Bordeaux’s Second Wines – 5 key targets for EP 2022

“It is also worth noting that the quality of second wines is especially high (in 2022).”

– William Kelley, The Wine Advocate

Second Wines have been a not-too-well-kept secret in Bordeaux in recent years, representing some of the most compelling buys for two principal reasons:

- More accessible entry points for what are usually excellent quality wines from some of the biggest brand names in all of fine wine.

- Second Wines have produced some of the most lucrative investments in recent years.

Before delving into the market outlook, it is important to refresh the definition of Second Wines, recently explained in depth in our newsletter Cult Insider. In short, wines made by Bordeaux’s classified growths that come from the same terroir as the Grand Vin and made in the same facility by the same winemaking teams fall under the Second Wine category. Sometimes estates dedicate separate vineyard parcels or, occasionally, separate winemaking facilities for their Second Wines. These often get referred to as Second Label wines. However, for the analysis in this article, we will group these two categories together under the ‘Second Wines’ umbrella term.

Second Wines – why the hype?

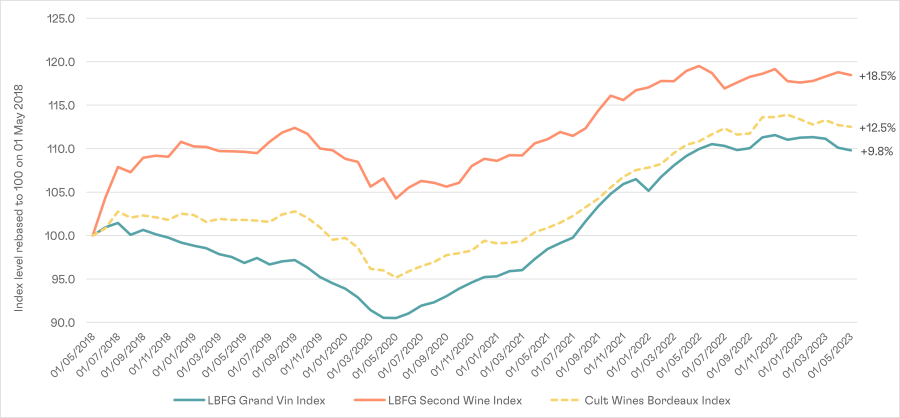

Second Wines have a strong recent history in terms of good-valued EP purchases that go on to outperform the wider Bordeaux market. Going back five years, Second Wine performance jumped due to a strong post-release rally following the EP campaign for the 2016 vintage. The category has since maintained its edge versus both Grand Vins and the larger Bordeaux base.

Figure 1 – Post-EP bounce in 2018 drives Second Wines’ outperformance

Second Wines vs Grand Vins and Cult Wines Bordeaux Index (May 2018-May 2023)

Source: Pricing data from Wine-Searcher.com as of 30 Apr 2023. Past performance is not a guarantee of future returns. First Growth and Second Wines indices includes all left bank First Growth and their second wines, respectively. Cult Wines Bordeaux Index based on Cult Wines Indices.

More in the tank

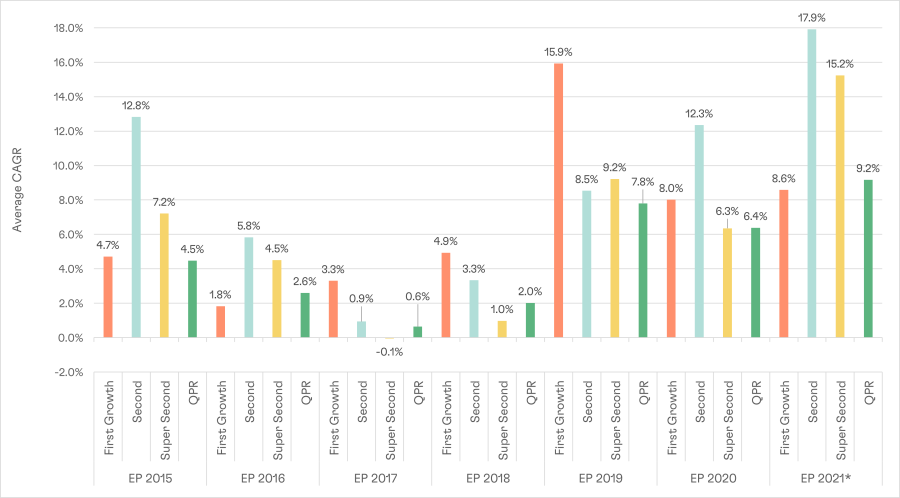

Although the overall performance of Second Wines has been more in line with the Bordeaux market at large in recent years, the Second Wine category has been Cult Wine Investment’s top performer in the past two EP campaigns. Part of this success stems from a selective approach, but it also indicates Second Wines are again becoming one of the most compelling EP buying opportunities as they were back in the 2015 and 2016 vintage campaigns.

Figure 2 – Second Wines back at the top of EP performance

Cult Wine Investment EP CAGR by category – 2015–2021 EP campaigns

Source: Pricing data from Wine-Searcher.com as of 31 Mar 2022. Past performance is not a guarantee of future returns. CAGR = compound annual growth rate of purchases made between 01 April and 30 June (except for EP 2019, which includes purchases made between 01 May and 31 July due to COVID delay) of EP campaigns for 2015-2021 vintages.

We see reasons why this momentum should carry over into the new 2022 EP campaign. A common theme amongst most commentators about the 2022 vintage is that there has been a “partial flattening of the hierarchical pyramid” (Neal Martin, Vinous), with some Second Wines offering Grand Vin-level quality and ageing ability.

In addition to this hype around quality, the Second Wines category could take a greater share of demand this year due to the wider market backdrop. Buyers have shown signs of increased price sensitivity amid the general appreciation of fine wine prices alongside the macroeconomic cost-of-living concerns. Under-the-radar producers will likely be one beneficiary of this trend, but big brands still hold sway. Second Wines represent accessible ways to access the prestige of these iconic names during a year when quality came from all levels of the hierarchy. Added demand could translate to onward performance.

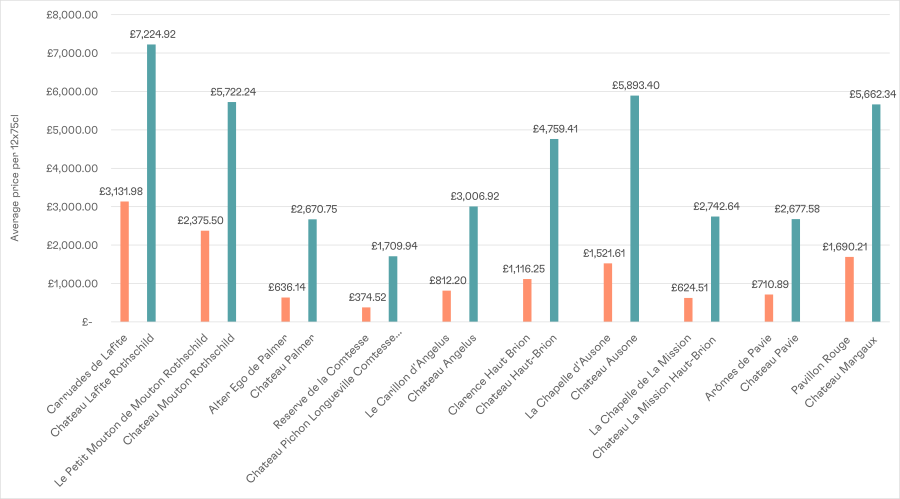

Figure 3 – Average prices of select Grand Vins and Second Wines

Source: Pricing data from Wine-Searcher.com as of 01 May 2023. Prices are averages of vintages 2016-2020.

Still, a selective approach that factors in wine quality and relative value against a producer’s Grand Vin and the wider market can help improve performance potential. Although most wines haven’t yet hit the market, here is a rundown of some of the top Second Wines we are anticipating among the 2022 EP releases.

