September 2023 Flash Report - Fine wine downturn slows down

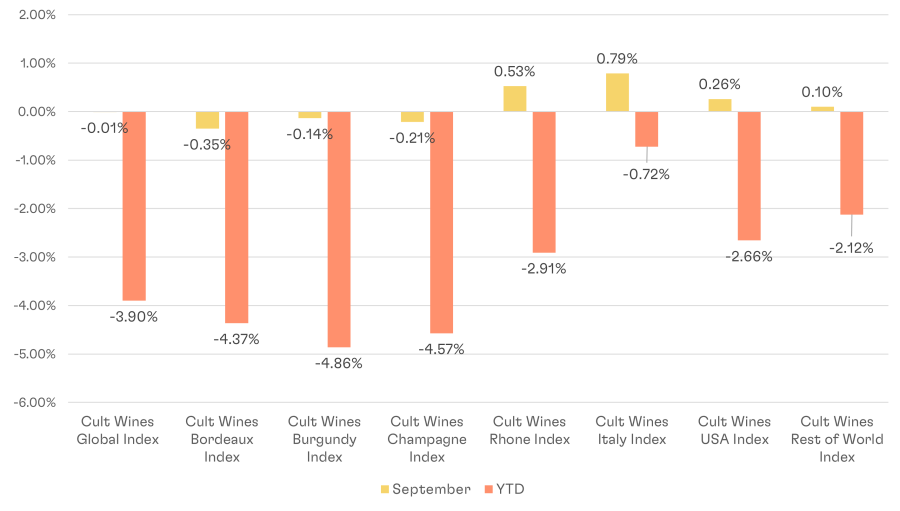

Cult Wines Indices – Returns as of 30th September 2023

Source: Pricing data as of 30 September 2023. Cult Wines Indices are an objective measure of the global fine wine market based on Wine-Searcher pricing data and rebalanced annually based on strict liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

Fine Wine markets continued to stabilise in September with another month of flat performance amongst mixed trading across regions. Cult Wines Global Index was stable at -0.01%, bringing the YTD slump to -3.90%.

Whilst it might be too early to call for the end of the correction experienced since beginning of the year, the outlook for inflation and rates seems to have improved on the macro side and some interest has come back to the asset class driven by bargain hunters.

The price declines were moderate for the three main French regions – Burgundy, Bordeaux and Champagne – whilst other regions clocked some moderate growth.

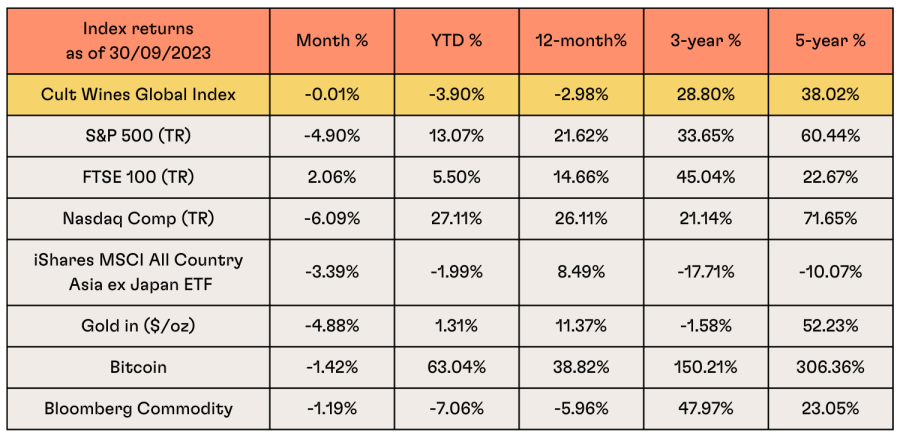

Macro market summary

Source: Investing.com, Wine-Searcher as of 30 September 2023. Past performance is not indicative of future returns. *Volatility = Rolling 5-year standard deviation of monthly returns.

Stock markets and other risk assets had a tough month despite falling inflation, it is perceived that rates across the globe will be higher for longer. Expectations of rate cuts in 2024 are now curtailed and economic growth and employment data remained healthy in the US.

