Left Bank First Growths: Value at the Top

Cult Wine Investment has always prioritised building a diverse portfolio including different producers at different category levels.

For Bordeaux, we’ve broken down our producers into five categories – First Growths, Super Seconds, Quality-Price Ratio, and Second Wines. Our 2021 EP Report contains a more detailed description of the categories.

Here, we delve into some of target producers in each category, starting with First Growths and their respective Second Wines.

The First Growths of the Left Bank have long been the pinnacle of Bordeaux, the cornerstone region of the fine wine universe. And today, these châteaux could represent some of the best value among the top tiers of global market.

As the top rung of the Left Bank pyramid, they have long commanded some of the heftiest price tags, as global wine lovers sought their consistent top quality and brand prestige. This has helped Left Bank First Growths perform reliably – 5-year total return of 23.9%1 - even if they’re not normally associated with a bargain.

However, Bordeaux First Growth prices appear relatively accessible in the current market. This stems from Burgundy and Champagne’s dominant performance over the past two years, which has made the steady price appreciation of Bordeaux wines look modest in comparison, especially considering the excellent wines they promise.

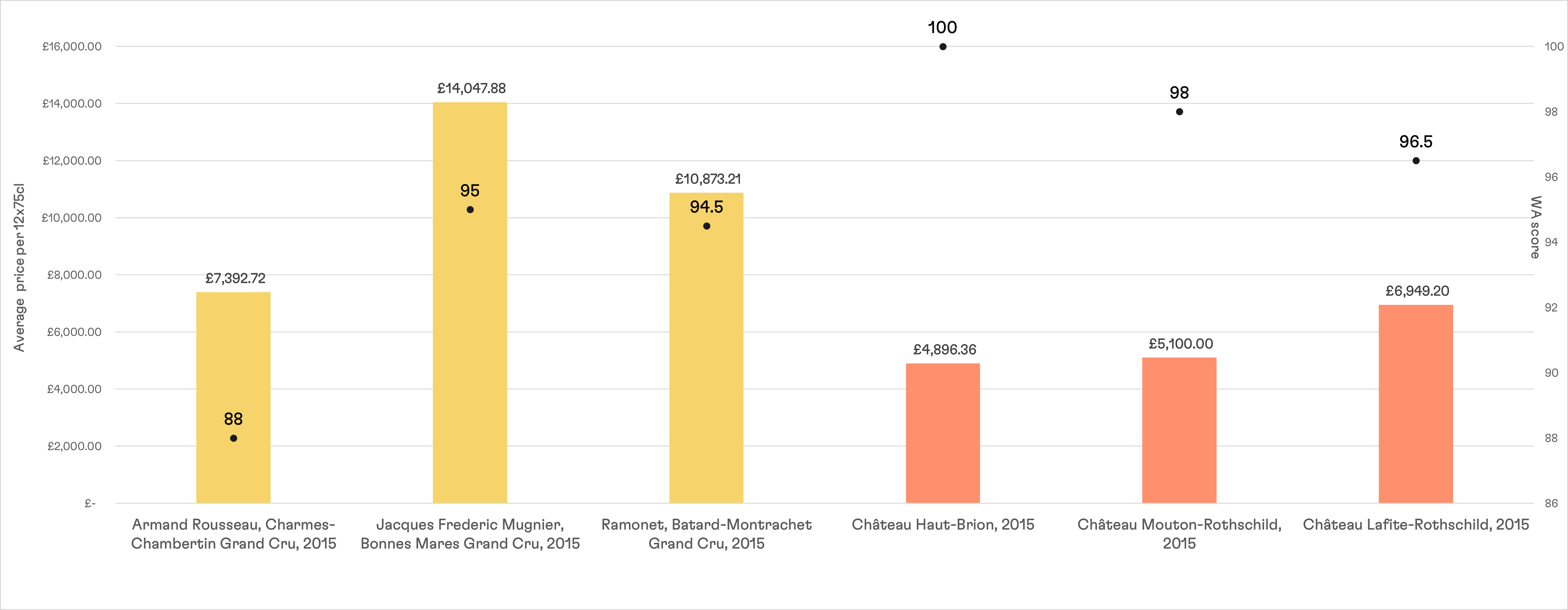

Looking at critic scores backs up this view. Taking the 2015 vintage as an example (chart below), Bordeaux First Growths with perfect or near-perfect critic scores come much cheaper than many Burgundy wines with similar or lower scores.

