Access & strict selection deliver strong returns

The Burgundy market is soaring to new heights, and consequently, competition for new stock is fierce. Therefore, we strongly recommend wine collectors and investors start buying physical back vintages now, ahead of the 2020 vintage ‘en primeur’ campaign set to begin early next year.

Although we are looking forward to the high-quality new 2020s, existing back vintages can help buyers maximise the potential of the surging market and avoid disappointment during EP when a supply-demand imbalance could squeeze allocations of the top wines.

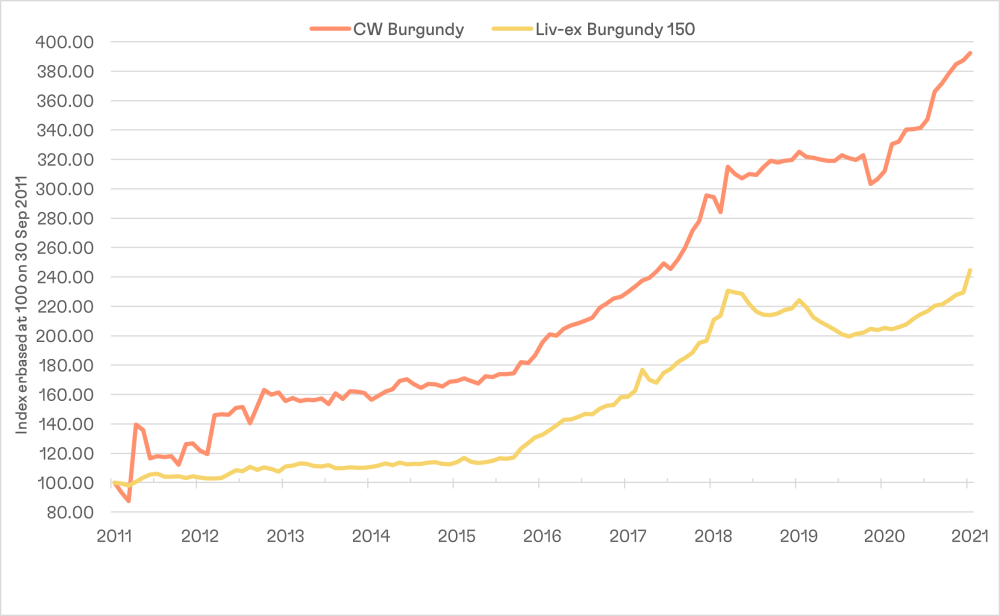

Cult Wine Investment’s Burgundy selections posted a return of 25.7% over the 12-month period ending 30 September 2021 (returns calculated quarterly), an acceleration of our long-term outperformance.

Cult Wine Investment’s stellar returns in Burgundy

CW Burgundy vs Liv-ex Burgundy 150 (30 Sep 2011 – 30 Sep 2021)

Source: Pricing data from Liv ex, analysis by Cult Wine Investment.

Burgundy’s impressive run was reflected in Liv-ex’s recently released Power 100 list, a ranking of the most powerful wines in the secondary market. For the first time, the annual list featured more top Burgundy producers than Bordeaux (33 vs 30).

This booming market is welcome news for those who invest in Burgundy, but it also means increased competition for new releases. The recent Hospice de Beaune charity auction saw prices per-barrel of the 2021 vintage (won’t be released in bottle until early 2023) fetch record levels. The highlight was a 228-litre barrel of Corton Renardes Grand Cru commanding a record £800,000! Meanwhile, the number of barrels sold dropped by roughly half compared to the previous year.

Burgundy bull market can continue

This ultra-competitive market will likely carry over into upcoming 2020 EP campaign as signs point to prices maintaining their strong upward trend into next year. The current rally still lags the total return seen in Burgundy’s most recent rise, according to the Liv-ex Burgundy 150 index (see below).

Burgundy’s potential

Comparison of Burgundy bull markets of 10 months or longer

Source: Liv-ex as of 31 October 2021

An ongoing supply-demand dynamic also support further price appreciation:

- Strong demand - The economic recovery and development of the fine wine investment market is generating increased global demand for top-echelon Burgundy.

- Supply shortage - The devastating frosts across France in early 2021 are expected to hurt production volumes. Some estimates for the 2021 harvest are for a 50% drop versus the five-year average levels between 2016 and 2020. Although the 2021 Burgundy vintage won’t hit the market until early 2023, these expectations are already driving existing wine prices higher, especially for the region’s best vintages.