Fine wine Q4 outlook – My view on the current market

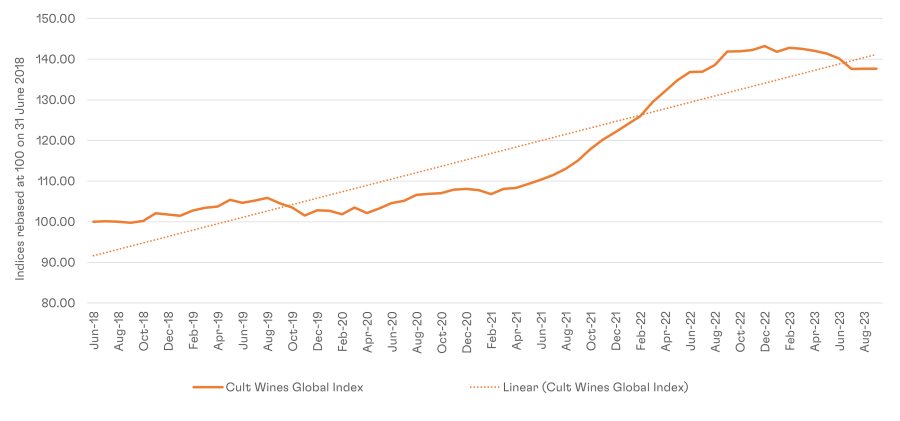

Over the last 9 months, the fine wine market has declined by -3.90% according to the Cult Wines Global Index[1]. Whilst this appears as a mild correction across a well-diversified index, some individual wines have seen some more severe price adjustments following the strong rally we experienced between 2020 and 2022.

Even if this current slowdown persists a little longer, history indicates that, over the long-term, those periods of consolidation provide good opportunities to accumulate. However, not everyone is able to deploy funds and some investors need to free up cash or are still looking to take profits after the rally.

In this article, I would like to address two topics which are intrinsically linked:

- As a holder, where do I find liquidity in the current market and at what price?

- As a new or existing investor, is this a good time to enter the market?

Fine wine in 2023 – How to approach fine wine in the current corrective period?

After two years of strong performance, the fine wine rally has hit a bit of a bump. There’s no avoiding the fact that wine prices in 2023 are down, -3.90%, according to the Cult Wines Global Index, with all regional indices in negative territory (as of 30th September 2023).

This decline must be kept in perspective – fine wine is a long-term investment, with a strong diversification profile, and the figures still look favourable from this vantage point. The 3-year and 5-year returns are 28.80% and 38.1%, respectively[2] with a 5-year volatility of 1.1%.

Figure 1 – Cult Wines Global Index rebased June 2018

Source: Cult Wines Global Index based on Wine-Searcher.com pricing

Corrective periods can be healthy stages of a full market cycle as sellers seek to take profit from previous periods of growth and buyers consider entry points to the market. As we have seen a pause in negative returns in the past two months, is it time to take advantage of the recent stability to sell or are we on the cusp of another cycle up-trend?

Why fine wine prices are on the backfoot?

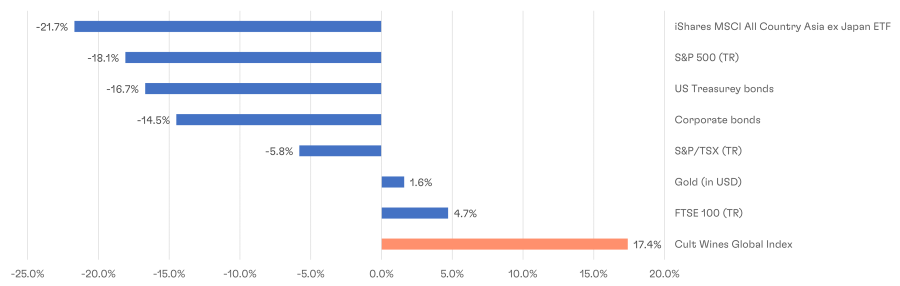

Fine wine outperformed all asset classes between 2020 and 2023 – a natural period of price consolidation was likely given the pace of the rally (two-year return of +32.85% from Jan 2021-Jan 2023[3]).

Whilst in 2022 the financial markets were spooked by inflation, fine wine continued to perform.

Figure 2 – Fine wine vs. major financial assets in 2022

Source: Investing.com. Pricing data as of 30 September 2023

But ultimately macroeconomic conditions cannot be ignored. Even though fine wine’s track record shows a low correlation to wider market sentiment, cost-of-living, rising interest rates and economic growth concerns finally hit. As we wrote in our June 2023 flash report the two main macro headwinds affecting the wine market are as follows:

- Interest rates: Higher interest rates may prompt some investment-minded buyers to favour cash or fixed-income investments, which offer healthier rates of return.

- Foreign exchange rate: The British pound has recovered in 2023 after a plunge to new lows in autumn 2022. As of 30 September 2023, sterling had appreciated 9.3% against the US dollar over a year.