Figure 1 - Prices & scores of select Bordeaux First Growths vs Burgundy Grand Crus

Source: Pricing data from Liv-ex as of 24 May 2022.

We recognise that these examples are only anecdotal and that other factors impact prices, such as quantity. However, if you’re searching for global iconic wines with high scores, Bordeaux holds some of the better value options, at the moment.

With the current challenging economic backdrop, we also expect buyers will start to favour the more stable segments of the market, such as Bordeaux. This could spur Bordeaux’s top wines to close the gap versus Burgundy peers.

1 Château Lafite-Rothschild

Chateau Lafite Rothschild is a true global icon synonymous with luxury, prestige and amazing wine. Saskia de Rothschild is now in charge after taking over from her father Baron Eric de Rothschild in 2018 to become the 8th generation of the Rothschild family and the first woman at the helm.

Lafite is a consistent performer, as its brand always finds a strong market. But we see reasons why Lafite’s performance could accelerate due to the unusually large price gaps with top wines from Burgundy.

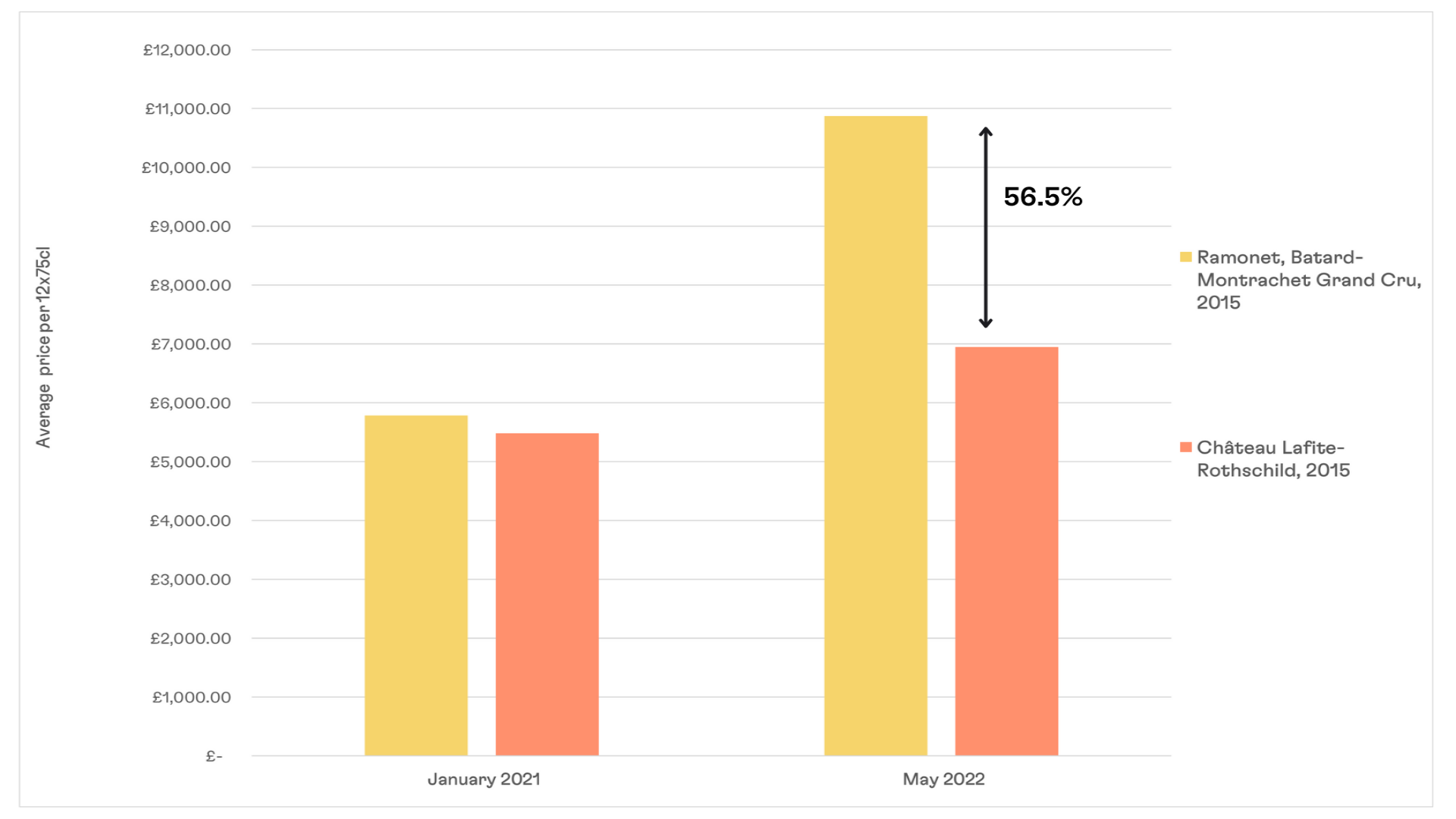

Figure 2 below shows an example of the current large price gap between Bordeaux First Growths and Burgundy by comparing prices of Ramonet, Batard-Montrachet Grand Cru 2015 (94+points, Wine Advocate) and Château Lafite 2015 (96+points, Wine Advocate) at the beginning of 2021 and now. A similar trend is found across different vintages and against different wines in Burgundy. In the months ahead, we believe Lafite can close some of these gaps.

Figure 2 - Price gap signals relative value

Château Lafite vs Ramonet, Batard-Montrachet Grand Cru 2015

Source: Pricing data from Liv-ex as of 24 May 2022.

- Wine Advocate 2021 score: 95-97pts

- Vinous 2021 score: 95-97pts (Galloni); 95-97pts (Martin)

- Performance: 14.4% (average all-vintage 5-year return, Wine Searcher)

Carruades de Lafite

Lafite’s second wine has enjoyed a growing global market in recent years. As a result, Carruades has been Cult Wine Investment’s top performing EP wine over the past five EP campaigns.2

- Wine Advocate 2021 score: 90-92 pts

- Vinous 2021 score: 91-93pts (Galloni); 89-91pts (Martin)

- Performance: 28.4% (average all-vintage 5-year return, Wine Searcher)

