Bordeaux EP 2021 Summary – Highlights and Outlook from a Mixed Campaign

The 2021 Bordeaux En Primeur campaign very much represented the vintage as whole – some exciting highlights amidst variable results. Many of the top chateaux in the region rose to the challenges of the growing season to produce a strong set of wines even if some didn’t quite equal the excellence seen in the 2018-2020 trilogy. With this heterogenous nature of the 2021 wines, release prices would turn out to be key and, much like the quality of the wines, some were more attractive than others.

The campaign got off to an encouraging start with ex-negociant prices often coming slightly below prices from a year ago. Overall, average ex-negociant release prices for the wines that make up Cult Wine Investment’s EP40 index (a fixed group of 40 wines from the Bordeaux market) were 2.4% below their 2020 EP levels. Consequently, when wine and brand quality were also strong, the 2021 releases formed attractive buying opportunities with long-term investment potential. Highlights included First Growths such as Chateau Lafite on 7 June as well as its second wine, Carruades, on 12 May.

However, many prices toward the end of the campaign were coming roughly in line with last year. Buyers displayed selectivity throughout, with demand varying from wine to wine depending on quality, price and brand popularity. In our view, this selectivity stemmed from:

- Vintage reputation – Although most critics and commentators recognised quality came higher than expected in 2021, the vintage is not currently viewed as among Bordeaux’s best. Buyers likely concentrated on the highest-quality wines and those released at attractive prices.

- Macroeconomic environment – Many potential buyers remain cautious amid talk of economic recessions in major economies. Consequently, some showed hesitancy to commit large quantities of funds to long-term EP wine purchases despite wine’s track record of stability during volatile conditions in the wider markets.

- Back vintages – Back vintages of several chateaux represented the more attractive relative value options than the new 2021 releases due to better price-to-point ratios. Even in cases where the 2021s still offered good value, demand was more spread out across a producer’s full range rather than concentrated in the new wines.

This reception for the 2021 EP wines validated Cult Wine Investment’s decision at the beginning of the campaign to focus buying efforts on the entire Bordeaux market in order to access the best relative value opportunities across new and older vintages alike.

Outlook for 2021 wines: Good things can come to those who wait

The internal drivers of the fine wine market are solid and should keep prices stable and trending higher. However, in the coming months, the performance potential of the entire 2021 cohort could be limited by the mixed reputation of the vintage and the uncertain macroeconomic environment.

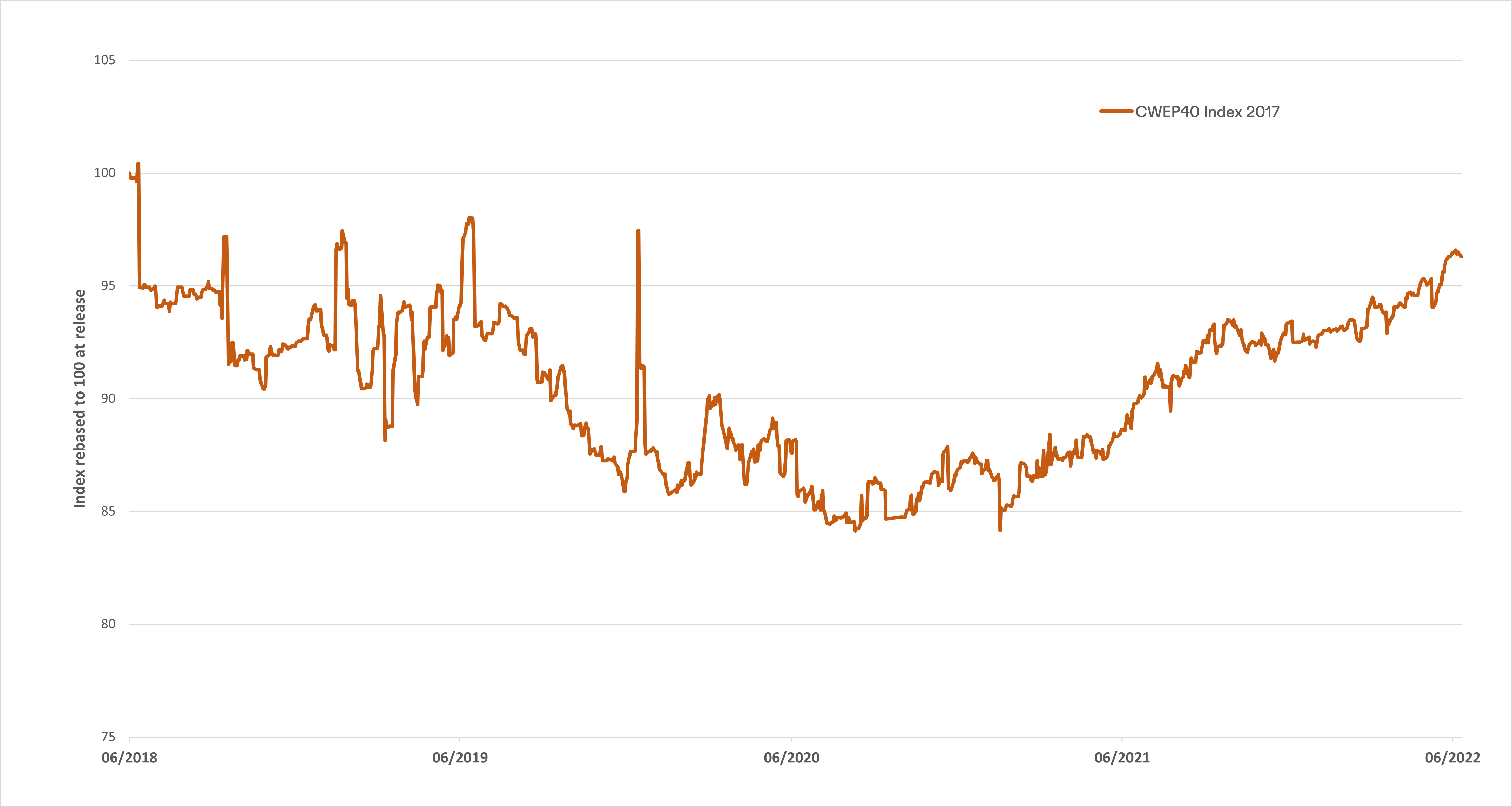

But EP purchases often deliver the best rewards over the longer term. A look back at the performance history of the 2017 EP wines supports this view. Initially, the 2017s struggled due to a combination of high release prices and overall vintage quality falling short of 2016 and the 2018-2020 trilogy. However, the 2017 EP index has delivered steady appreciation over the past two years, as shown below.

Performance history of EP40 Index - 2017

Source: Pricing data from Liv-ex as of 27 Jun 2022. Past performance is not necessarily indicative of future results. CWEP40 index is a fixed group of 40 wines from the Bordeaux market.

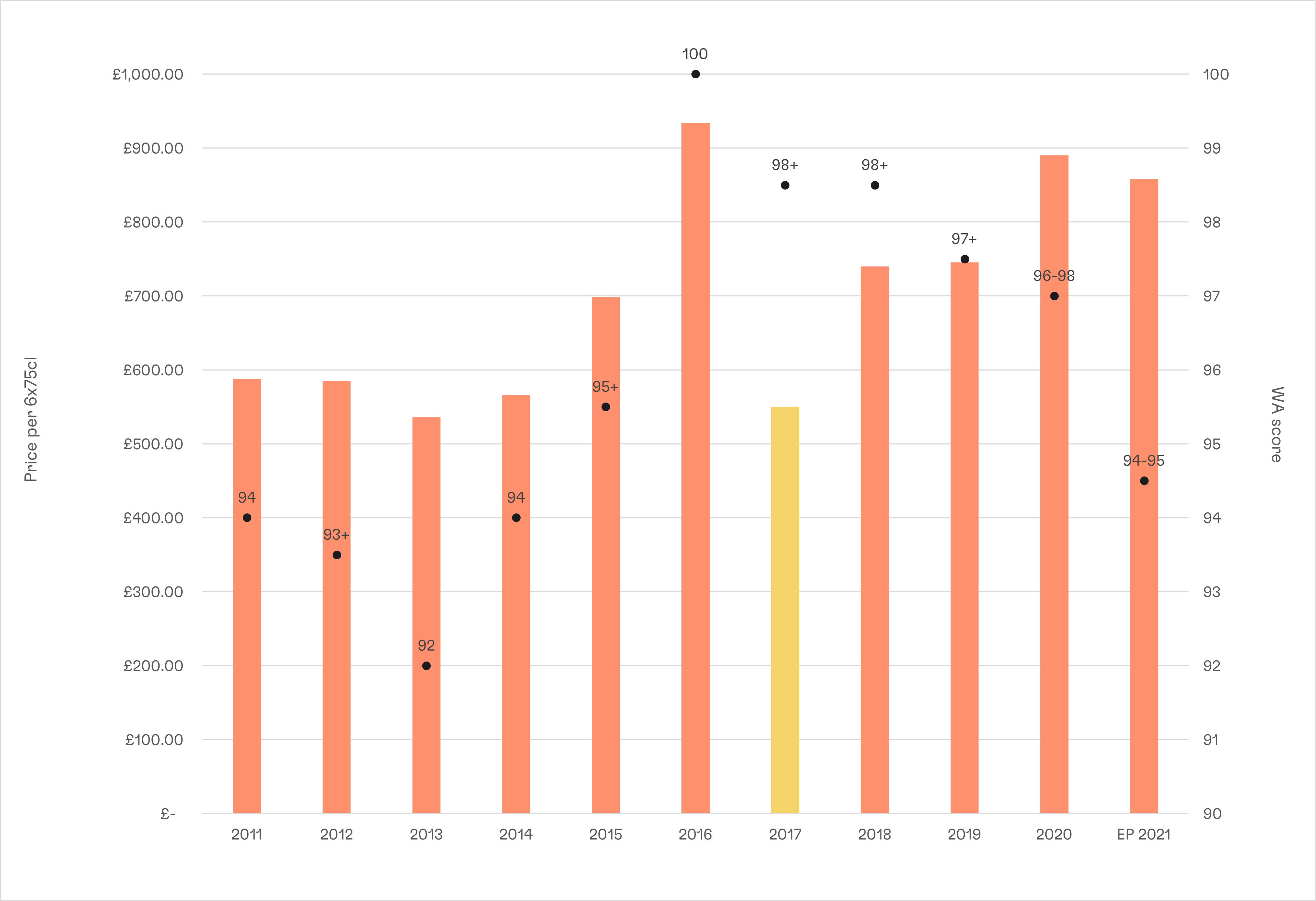

We think there is more potential in the 2017s, especially among the top wines of the vintage where scores rival or surpass those from surrounding vintages. Cos d'Estournel’s 2017 forms a good example of a wine that ranks among the chateau’s best of the last 10 years but currently trades at a discount to other vintages.

Cos d’Estournel score vs price comparison

Source: Pricing data from Liv-ex as of 27 June 2022.

What this means for that 2021s is that:

- Buyers should remember EP purchases are long term purchases.

- Individual wines might offer up similar quality to a top vintage. These can make attractive relative value targets as initial demand might overlook them due to the high-level vintage reputation.

Highlights from EP campaign

Left Bank First Growth

Chateau Lafite Rothschild

Wine Advocate 95-97pts; Vinous 95-97pts (Galloni & Martin)

Ex-negociant: €470/bottle

Ex-London RRP: £2,904 6x75cl

- Ex-London release price made 2021 the lowest priced Lafite in the market, meaning this was an excellent access point to one of world’s most iconic wine brands.

- Volumes are reportedly down around -20% vs averages in 2021. Lafite is always difficult to source in quantity, and 2021 could be especially difficult once it reaches bottle.

- Consistent performance track record: 14.4% (average all-vintage 5-year return, Wine Searcher).

Right Bank First Growth

Chateau Cheval Blanc

Wine Advocate 95-97pts; Vinous 96-98pts (Galloni), 95-97pts (Martin)

Ex-negociant: €390/bottle

Ex-London RRP: £2,370 6x75cl

- Encouraging release price for a contender for wine of the vintage.

- Ex-London price comes at a discount to the current market pricing of the 2018 (98+pts), 2019 (100pts), and 2020 (no WA score) vintages.

- Consistent performance track record: +20.9% (average all-vintage 5-year return, Wine Searcher).

Super Second

Chateau Figeac

Wine Advocate 94-97pts; Vinous 93-95pts (Galloni), 95-97pts (Martin)

Ex-negociant: €162/bottle

Ex-London RRP: £978 6x75cl

- Brand on the rise – Figeac is likely to receive upgrade to top echelon of St Emilion rankings in 2022 reclassification.

- Strong performance track record: +81.9% (average all-vintage 5-year return, Wine Searcher).

- Volumes reportedly down over 20% vs 2020 meaning this could be difficult to source when it’s released in bottle.

QPR

Chateau Les Carmes Haut-Brion 2021

Wine Advocate 94-97pts; Vinous 96-98pts (Galloni), 93-95 (Martin)

Ex-negociant: €80.40/bottle

Ex-London RRP: £474 6x75cl

- Standout performance track record: +122.6% (average all-vintage 5-year return, Wine Searcher)

- Relative value versus current pricing of 2018-2020 vintages with a similar score

Second wine

Carruades de Lafite 2021

Wine Advocate 90-92pts; Vinous 91-93pts (Galloni), 89-91pts (Martin)

Ex-negociant: €160/bottle

Ex-London RRP: £990 6x75cl

- Similar to the Grand Vin above, the 2021 release price represents the lowest priced Carruades in the market.

- Excellent performance track record: +50% (average all-vintage 5-year return, Wine Searcher)

Disclaimer: Past performance is not indicative of future success. Returns were calculated in GBP and may vary depending on exchange rates. Any investment involves risk of partial or full loss of capital. The Cult Wine Investment Performance is a hypothetical tool. The results depicted here are not based on actual trading and do not account for the Cult Wine Investment annual management fees. There is no guarantee of similar performance with an investor’s particular portfolio.

Related Articles

Bordeaux 2024 En Primeur Roundup: A Vintage with Something to Prove

By Aarash Ghatineh

Bordeaux En Primeur 2024 Vintage: A Detailed Analysis

By Tom Gearing