Figure 3 – Sterling strengthening

GBP/USD exchange rate (30 Sep 2022 – 30 Sep 2023)

Source: Investing.com. Pricing data as of 30 September 2023

One additional factor is the lack of rebound in demand from Asia post-COVID restrictions and, in particular, China – the ongoing concerns about the Chinese economy have affected demand for the two benchmark fine wine regions of Burgundy and Bordeaux.

The current outlook

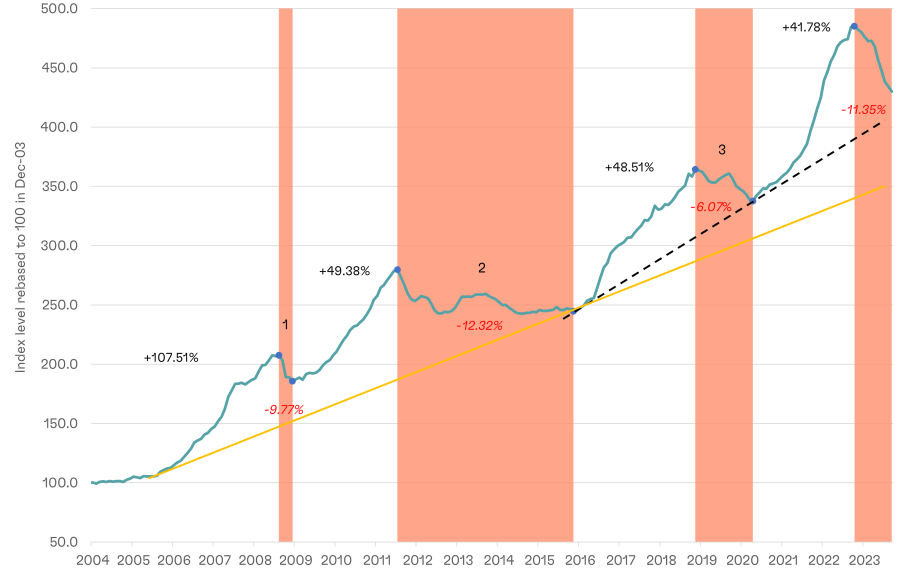

The current fine wine correction is steep at -11.35%[4] over the last 12-months according to Liv-ex and reminiscent of the one experienced at the onset of the Financial Crisis of 2008 when prices dropped by close to 10% in a matter of months (Liv-ex 1000 figures as per below chart).

Whilst each period is different, both followed a quick rise in interest rates leading to a re-pricing of global assets.

Figure 4 – Fine wine long-term performance

Liv-ex 1000 rebased at 100 1st Jan 2004

Source: Liv-ex. Pricing data as of 30 September 2023

However, the likelihood of a long period of very low-interest rates similar to the one that followed the Great Recession of 2008-2009 is low. So where does that leave us?

Risks – Uncertainty is the operative word regarding fine wine’s near-term outlook. The length and scale of the 2020-2022 rally mean that wine prices are still comfortably higher than they were in early 2020. Consequently, there is room for ongoing choppy price performance in the months ahead and no guarantee of a quick turnaround.

High interest rates and economic uncertainties are likely to remain obstacles in the coming months, The strong British Pound might form a drag on demand from non-UK buyers. Most physical fine wine stocks are denominated in Sterling, which means they become more expensive when GBP appreciates relative to the US dollar or other currencies.

The bottom of the current correction is difficult to predict as we are still above the long-term trend line (in yellow in the chart above) so there is room for some further adjustment in prices.

Ultimately, it is important to remember that the current “crisis” is not specific to fine wine – unlike in 2011-2014 when it was triggered by a Bordeaux price bubble.

Opportunity – Inflation appears to be easing in most major economies and, so far, the market seems to be adapting to the return of the new “normal” of interest rates of 3 to 5, which was the environment we had pre-2008.

Some wines have seen price adjustments far more significant than suggested by the indices – the Bordeaux market, in particular, has seen a notable drop in prices, with some of the First Growths experiencing a decline of approximately 15% or more YTD: Chateau Lafite Rothchild 2017 is currently trading at £2,850 per 6 when it was comfortably selling at £3,200 to £3,300 in December 2022.

In any market, corrections are necessary for the trend to continue and fine wine is no exception.

This correction has been steep, however, and when a market sells off the quality of assets gets often disregarded in the search for liquidity and this can provide great entry points for the keen buyer and astute investor. For example, Chateau Rayas, one of the most collectable and highly sought-after producers in the Rhone region, saw its 2009 & 2011 vintages dropping more than 30% YTD.

Liquidity

As with many Alternative Assets, fine wine has its own liquidity dynamics. There is no instant, public market and execution requires finesse: distribution network and access to buyers, a global footprint and expertise such as Cult Wines’.