2 Château Mouton-Rothschild

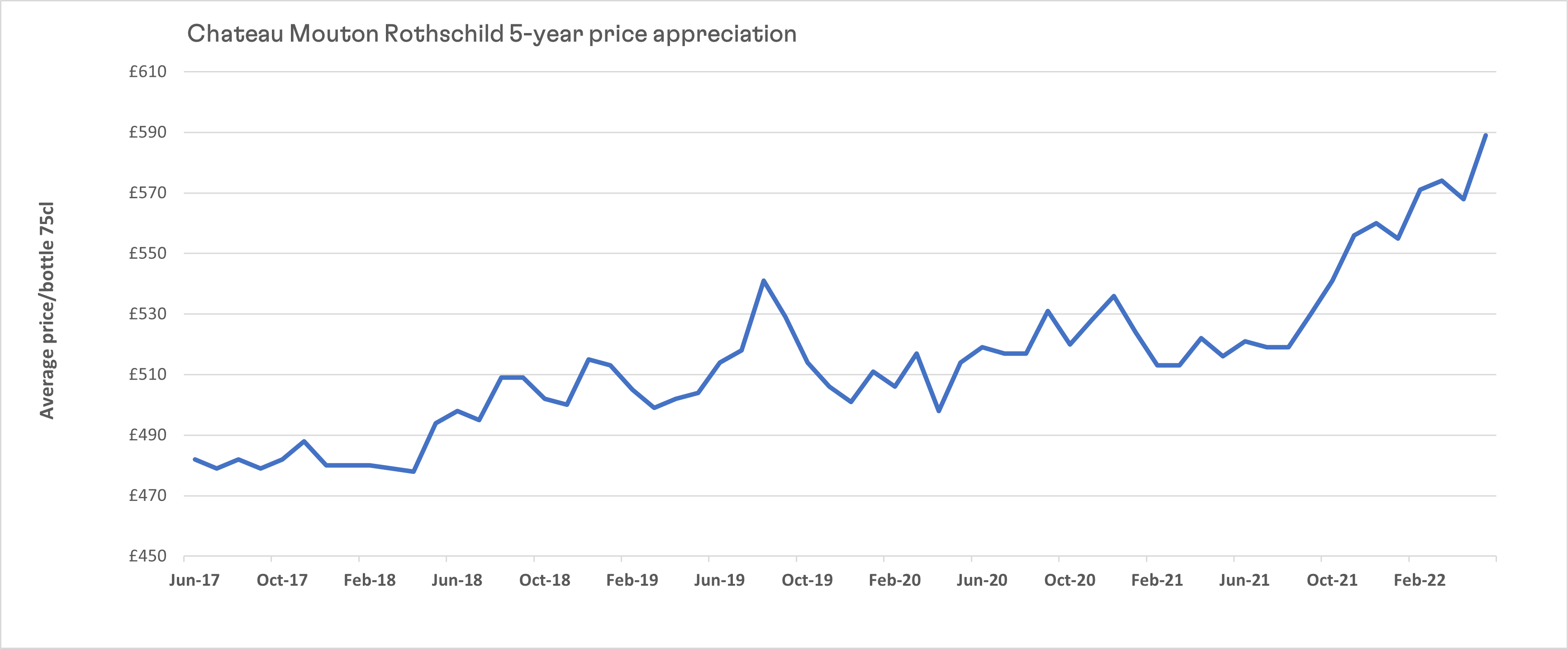

Despite being excluded from the original Bordeaux 1855 classification, Chateau Mouton Rothschild was promoted to First Growth in 1973. Today, its status is unquestioned, as it regularly produces top scoring wines. The bottles for each vintage feature unique labels from global artists, adding to their collectability.

Source: Pricing data from Wine Searcher as of 26 May 2022.

- Wine Advocate 2021 score: 95-96pts

- Vinous 2021 score: 94-96pts (Galloni); 93-95pts (Martin)

- Performance: 22.2% (average all-vintage 5-year return, Wine Searcher)

Le Petit Mouton

Over the past decade, many second wines have posted big returns, much of which were concentrated in the 2016-2018 period. However, Le Petit Mouton has maintained a strong upward trajectory in recent years, indicating this is still a ‘growth’ wine.

- Wine Advocate 2021 score: 89-91 pts

- Vinous 2021 score: 91-93pts (Galloni); 90-92pts (Martin)

- Performance: 60.2% (average all-vintage 5-year return, Wine Searcher)

3 Château Margaux

Margaux is renowned around the world for the quality and elegance of both its Grand Vin and second wine, Pavillon Rouge du Chateau Margaux. The Margaux appellation excelled in 2021 despite the climatic challenges, so it comes as little surprise to see Chateau Margaux post some of the top scores (4th highest WA rating) in 2021 across all of Bordeaux.

Alongside topflight quality, Margaux’s strong presence in Asia helps drive strong demand. Even with the headlines focussing on the mixed quality of 2021 across Bordeaux, Margaux’s line-up will surely see a very competitive market.