UK stock market bucked the trend as it was supported by banking and energy stocks: interest rates and oil price rises benefited both.

Concerns about Chinese economy and the wider pacific region weighed on shares in Asia.

In Fixed Income, 10y government bond returns were negative across developed markets as yields rose over the quarter: US 10y – 4.61% and Germany 10y – 2.93%.

Commodities saw oil up by 10% and Gold declined by 5%.

Burgundy En Primeur 2022 Vintage Report

Cult Wines' comprehensive analysis of the Burgundy En Primeur 2022 vintage offers crucial insights, delving into the quality, availability, and investment potential of this exceptional vintage. Download the report today!

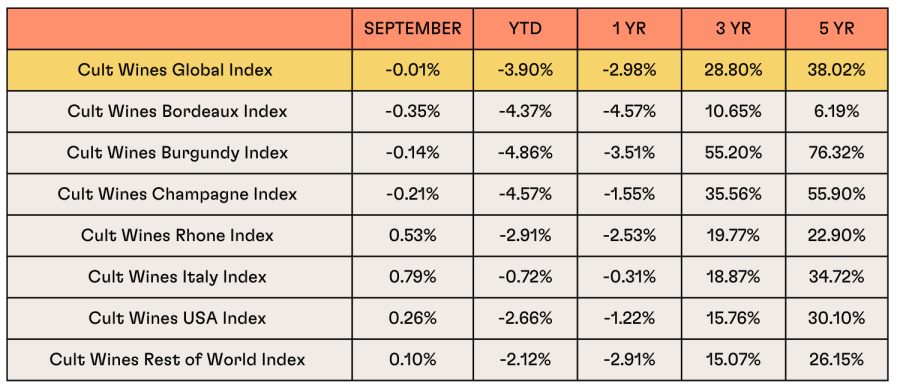

Regional wine performance detail

Source: Pricing data from Wine-Searcher as of 30 September 2023. Based on average across all vintages of wines contained in Cult Wines Indices, which are rebalanced regularly based on strict, objective liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

- The Cult Wines Bordeaux Index mildly declined 0.35% in September. Trade in the region continued to suffer from lack of appetite from Asian market and strong British Pound. Certain Bordeaux First Growths faced headwinds in the market, leading to a decline in prices, whilst Leoville Barton from the Super Second category saw substantial gains in September, with 2015 experiencing a remarkable price surge nearing 10%.

- The Champagne and Burgundy indices continue to consolidate after retracing from the heights hit in late 2022 with moderate losses for September. Interest is coming back to the market after some price corrections. Perrot Minot & Joseph Drouhin from Burgundy have continued their ascent as global demand for their labels surged. While grower Champagne have been more affected by the downturn, vintage Champagne from Grand Marques houses have shown more resilience in terms of price performance. Among the September’s winners are Egly-Ouriet, Brut Millesime Grand Cru 2002 (+10%), Perrier Jouet, Belle Epoque 2014 (+7%) & Cristal Rose 2008 (+5%).

- Cult Wines Italy Index was the best performing index in September with strong showing from both Tuscany and Piedmont. Interest was widespread supported by strong demand from USA. Investors who diversified their portfolios with Bruno Giacosa & Tignanello labels reaped the rewards as these producers outperformed the broader wine market.

- Cult Wines USA index continues to show stability with both domestic demand and a favourable GBP/USD fx rate supporting interest.

- Characterised by a lack of significant price movement in key wine categories, Cult Wines ROW index remained relatively stagnant with a 0.1% monthly return. Chile & Argentina have experienced mixed results, while certain names from Spain managed to maintain their value. Vega Sicilia, for example, held up well due to strong brand recognition and increased global demand, with its Unico 2011 and Alion 2014 & 2012 performing well YTD.

2023 Wine Performance League Table – YTD Return % Across Vintages

Source: Pricing data from Wine-Searcher as of 30 September 2023. Based on average across all vintages of wines contained in Cult Wines Indices, which are rebalanced regularly based on strict, objective liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014. The Indices are separate from Cult Wine Investment Performance which tracks wines purchased by Cult Wine Investment.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.