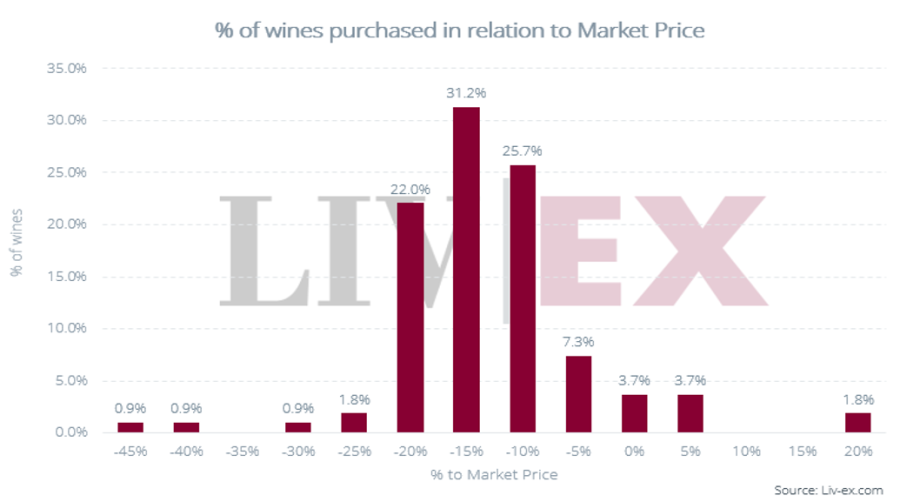

Realised and cleared prices often come at a discount to valuation, especially in a challenging market. This recent chart from Liv-ex shows that 79% of transactions on their platform in 2023 were executed between -10% and -20% below their official market prices.

Figure 5 – Fine wine transaction prices on the Liv-ex platform vs market price

Source: Liv-ex. Pricing data as of 30 September 2023

This suggests that there is liquidity but… at a price – and that the best execution requires time – selling fast requires flexibility on pricing. For a seller, this needs to be considered carefully.

Fine wine is now a buyer’s market

To reap the rewards of fine wine investment, it is often best to ride out the lows and avoid trying to time the market to perfection.

The current market, in my view, presents great opportunities for new and seasoned wine investors alike – I believe this is a buyer’s market as we have seen a significant correction in prices whilst the long-term trend is still intact. Even if this current correction persists a little longer, history indicates that when fine wine prices do turn, they might turn quickly. As with most financial assets, trying to precisely time the fine wine market is often a fool’s errand. And fine wine assets are difficult to access quickly.

The nature of the fine wine market means this period should be used to source and acquire long-term opportunities. It won’t be an easy period as prices might remain volatile but it’s a classic case of when you look in the rear-view mirror, those prices might not be around anymore and the current drop will look like a blip in the long-term trend.

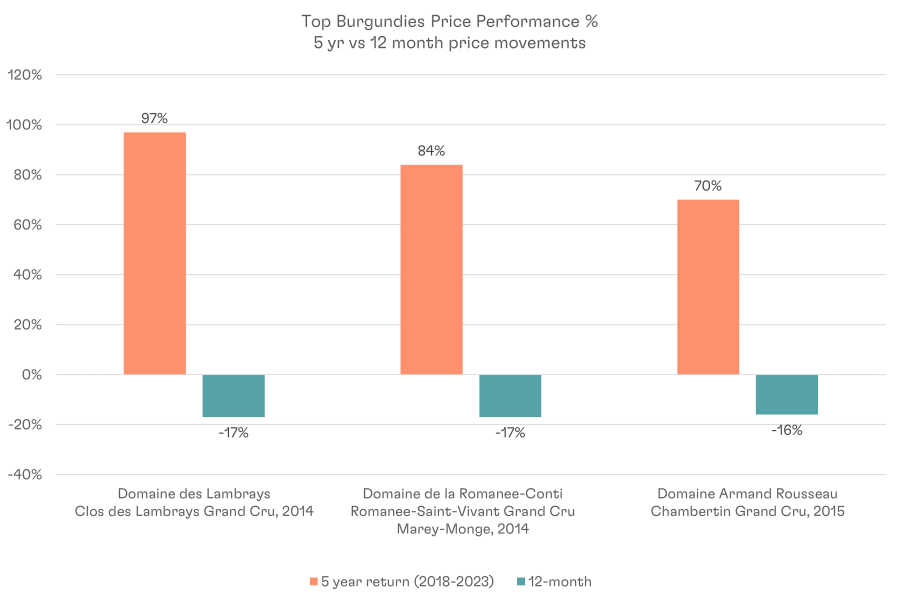

Figure 6 – Sample Burgundy wines performance over 5-year and 12-months

Source: Liv-ex: Pricing data as of 30 September 2023

Therefore, I view the current backdrop as a chance to identify entry points and accumulate great assets if you follow the four rules below:

- Buy the best quality names and vintages that have sold off

- Buy the wines that have been most oversold

- Use the best data and analytics to research and price

- Focus on the long term: the trend is your friend

A good example of the above is Domaine de la Romanee-Conti, Romanee Conti Grand Cru 2019, scored a perfect 100 by the Wine Advocate and Neal Martin, which has dropped in price by 22.7% year to date according to Wine-Searcher data.

Disclaimer: Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.

[1] Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014. Prices are calculated in GBP and results may vary in other currencies.

[2] Cult Wines Global Index based on Wine-Searcher.com pricing.

[3] Cult Wines Global Index based on Wine-Searcher.com pricing.

[4] Liv-ex 1000