The Half-Year Wine Market Review: What the Data Says & What’s Next?

About the Dataset

The report is compiled using over £280 million of fine wine transactions recorded over the past 10 years. This includes trades conducted through our B2B wine trading desk, global exchanges, and our own marketplace platform, CultX. Each trade is tagged at the wine and vintage level (LWIN11) and includes volume, value, and frequency data.

While this is one of the most comprehensive private datasets in the market, it still represents only a subset of the overall fine wine universe. Much of the global fine wine trade remains opaque, with limited public access to pricing or trading activity. As such, these figures likely understate the true liquidity of some wines, particularly those traded via private channels, but still offer a unique window into actual transactional behaviour across key regions and producers.

Most other market commentators typically use widely reported indices, or offer side market data, or single-channel transaction data. The insights from this report are based solely on transactions occurring in the market.

Table of Contents

- 2025 So Far

- The General Market

- What Buyers Are Targeting

- Older vintages, value wines, and top names are driving demand despite lower prices

- Bordeaux: A Market Reset in Motion

- Spotlight on Mouton: trading up 26% whilst prices fall 13%

- Montrose leads the way

- 2005 vintage finds favour

- Burgundy: The Comedown Continues

- Older vintages more resilient

- Domaine de l’Arlot shines brightly

- Clos des Lambrays volumes up 52% in 2025, Clos de Tart down 48%

- Champagne: Stabilising Post-Pandemic

- Older vintages holding value better

- Cristal: all vintages down in price, but trading at 4-year high

- Dom Pérignon P2 Defies the Market

- Italy: Consolidation Around the Icons

- Gaja, Tignanello, and Vietti best performers

- Closer Look: Tignanello, older vintages outperform younger by a growing premium

- Top 10 account for nearly two-thirds of Italian trade volumes

- USA: Top Names Under Pressure

- Ridge Vineyards a clear standout

- Screaming Eagle: iconic Napa label hit hardest by downturn

- Rhône: The Steepest Declines

- 2019 vintage outperforms

- Spotlight: Jean Louis Chave, Hermitage Rouge

- Rayas 2007: legendary wine down 63.5% in under three years

- Rest of World: Resilience & New Momentum

- Viña Don Melchor leads the way with higher prices and volumes

- Vega Sicilia outperforms wider fine wine market in 2025

- Penfolds shows early rebound as China market reopens

- Market Outlook & Closing Thoughts

2025 So Far: Reset, Repricing, and an Opportunity

If 2022 was the high, 2023 the hangover, and 2024 a weakened market, then 2025 feels like the year the fine wine market has started to quietly recalibrate. Prices have continued to soften across the major regions, particularly Bordeaux and Burgundy, but beneath the surface, there are signs of life as smart collectors and active traders begin to re-engage.

The backdrop has been anything but easy. Political instability in the US and Europe, a faltering recovery in China, the looming threat of new tariffs, and ongoing weakness in the wider luxury goods sector have all weighed on sentiment. Yet, despite the challenges and the continued downward pressure on prices, the data points to a shift. There are early signals that the market could be edging towards stability after a long downturn.

This review is based entirely on real trading data from the Cult Wines ecosystem. That includes transactions on the B2B wholesale market, private clients using our marketplace and trading platform, and global exchanges such as Liv-ex, alongside open-market data. We track and collate data on thousands of wines, covering a five-year window, and only use actual transaction prices. This matters. Too often, wine market commentary relies on derived offer data, which reflects asking prices rather than deals done. Offers tell you what sellers hope to get. Trades tell you what buyers are actually willing to pay.

By focusing on transactions, we get a truer barometer of what is really happening. In the pages ahead, we will unpack what has moved and what hasn’t, highlight both outperformers and underperformers, and outline the key trends to watch for the remainder of the year.

The General Market: Falling Prices, Rising Activity

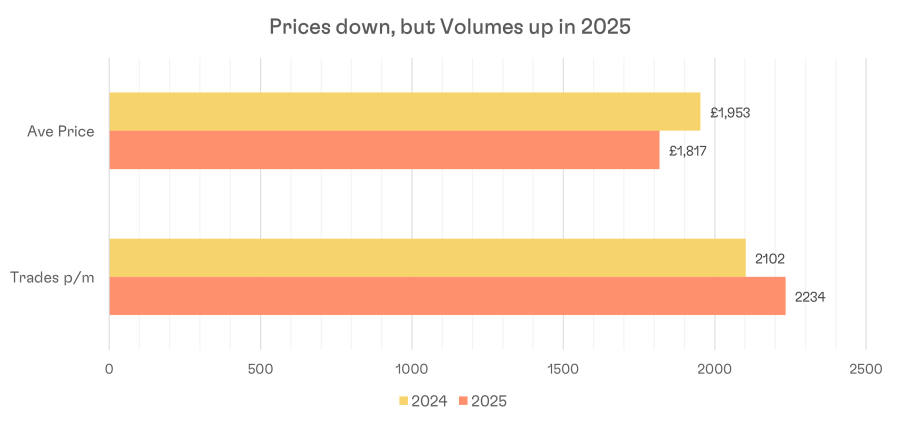

- Trading volumes up 6.3% year-to-date

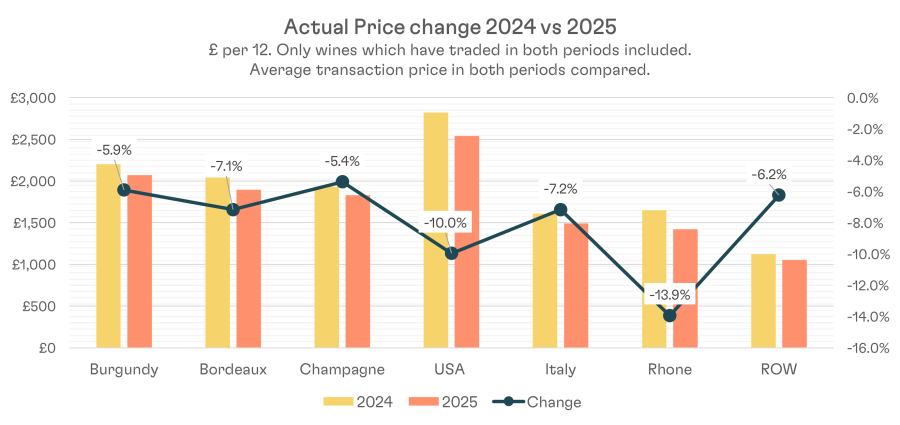

- Prices down 7% across all regions

- Champagne is the best performer with prices down just 5.4%

- Rest of World leads in proportion of wines trading higher versus 2024 (36%)

It may sound counterintuitive, but while prices have softened in 2025, trading activity has picked up. Monthly volumes are up 6.3% compared to last year, averaging 2,234 trades per month versus 2,100 in 2024. That’s 15,638 trades by mid-July compared to 25,223 for the whole of last year. More wine is moving, albeit at lower prices.

Of the 2,774 wines that have traded this year, 1,979 also traded in 2024. Their average trade price has fallen from £1,953 to £1,817, a drop of 6.97%.

This is the key point: prices are still correcting, but liquidity is improving.

More trades, more buyers, and tighter bid-offer spreads often mark the early stages of market stabilisation. We are not calling the bottom yet, but the data suggests we may be getting close.

What Buyers Are Targeting

Three themes stand out from the data.

First, older, higher-quality vintages are performing better than younger releases. The latter, while often well scored, face heavier pressure due to large volumes on the secondary market. Collectors are favouring maturity and drinking readiness.

Second, value is cutting through. In several regions, the wines that outperform are not the most famous names, but those offering strong relative value, high quality at a compelling price point.

Third, and perhaps most encouraging for those looking for recovery signals, the most prominent names, First Growths, Grand Cru Burgundy, and the prestige Champagne houses are seeing a marked increase in trading volumes despite prices still trending lower. Buyers are stepping in at these new levels, suggesting they see long-term value after the downturn.

In short, price declines have brought more participants to the table. As buyer numbers increase and begin to match seller supply, prices tend to stabilise. That stability breeds confidence, and confidence is the essential ingredient for a healthier, more positive market.

Download the H1 2025 Price & Trading Analysis Dataset

Access over 10,000 lines of data covering 3,330 unique wines, including trading volumes, total traded value, and average trade prices from 2022 to 2025, showing performance shifts across all metrics.

An exclusive dataset compiled by Cult Wines for fine wine investors and trade professionals.

Bordeaux: A Market Reset in Motion

Bordeaux 2025 at a Glance

| Metric | Result |

|---|---|

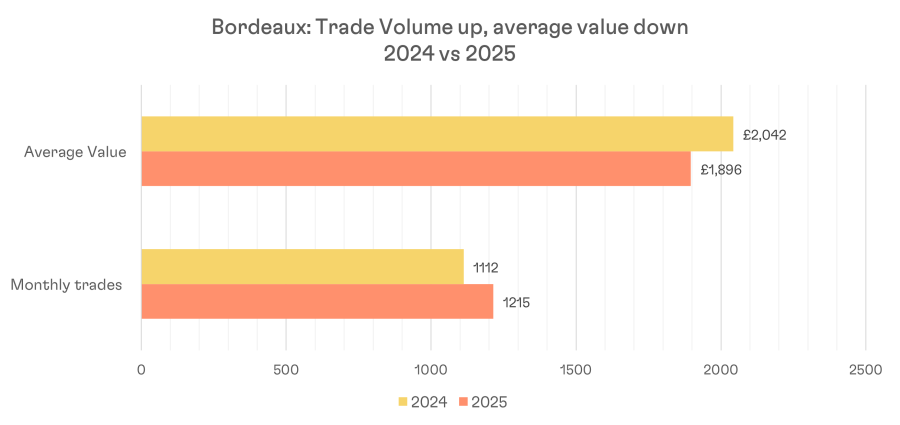

| Increase in Trading Volumes vs 2024 | +9.3% |

| Wines Traded YTD | 1,015 (88% of last year’s total) |

| Average Price Change vs 2024 | -7.15% |

| Repeat Trades at Lower Prices | 80% (second highest of any region) |

Bordeaux has endured a difficult period, but there are early signs of a recovery taking shape.

Trading volumes are up 9.3% in 2025, with monthly activity rising from 1,112 trades in 2024 to 1,215 this year. The breadth of the market is also improving, with 1,015 unique wines already changing hands compared to 1,150 in the whole of last year. That is 88% of 2024's total in just over half the time, signalling that more Bordeaux wines are returning to buyers' attention.

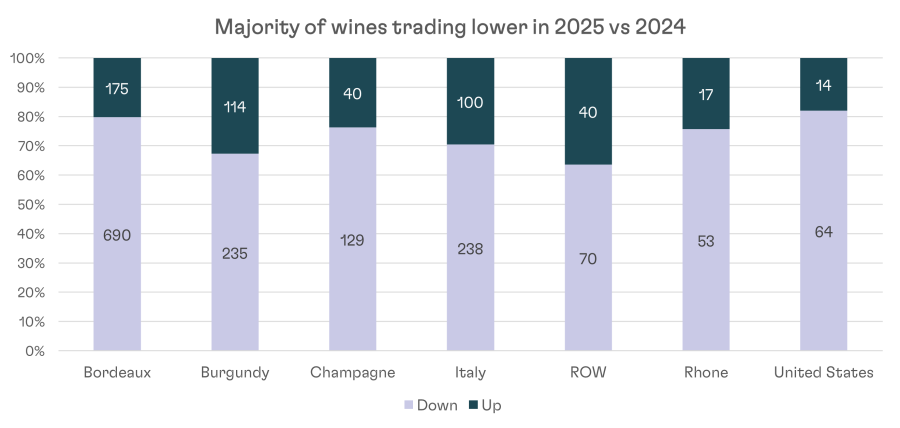

Prices, however, remain under pressure. Across wines that traded in both years, the average price has fallen from £2,042 to £1,896, a drop of 7.15% and slightly below the all-region average. Of all Bordeaux wines trading at least twice in both 2024 and 2025, 80% are changing hands at lower prices, the second-highest proportion of any major region (after the United States). Given 10x the amount of wines are traded in Bordeaux, this represents a significantly larger number of wines trading lower in 2025.

The year began positively, helped by Asian demand around the Chinese New Year, but momentum slowed in March following the announcement of new tariffs. April remained muted, while May and June were overshadowed by a subdued En Primeur campaign. July has brought renewed activity, with more trades completing and bid-offer spreads narrowing.

In summary, prices have adjusted lower, but liquidity is improving. If the increase in trading volumes continues, it could lay the groundwork for stabilisation and a more confident Bordeaux market in the months ahead.

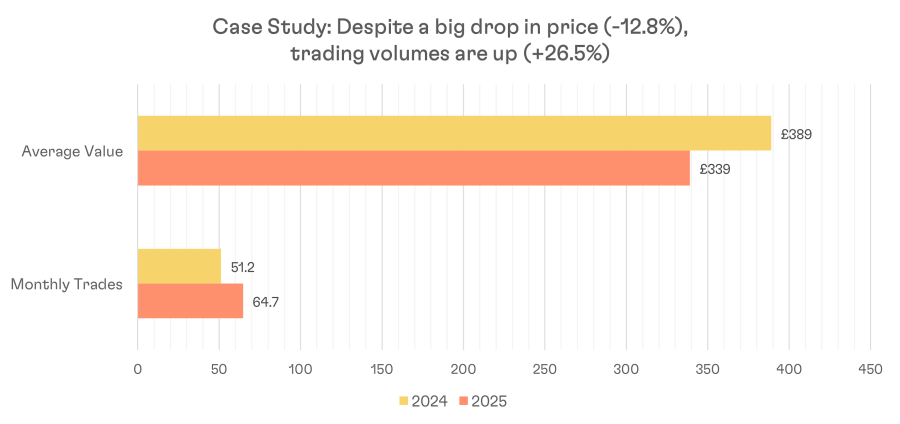

Spotlight: Mouton Rothschild

If you want proof that the market is moving, look at Mouton Rothschild.

In 2025, there have already been 453 trades compared with 614 in the whole of 2024. On a pro-rata basis, that is an increase of 26.5 per cent and clear evidence of growing momentum, even though the average price has slipped from £4,667 to £4,068, a fall of 12.8 per cent.

The 2016 vintage stands out. It has already changed hands 102 times this year, which is 71 per cent more than the total trades in 2024. This is despite the price falling to £397 per bottle, a drop of 10.5%.

2016 Mouton is widely regarded as one of the greatest modern Bordeaux wines, with three perfect 100-point scores. At under £400 a bottle, the market is recognising exceptional value, and buyers are stepping back in.

Vintage Analysis: Green Shoots in the Data

Looked at by vintage, there are a few green shoots of positivity in what's otherwise been a broadly downbeat picture. Over 80% of Bordeaux wines have traded down in 2025 compared to the previous year. But even in a correcting market, there are always outliers, and some vintages are quietly outperforming.

One of the early movers this year is 2022, now hitting the market physically for the first time. With a wave of strong in-bottle scores from top critics, some wines from this vintage have started to find their feet. Admittedly, comparisons with 2024 data should come with a pinch of salt, as many trades last year were still on futures.

That said, certain names have clearly gained traction in the secondary market: Carmes Haut-Brion 2022 stands out as one of the strongest performers across the board, trading up 22% from £1,067 to £1,302, with 34 trades already recorded this year.

Outside of 2022, the theme seems to be classic vintages with bottle age. Wines from 2000, 2005 and 2009 are all outperforming the regional average, with between 29% and 37% of wines from those vintages trading higher than last year. This points to buyers seeking value in tried-and-tested wines, with the confidence that top-quality Bordeaux from great years is worth paying for, especially when prices across the board have softened.

2005 is one to watch. Now approaching its 20th birthday, this vintage appears to be gaining favour again. With more than a third of 2005's trading above 2024 levels, it may be a smart move for collectors or investors looking to capitalise on a softer market to secure some real quality at attractive prices.

Bordeaux Vintage Performance (2025 vs 2024)

| Vintage | Wines Traded | Down | Up | % Up |

|---|---|---|---|---|

| 2022 | 12 | 5 | 7 | 58% |

| 2007 | 2 | 1 | 1 | 50% |

| 2005 | 27 | 17 | 10 | 37% |

| 2000 | 9 | 6 | 3 | 33% |

| 2011 | 12 | 8 | 4 | 33% |

| 2009 | 45 | 32 | 13 | 29% |

| 2012 | 26 | 19 | 7 | 27% |

| 1998 | 4 | 3 | 1 | 25% |

| 2004 | 4 | 3 | 1 | 25% |

| 2013 | 12 | 9 | 3 | 25% |

| 2021 | 42 | 32 | 10 | 24% |

| 2015 | 62 | 49 | 13 | 21% |

| 2016 | 69 | 58 | 11 | 16% |

| 2010 | 46 | 39 | 7 | 15% |

| 2014 | 33 | 28 | 5 | 15% |

| 2020 | 73 | 63 | 10 | 14% |

| 2003 | 8 | 7 | 1 | 13% |

| 2017 | 50 | 45 | 5 | 10% |

| 2018 | 55 | 51 | 4 | 7% |

| 2019 | 85 | 79 | 6 | 7% |

| 2006 | 17 | 16 | 1 | 6% |

| 1985–2002 (misc.) | 36 | 36 | 0 | 0% |

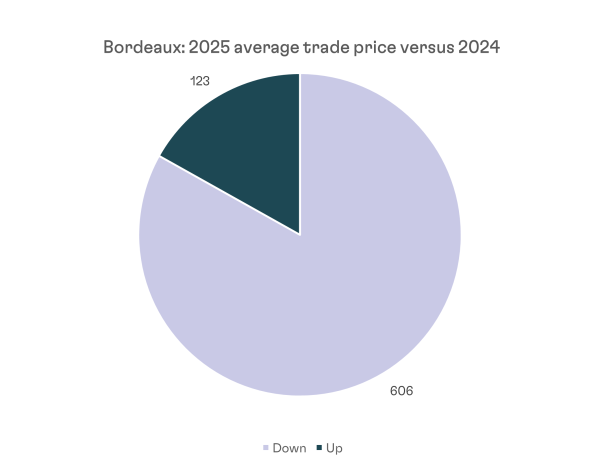

| Total | 729 | 606 | 123 | 17% |

In total, of the 728 wines from Bordeaux with a like-for-like vintage match across both years, just 17% have seen positive price movement in 2025, but those that have are starting to tell us something.

When we look at the worst-performing vintages, the data paints a pretty clear picture. The biggest declines are concentrated in the recent releases, namely 2017, 2018 and 2019. These are vintages where trade volumes are high and, understandably, most collectors and portfolios have larger exposure. The wines aren’t in their drinking window yet, and there's still plenty of stock in the market, which has added pressure on prices during the sell-off.

It doesn’t help the case for 2019s, which, despite their obvious quality and critical acclaim, have continued to fall in value this year. That said, the current pricing may present a smart entry point for long-term holders who can afford to be patient. The fundamentals remain strong, but with supply still high, it may take a bit longer for the market to find its footing.

Wine-by-Wine: The Standouts, the Survivors & the Strugglers

With 80% of Bordeaux wines trading down year-on-year, the data doesn’t exactly scream optimism. But zoom in a little, and some names are holding their own, even quietly outperforming. The table below tracks how many vintages per château have traded this year, and crucially, how many are up vs down compared to 2024.

| Wine | Vintages Traded | Down | Up | % Up |

|---|---|---|---|---|

| Chateau Montrose 2eme Cru Classe, Saint-Estephe | 15 | 9 | 6 | 40% |

| Chateau d'Armailhac 5eme Cru Classe, Pauillac | 8 | 5 | 3 | 38% |

| Chateau Rauzan-Segla 2eme Cru Classe, Margaux | 11 | 7 | 4 | 36% |

| Chateau Leoville Barton 2eme Cru Classe, Saint-Julien | 13 | 9 | 4 | 31% |

| Chateau La Conseillante, Pomerol | 11 | 8 | 3 | 27% |

| Ducru-Beaucaillou 2eme Cru Classe, Saint-Julien | 15 | 11 | 4 | 27% |

| Chateau Clinet, Pomerol | 8 | 6 | 2 | 25% |

| Chateau L'Evangile, Pomerol | 8 | 6 | 2 | 25% |

| Chateau Cheval Blanc, Saint-Emilion Grand Cru | 12 | 9 | 3 | 25% |

| Chateau Lynch-Bages 5eme Cru Classe, Pauillac | 16 | 12 | 4 | 25% |

| Chateau Pavie Premier Grand Cru Classe A, Saint-Emilion Grand Cru | 13 | 10 | 3 | 23% |

| Chateau Pichon Baron 2eme Cru Classe, Pauillac | 9 | 7 | 2 | 22% |

| Domaine de Chevalier, Rouge Cru Classe, Pessac-Leognan | 9 | 7 | 2 | 22% |

| Chateau Calon Segur 3eme Cru Classe, Saint-Estephe | 10 | 8 | 2 | 20% |

| Chateau Canon Premier Grand Cru Classe B, Saint-Emilion Grand Cru | 10 | 8 | 2 | 20% |

| Chateau Pichon Longueville Comtesse de Lalande 2eme Cru Classe, Pauillac | 10 | 8 | 2 | 20% |

| Chateau La Mission Haut-Brion Cru Classe, Pessac-Leognan | 15 | 12 | 3 | 20% |

| Chateau Pontet-Canet 5eme Cru Classe, Pauillac | 15 | 12 | 3 | 20% |

| Chateau Troplong Mondot Premier Grand Cru Classe B, Saint-Emilion Grand Cru | 11 | 9 | 2 | 18% |

| Chateau Angelus, Saint-Emilion Grand Cru | 13 | 11 | 2 | 15% |

| Cos d'Estournel 2eme Cru Classe, Saint-Estephe | 13 | 11 | 2 | 15% |

| Vieux Chateau Certan, Pomerol | 14 | 12 | 2 | 14% |

| Chateau Ausone, Saint-Emilion Grand Cru | 8 | 7 | 1 | 13% |

| Chateau Smith Haut Lafitte, Rouge Cru Classe, Pessac-Leognan | 8 | 7 | 1 | 13% |

| Pavillon Rouge du Chateau Margaux, Margaux | 8 | 7 | 1 | 13% |

| Petrus, Pomerol | 8 | 7 | 1 | 13% |

| Chateau Duhart-Milon 4eme Cru Classe, Pauillac | 9 | 8 | 1 | 11% |

| Chateau d'Yquem Premier Cru SUperieur, Sauternes | 9 | 8 | 1 | 11% |

| Le Clarence de Haut-Brion, Pessac-Leognan | 9 | 8 | 1 | 11% |

| Chateau Beychevelle 4eme Cru Classe, Saint-Julien | 11 | 10 | 1 | 9% |

| Chateau Figeac Premier Grand Cru Classe A, Saint-Emilion Grand Cru | 11 | 10 | 1 | 9% |

| Chateau Grand-Puy-Lacoste 5eme Cru Classe, Pauillac | 11 | 10 | 1 | 9% |

| Chateau Leoville Poyferre 2eme Cru Classe, Saint-Julien | 11 | 10 | 1 | 9% |

| Chateau Pape Clement Cru Classe, Pessac-Leognan | 12 | 11 | 1 | 8% |

| Chateau Latour Premier Cru Classe, Pauillac | 13 | 12 | 1 | 8% |

| Chateau Leoville Las Cases 2eme Cru Classe, Saint-Julien | 17 | 16 | 1 | 6% |

| Chateau Haut-Brion Premier Cru Classe, Pessac-Leognan | 18 | 17 | 1 | 6% |

| Chateau Haut-Bailly Cru Classe, Pessac-Leognan | 8 | 8 | 0 | 0% |

| Chateau Palmer 3eme Cru Classe, Margaux | 9 | 9 | 0 | 0% |

| Chateau Lafite Rothschild Premier Cru Classe, Pauillac | 18 | 18 | 0 | 0% |

| Chateau Margaux Premier Cru Classe, Margaux | 18 | 18 | 0 | 0% |

| Chateau Mouton Rothschild Premier Cru Classe, Pauillac | 23 | 23 | 0 | 0% |

Let's start with the positive news. Château Montrose sits proudly at the top of the pile, with 6 out of 15 vintages trading in the green; that's 40% of them showing a positive return so far this year. That's comfortably above the regional average and speaks to Montrose's growing appeal as a reliable, age-worthy Saint-Estèphe that still offers value compared to the Firsts and even other second growth stablemates. Its reputation has quietly improved over the last decade, and the market appears to be catching on.

Hot on the heels are the likes of d'Armailhac, Rauzan-Ségla, and Léoville Barton, all clocking over 30% of vintages in positive territory. These are wines with strong reputations, stable production, and relative affordability, which seem to be attracting the more value-conscious end of the market. In a risk-off environment, it's no surprise that collectors are leaning toward well-known second growths and "super seconds" that offer pedigree without the price tag.

Wines like La Conseillante, Ducru, Clinet, and L'Evangile round out the upper tier, broadly outperforming the market by not falling as far, or in some cases, finding support for specific vintages. There's a clear preference emerging for high-quality wines with a bit of bottle age and a touch of underdog momentum.

And then, at the bottom, the First Growths. But maybe a turning point?

It's no secret that the First Growths have had a rough ride. In fact, all five are sitting right at the bottom of the rankings. Lafite, Margaux, and Mouton have each seen 18+ vintages trade this year, yet not a single one of those vintages is showing a positive return compared to 2024. Zero. Haut-Brion and Latour just about scrape in with one green vintage each.

So yes, from a raw performance perspective, it's not pretty. But dig a little deeper, and there's a more encouraging trend beginning to take shape.

After nearly two years of steady price declines, we're now seeing First Growths trade actively - just at new, lower levels. And that shift might be a good thing. As buyers adjust to the re-based pricing, activity is starting to pick up again. If this continues, and the balance between buyers and sellers begins to even out, it could signal that we're approaching a floor - and possibly the early stages of a recovery.

A good example? Haut-Brion 2021. Officially the cheapest vintage of any physical First Growth on the market right now, it's traded 24 times already this year - up 50% on last year's total (17 trades). The average price has fallen 8.6% from £3,086 to £2,820 (or £257 to £235 per bottle), but it's clear there are buyers willing to step in at this level.

The 2021 vintage across all four First Growths (Lafite, Margaux, Mouton, and Haut-Brion) is telling a similar story: prices are down 8–10% year-on-year, but trading volumes are up a remarkable 93% versus 2024. That kind of uptick in activity is a strong leading indicator that these price points are starting to find support.

Put simply: the Firsts aren't flying, but they're clearing. And in a falling market, that matters.

It's still too early to call a proper rebound, but if volume continues to build at these levels, and macro sentiment doesn't get any worse, we might look back on 2025 as a vintage year for First Growth buyers. Not in the glass, perhaps, but in the ledger.

Download the H1 2025 Price & Trading Analysis Dataset

Access over 10,000 lines of data covering 3,330 unique wines, including trading volumes, total traded value, and average trade prices from 2022 to 2025, showing performance shifts across all metrics.

An exclusive dataset compiled by Cult Wines for fine wine investors and trade professionals.

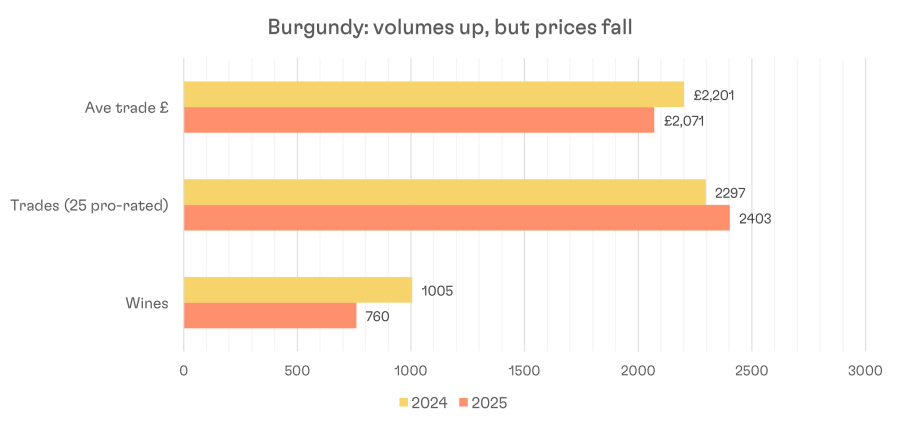

Burgundy: The Comedown Continues, but Signs of Balance are Emerging

After a blistering run during the COVID years, Burgundy has spent the last 24 months gradually deflating. But based on 2025 trading so far, there are signs the worst of the correction may be behind us.

The graph displays the average trade value of all trades, the total trades for 2024 and 2025 year-to-date (ytd), pro-rated for annual estimates, and the total number of unique wine trades in 2024 and 2025 ytd.

At first glance, volumes look down, 1,502 trades and 760 individual wines so far in 2025, compared to 2,297 trades and 1,005 wines in the whole of 2024. But once you adjust for the fact that we’re only seven months into the year, activity is holding steady every month. In fact, on a pro-rata view, both the number of wines and trades are broadly flat with a slight uptick in 2025.

Prices, however, have continued to soften. Among the 349 wines that have been traded in both 2024 and 2025, average trade prices are down 5.9% from £2,201 to £2,071. That’s slightly better than Bordeaux’s decline, but still indicative of a cautious market where value is being reappraised.

Still, Burgundy boasts the highest percentage of price risers among the major regions, with 32.7% of wines trading up in 2025. That’s comfortably ahead of Bordeaux (17%), Champagne (21%), and the US (16%), which suggests buyers aren’t abandoning Burgundy; they’re just being far more selective.

The message? Burgundy isn’t crashing, it’s consolidating. The hype’s cooled off, but the appetite for the right wines, at the right prices, is still very much there.

Vintage Analysis: What Does it Tell us?

When we filter the data to include only wines that have traded at least once in both 2024 and 2025, a clear pattern emerges, similar to what we see in Bordeaux.

Although the sample sizes vary from vintage to vintage, the trend is consistent. Older, high-quality vintages are more likely to see price gains this year. Burgundy’s 2010, 2009, 2012, 2015 and 2016 vintages, all highly rated and now with more than a decade of age, have each recorded a higher percentage of wines trading up than the regional average.

At the other end of the scale, the newer vintages are underperforming. There is simply more stock from these years on the market, creating greater downward pressure on prices. The 2021 and 2022 releases, along with the off-prime red 2017 vintage and the hot, ripe 2018, have all seen the majority of wines trade lower than in 2024.

Even the exceptional 2019 and 2020 vintages, despite their critical acclaim, have not escaped the trend. Between 62 and 68 per cent of wines from these years are trading at lower prices than last year. Given the undoubted quality of both vintages, this may signal a buying opportunity for long-term collectors. With prices trending down, there is potential to secure some of Burgundy’s future greats at attractive levels.

Burgundy: Vintage Performance

| Vintage | Grand Total | Up | Down | % Up |

|---|---|---|---|---|

| 2010 | 3 | 2 | 1 | 67% |

| 2012 | 6 | 4 | 2 | 67% |

| 2009 | 4 | 2 | 2 | 50% |

| 2011 | 4 | 2 | 2 | 50% |

| 2015 | 11 | 5 | 6 | 45% |

| 2016 | 29 | 12 | 17 | 41% |

| 2013 | 5 | 2 | 3 | 40% |

| 2020 | 58 | 22 | 36 | 38% |

| 2019 | 57 | 18 | 39 | 32% |

| 2018 | 71 | 20 | 51 | 28% |

| 2017 | 43 | 12 | 31 | 28% |

| 2022 | 30 | 7 | 23 | 23% |

| 2014 | 13 | 3 | 10 | 23% |

| 2021 | 15 | 3 | 12 | 20% |

| Grand Total | 349 | 114 | 235 | 33% |

Trends by Wine & Producer: Price & Trading Volumes

When we strip the data back to wines that have traded in both periods, remove outliers, and group by producer (minimum of three qualifying wines), no single name dominates the performance tables. There are, however, some clear outperformers.

| Producer | Down | Up | % Up |

|---|---|---|---|

| Arlot | 0 | 3 | 100.0% |

| William Fevre | 0 | 3 | 100.0% |

| Leroy | 2 | 2 | 50.0% |

| Lambrays | 6 | 5 | 45.5% |

| Drouhin | 11 | 8 | 42.1% |

| Bouchard | 3 | 2 | 40.0% |

| Louis Latour | 3 | 2 | 40.0% |

| Coquard Loison Fleurot | 7 | 4 | 36.4% |

| Bonnea du Martray | 2 | 1 | 33.3% |

| Liger-Belair | 2 | 1 | 33.3% |

| Meo Camuzet | 2 | 1 | 33.3% |

| Leflaive | 9 | 3 | 25.0% |

| Ponsot | 6 | 2 | 25.0% |

| Faiveley | 7 | 2 | 22.2% |

| Clos Tart | 4 | 1 | 20.0% |

| Noellat | 4 | 1 | 20.0% |

| Girardin | 5 | 0 | 0.0% |

| Henri Boillot | 5 | 0 | 0.0% |

| Marquis d'Angerville | 5 | 0 | 0.0% |

| Tortochot | 4 | 0 | 0.0% |

| Vougeraie | 4 | 0 | 0.0% |

| Comte Armans | 3 | 0 | 0.0% |

| Vincent Dancer | 3 | 0 | 0.0% |

| Georges Roumier | 3 | 0 | 0.0% |

| Louis Jadot | 3 | 0 | 0.0% |

Right at the top is Domaine de l’Arlot. Trading volumes are not huge, but they are noticeably higher than in 2024, and the average trade price is up.

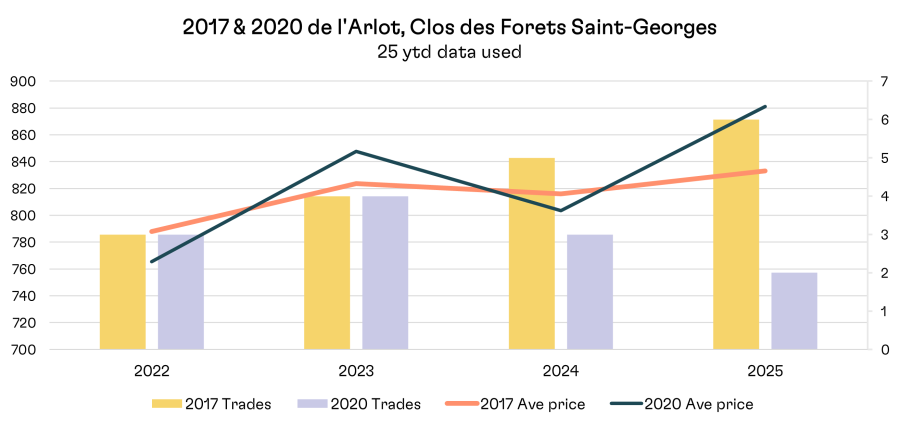

For example, the 2017 and 2020 Nuits-Saint-Georges Premier Cru, Clos des Forêts Saint-Georges, have both traded more frequently this year and achieved their highest average trade value since 2022.

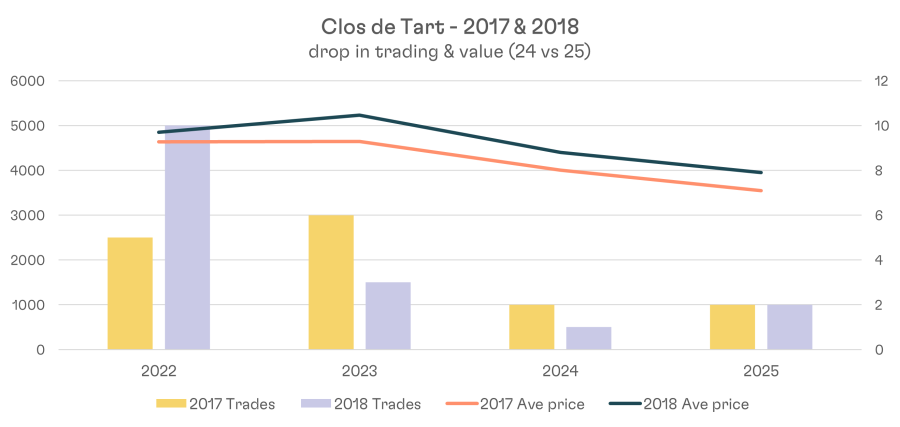

“Clos des Lambrays volumes up 52% in 2025, Clos de Tart down 48%."

Two Grand Cru vineyards often compared to each other, Clos des Lambrays and Clos de Tart, have had very different starts to 2025. Both share similarities in style and have benefited from a decade of strong price growth. Yet Clos des Lambrays has held up far better, with an almost even split between the number of wines trading up and down this year. Clos de Tart, by contrast, has only one vintage in positive territory.

Clos des Lambrays’ resilience is all the more interesting given recent price hikes by LVMH on the 2019, 2020 and 2022 vintages, all now priced above £4,000 per 12 bottles. These levels represent a significant improvement over earlier releases of similar quality, such as the 2016 release at £2,245.

The increases appear to have made older, top-scoring vintages look relatively good value. The 2010 and 2015 vintages have both seen meaningful gains, with average transaction values rising from £2,911 to £3,165 (2010) and £2,703 to £2,913 (2015).

Clos de Tart, meanwhile, has experienced a drop in trading volumes and downward pressure on its younger vintages. The 2018 and 2017 have both fallen by around 10 per cent, now trading at £3,951 and £3,548 respectively, compared with £4,400 and £4,000 last year.

The broader trading data echoes these patterns. Wines with at least ten trades in each period show Clos des Lambrays volumes up by over 50 per cent, while Clos de Tart volumes are down nearly half.

Leflaive also stands out, with two wines among the top five biggest percentage gainers, reinforcing the ongoing strength of white Burgundy demand. The top-performing list is evenly split between red and white, underlining the continued appeal of both styles in 2025.

Burgundy: Trades & Price Change

| Wine | 2024 # of Trades | 2025 # of Trades | 2025 Annualised | % Change | Ave Price Change (%) |

|---|---|---|---|---|---|

| Henri Gouges, Nuits-Saint-Georges Premier Cru, Clos des Porrets-Saint-Georges | 10 | 12 | 19.2 | 92% | -5.4 |

| Leflaive, Puligny-Montrachet Premier Cru, Clavoillon | 21 | 21 | 33.6 | 60% | -13.5 |

| Clos des Lambrays | 84 | 80 | 128 | 52% | -1.6 |

| Leflaive, Puligny-Montrachet Premier Cru, Les Pucelles | 19 | 18 | 28.8 | 52% | -0.8 |

| Ponsot, Clos de la Roche Grand Cru, Cuvee Vieilles Vignes | 27 | 24 | 38.4 | 42% | -7.2 |

| Comte Armand, Pommard Premier Cru, Clos des Epeneaux | 20 | 16 | 25.6 | 28% | -15.0 |

| Marquis d'Angerville, Volnay Premier Cru, Champans | 13 | 10 | 16 | 23% | -14.5 |

| Joseph Drouhin, Beaune Premier Cru, Le Clos des Mouches Rouge | 25 | 19 | 30.4 | 22% | -3.8 |

| Domaine de la Vougeraie, Vougeot Premier Cru, Le Clos Blanc de Vougeot | 23 | 17 | 27.2 | 18% | -10.0 |

| Louis Latour, Corton-Charlemagne Grand Cru | 46 | 32 | 51.2 | 11% | 0.6 |

| Henri Boillot, Puligny-Montrachet Premier Cru, Clos de la Mouchere | 29 | 19 | 30.4 | 5% | -2.0 |

| Jacques-Frederic Mugnier, Nuits-Saint-Georges Premier Cru, Clos de la Marechale Rouge | 20 | 12 | 19.2 | -4% | 1.2 |

| Bonneau du Martray, Charlemagne Grand Cru | 40 | 23 | 36.8 | -8% | -3.6 |

| Joseph Drouhin, Montrachet Grand Cru, Marquis de Laguiche | 42 | 23 | 36.8 | -12% | -12.2 |

| Domaine William Fevre, Chablis Grand Cru, Les Clos | 26 | 9 | 14.4 | -45% | 0.3 |

| Clos de Tart | 65 | 21 | 33.6 | -48% | -2.9 |

In summary, Burgundy remains one of the most resilient of the major regions, with the highest number of wines trading up in 2025 (33%) compared with 2024, even if this is still a minority. Trading volumes are beginning to edge higher, and buyers are seeking value in high-quality vintages with a little more age.

Clos des Lambrays is a microcosm of this behaviour, with recent new-release price hikes pushing collectors towards older, well-scored vintages that sit at a significant discount. It mirrors a wider vintage trend, where years such as 2009, 2010, 2012, 2015 and 2016 are holding up better than younger counterparts.

Whether this represents the first signs of recovery is harder to call. The data for the first half of the year paints a mixed picture, and variability may remain the defining feature of the Burgundy market for now.

Download the H1 2025 Price & Trading Analysis Dataset

Access over 10,000 lines of data covering 3,330 unique wines, including trading volumes, total traded value, and average trade prices from 2022 to 2025, showing performance shifts across all metrics.

An exclusive dataset compiled by Cult Wines for fine wine investors and trade professionals.

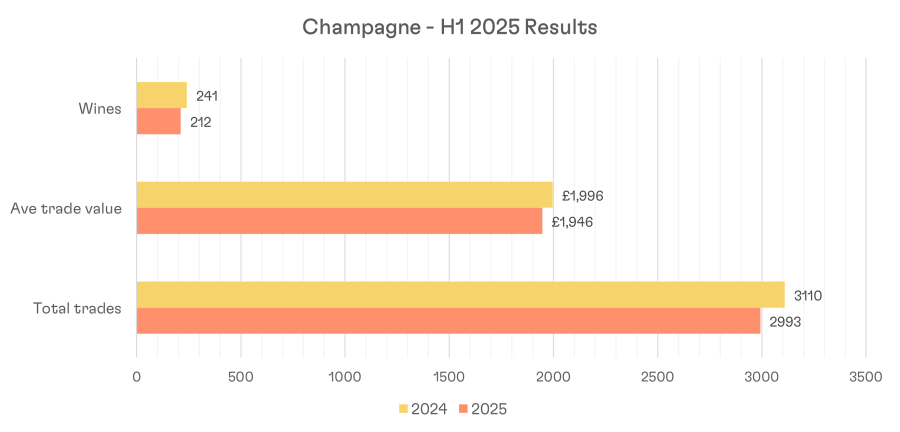

Champagne: Stabilising After the Post-Pandemic Adjustment

- Prices fall 5.4% in 2025, the best of all regions

- 24% of Champagnes are trading higher in H1 2025

- Trading volumes slightly down on 24 (-3.9%)

Champagne has fallen more modestly than Bordeaux and Burgundy so far this year. Across 171 wines that have traded in both 2024 and 2025, the average price is down just 5.4 per cent, from £1,933 to £1,829. Around 76 per cent of these wines are trading lower, with 24 per cent posting gains.

Trading volumes in 2025 are only slightly behind last year, the average trade value is almost identical, and the breadth of wines in the market remains consistent. This stability reflects Champagne’s resilience, particularly given the sharp price inflation it experienced during the pandemic, second only to Burgundy.

The slowdown in price depreciation is encouraging. In 2023 and 2024, Champagne absorbed significant corrections after its pandemic surge, but this year’s data points to a plateau. The fact that volumes have held up suggests the market has digested these changes rather than sliding further.

Behind the scenes, major houses have been lobbying the region’s central bureau to reduce maximum yields to 8,000kg per hectare, a historically low level. This would help lower their contractual commitments to growers, address slowing sales, and tighten supply.

While this highlights a degree of pressure in the market, the current trading data shows no major drop in volumes compared to last year. In other words, the proposed yield cuts are not a reaction to a fresh collapse in trading activity, but a strategic move to manage long-term pricing.

Overall, the Champagne market in 2025 feels like it is treading water, with some positive signs that conditions are improving. Prices are stabilising, trading levels are steady, and the region’s ability to manage production offers a buffer against downside risks. If supply is indeed tightened over the next 6–18 months, we could see a reduction in available stock, which may support prices further.

For value-focused investors, Champagne could be an attractive short-to-medium term play, particularly if production cuts coincide with an improving macroeconomic backdrop.

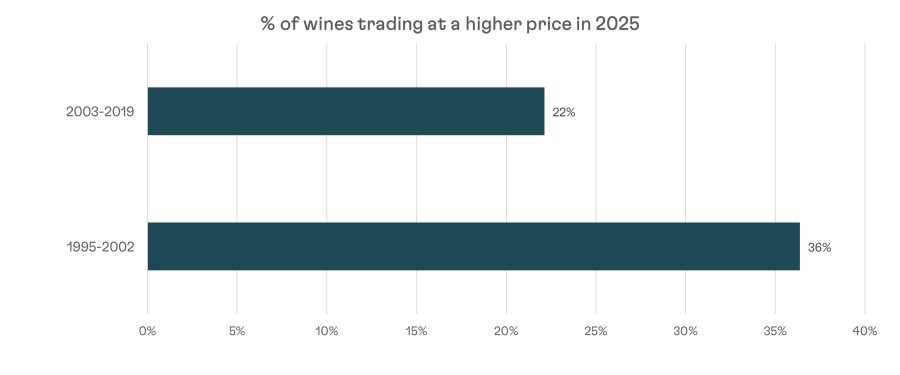

Vintage Analysis: What Does it Mean?

Champagne shows the same pattern as Bordeaux and Burgundy, with older vintages generally holding value better. While the sample size is smaller, the split by age is clear:

- Older vintages (2002 and earlier): 36% trading up, outperforming the regional average by 12%

- Younger vintages (2003 onwards): 22% trading up, slightly below the regional average of 24%

| Vintage | Grand Total | Up | Down | % Up |

|---|---|---|---|---|

| 1997 | 1 | 1 | 0 | 100% |

| 2019 | 1 | 1 | 0 | 100% |

| 2000 | 3 | 2 | 1 | 67% |

| 1998 | 2 | 1 | 1 | 50% |

| 1996 | 3 | 1 | 2 | 33% |

| 1995 | 3 | 1 | 2 | 33% |

| 2003 | 3 | 1 | 2 | 33% |

| 2007 | 9 | 3 | 6 | 33% |

| 2010 | 3 | 1 | 2 | 33% |

| 2011 | 6 | 2 | 4 | 33% |

| 2015 | 7 | 2 | 5 | 29% |

| 2004 | 15 | 4 | 11 | 27% |

| 2002 | 9 | 2 | 7 | 22% |

| NV | 37 | 8 | 29 | 22% |

| 2009 | 5 | 1 | 4 | 20% |

| 2013 | 10 | 2 | 8 | 20% |

| 2014 | 5 | 1 | 4 | 20% |

| 2012 | 11 | 2 | 9 | 18% |

| 2005 | 6 | 1 | 5 | 17% |

| 2008 | 19 | 3 | 16 | 16% |

| 2006 | 12 | 1 | 11 | 8% |

| 1995 | 1 | 0 | 1 | 0% |

| 2016 | 1 | 0 | 1 | 0% |

| Grand Total | 169 | 40 | 129 | 24% |

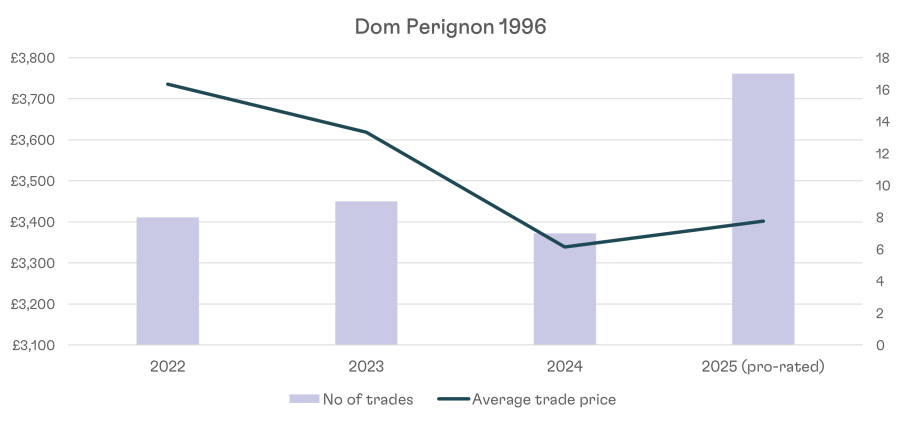

Spotlight: Dom Pérignon 1996

After a steep price decline from its 2022 peak through 2023 and 2024, the 1996 vintage has seen a modest rebound in 2025, trading 1.9% higher than last year. Trading activity has also picked up, with 10 trades year-to-date already surpassing annual totals for previous years. On a pro-rata basis, volumes could almost double historical averages.

Trends by Wine & Producer: Price & Trading Volumes

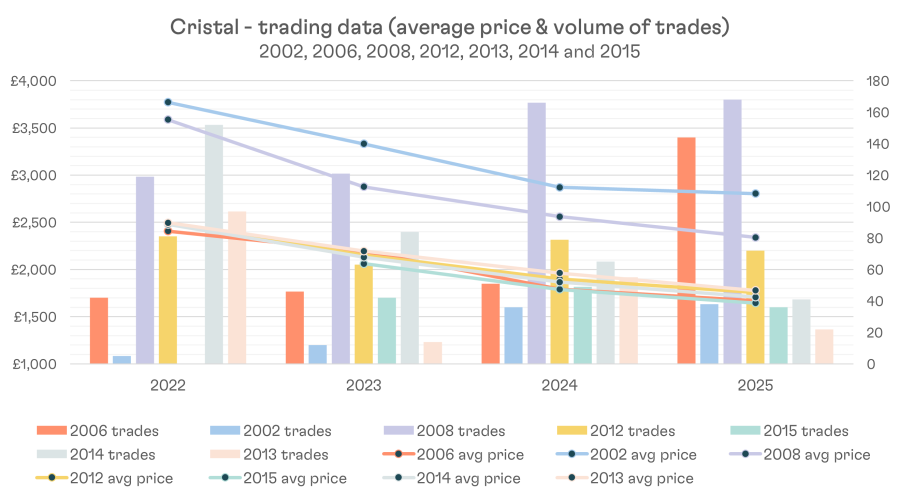

The first half of 2025 has been challenging for many of Champagne’s biggest names. Houses such as Taittinger, Louis Roederer (Cristal), Krug and Bollinger have seen almost every vintage trade at lower average prices than in 2024. For Louis Roederer, for example, all 11 vintages tracked are down, averaging a -7.2% price change.

At the other end of the spectrum, a handful of growers and prestige houses are bucking the trend. Egly-Ouriet continues to stand out, with 36% of its traded vintages showing year-on-year price gains, notably the 2008 (three 100-point scores) and 2012 (99 points).

| Producer | Grand Total | Up | Down | % Up |

|---|---|---|---|---|

| David Leclapart | 3 | 3 | 0 | 100% |

| Deutz | 1 | 1 | 0 | 100% |

| Jacquesson | 1 | 1 | 0 | 100% |

| Agrapart & Fils | 4 | 2 | 2 | 50% |

| Henri Giraud | 2 | 1 | 1 | 50% |

| Billecart-Salmon | 7 | 3 | 4 | 43% |

| Egly-Ouriet | 11 | 4 | 7 | 36% |

| Gosset | 3 | 1 | 2 | 33% |

| Larmandier-Bernier | 3 | 1 | 2 | 33% |

| Perrier Jouet | 3 | 1 | 2 | 33% |

| Rare | 6 | 2 | 4 | 33% |

| Salon | 6 | 2 | 4 | 33% |

| Veuve Clicquot | 3 | 1 | 2 | 33% |

| Dom Perignon | 23 | 7 | 16 | 30% |

| Charles Heidsieck | 7 | 2 | 5 | 29% |

| Jacques Selosse | 4 | 1 | 3 | 25% |

| Vilmart & Cie | 4 | 1 | 3 | 25% |

| Pol Roger | 9 | 2 | 7 | 22% |

| Philipponnat | 7 | 1 | 6 | 14% |

| Taittinger | 12 | 1 | 11 | 8% |

| Bollinger | 13 | 1 | 12 | 8% |

| Krug | 13 | 1 | 12 | 8% |

| Armand de Brignac | 1 | 0 | 1 | 0% |

| Delamotte | 2 | 0 | 2 | 0% |

| Dom Ruinart | 1 | 0 | 1 | 0% |

| Laurent Perrier | 4 | 0 | 4 | 0% |

| Louis Roederer | 11 | 0 | 11 | 0% |

| Pierre Peters | 1 | 0 | 1 | 0% |

| Pommery | 1 | 0 | 1 | 0% |

| Savart | 1 | 0 | 1 | 0% |

| Tarlant | 2 | 0 | 2 | 0% |

Volumes Tell a Different Story

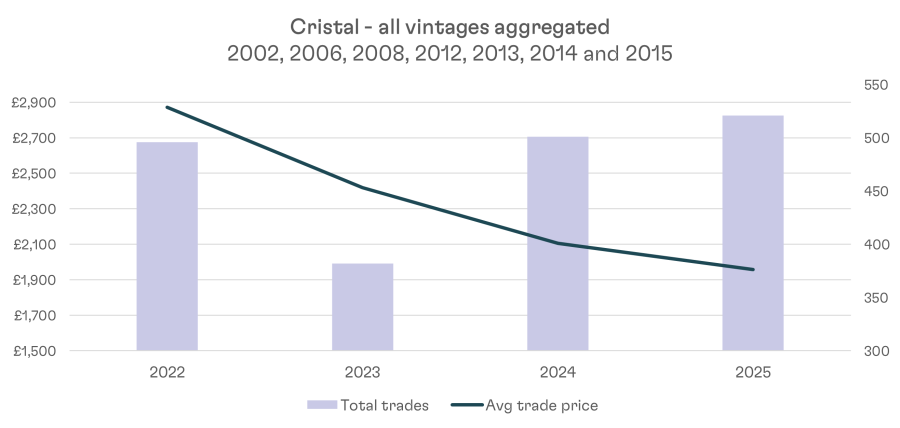

Despite broad price declines, volumes for certain houses remain resilient.

Cristal is a prime example: every tracked vintage is down in price, yet trading activity is on course for its highest level in four years. This suggests that while buyers are not paying 2022–2023 prices, they are willing to transact at today’s levels in greater numbers than in the past two years.

Cristal, one of the most recognised prestige cuvées, often acts as a bellwether for Champagne. The post-2022 drop in volumes reflected the impact of rising interest rates and tighter money supply on luxury goods demand. If 2025 ends ahead of 2023 and 2024 in volume terms, it could signal stronger market support for prices at current levels.

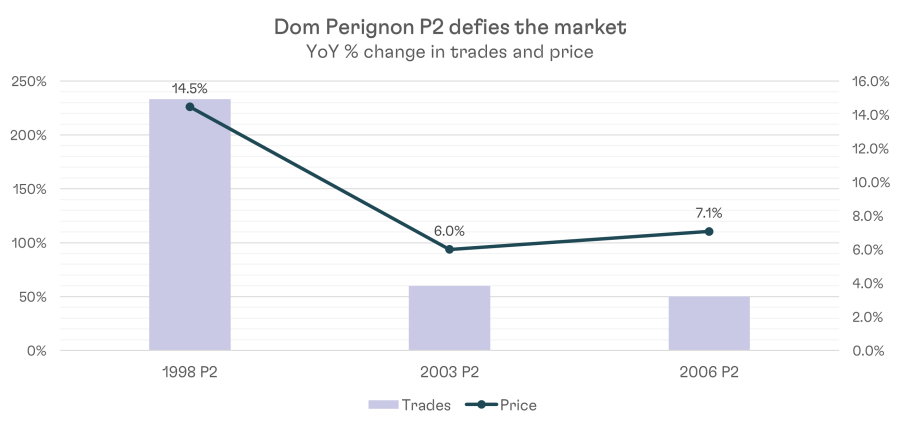

Dom Pérignon P2 Defies the Market

One of the most notable stories in 2025 has been the performance of Dom Pérignon P2.

Vintages such as 1998, 2003 and 2006 have all recorded double-digit increases in trading volumes, with the 1998 already seeing 12 trades this year compared with six in all of 2024. Prices are also up sharply, from £3,344 last year to £3,827 in 2025 (+14.5%).

While still around 10% below the £4,200 levels seen in 2022–2023, this is a clear example of strong demand for mature, high-quality Champagne with extended lees ageing.

This trend fits squarely with what we have seen across the market in 2025: strong demand for older, high-quality vintages. With P2, extended lees ageing is part of its very identity, giving it built-in maturity and complexity. It is little surprise, then, that Champagne collectors remain willing to pay and compete for bottles of this calibre.

Top 10 Most Traded Champagne Brands (First Half of 2025):

| Producer | 2024 Total Trades | 2025 Total Trades (YTD) |

|---|---|---|

| Dom Perignon | 596 | 332 |

| Louis Roederer | 531 | 323 |

| Taittinger | 510 | 295 |

| Bollinger | 211 | 114 |

| Krug | 189 | 98 |

| Salon | 59 | 63 |

| Rare | 92 | 62 |

| Egly-Ouriet | 120 | 53 |

| Charles Heidsieck | 73 | 48 |

| Pol Roger | 126 | 43 |

Download the H1 2025 Price & Trading Analysis Dataset

Access over 10,000 lines of data covering 3,330 unique wines, including trading volumes, total traded value, and average trade prices from 2022 to 2025, showing performance shifts across all metrics.

An exclusive dataset compiled by Cult Wines for fine wine investors and trade professionals.

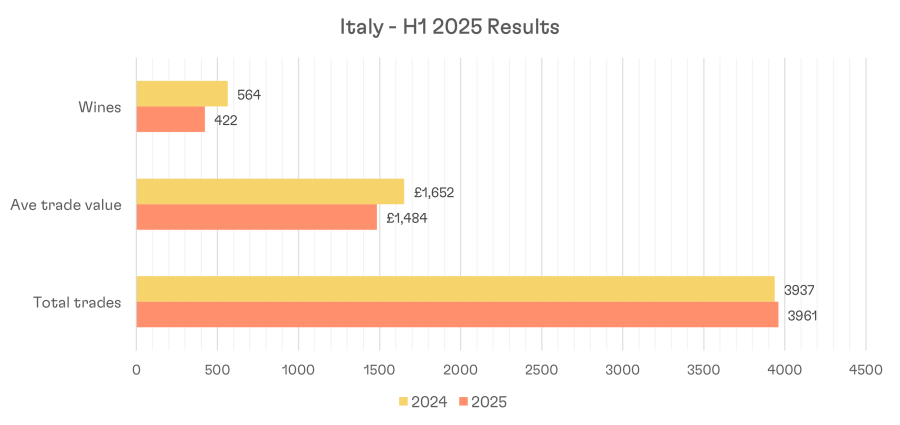

Italy: Consolidation Around the Icons

- Prices down on average by 7.2%

- Volumes are pretty flat Year-on-Year

- Higher concentration of trades in the big names (all experience % gains in transactions YoY).

Of the 338 Italian wines traded in both 2024 and 2025, prices have fallen on average by 7.2%, putting the region slightly behind Bordeaux.

Despite the steeper decline, 30% of these wines have traded at higher prices than last year, a stronger proportion than both Bordeaux and Champagne. This points to greater price volatility, with some wines needing deeper discounts to secure buyers while others have managed to rise in value.

Trading activity remains highly concentrated. Of the 91 Italian producers traded this year, the top ten account for 64% of total transactions, with the top five representing half of the market.

Nine of the top ten have increased their number of trades on a pro-rated basis compared with 2024, which could indicate that in softer market conditions, collectors and investors are consolidating around the most liquid and recognisable names.

It may also suggest that these wines, already well-established globally, are easier to sell and trade even in a down market.

Vintage Analysis: Understanding the Numbers

Because the data covers multiple Italian regions, vintage analysis is less clear-cut than for single-region markets. That said, some universally acclaimed years stand out. The 2016 vintage, in which many Italian regions produced wines of exceptional quality, dominates trading in 2025, representing 25% of all Italian trades.

The broader trend seen in other regions is visible here too: older vintages are outperforming more recent ones. At the upper end of the performance table, mature vintages such as 2005, 2008, 2011 and 2012 show stronger results, while recent years like 2019 and 2020 have been more pressured. This could reflect the higher availability and greater number of sellers for younger vintages, creating downward pressure on prices.

Conversely, older vintages, with reduced supply and more bottle age, are attracting stronger bids from buyers seeking both maturity and scarcity.

| Vintage | Grand Total | Up | Down | % Up |

|---|---|---|---|---|

| 2005 | 2 | 2 | 0 | 100% |

| 2008 | 5 | 3 | 2 | 60% |

| 2011 | 9 | 5 | 4 | 56% |

| 2012 | 13 | 7 | 6 | 54% |

| 2009 | 7 | 3 | 4 | 43% |

| 2014 | 18 | 6 | 12 | 33% |

| 2017 | 26 | 8 | 18 | 31% |

| 2021 | 10 | 3 | 7 | 30% |

| 2015 | 42 | 12 | 30 | 29% |

| 2018 | 32 | 9 | 23 | 28% |

| 2016 | 83 | 22 | 61 | 27% |

| 2013 | 27 | 7 | 20 | 26% |

| 2010 | 16 | 4 | 12 | 25% |

| 2019 | 28 | 7 | 21 | 25% |

| 2020 | 12 | 2 | 10 | 17% |

| 2004 | 1 | 0 | 1 | 0% |

| 2006 | 2 | 0 | 2 | 0% |

| 2007 | 4 | 0 | 4 | 0% |

| 2022 | 1 | 0 | 1 | 0% |

| Grand Total | 338 | 100 | 238 | 30% |

Producer Trends

Looking at producers with at least five wines traded in both 2024 and 2025, a few names stand out.

Gaja is performing well above the regional average, with 42% of its wines up year-on-year, while Tignanello continues its strong multi-year run with 40% of wines in positive territory. Other notable performers include La Spinetta, Tua Rita and Vietti, each with more than 40% of their traded wines up.

At the other end of the scale, some high-volume names have struggled. Giacomo Conterno and Sassicaia, despite being among the most traded brands in Italy, have only 13% and 12% of their wines up, respectively, in 2025.

This is a reminder that high liquidity does not necessarily equate to price resilience in a softer market.

| Producer | Up | Down | % Up | Grand Total |

|---|---|---|---|---|

| La Spinetta | 3 | 2 | 60% | 5 |

| Tua Rita | 3 | 4 | 43% | 7 |

| Vietti | 3 | 4 | 43% | 7 |

| Gaja | 11 | 15 | 42% | 26 |

| Fattoria Le Pupille | 2 | 3 | 40% | 5 |

| Luciano Sandrone | 2 | 3 | 40% | 5 |

| Rampolla | 2 | 3 | 40% | 5 |

| Tignanello | 6 | 9 | 40% | 15 |

| Massolino | 3 | 5 | 38% | 8 |

| Poggio di Sotto | 2 | 4 | 33% | 6 |

| Casanova di Neri | 2 | 5 | 29% | 7 |

| Marroneto | 2 | 5 | 29% | 7 |

| Masseto | 2 | 5 | 29% | 7 |

| Fontodi | 2 | 6 | 25% | 8 |

| Ornellaia | 3 | 10 | 23% | 13 |

| Bruno Giacosa | 3 | 11 | 21% | 14 |

| Antinori (Castello della Sala) | 1 | 4 | 20% | 5 |

| Elio Grasso | 1 | 4 | 20% | 5 |

| Guado Al Tasso | 1 | 4 | 20% | 5 |

| Solaia | 1 | 6 | 14% | 7 |

| Giacomo Conterno | 2 | 13 | 13% | 15 |

| Sassicaia | 2 | 15 | 12% | 17 |

| Biondi-Santi | 1 | 9 | 10% | 10 |

| Bartolo Mascarello | 0 | 6 | 0% | 6 |

Standout Italian Wines

Several wines have shown both an increase in average trade price and an increase in trading volumes year-on-year. Notable examples include:

| Wine Name | Vintage | 2024 Total Trades | 2025 Total Trades | 2024 Avg Price | 2025 Avg Price | YoY % Change | % Change in Trading |

|---|---|---|---|---|---|---|---|

| Guado Al Tasso, Bolgheri | 2018 | 6 | 8 | £924 | £1,070 | 15.8% | 129% |

| Tua Rita, Redigaffi, Toscana | 2013 | 3 | 3 | £1,080 | £1,240 | 14.8% | 71% |

| Tignanello, Toscana | 2009 | 5 | 3 | £1,465 | £1,677 | 14.5% | 3% |

| Gaja, Barbaresco | 2015 | 9 | 11 | £1,402 | £1,539 | 9.8% | 110% |

| Il Poggione, Brunello di Montalcino, Vigna Paganelli Riserva | 2015 | 19 | 26 | £407 | £442 | 8.4% | 135% |

| Sassicaia, Tenuta San Guido, Bolgheri | 2012 | 13 | 11 | £2,155 | £2,301 | 6.8% | 45% |

| Ornellaia, Bolgheri | 2017 | 20 | 19 | £1,448 | £1,543 | 6.6% | 63% |

| Ornellaia, Bolgheri | 2009 | 4 | 9 | £1,949 | £2,052 | 5.3% | 286% |

| Luciano Sandrone, Barolo, Vigne | 2016 | 6 | 6 | £1,879 | £1,974 | 5.1% | 71% |

These examples show that even in a down market, certain wines are finding strong buyer demand and achieving price gains, particularly where quality, reputation and maturity converge.

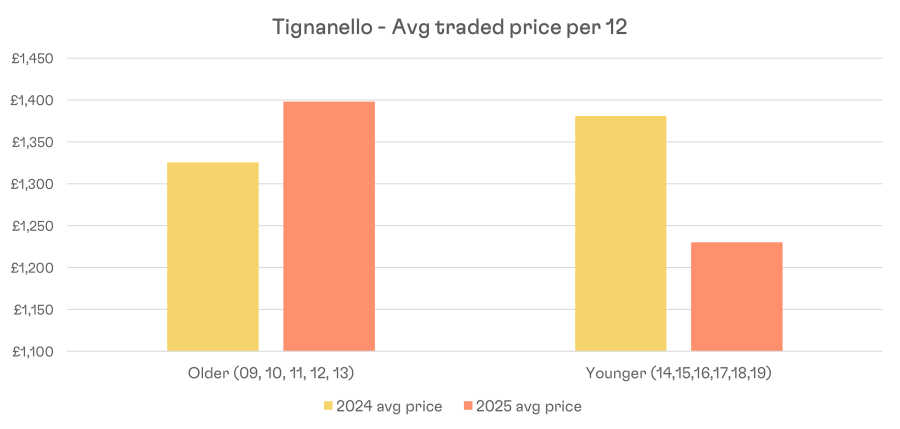

Closer Look: Tignanello

Tignanello remains the most traded Italian brand by volume and continues to outperform the region as a whole. While more vintages have traded lower this year than higher, the proportion of vintages in positive territory (40%) is above the Italian average.

There is a stark difference in performance between older and younger vintages. In 2024, vintages from 2014–2019 had a higher average trade price (£1,381) than those from 2009–2013 (£1,325). This has reversed sharply in 2025. Older vintages have appreciated by 5% to around £1,400, while newer vintages have fallen by 11% to £1,230. The older group is now trading at a 13.6% premium to the younger vintages, underlining the market’s current preference for maturity and reduced supply.

This seems to be the common theme we see playing out in the market. The younger vintages, with more stock on the market, are liquid; however, the increased number of sellers may be exerting greater downward pressure on prices.

Similarly, where buyers are willing to trade up and maintain higher prices, availability is generally lower, and quality is higher. This is often the case with older vintages that have more maturity, and it is also where quality is typically found.

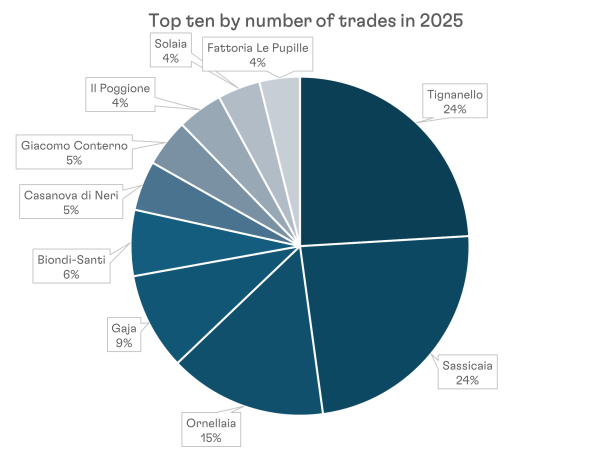

Top 10 Producers Dominate Italian Trade Volumes in 2025

There are 91 producers in Italy that have recorded trades in 2025. Remarkably, the top ten producers account for 64% of that total, with the top five accounting for 50% of the total.

In fact, the share of trade for Italy’s biggest names is growing in 2025. Almost all of the top ten producers, with the exception of Biondi-Santi, have increased their number of trades on a pro-rated basis compared to last year. This could indicate that the dominant brands are continuing to consolidate their position within the Italian market.

It may also reflect investor and collector behaviour in a weaker market, where activity tends to centre on the most liquid, easily traded wines. The longer tail of less prominent labels is still present, but in softer conditions, market participants may be gravitating towards these safer, more established names.

| Producer/Wine | 2024 | 2025 YTD | 2025 Annualised | % Change |

|---|---|---|---|---|

| Tignanello | 570 | 355 | 609 | 7% |

| Sassicaia | 451 | 351 | 602 | 33% |

| Ornellaia | 277 | 222 | 381 | 37% |

| Gaja | 147 | 137 | 235 | 60% |

| Biondi-Santi | 183 | 93 | 159 | -13% |

| Casanova di Neri | 109 | 70 | 120 | 10% |

| Giacomo Conterno | 104 | 67 | 115 | 10% |

| Il Poggione | 102 | 64 | 110 | 8% |

| Solaia | 53 | 60 | 103 | 94% |

| Fattoria Le Pupille | 59 | 57 | 98 | 66% |

In summary, the Italian market in the first half of the year has, like most regions, seen more wines falling in value than rising.

However, as elsewhere, the iconic, high-profile brands are trading more frequently, with volumes up for nine out of the ten most traded wines. Within this universe of collectible labels, there are pockets of resilience, with producers such as Tignanello, Gaja and Vietti outperforming the wider market.

Super Tuscans & Market Resilience

Sassicaia and Ornellaia, two of the top three most traded wines in Italy, have seen modest price declines of -7.7% and -3.3% respectively.

However, both are trading at higher volumes than in 2024, suggesting that current price levels are attracting buyers and could provide a base for stability or even recovery in the second half of the year.

Ornellaia, for example, has already traded 213 times year-to-date, compared to 269 for the whole of last year, putting it on track to surpass its 2024 total comfortably.

Download the H1 2025 Price & Trading Analysis Dataset

Access over 10,000 lines of data covering 3,330 unique wines, including trading volumes, total traded value, and average trade prices from 2022 to 2025, showing performance shifts across all metrics.

An exclusive dataset compiled by Cult Wines for fine wine investors and trade professionals.

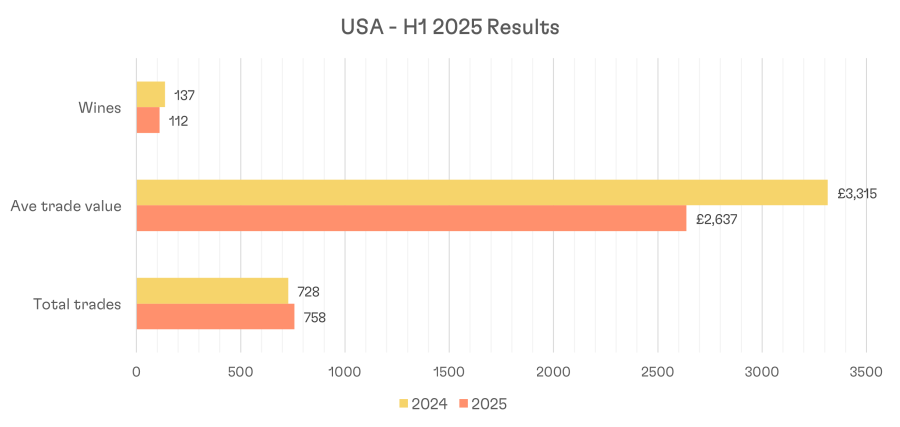

USA: Tariffs Bite & Top Names Under Pressure

- Prices down 10% in 2025

- 78 wines traded in both 2024 and 2025, averaging £2,823 in 2024 vs £2,542 in 2025

- Volume of trading up 3.9% in the first half of 2025 vs 2024

The USA market has faced a challenging first half of 2025. Of the 78 wines that traded in both years, just 18% achieved a higher average sale price in 2025 compared with 2024. This means over 80% have fallen in value, placing the USA slightly behind Bordeaux on this metric, recording the second largest average price drop of any region in this report.

Prices for this group declined from an average of £2,823 to £2,542, a 10% fall.

Volumes remain relatively steady, with 2025 on track to slightly surpass 2024 in total trades. The number of individual wines changing hands is also broadly similar, though slightly lower year-on-year.

Much of the market narrative in 2025 has been dominated by US tariffs, specifically the new 15% import tax on European wines. Interestingly, the region most affected so far appears to be the USA itself. The indirect consequence, perhaps not anticipated by policymakers, has been a decline in trading prices for many collectible, investment-grade US wines.

In theory, reduced European imports or a shift towards domestic purchases could support US producers. In practice, at the high end of the market, Napa Cabernet is not a direct substitute for Bordeaux, nor does US Pinot easily replace Grand Cru Burgundy in the eyes of collectors. For these buyers, who are often price inelastic, an additional 15% tariff is unlikely to deter purchases of European icons.

As a result, the anticipated boost for top-tier US wines has not materialised. Instead, certain US brands, notably Screaming Eagle, Harlan, and Opus One, have long relied on mainland Chinese demand to sustain prices. In recent years, they have faced similar pressures to Bordeaux First Growths, with Chinese demand softening. Even if the Chinese fine wine market recovers, there is a question over whether these US wines still carry the same cultural cachet as before, especially compared with European counterparts.

Where the data does show relative resilience is in US wines, less dependent on Chinese demand and priced below the super-premium tier. Established names such as Ridge, which have built long-term reputations for quality without the extreme pricing of Napa’s top labels, have weathered the current climate more successfully.

This mirrors a pattern seen in other regions; for example, certain Italian and Burgundy producers have maintained trading momentum despite wider market softness, highlighting the advantage of strong brand equity at more accessible price points.

USA Wine Performance by Winery (H1 2025)

The first half of 2025 has been challenging for most leading US wineries, with the majority of wines trading below 2024 levels.

The clear exception is Ridge Vineyards, a historic estate in Monte Bello known for producing fresher, more Bordeaux-like wines compared with the bigger, fuller-bodied Napa Cabernets. Ridge has maintained relatively modest pricing, consistently strong critic scores and a loyal following.

In a decade dominated by label-driven collectibles such as Harlan Estate, Opus One, and Screaming Eagle, Ridge’s resilience in a softer market is notable.

| Winery | Grand Total | Up | Down | % Up |

|---|---|---|---|---|

| Ridge | 7 | 4 | 3 | 57% |

| Realm Cellars | 2 | 1 | 1 | 50% |

| Harlan Estate | 7 | 2 | 5 | 29% |

| Verite | 4 | 1 | 3 | 25% |

| Sine Qua Non | 8 | 1 | 7 | 13% |

| Continuum | 5 | 0 | 5 | 0% |

| Dominus | 8 | 0 | 8 | 0% |

| Hundred Acre | 3 | 0 | 3 | 0% |

| Inglenook | 2 | 0 | 2 | 0% |

| Joseph Phelps | 6 | 0 | 6 | 0% |

| Kapcsandy Family Winery | 3 | 0 | 3 | 0% |

| Opus One | 10 | 0 | 10 | 0% |

When overlaying volumes, average prices and year-on-year changes, the data shows that all featured wineries have seen average prices decline.

Interestingly, the steepest price drops often coincide with increased trading volumes. This suggests that sellers willing to discount, in some cases by 20% compared with 2024, are still able to find a market.

| Winery | 2024 Total Trades | 2025 Total Trades | 2024 Avg Price | 2025 Avg Price | % Vol Traded | % Price Change |

|---|---|---|---|---|---|---|

| Ridge | 26 | 15 | £1,811 | £1,800 | -1.1% | -0.6% |

| Joseph Phelps | 73 | 23 | £1,550 | £1,497 | -46.0% | -3.4% |

| Harlan Estate | 40 | 23 | £9,747 | £9,330 | -1.4% | -4.3% |

| Opus One | 218 | 126 | £3,009 | £2,871 | -0.9% | -4.6% |

| Realm Cellars | 12 | 10 | £1,170 | £1,116 | 42.9% | -4.7% |

| Dominus | 95 | 47 | £2,215 | £2,002 | -15.2% | -9.6% |

| Kapcsandy Family | 5 | 10 | £1,477 | £1,281 | 242.9% | -13.3% |

| Sine Qua Non | 14 | 25 | £2,951 | £2,480 | 206.1% | -16.0% |

| Inglenook | 4 | 4 | £1,155 | £928 | 71.4% | -19.6% |

| Verite | 13 | 15 | £1,761 | £1,388 | 97.8% | -21.2% |

| Hundred Acre | 6 | 13 | £4,560 | £3,529 | 271.4% | -22.6% |

| Continuum | 23 | 26 | £1,845 | £1,407 | 93.8% | -23.8% |

This mirrors patterns seen in other regions such as Bordeaux and Champagne, where price corrections have been accompanied by higher trading volumes. It may indicate that buyers are starting to accept these lower levels as the new market floor. If this holds, it could provide a stabilising base for any future recovery, particularly for brands with strong reputations and broad global appeal.

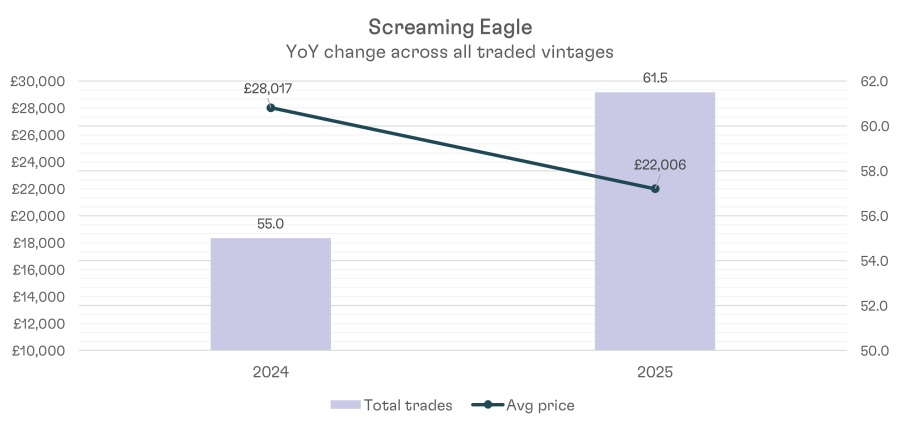

Spotlight on Screaming Eagle

Screaming Eagle remains the poster child of the US investment-grade wine market. Produced in tiny quantities, regularly achieving 100-point scores, and holding near-mythical status among US collectors, it has also enjoyed strong demand in Asia, particularly China, where a bottle with the red eagle once carried the same cachet as DRC or Lafite. Over the past decade, it has delivered exceptional returns, but the recent market downturn has hit it harder than any other collectible Napa wine.

In the first half of 2025, 12 vintages traded in both 2024 and 2025. Volumes were relatively robust, with 41 trades compared to 55 in all of 2024. On a pro-rated basis, this equates to an 11.8% increase year-on-year. However, average trade prices fell across almost every vintage, with the sole exception being 2010, which traded once at roughly the same price as last year.

| Vintage | 2024 Trades | 2025 Trades | 2024 Avg Price | 2025 Avg Price | % Price Change | % Vol Trades |

|---|---|---|---|---|---|---|

| 2007 | 4 | 1 | £31,250 | £24,000 | -23.2% | -62.5% |

| 2008 | 2 | 1 | £28,570 | £26,000 | -9.0% | -25.0% |

| 2009 | 1 | 3 | £29,336 | £22,761 | -22.4% | 350.0% |

| 2010 | 4 | 1 | £28,880 | £29,200 | 1.1% | -62.5% |

| 2011 | 1 | 1 | £28,288 | £22,780 | -19.5% | 50.0% |

| 2012 | 3 | 2 | £29,860 | £27,208 | -8.9% | 0.0% |

| 2015 | 3 | 6 | £27,590 | £22,924 | -16.9% | 200.0% |

| 2016 | 7 | 2 | £28,365 | £23,500 | -17.2% | -57.1% |

| 2018 | 5 | 4 | £29,171 | £27,170 | -6.9% | 20.0% |

| 2019 | 9 | 5 | £26,339 | £17,491 | -33.6% | -16.7% |

| 2020 | 4 | 5 | £25,139 | £20,096 | -20.1% | 87.5% |

| 2021 | 12 | 10 | £23,417 | £20,927 | -10.6% | 25.0% |

| Total | 55 | 41 | £28,017 | £22,006 | -15.6% | 11.8% |

The sharpest drop came from the 2019 vintage, down 33.6% to an average of £17,491, compared with £26,339 last year. Across all 41 trades, Screaming Eagle’s average price in 2025 has fallen by 15.6% to £22,006 per 12-bottle case, or £1,833 per bottle.

For context, before the market peak, this wine regularly traded above £30,000 per 12, reached £45,000 at the peak in November 2022, and has now halved in value. At around £2,000 per bottle, the market appears over-corrected compared with long-term averages, which could present attractive entry points for long-term investors.

Buyer interest at these levels is clear, with strong volume activity despite softer pricing. Anything under £5,000 per 3-bottle case looks compelling for a wine that has historically traded well above that range. For now, the market remains soft and volatile, which may provide further buying opportunities before any sustained recovery takes hold.

Download the H1 2025 Price & Trading Analysis Dataset

Access over 10,000 lines of data covering 3,330 unique wines, including trading volumes, total traded value, and average trade prices from 2022 to 2025, showing performance shifts across all metrics.

An exclusive dataset compiled by Cult Wines for fine wine investors and trade professionals.

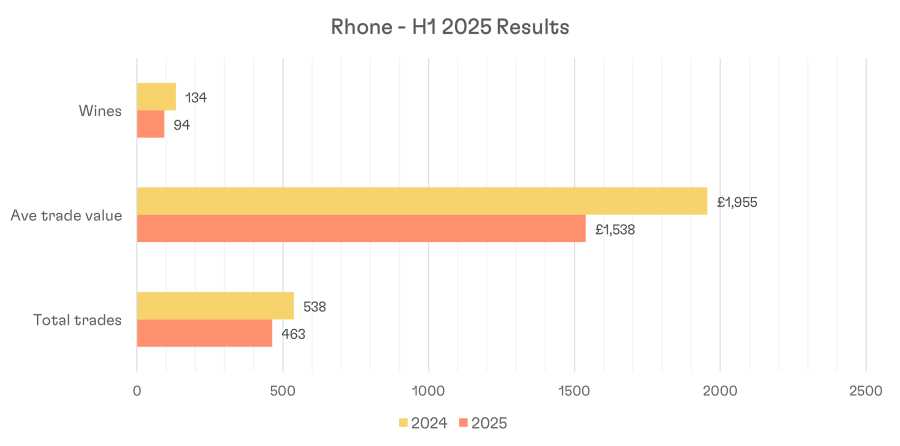

Rhône: The Steepest Declines but Value Pockets Emerging

- Prices down 13.9% in 2025

- 76% of wines traded at a lower average price in 2025 vs 2024

- Volumes down 14%

In the first half of 2025, Rhône wines have traded on average 13.9% lower than in 2024. Of the 70 wines that traded in both years, just 24% achieved a higher average price, while 76% declined. The average price across these wines fell from £1,650 in 2024 to £1,420 in 2025. Trading volumes are also on track to finish ~14% lower year-on-year, with the region recording the steepest drop in average transaction price of any major region.

Long considered a laggard in the fine wine investment market, the Rhône has continued that pattern in the current downturn. While Bordeaux and the US have a larger proportion of wines trading at lower values, the Rhône’s average price decline of 13.9% still represents the sharpest fall among regions for wines that have traded.

Rhône Vintage Trends

Unlike other regions, where older vintages from top years are outperforming, Rhône’s vintage-level performance is mixed. The standout is 2019, where 45% of wines traded at higher prices than last year. Notably, it is also the most actively traded vintage, suggesting that collectors are seeking quality and value in a softer market. This aligns with the broader 2025 trend of wines offering strong quality-to-price ratios outperforming their peers.

Among the five biggest risers in 2019, four are Châteauneuf-du-Pape and one is from the Northern Rhône: M. Sorrel Hermitage Le Gréal 2019. This wine has traded four times in 2025 at an average of £1,483, up from £1,106 in 2024. With critic scores between 97 and 100 points and Jeb Dunnuck drawing comparisons to the legendary 1961 Jaboulet Hermitage La Chapelle, demand at around £125 per bottle is unsurprising.

The data suggests that, even in a weak market, collectors are prepared to pay for wines that combine proven quality with long-term potential at accessible prices. In the Rhône, 2019 appears to fit that profile better than any other recent vintage.

| Vintage | Grand Total | Up | Down | % Up |

|---|---|---|---|---|

| 2008 | 1 | 1 | 0 | 100% |

| 2009 | 3 | 2 | 1 | 67% |

| 2019 | 11 | 5 | 6 | 45% |

| 2012 | 5 | 2 | 3 | 40% |

| 2016 | 7 | 2 | 5 | 29% |

| 2015 | 9 | 2 | 7 | 22% |

| 2018 | 10 | 2 | 8 | 20% |

| 2017 | 9 | 1 | 8 | 11% |

| 2007 | 1 | 0 | 1 | 0% |

| 2010 | 5 | 0 | 5 | 0% |

| 2011 | 1 | 0 | 1 | 0% |

| 2014 | 4 | 0 | 4 | 0% |

| 2020 | 4 | 0 | 4 | 0% |

| Grand Total | 70 | 17 | 53 | 24% |

Rhône Producer Performance

Filtering for producers with a minimum level of trading to remove anomalies from thin data reveals a consistent pattern in the Rhône during H1 2025. Almost every one of the top 12 most-traded producers has seen its average price fall compared with 2024. The sole exception is Vieux Télégraphe, which remained flat year-on-year.

As in other regions, some of the biggest names have recorded higher trading volumes despite falling prices. Jean-Louis Chave, for example, saw volumes rise 174% even as its average price slipped 9%.

The region’s flagship, Château Rayas, continues to struggle to hold value. Revered by collectors as one of the most singular wines in the world and the pinnacle expression of Grenache, it has traded just twice so far this year at an average of £7,342 per 12x75cl. This remains far above its peers, but represents a steep drop from its market peak. Alongside Rousseau in Burgundy, Rayas is among the biggest fallers since the 2022 peak.

| Wine | 2024 Trades | 2025 Trades | 2024 Avg Price | 2025 Avg Price | % Change Price | % Trade Vol |

|---|---|---|---|---|---|---|

| Vieux Telegraphe | 10 | 4 | £506 | £505 | 0% | -31% |

| Chateau de Beaucastel Rouge | 77 | 32 | £577 | £561 | -3% | -29% |

| Clos des Papes | 38 | 26 | £740 | £696 | -6% | 17% |

| Domaine Jean Louis Chave | 10 | 16 | £3,612 | £3,285 | -9% | 174% |

| Domaine de la Chapelle | 40 | 19 | £1,360 | £1,189 | -13% | -19% |

| Domaine du Pegau | 98 | 42 | £889 | £772 | -13% | -27% |

| E. Guigal | 39 | 20 | £2,626 | £2,260 | -14% | -12% |

| Thierry Allemand | 4 | 4 | £1,883 | £1,586 | -16% | 71% |

| M. Chapoutier | 23 | 26 | £1,819 | £1,517 | -17% | 94% |

| Chateau de Beaucastel Hommage | 11 | 8 | £2,307 | £1,907 | -17% | 25% |

| Domaine de la Janasse | 31 | 22 | £497 | £397 | -20% | 22% |

| Chateau Rayas | 8 | 2 | £9,889 | £7,342 | -26% | -57% |

| Grand Total | 404 | 232 | £1,650 | £1,441 | -13% | -2% |

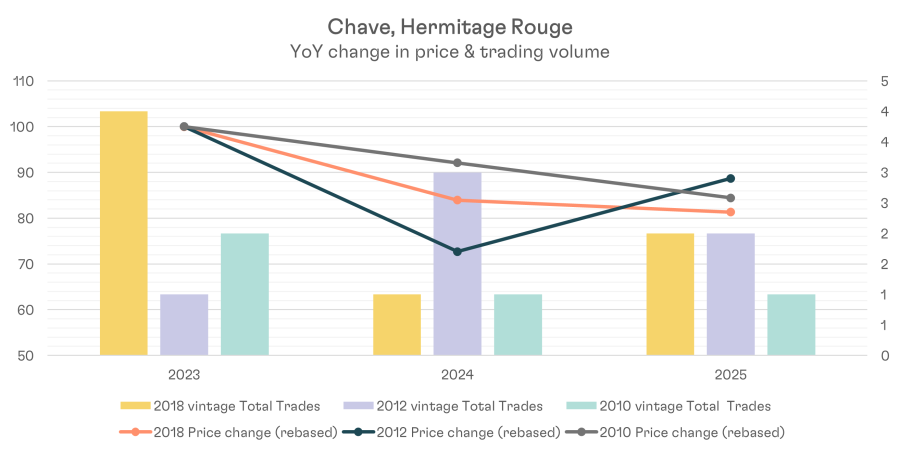

Spotlight: Jean Louis Chave, Hermitage Rouge

There have been reports within the wine trade suggesting Jean-Louis Chave has been one of the standout performers in 2025. However, our transactional data, which reflects actual prices achieved across the secondary market (exchanges, auctions, CultX, and our B2B wholesale activity), paints a more complex picture. This highlights the difference between assessing price trends from advertised offers versus analysing real-world sales.

Looking at three vintages that have traded in each of the last three years, H1 2025 has seen a rise in trading volumes compared with 2024. The 2018 and 2010 vintages are both on track to record more transactions this year, despite prices falling 3% and 8% respectively. This underlines the market’s willingness to transact at recalibrated price points.

The 2012 vintage has been the exception, rebounding from a 2024 average of £2,254 to £2,749 in 2025, up 22% year-on-year, though still below the £3,100 average recorded in 2023.

The 2018 and 2010 make for a notable comparison: the 2018, awarded a perfect 100 points from Jeb Dunnuck and 99 from The Wine Advocate, currently trades at £3,690, a 46% discount to the 2010, which holds a perfect Robert Parker 100-point score and is averaging £6,840 this year.

While Chave Hermitage’s overall average price is down around 9% in 2025, the combination of increased volumes, selective vintage strength, and relative value in certain years suggests that pricing may be stabilising. For medium to long-term investors, the current environment could present an opportunity to acquire high-quality vintages at attractive entry points.

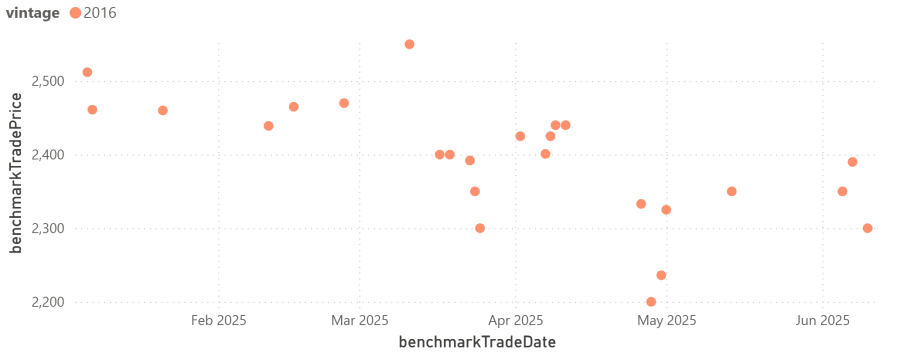

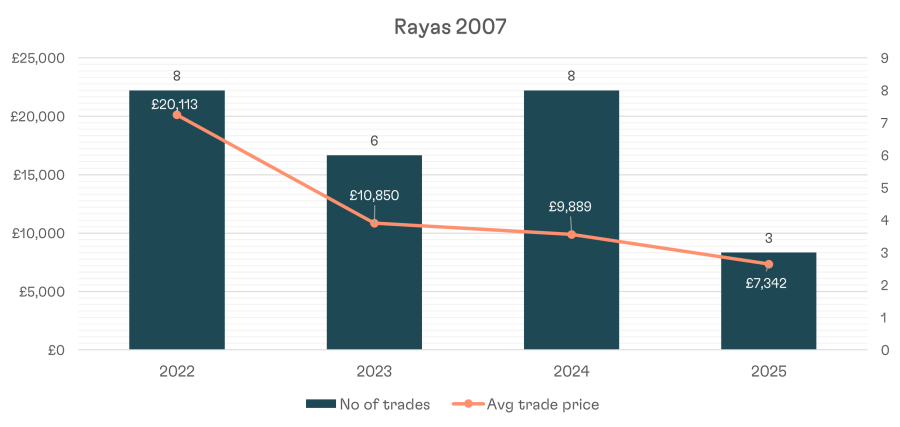

Spotlight: Rayas 2007

As noted earlier, 2025 has so far been another difficult year for Rayas, extending the decline that began after the market peak in 2022. The 2007 vintage, shown in the graphic below, is a clear example of the scale of the correction.

