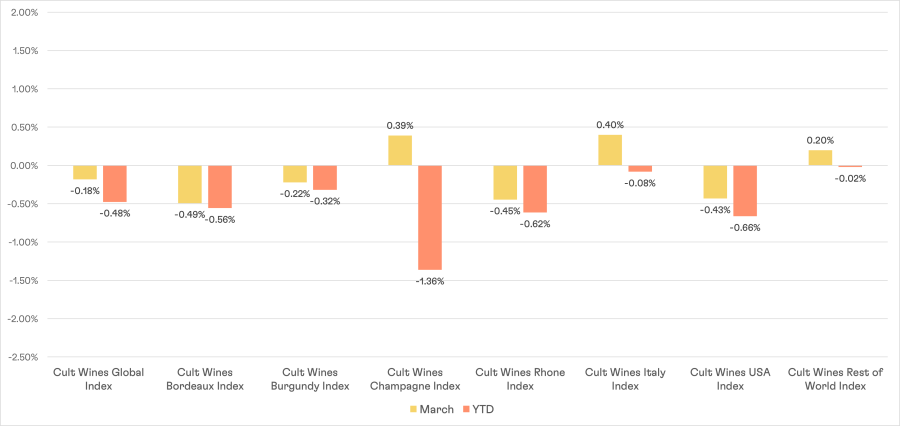

March 2023 Flash Report - Mixed direction for fine wine market

Cult Wines Indices – Returns as of 31 March 2023

Source: Pricing data as of 31 Mar 2023. Cult Wines Indices are an objective measure of the global fine wine market based on Wine-Searcher pricing data and rebalanced annually based on strict liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

Fine wine markets edged lower in March, as measured by the Cult Wines Global Index, to conclude a choppy first quarter in the wake of the long rally in 2021-2022. After a January decline, wine prices rebounded with a strong February (+0.70%) before sliding back again slightly in March.

Regional performance reflects this mixed direction. Some regions (Champagne, Italy) saw healthy gains in March while others declined, often in a reversal of their performance in February.

The choppy performance is likely due to some increased buyer selectivity as people gauge the sustainability of the price rises of the past few years. It also suggests relative value across regions and individual producers is playing a greater role; regional drops are quickly followed by a rebound and vice-versa.

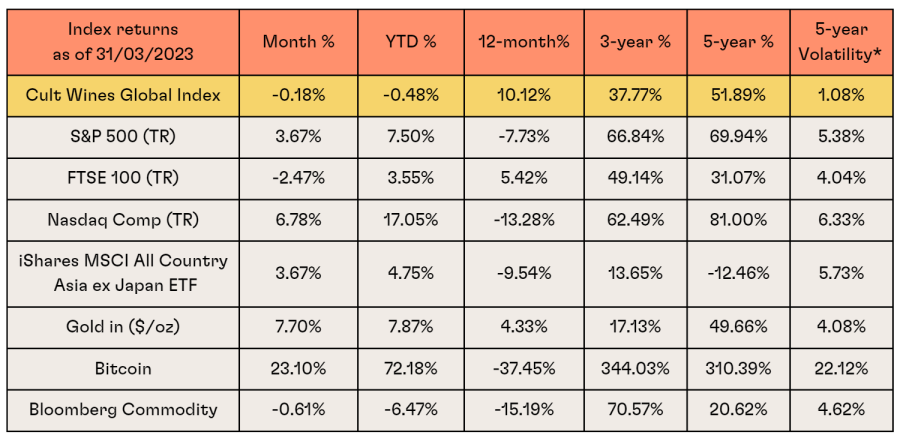

Macro market summary – Strong finish overcomes volatile month

Source: Investing.com, Wine-Searcher as of 31 Mar 2023. Past performance is not indicative of future returns. *Volatility = Rolling 5-year standard deviation of monthly returns

Concerns of a banking crisis triggered a renewed bout of financial market volatility in March. The failure of Silicon Valley Bank and another US regional bank sparked fears of contagion, sending equities and other risk assets globally to multi-month lows. Bond markets rallied amid the flight to safety.

The situation had calmed by month’s end, allowing equity markets to recover. Sentiment also improved as the February US inflation release showed the year-on-year rate had eased. This boosted optimism that the Federal Reserve could pause its tightening cycle in the coming months.

The British pound ended the month stronger against the US dollar, partly due to expectations that the Fed would ease its monetary policy. Additionally, better-than-expected UK economic data suggest the country may avoid a technical recession. However, the banking sector turmoil as well as year-on-year inflation escalating in February meant UK stocks underperformed.

Regional wine performance detail

- The Cult Wines Italy Index delivered the biggest monthly gain (+0.40%) in March. Many Italian wines offer excellent relative value compared to French counterparts and could benefit as buyers seek to maximise value in a mixed macroeconomic backdrop.

- Recent Super Tuscan and Piedmont releases drew increased interest to the region and led to a repricing of back vintages. The new Tignanello 2020 offers appealing relative value for long-term performance, but it was the 2007 that emerged as the top March performer (+34.7%). The 2015 Giuseppe Mascarello e Figlio Monprivato, Barolo contributed an impressive 26.8% jump.

- The Cult Wines Champagne Index recovered (+0.39%) after declines in January and February. Demand remains strong for scarce back vintage Champagnes, helping the recovery. A 22.5% monthly gain for 1997 Cristal and a 17.4% rise for 2002 Ruinart Blanc de Blancs led the way in March.

- The Cult Wines Bordeaux Index provided an example of the choppy overall market as its March decline (-0.49%) came in the wake of a strong February (+0.45%). The drop could also stem from people taking profits and freeing-up cash ahead of the 2022 En Primeur campaign, which many expect to be an exceptional vintage.

- The Cult Wines USA Index fell (-0.43%) in March, as prices settled following a spike in February (+1.48%). The strong British pound versus the US dollar may have also been a factor. Cult Wines Indices are denominated in GBP and a larger proportion of US wine prices will be denominated in US dollars, which would equate to a lower figure when GBP strengthens.

- Rhone wines also traditionally have a strong presence in the North American market, meaning the weaker dollar may have played into the Cult Wines Rhone Index March drop.

- Burgundy is another region where prices are fluctuating – the Index declined in March (-0.22%) after a February gain (+0.99%). Domaine Drouhin Laroze claimed both the best (2007 Chambertin-Clos de Beze Grand Cru +39.1%) and worst (2013 Chapelle-Chambertin Grand Cru -19.9%) performing wines of the month, further evidence that the current mixed market is linked to people seeking out the best relative value opportunities rather than deteriorating demand overall.

2023 Wine Performance League Table – YTD Return % Across Vintages

Source: Pricing data from Wine-Searcher as of 31 Mar 2023. Based on average across all vintages of wines contained in Cult Wines Indices, which are rebalanced regularly based on strict, objective liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

- A handful of excellent, good-valued wines continue to feature among the best year-to-date performers, indicating that a focus on relative value opportunities is paying dividends in the current market.

- Artadi Pagos Viejos remains the top performer after one quarter, while Remirez de Ganuza Reserva also continues to appreciate, demonstrating the potential of Rioja.

- However, Guidalberto closed the gap in March, helped by attention around the recent release of the high-quality 2021 vintage. This Tuscan Merlot-based wine of Tenuta San Guido is generating more appreciation as a serious, age-worthy wine in its own right rather than just a second label to Sassicaia.

- However, up-and-coming names aren’t the only drivers of the 2023 market. Three Champagnes leapt into the top 10 in March amid the rebound in the region. Strong market fundamentals based on a persistent supply-demand imbalance for vintage Champagne remain intact, demonstrated by the impressive YTD performance of Laurent Perrier, Brut Millesime and Billecart-Salmon, Vintage wines.

- A surprise appearance came from Cullen’s Diana Madeline, a Bordeaux-blend from Margaret River that has seen critic scores steadily improve over the past decade.

Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014. The Indices are separate from Cult Wine Investment Performance which tracks wines purchased by Cult Wine Investment.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.