Fine wine doldrums – how to approach fine wine after a two-year rally

Why fine wine prices are on the backfoot

The impact from macroeconomic factors

Fine wine is a long-term endeavour

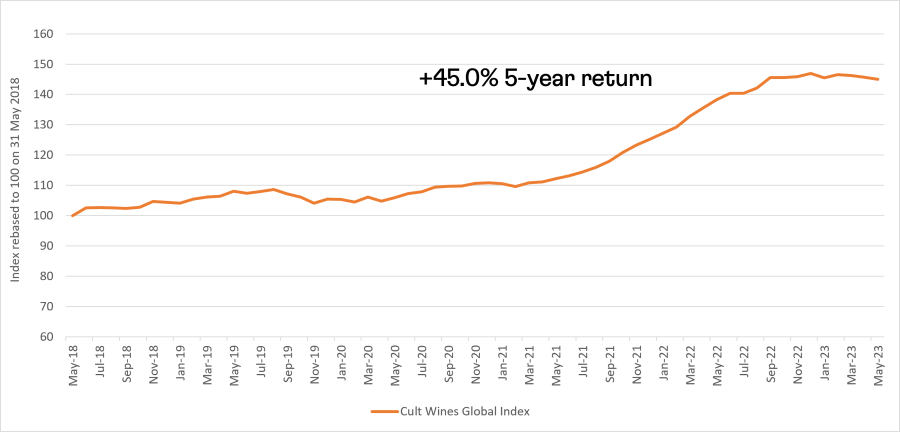

After two years of strong performance, the fine wine rally has hit a bit of a bump. There’s no avoiding the fact that wine prices in 2023 are down 1.31%, according to Cult Wines Global Index, with all regional indices in negative territory (as of 31 May 2023).

This decline must be kept in perspective; fine wine is a long-term investment, and the figures still look favourable from this vantage point. The one- and three-years returns are 4.85% and 36.95%, respectively[1].

Figure 1 - Keeping the slowdown in perspective

Cult Wines Global Index five-year performance

Source: Cult Wines Indices based on Wine-Searcher pricing as of 31 May 2023. Past performance is not a guarantee of future returns.

Corrective periods can be healthy stages of a full market cycle as buyers gauge if the price rises are sustainable. They also can offer a point of entry and attract new buyers to the market. However, we’ve seen negative returns in four of the five months this year, so it is worth discussing the matter to ascertain possible causes and what the outlook is from here.

Why fine wine prices are on the backfoot

A natural period of price consolidation is likely the primary factor pushing fine wine prices lower in early 2023. Given the pace of the rally (two-year return of +32.85% from Jan 2021-Jan 2023[2]), a temporary period where prices drift sideways or slip a bit should not come as a surprise.

Evidence that this is what’s occurring now is found in the fact that the two biggest underperforming regions, Burgundy and Champagne, led the charge during the 2021-2022 boom.

Specific wines have also still delivered healthy gains even in regions that have struggled, indicating that appetite for the right wines at the right price remains intact. Laurent Perrier Brut Millesime and Egly-Ouriet Brut Millesime are up 22.0% and 18.4% (average across vintages in Cult Wines Indices) so far this year.[3] We’ve also seen significant gains from some Rioja wines and Tenuta San Guido’s Guidalberto, suggesting that demand is seeking relative value in the current climate.

The impact from macroeconomic factors

But current macroeconomic conditions cannot be ignored. Even through fine wine’s performance track record shows a relative decorrelation to wider market sentiment, it would be naïve to assume that the cost-of-living concerns, rising interest rates and economic growth concerns had no impact. The two main macro headwinds, as we perceive them, are:

Interest rates

Interest rates

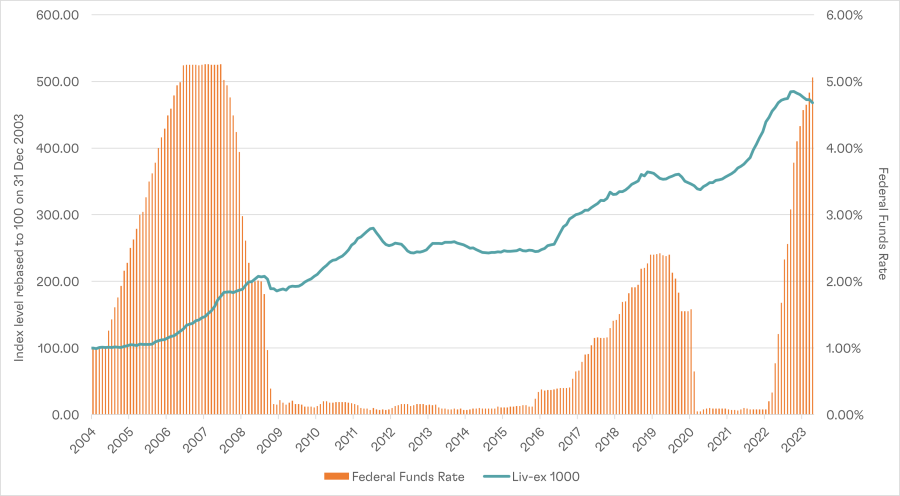

Higher interest rates may prompt some investment-minded buyers to favour cash or fixed income investments, which offer healthier rates of return when rates are higher. One might assume that less cash available for alternative assets, such as fine wine, might correspond to lower prices.

However, a look back at the link between US rates and fine wine prices (using Liv-ex 1000 index due to its longer history) shows that higher rates do not necessarily equate to falling wine prices. In our view, this doesn't mean that the current higher rates aren't affecting the prices of alternative assets, such as fine wine, but they are unlikely to be the main factor.

Figure 2 – No inverse relationship

Liv-ex 1000 index and US Federal Reserve Interest Rate and US

Source: Liv-ex as of 31 May 2023. Past performance is not a guarantee of future returns.

Foreign exchange rate

Foreign exchange rate

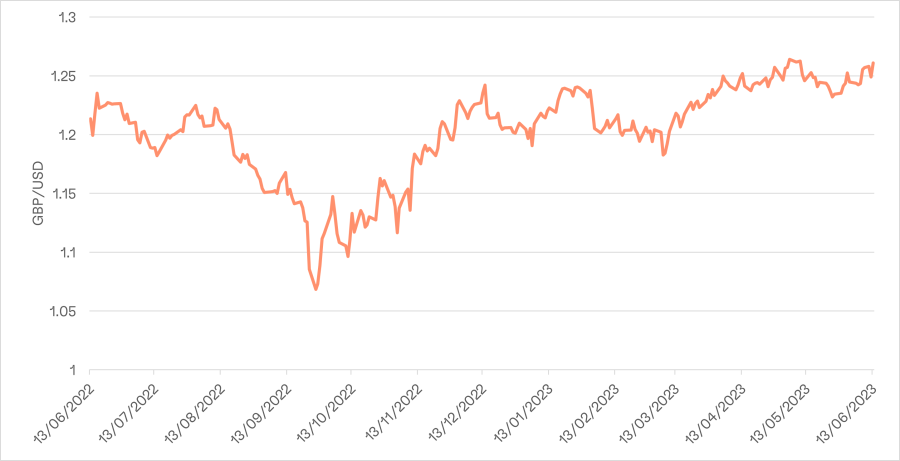

The British pound has recovered in 2023 after plumbing new depths in autumn 2022. As of 12 June, sterling has appreciated 3.74% against the US dollar. The stronger pound hurts the performance of the Cult Wines Indices, which include Wine-Searcher.com prices from a global data set. Consequently, a rise in Sterling can equate to a lower Index value (Cult Wines Indices are calculated in pounds sterling).

Figure 3 - Sterling strenghtening so far in 2023

GBP/USD exchange rate: 16 June 2022 - 16 June 2023

Source: Investing.com as of 16 June 2023.

