Investors Face Renewed Inflation Dilemma as Rate Cuts Erode Savings Returns

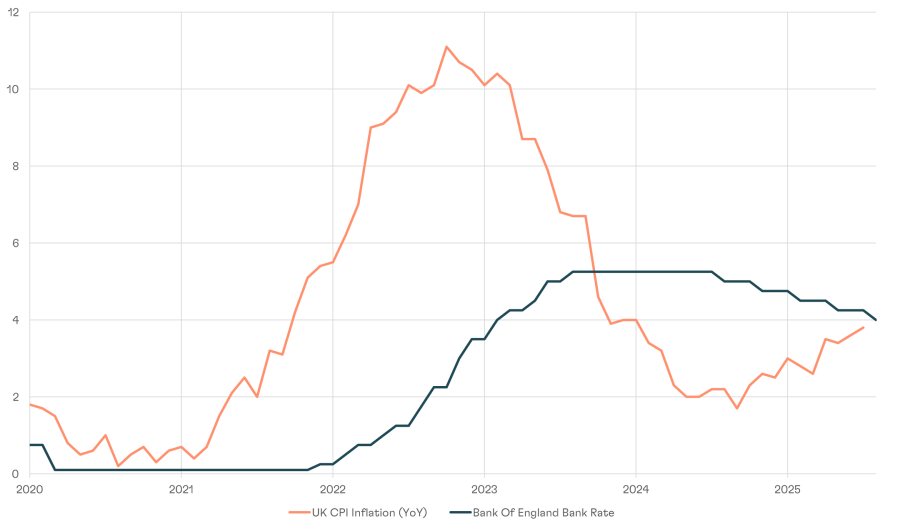

With UK inflation holding at 3.8% and the Bank of England cutting its base rate in August, savers once again face the prospect of losing money in real terms by leaving cash in the bank.

For much of the past two years, high interest rates provided a rare window where cash deposits could outpace inflation. That window has now closed. As banks reduce savings and fixed deposit rates following the BoE’s move, ordinary households and investors alike are left searching for safe havens.

The chart below illustrates the squeeze: while inflation has fallen from the double-digit peaks of 2022, it remains stubbornly above the central bank’s 2% target. With policy rates now in retreat, the “real” return on cash is negative once again.

UK CPI Inflation vs Bank of England Bank Rate (2020–2025)

Source: Office for National Statistics (ONS), CPI annual rate, all items (series D7G7), released on 20 August 2025; Bank of England, Official Bank Rate history (including cuts to 4.25% on 8 May 2025 and 4.00% on 7 August 2025).

Alternatives step into the spotlight

This changing landscape is fuelling fresh interest in alternative assets, such as fine wine. Once considered the preserve of wealthy collectors, fine wine has become increasingly accessible through digital platforms like CultX, which allows investors to build and trade collections of the world’s most sought-after bottles.

“After a two-year market correction, entry points into fine wine are some of the most attractive we’ve seen in over a decade,” says Tom Gearing, CEO of Cult Wines, the world’s leading fine wine investment company. “Investors who are frustrated with eroding savings returns are taking a serious look at wine as a diversifier that can hold its value against inflation.”

Long-term resilience

Fine wine has historically shown low correlation with equities and steady appreciation over time. According to Cult Wines’ data, a diversified portfolio of top Bordeaux and Burgundy wines has delivered average annualised returns of 8–10% over the past 20 years. Crucially, during periods of market volatility or negative real interest rates, wine prices have tended to hold firm or even rise.

The recent correction in 2023–24, where prices fell between 20% and 25% across many regions, is being seen by experienced investors as a reset rather than a reversal.

“We’ve been through a cooling-off period after years of rapid growth,” says Gearing. “For those coming in now, valuations are attractive, supply remains finite, and long-term demand trends are only moving in one direction.”

A human story behind the data

One recent CultX client, a 37-year-old London professional, moved £20,000 out of fixed-rate savings this summer after their bank cut the interest from 4.5% to 3.2%.

“It just didn’t make sense to watch inflation eat away at my money,” they said. “Wine felt like something tangible, with a track record of growth, and the platform makes it simple to manage.”

Looking ahead

As policymakers balance inflation control with growth, interest rates are likely to remain under pressure. For investors, the dilemma is clear: accept shrinking real returns on cash, or explore alternative assets with the potential to outpace inflation.

“Wine isn’t a silver bullet,” cautions Gearing. “But as part of a balanced portfolio, it offers a compelling mix of scarcity, global demand, and cultural value. For many, it’s becoming less of a luxury and more of a smart hedge.”