- Wine Advocate 2021 score: 95-97+pts

- Vinous 2021 score: 95-97pts (Galloni); 94-96pts (Martin)

- Performance: 24.7% (average all-vintage 5-year return, Wine Searcher)

Pavillon Rouge

Pavillon Rouge has reached a new level of consistent quality over the past decade and its Wine Advocate score in 2021 was among the top for all second wines. Margaux also excelled with its white wine, Pavillon Blanc, which received a 94-96 point score from Wine Advocate, the top end of which would equal the estate’s highest ever score for a white wine.

- Wine Advocate 2021 score: 91-93 pts

- Vinous 2021 score: 91-93pts (Galloni); 90-92pts (Martin)

- Performance: 33.1% (average all-vintage 5-year return, Wine Searcher)

4 Château Haut-Brion

The 2021 Chateau Haut Brion is Wine Advocate’s top scoring Left Bank First Growth, keeping alive a run of high 90s or perfect 100 points from the publication. But this success is nothing new for the only official First Growth outside of the Medoc. Haut-Brion was served at the court of English King Charles I, and Samuel Pepys mentioned drinking 'Ho Bryon' in his diary on 10 April 1663.

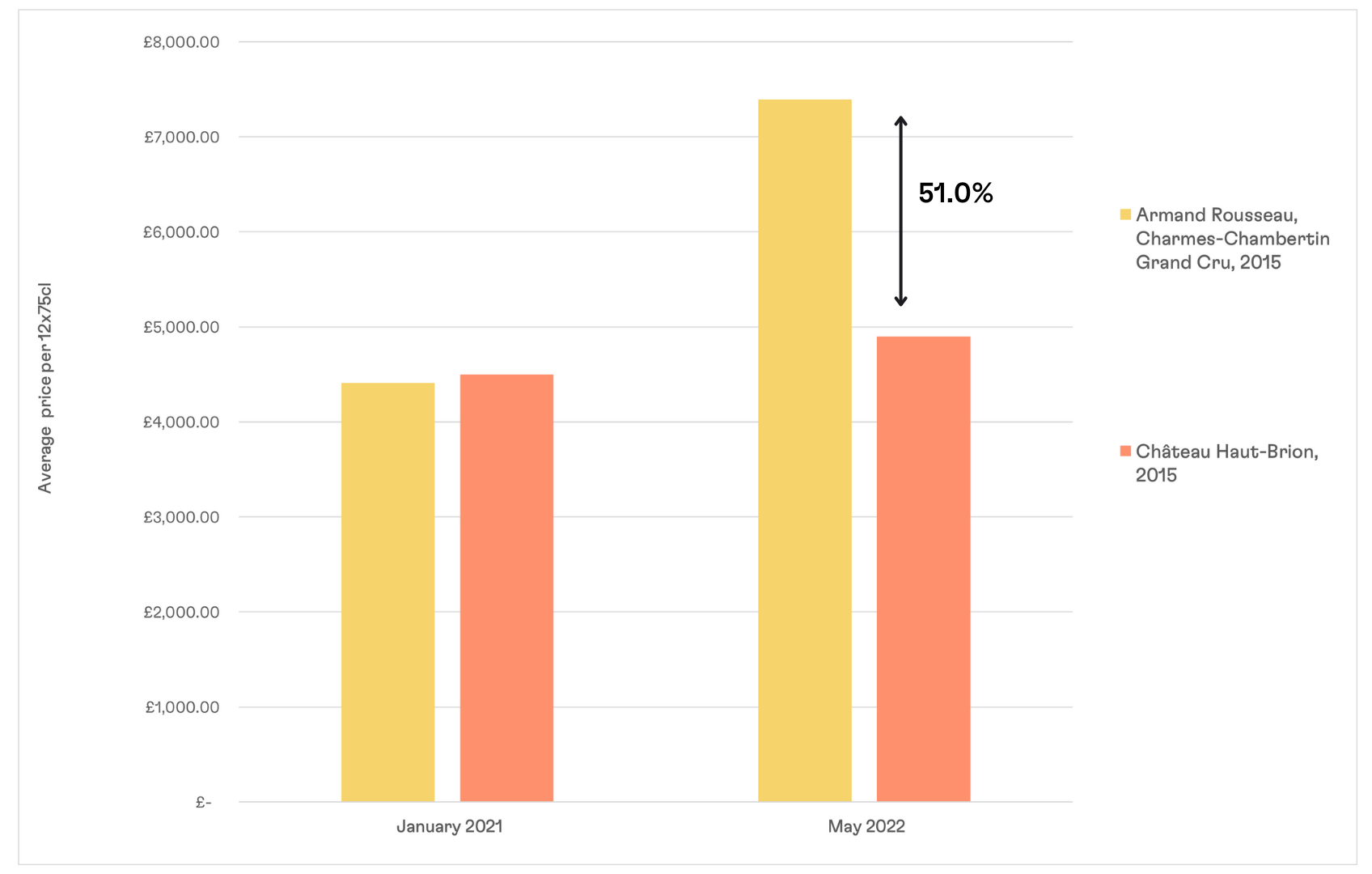

Like other First Growths, the large price gap between Haut Brion and Burgundy peers signals a relative value opportunity (Figure 3 below). The excellent 2021 Haut-Brion could spur interest in both the EP wine as well as top back vintages, such as this 2015.

Figure 3 - Price gap signals relative value

Château Haut-Brion vs Armand Rousseau, Charmes-Chambertin Grand Cru

Source: Pricing data from Liv-ex as of 24 May 2022.

- Wine Advocate 2021 score: 96-98pts

- Vinous 2021 score: 95-97pts (Galloni); 95-97pts (Martin)

- Performance: 17.1% (average all-vintage 5-year return, Wine Searcher)

Le Clarence de Haut-Brion

