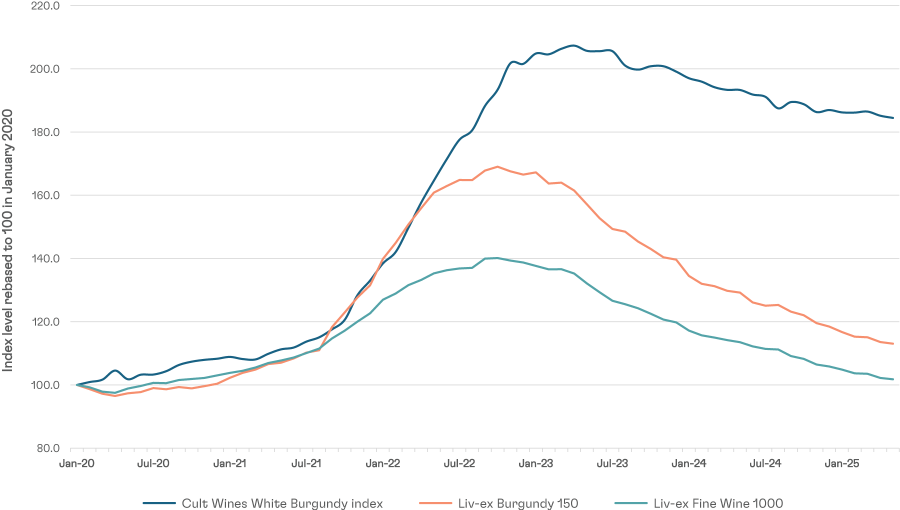

Exhibit 9:

White Burgundy target producer performance vs Liv-ex Indices

Source: Burgundy 150 & Fine Wine 1000 indices from Liv-ex as of 1 July 2025. Pricing data from Wine-Searcher as of 1 July 2025, Cult Wines White Burgundy target producer index comprised of 850 unique vintages of 290 wines (vintages 2010 onwards), across 40 of our 47 target producers.

Alongside the liv-ex Burgundy 150 and Fine Wine 1000 indices, our target white Burgundy producers experienced rapid price appreciation through 2021 & 2022, reflecting a broader rally in the fine wine market. The Cult Wines White Burgundy index did however enjoy a more sustained period of price appreciation clearly outperforming both benchmarks.

What is particularly notable is the divergence that follows this period of rapid market growth. While both the Burgundy 150 and Fine Wine 100 indices have declined significantly since early 2023, our White Burgundy target producers index has shown far greater stability. Despite some softening, it has retained most of its gains and remains well above pre-rally levels.

This sustained outperformance reflects the strength of a curated producer-led approach, suggested that top-tier white Burgundy has benefited from more resilient demand, even amid broader market corrections.

Interested in the Cult Wines White Burgundy Investment Strategy?

The current market gives us a window to buy top-tier white Burgundy with real investment logic behind it, at prices that are unlikely to last. The combination of lower production, growing global demand, and long-term outperformance makes this a rare opportunity.

We have identified approximately £1 million of high-conviction opportunities and emerging names to watch. To secure the most favourable allocations and entry points, we advise all parties to register their interest now using the button below, ready to act promptly.

Minimum Stategy Investment: £5,000*

*As part of a diversified investment account with a minimum overall investment of £25,000.

The value of wine investments can go down as well as up. Past performance is not a reliable indicator of future results, and returns are not guaranteed. Investing in fine wine involves risks, including market volatility, illiquidity, and potential loss of capital. Cult Wines do not offer financial advice and is not authorised or regulated by the Financial Conduct Authority to provide investment advice. All investors should consider seeking independent professional advice before making investment decisions. Wine investments should be viewed as a long-term strategy and may not be suitable for everyone. You should only invest money that you can afford to commit for an extended period and be prepared to accept the risk of underperformance or loss. Wine investments are not covered by the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS).