Burgundy’s icons: The foundation of long-term gains

Burgundy has become a champion region for fine wine investors on the back of its iconic wines. Domaine Leroy, Jayer, Rousseau, Romanee-Conti are among the most sought-after names by collectors, investors and wine lovers around the world.

Several producers within our Iconic category drove Burgundy’s huge returns over the past year. Cult Wine Investment’s Burgundy index returned 24.6% in 2021 but our Iconic wine selections shot up by 36.8%. This outperformance did not come as a surprise as we recognised how the improving economic backdrop benefitted these most prestigious segments of fine wine.

Cult Wine Investment Iconic Producer Category

- Domaine Armand Rousseau

- Coche Dury

- Domaine du Comte Liger-Belair

- Domaine D’Auvenay

- Domaine Leflaive

- DRC

- Ponsot

- Prieure Roch

- Ramonet

- Sylvain Cathiard

Long term foundations

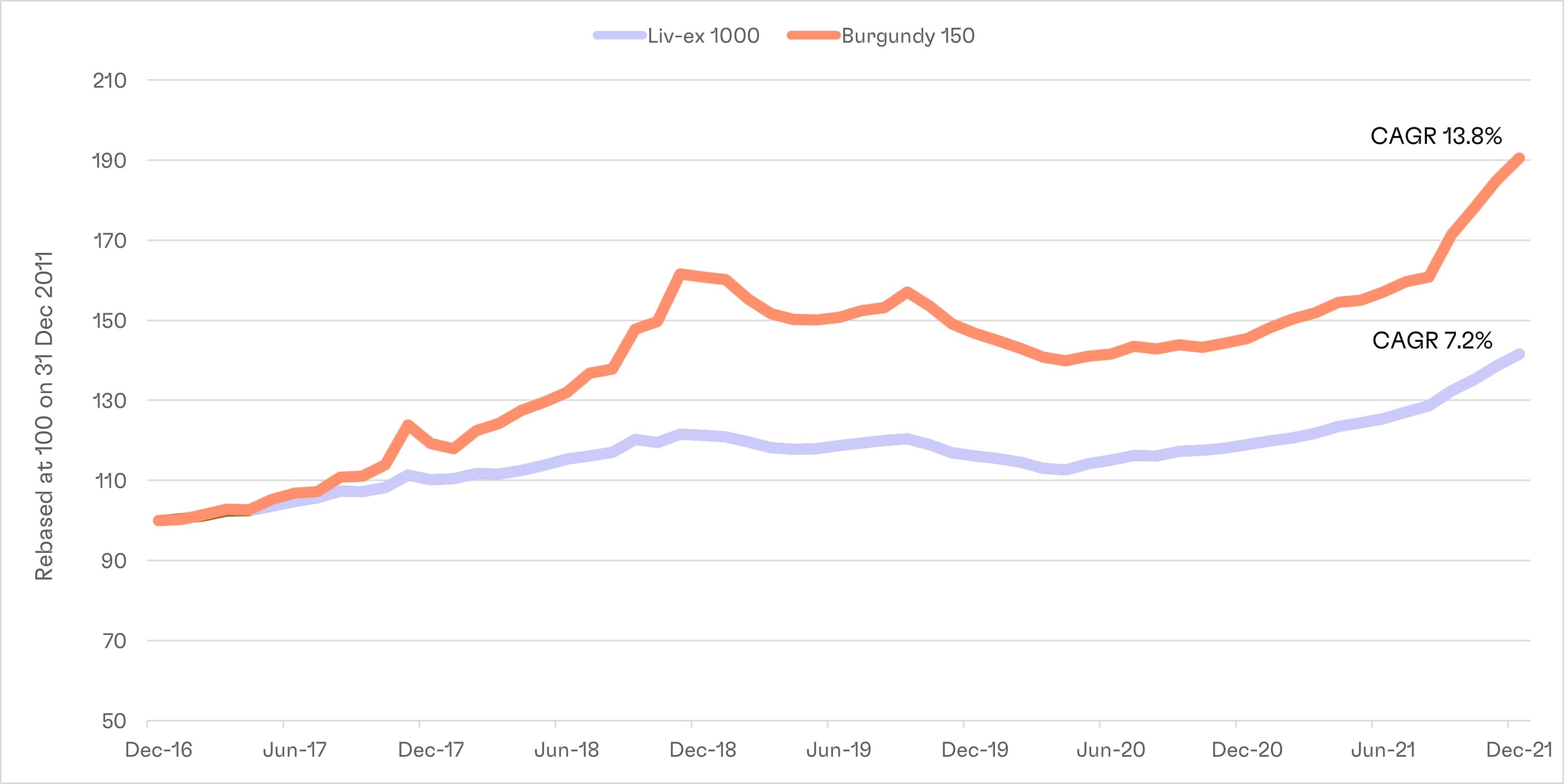

Iconic producers form the foundation of a long-term strategy. But after the towering price gains in 2021, some might view this segment of the market with caution as the 2020 EP begins. Afterall, Burgundy prices did experience a temporary period of consolidation in 2019-2020. But we believe this misses the point of investing in Iconic wines, which offer a track record of strong price growth over different periods.

The recent rally is not the first such period of outperformance for Iconic Burgundy wines, nor do we expect it to be the last. The below image shows how periods of strong gains of the Liv-ex’s Burgundy 150 index (comprised primarily of Iconic producers) more than compensates for the 2019 dip.

Source: Pricing data from Liv-ex as of 31 December 2021.

CAGR = Compound annual growth rate calculated in GBP. Past performance does not guarantee future results.

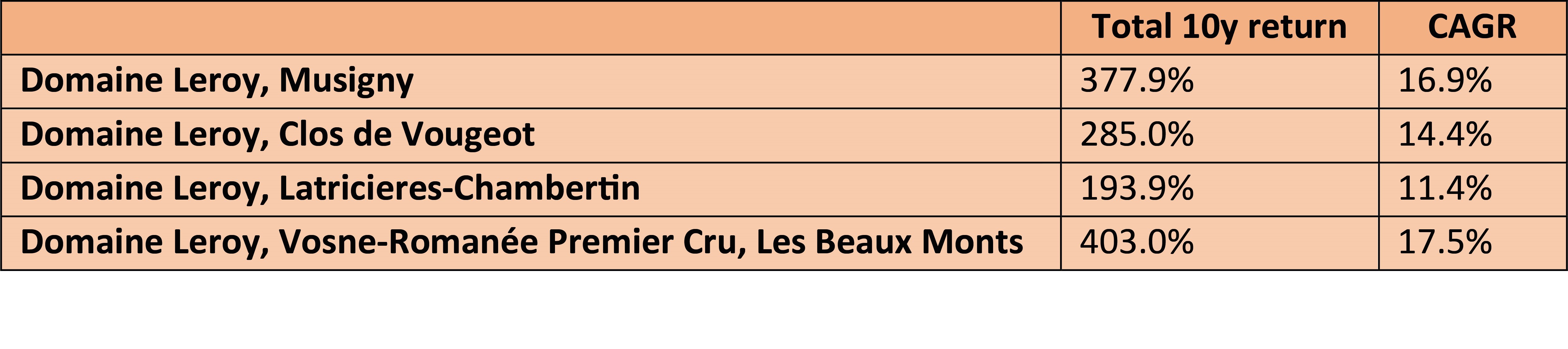

Demand for top names transcends market shifts and supply is always limited. With Iconic wines, the challenge is less about timing the market specifically and more about simply getting access and reaping the rewards over long time horizons. Furthermore, several wines from Domaine Leroy (not included in Burgundy 150) have delivered staggering long-term figures, well above the wider market.

Source: Pricing data from Liv-ex as of 31 December 2021. Returns based on 10 most recent available vintages of select wines.

CAGR = Compound annual growth rate calculated in GBP. Past performance does not guarantee future results.

Which Iconic names we’re targeting

Grabbing a strong vintage when it hits the market can lead to big gains. Cult Wine Investment’s Iconic picks from last year’s 2019 vintage releases posted a remarkable 68.1% return through the end of the year. This potential is why we’re excited about this year’s EP for the 2020 vintage, which, as we’ve written before, is a great one.

Access at the Iconic level of the market is always a challenge, however. Many iconic producers do not release their wines during the first wave of EP releases – some will not become available until March or even later. This is why a diverse approach looking at back vintages is important. This is especially true now amid expectations of lower supply from the 2021 vintage (to be released 2023), due to severe frosts earlier this year.

The credentials of true crème de la crème names such as Leroy and DRC are well known. But our full list of Iconic producers can make excellent foundations of a Burgundy allocation.

Here, we highlight three of our favourite Burgundy producers and a few of their top wines that should form the foundation of a strong Burgundy allocation.

1 Emmanuel Rouget

If you’re looking for an example of the red-hot Burgundy market, look no further than Emmanuel Rouget. Although already Iconic, Rouget’s reputation is still on the rise. It jumped 205 places in the Liv-ex Power 100 rankings in 2021 up to 44th.

This is the personal label of one of Burgundy’s greatest winemakers, Emmanuel Rouget, who got his start back in 1976 under the tutelage of his uncle and Burgundy legend Henri Jayer. Today, Emmanuel, with the help of his sons Nicolas and Guillaume, creates wine for both his own label and his uncle George Jayer.

The Domaine Emmanuel Rouget wines come in minuscule quantities, meaning they command high prices. However, some Rouget wines still offer value when compared to the biggest names like Leroy or DRC. The average price of a bottle of Rouget’s Echézeaux Grand Cru sat at £858 (all vintage worldwide retail average according to Wine Searcher) whereas a DRC Echézeaux Grand Cru averaged £2,525.

-

Vosne-Romanée Cros Parantoux Premier Cru

- Average 5-year price growth – 119% (Wine Searcher)

- 2020 score – 96-98 points (Neal Martin, Vinous)

-

Echézeaux Grand Cru

- Average 5-year price growth – 90% (Wine Searcher)

- 2020 score – 92-94 points (Neal Martin, Vinous)

2 Armand Rousseau

Rousseau wines are everything that is great about Burgundy – history, prestige and amazing quality. Armand Rousseau began making wine in the early decades of the 20th century, pioneering domaine bottling in the 1930s. At the time, Rousseau wines had a strong US presence, and this international following has been a hallmark of the domaine ever since.

Rousseau wines have always remained true to the classic Burgundy style the domaine helped popularise many years ago rather than shifting with changing trends. Today, it is Armand’s grandson Eric and great-granddaughter Cyrielle making fantastic wines using traditional methods.

-

Chambertin Clos-de-Bèze Grand Cru

- Average all-vintage 5-year price growth – 188% (Wine Searcher)

- 2020 score – 98-100 points (Neal Martin, Vinous)

-

Chambertin Grand Cru

- Average all-vintage 5-year price growth – 208% (Wine Searcher)

- 2020 score – 96-98 points (Neal Martin, Vinous)

-

Gevrey-Chambertin Clos Saint-Jacques Premier Cru

- Average all-vintage 5-year price growth – 173% (Wine Searcher)

- 2020 score – 96-98 points (Neal Martin, Vinous)

3 Sylvain Cathiard et Fils

Cathiard’s prominence with wine lovers around the world has soared over the past decade or so. In 2021, Sylvain Cathiard jumped 88 places in the Power 100 list to 21st overall with several of its wines seeing big price jumps.

The history of this family producer goes back to the 1930s when Sylvain’s grandfather started making wine in the region. Sylvain took over for his father in 1995 and, together with his wife and son, he’s catapulted the wines into the top echelon.

In the early 2000s, Cathiard wines did not enjoy the global following of other Iconic names, but the amazing Pinot Noirs made by Sylvain and his son now are deservedly viewed as some of the finest in Burgundy.

-

Romanée-Saint-Vivant Grand Cru

- Average 5-year price growth – 85% (Wine Searcher)

- 2020 score – 95-97 points (Neal Martin, Vinous)

-

Vosne-Romanée Aux Malconsorts Premier Cru

- Average 5-year price growth – 107% (Wine Searcher)

- 2020 score – 95-97 points (Neal Martin, Vinous)

-

Vosne-Romanée Les Suchots Premier Cru

- Average 5-year price growth – 119% (Wine Searcher)

- 2020 score – 92-95 points (Neal Martin, Vinous)

Emmanuel Rouget

If you’re looking for an example of the red-hot Burgundy market, look no further than Emmanuel Rouget. Although already Iconic, Rouget’s reputation is still on the rise. It jumped 205 places in the Liv-ex Power 100 rankings in 2021 up to 44th.

This is the personal label of one of Burgundy’s greatest winemakers, Emmanuel Rouget, who got his start back in 1976 under the tutelage of his uncle and Burgundy legend Henri Jayer. Today, Emmanuel, with the help of his sons Nicolas and Guillaume, creates wine for both his own label and his uncle George Jayer.

The Domaine Emmanuel Rouget wines come in minuscule quantities, meaning they command high prices. However, some Rouget wines still offer value when compared to the biggest names like Leroy or DRC. The average price of a bottle of Rouget’s Echézeaux Grand Cru sat at £858 (all vintage worldwide retail average according to Wine Searcher) whereas a DRC Echézeaux Grand Cru averaged £2,525.

1 Vosne-Romanée Cros Parantoux Premier Cru

- Average 5-year price growth – 119% (Wine Searcher)

- 2020 score – 96-98 points (Neal Martin, Vinous)

2 Echézeaux Grand Cru

- Average 5-year price growth – 90% (Wine Searcher)

- 2020 score – 92-94 points (Neal Martin, Vinous)

Armand Rousseau

Rousseau wines are everything that is great about Burgundy – history, prestige and amazing quality. Armand Rousseau began making wine in the early decades of the 20th century, pioneering domaine bottling in the 1930s. At the time, Rousseau wines had a strong US presence, and this international following has been a hallmark of the domaine ever since.

Rousseau wines have always remained true to the classic Burgundy style the domaine helped popularise many years ago rather than shifting with changing trends. Today, it is Armand’s grandson Eric and great-granddaughter Cyrielle making fantastic wines using traditional methods.

1 Chambertin Clos-de-Bèze Grand Cru

- Average all-vintage 5-year price growth – 188% (Wine Searcher)

- 2020 score – 98-100 points (Neal Martin, Vinous)

2 Chambertin Grand Cru

- Average all-vintage 5-year price growth – 208% (Wine Searcher)

- 2020 score – 96-98 points (Neal Martin, Vinous)

3 Gevrey-Chambertin Clos Saint-Jacques Premier Cru

- Average all-vintage 5-year price growth – 173% (Wine Searcher)

- 2020 score – 96-98 points (Neal Martin, Vinous)

Sylvain Cathiard et Fils

Cathiard’s prominence with wine lovers around the world has soared over the past decade or so. In 2021, Sylvain Cathiard jumped 88 places in the Power 100 list to 21st overall with several of its wines seeing big price jumps.

The history of this family producer goes back to the 1930s when Sylvain’s grandfather started making wine in the region. Sylvain took over for his father in 1995 and, together with his wife and son, he’s catapulted the wines into the top echelon.

In the early 2000s, Cathiard wines did not enjoy the global following of other Iconic names, but the amazing Pinot Noirs made by Sylvain and his son now are deservedly viewed as some of the finest in Burgundy.

1 Romanée-Saint-Vivant Grand Cru

- Average 5-year price growth – 85% (Wine Searcher)

- 2020 score – 95-97 points (Neal Martin, Vinous)

2 Vosne-Romanée Aux Malconsorts Premier Cru

- Average 5-year price growth – 107% (Wine Searcher)

- 2020 score – 95-97 points (Neal Martin, Vinous)

3 Vosne-Romanée Les Suchots Premier Cru

- Average 5-year price growth – 119% (Wine Searcher)

- 2020 score – 92-95 points (Neal Martin, Vinous)