The current outlook

Risks - Uncertainty is the operative word regarding fine wine’s near-term outlook. The length and scale of the 2020-2022 rally means that wine prices are still far higher than they were in early 2020. Consequently, there is room for ongoing choppy price performance in the months ahead.

High interest rates and cost-of-living concerns are likely to remain obstacles in the coming months, but the above analysis suggests that wine can perform in different rate environments. The strong British pound might form a drag on demand from non-UK buyers. Most physical fine wine stocks are denominated in Sterling, which means they become more expensive when the GBP appreciates relative to US dollar or other currencies.

Upside - There is also room for optimism. Inflation appears to be easing in most major economies, opening the door for more accommodative monetary policies by the Federal Reserve and other central banks later this year. A less restrictive environment could lead to more cash looking for alternative assets again or simply discretionary spending in hospitality sectors.

Ultimately, it is important to remember that the current challenges do not impact only fine wine. Indeed, many economists are anticipating the US economy to slide into the recession later in 2023, suggesting the potential for more turbulence in equity and other financial markets.

This underscores that even when fine wine isn’t posting big returns, its track record of providing relative stability and downside protection compared to many other mainstream assets can benefit an investment portfolio.

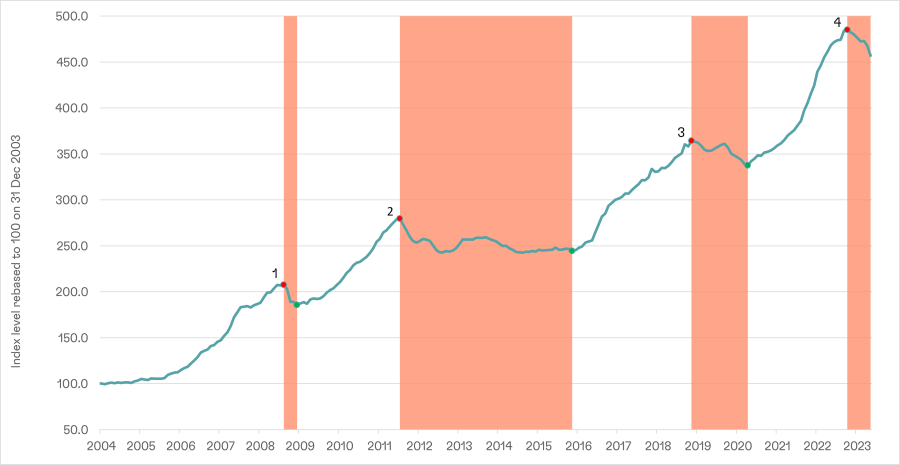

Fine wine is a long-term endeavour

To reap the rewards of fine wine rallies, it is often best to ride out the lows. Even if this current slowdown persists a little longer, history indicates that when fine wine does turn, it will turn quickly, and the rebound could be stronger than the decline. As with most financial assets, trying to precisely time the fine wine market is a fool’s errand.

Figure 4 – Downturns have given way to long rallies

Long-term performance history of Liv-ex 1000

Source: Liv-ex.com as of 31 May 2023. Past performance is not a guarantee of future returns.

The nature of the fine wine market means slow periods should be used to source long-term opportunities. The scarcity and often low liquidity of the world’s finest and most sought-after wines means access is always a challenge. Waiting until prices are on their way up again can mean missing out on the best wines and/or paying a premium.

Therefore, we view the current backdrop as a chance to identify entry points. Given the near-term concerns, some wines might still come at prices that have limited upside. But an analytical approach can help locate emerging opportunities to source scarce wines at prices that hold long-term performance potential.

[1] Cult Wines Global Index based on Wine-Searcher.com pricing. Past performance is not a guarantee of future returns.

[2] Cult Wines Global Index based on Wine-Searcher.com pricing. Past performance is not a guarantee of future returns.

[3] Cult Wines Indices based on Wine-Searcher.com pricing as of 31 May 2023. Past performance is not a guarantee of future returns.

Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.