Carruades de Lafite

- 91-93pts - 2022 score from William Kelley, The Wine Advocate

- 17.8% - average CAGR of CWI’s EP purchases[1]

- 43.6% of Grand Vin price (Wine-Searcher.com as of 01 May 2023)

Chateau Lafite’s Second Wine ticks many boxes as a great EP release: iconic brand name, top quality wine from the same terroir as the Grand Vin, and a track record of attractive release prices. As such, Carruades has posted some of the highest returns across the entire Bordeaux market.

The 2022 Carraudes looks to carry on this tradition with excellent scores and a release price (£1,128/6x75cl) that makes it the cheapest Carruades on the market. Carruades contains a higher portion of Merlot than Lafite’s Grand Vin that comes from specific plots within the estate’s terroir.

Le Petit Mouton

- 92-94pts - 2022 score from Neal Martin, Vinous (no WA score)

- 10.8% - average CAGR of CWI’s EP purchases[2]

- 41.5% of Grand Vin price (Wine-Searcher.com as of 01 May 2023)

Le Petit Mouton offers a more affordable access point for a wine that brings a similar profile and the same brand power of First Growth Chateau Mouton Rothschild. Consequently, Le Petit Mouton’s CAGR sits second only to Carruades de Lafite among Cult Wine Investment’s EP purchases from the 2015-2021 EP campaigns.

Although its price ratio against the Grand Vin has narrowed, the 2022 Le Petit Mouton offers upside from its high scores. The 92-94 points range could ultimately make it the top scored Le Petit Mouton ever from The Wine Advocate.

Alter Ego

- 91-93pts – 2022 score from William Kelley, The Wine Advocate

- 10.7% - average CAGR of CWI’s EP purchases[3]

- 23.8% of Grand Vin price (Wine-Searcher.com as of 01 May 2023)

Made from dedicated parcels, Alter Ego de Chateau Palmer delivers a unique profile to the Grand Vin. Its 2022 EP release price is not yet out, but Alter Ego and other Second Wines of non-First Growth producers could drive the next wave of price appreciation within the Second Wine category. Their prices are typically around 20%-25% of their respective Grand Vin prices, compared to over 40% for the likes of Carruades de Lafite and Le Petit Mouton.

La Reserve de la Comtesse

- 91-93pts - 2022 score from Neal Martin, Vinous (no WA score)

- 5.7% - average CAGR of CWI’s EP purchases[4]

- 21.9% of Grand Vin price (Wine-Searcher.com as of 01 May 2023)

Chateau Pichon Longueville Comtesse de Lalande received huge attention this year as its 2022 comes near the top of many critics’ ratings. This hype around the Grand Vin should also generate more interest in the impressive Second Wine, La Reserve de la Comtesse.

The price ratio vs the Grand Vin is one of the most appealing among the leading estates, meaning Le Reserve de la Comtesse wines could start to post bigger returns in the coming years.

Pavillon Rouge du Chateau Margaux

- 92-94pts - 2022 score from William Kelley, The Wine Advocate

- 5.4% - average CAGR of CWI’s EP purchases[5]

- 29.9% of Grand Vin price (Wine-Searcher.com as of 01 May 2023)

Chateau Margaux’s Pavillon Rouge often nets some of the highest scores among Second Wines, hitting the mid-90s with regularity including in 2022 if re-scored at the top of its range.

Relative to Margaux’s Grand Vin, Pavillon Rouge prices are less than a third of the price of the Grand Vin on average, an appealing ratio for a First Growth estate. This relative value opportunity and big score for the 2022 could make this one of the smarter buys of the 2022 EP campaign depending on where its release price lands.

Want to register your interest?

Did you know our selections for Bordeaux have returned +58.3% on average since January 2014?

[1] Pricing data from Wine-Searcher as of 31 Mar 2022. Past performance is not a guarantee of future returns. CAGR = compound annual growth rate of Cult Wine Investment purchases made between 01 April and 30 June (except for EP 2019, which includes purchases made between 01 May and 31 July due to COVID delay) of EP campaigns for 2015-2021 vintages.

[2] Ibid.

[3] Ibid.

[4] Ibid.

[5] Ibid.

Related Articles

Bordeaux 2024 En Primeur Roundup: A Vintage with Something to Prove

By Aarash Ghatineh

Bordeaux En Primeur 2024 Vintage: A Detailed Analysis

By Tom Gearing