Haut-Brion’s second wine offers an accessible entry point into the timeless brand and is also made from the same vines on the coveted Pessac Leognan terroir as the Grand Vin.

- Wine Advocate 2021 score: 91-93pts

- Vinous 2021 score: 90-92pts (Galloni); 90-92pts (Martin)

- Performance: 28.9% (average all-vintage 5-year return, Wine Searcher)

5 La Mission Haut-Brion

Chateau La Mission Haut Brion is often described as the unofficial 6th First Growth, hence our inclusion in this top category.

La Mission Haut-Brion regularly flirts with perfect scores yet still comes with a much smaller price tag compared to other First Growths including its neighbour Château Haut-Brion, which is also owned by Bordeaux powerhouse Clarence Dillon.

We’ve discussed above how Bordeaux First Growths represent potential relative value opportunities in the current market. Therefore, La Mission could form the most attractive buy of the bunch in terms of stellar quality wine for a relatively accessible price.

- Wine Advocate 2021 score: 94-96pts

- Vinous 2021 score: 92-94pts (Galloni); 93-95pts (Martin)

- Performance: 9.1% (average all-vintage 5-year return, Wine Searcher)

La Chapelle de la Mission

- Wine Advocate 2021 score: 90-92pts

- Vinous 2021 score: 89-91pts (Galloni); 89-91pts (Martin)

- Performance: 29.0% (average all-vintage 5-year return, Wine Searcher)

1 30 Apr 2017 - 30 Apr 2022; calculated using Liv-ex pricing from 2006-2015 vintages of Left Bank First Growths. Past performance is not a guarantee of future returns. The performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The Cult Wine Investment Performance is a hypothetical tool. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wines customer which ranges from 2.95% to 2.25% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.

2 21% average compound annual growth rate of CWI’s EP purchases of Carruades from 2015-2020 EP campaigns.