This year, the wine has traded twice at an average of £7,342 per 12x75cl case, representing a 25.7% drop from its 2024 average of £9,899, which was achieved across eight transactions. Unusually, this decline has occurred alongside lower trading volumes, bucking the trend seen in other regions where the sharpest price falls have often been accompanied by heightened activity.

The longer-term picture is even more striking. In 2022, the 2007 vintage averaged £20,113 per case. That means values have fallen 63.5% in less than three years, a remarkable contraction for a wine with such a mythical reputation. Rayas is widely regarded as one of the world’s most distinctive and sought-after expressions of Grenache, often produced in tiny volumes and difficult to secure even for top collectors.

Ironically, Rayas never seemed to be caught up in the speculative frenzy that drove parts of the market between 2019 and 2022. Its pricing was more a function of a genuine supply-demand imbalance, with committed buyers willing to pay Burgundy-level prices for what is considered by many to be some of the most compelling Rhône wines ever made.

Today’s softer market tells a different story. Depressed trading volumes suggest sellers are having to cut deeply to find buyers. This is one to watch closely in the second half of 2025 and into early 2026. If volumes recover and the market settles at a new equilibrium, the current levels could represent a rare entry point for long-term collectors.

Download the H1 2025 Price & Trading Analysis Dataset

Access over 10,000 lines of data covering 3,330 unique wines, including trading volumes, total traded value, and average trade prices from 2022 to 2025, showing performance shifts across all metrics.

An exclusive dataset compiled by Cult Wines for fine wine investors and trade professionals.

Rest of the World: Value, Resilience & New Momentum

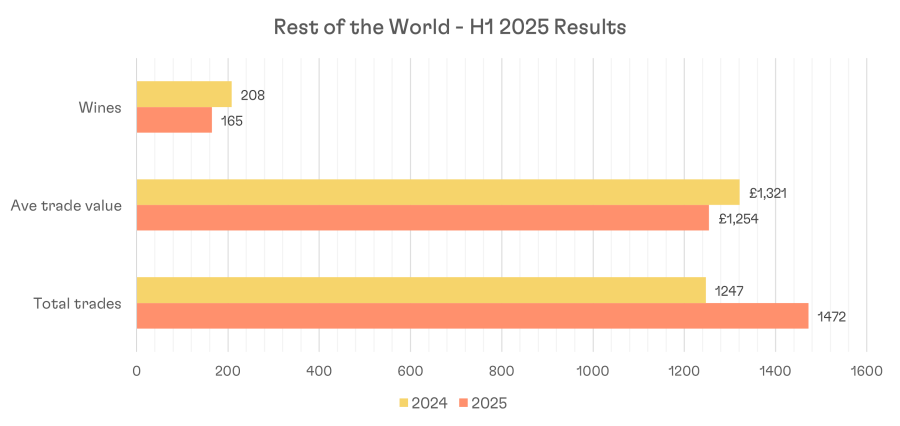

- Biggest proportion of wines trading higher (36%) in 2025 than in 2024, than any other region

- On average, wines are trading 6.2% lower than in 2024, which is the third best after Burgundy and Champagne

- Volumes up 15.3%

In a challenging first half of 2025 for the fine wine market, the Rest of the World category has been a rare bright spot. Trading volumes are on track to finish the year up 15.3% versus 2024, the largest projected increase of any region we track. While 64% of wines have still traded at lower prices than last year, this segment has shown more resilience than most.

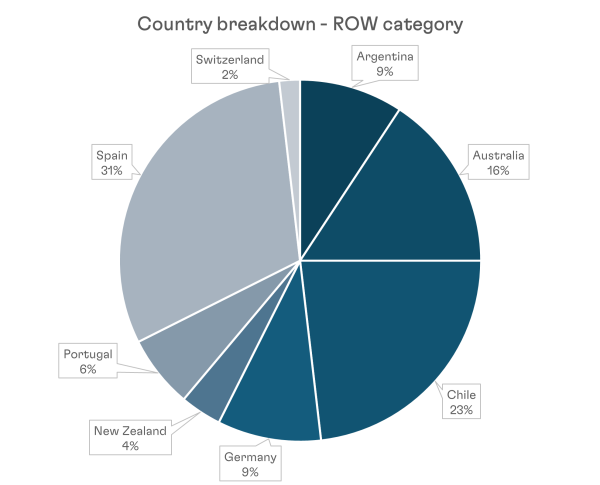

Several factors are driving this performance. In South America, Viña Don Melchor has benefited from the momentum of its 2021 vintage being named Wine Spectator’s Wine of the Year in 2024. In Spain, demand for Vega Sicilia’s portfolio beyond Unico has strengthened, leveraging the brand’s prestige. In Australia, Penfolds is regaining momentum following the removal of Chinese tariffs and re-entry into its largest export market.

This category often represents the market’s “value play”, high-quality wines that may not have the same profile as Bordeaux, Burgundy, Italy, or the US, but offer strong price-to-quality ratios. In softer markets, this value proposition becomes even more attractive, particularly in regions like Rioja or Chile, where highly rated Bordeaux blends are available at far more accessible prices.

With a combination of brand-driven demand, tariff-related boosts, and inherent value positioning, the Rest of the World segment could be well-placed to capitalise when market conditions improve. The ability to deliver relatively positive results in a down market suggests these wines may already be ahead of the curve.

For this analysis, we didn’t look too much into vintage, given the vast array of countries covered, and so there would be much homogeneity in the vintage quality and what that might be telling us.

Rest of World: Producer Analysis

Within the Rest of the World category, a handful of producers have managed to navigate 2025 with relative success. Vega Sicilia is one of the standout names, with 10 different wines and vintages trading so far this year.

Remarkably, 60% of those have achieved higher average prices than in 2024. This growth has been driven not by the flagship Unico, but by increasing demand and trading in the wider portfolio.

| Winery | Grand Total | Up | Down | % Up |

|---|---|---|---|---|

| Vina Don Melchor | 2 | 2 | 0 | 100% |

| Vega Sicilia | 10 | 6 | 4 | 60% |

| CVNE | 2 | 1 | 1 | 50% |

| Domaine Bournet-Lapostolle | 6 | 3 | 3 | 50% |

| Gantenbein | 2 | 1 | 1 | 50% |

| Marques de Murrieta | 2 | 1 | 1 | 50% |

| Peter Jakob Kuhn | 2 | 1 | 1 | 50% |

| Penfolds | 13 | 5 | 8 | 38% |

| Henschke | 3 | 1 | 2 | 33% |

| Taylor's | 3 | 1 | 2 | 33% |

| La Rioja Alta | 9 | 2 | 7 | 22% |

| Rothschild & Concha Y Toro | 9 | 2 | 7 | 22% |

| Cheval Blanc & Terrazas de Los Andes | 5 | 1 | 4 | 20% |

| Egon Muller | 5 | 1 | 4 | 20% |

| Sena | 6 | 1 | 5 | 17% |

| Catena Zapata | 3 | 0 | 3 | 0% |

| Felton Road | 3 | 0 | 3 | 0% |

| Remirez de Ganuza | 5 | 0 | 5 | 0% |

| Grand Total | 108 | 39 | 69 | 36% |

Penfolds is another notable case. After several challenging years following the China–Australia trade dispute, the lifting of tariffs has had a clear impact. Of the Penfolds wines traded in 2025, 38% have done so at higher average prices than last year. Given the prevailing market softness, this is a strong showing relative to both the regional average and other high-profile producers.

Rest of World: Wine Analysis

At the top of the performance table, Valbuena from Vega Sicilia leads with an 11.5% increase in average price compared to 2024, despite lower trading volumes.

In Chile, Viña Don Melchor continues to benefit from the momentum created by its 2021 vintage being named Wine Spectator’s Wine of the Year. Average prices are up 4.2%, with trading volumes increasing 16%.

Clos Apalta from Domaine Bournet-Lapostolle has also posted a positive 2025, with volumes up 44% and a modest price rise to £745. In the current market, any increase combined with robust volumes is noteworthy.

| Wine | 2024 Trades | 2025 Trades | 2024 Avg Price | 2025 Avg Price | % Change Price | % Change in Vol |

|---|---|---|---|---|---|---|

| Vega Sicilia, Valbuena 5.°, Ribera del Duero | 31 | 7 | £1,254 | £1,398 | 11.5% | -61% |

| Gantenbein, Pinot Noir, Graubunden | 5 | 6 | £1,682 | £1,861 | 10.6% | 106% |

| Penfolds, Bin 798 RWT Shiraz, Barossa Valley | 5 | 5 | £795 | £843 | 6.0% | 71% |

| R. Lopez de Heredia, Tondonia Tinto Reserva, Rioja | 22 | 17 | £293 | £311 | 5.9% | 32% |

| Vega Sicilia, Pintia, Toro DO | 3 | 4 | £515 | £538 | 4.4% | 129% |

| Vina Don Melchor, Cabernet Sauvignon, Puente Alto | 86 | 58 | £966 | £1,007 | 4.2% | 16% |

| Domaine Bournet-Lapostolle, Clos Apalta, Apalta | 31 | 26 | £734 | £745 | 1.5% | 44% |

| La Rioja Alta, 904 Gran Reserva, Rioja | 178 | 104 | £567 | £560 | -1.3% | 0% |

| Marques de Murrieta, Castillo Ygay Gran Reserva Especial, Rioja | 33 | 17 | £1,561 | £1,530 | -1.9% | -12% |

| Penfolds, Grange, South Australia | 71 | 44 | £3,753 | £3,660 | -2.5% | 6% |

| Rothschild & Concha Y Toro, Almaviva, Maipo Valley | 50 | 67 | £1,150 | £1,085 | -5.7% | 130% |

| Dr. Loosen, Erdener Treppchen Riesling GG Alte Reben, Mosel | 6 | 9 | £235 | £220 | -6.4% | 157% |

| Bodega Chacra, Cincuenta y Cinco Pinot Noir, Patagonia | 6 | 9 | £350 | £328 | -6.4% | 157% |

| La Rioja Alta, Vina Ardanza Reserva, Rioja | 61 | 40 | £217 | £202 | -6.6% | 12% |

| Catena Zapata, Nicolas Catena Zapata, Mendoza | 31 | 30 | £444 | £414 | -6.8% | 66% |

| Cheval Blanc & Terrazas de Los Andes, Cheval des Andes, Mendoza | 55 | 38 | £567 | £523 | -7.6% | 18% |

| Sena, Aconcagua Valley | 80 | 129 | £735 | £667 | -9.3% | 176% |

| Vega Sicilia, Unico, Ribera del Duero | 60 | 21 | £3,570 | £3,173 | -11.1% | -40% |

| Vega Sicilia, Alion, Ribera del Duero | 24 | 25 | £702 | £597 | -15.0% | 79% |

| Remirez de Ganuza, Gran Reserva, Rioja | 15 | 6 | £1,063 | £611 | -42.5% | -31% |

One of the more interesting stories comes from Rioja. López de Heredia’s Tondonia Tinto Reserva has seen average prices rise 5.9% alongside a 32% increase in volumes. At £311 per case of 12, it remains one of the most affordable wines in this report and has long been considered undervalued for its quality. Alongside La Rioja Alta, it commands a loyal global following, with the market clearly recognising its combination of value and pedigree in 2025.

While performance is still mixed across the wider producer list, these examples show that strong brands with global recognition, value-driven positioning, or timely market catalysts can buck broader trends, even in a year as challenging as this one.

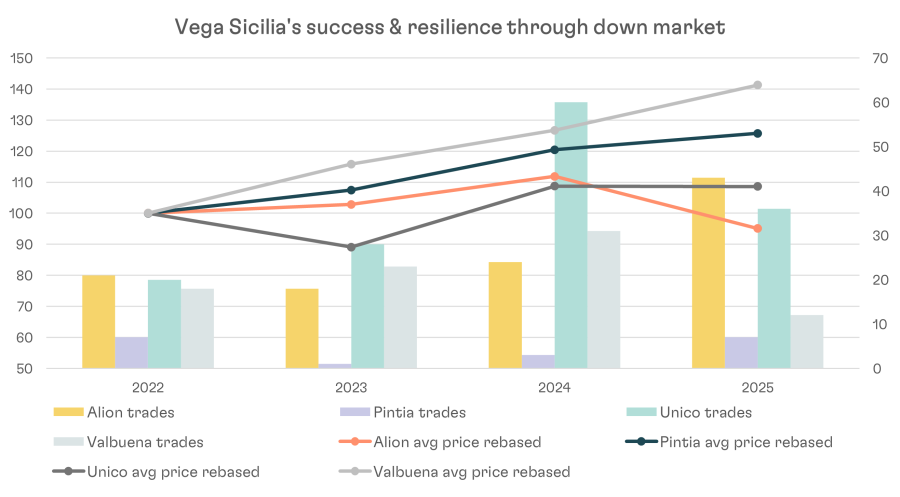

Spotlight: Vega Sicilia

Vega Sicilia has continued to outperform much of the fine wine market in 2025. Although price and volume movements have not been entirely smooth, the overall trajectory remains positive compared to broader market trends. While Unico is the flagship label and the one most collectors know best, the real driver of Vega’s resilience this year has been the strength of its wider portfolio.

Valbuena provides a clear example. In 2022 it averaged under £1,000 per 12, yet in 2025 it is trading at almost £1,400, an 11.5% increase on last year’s average price. Even the more accessible wines, such as Pintia and Alion, have shown encouraging signs. Alion’s trading volumes are up 80% year on year, and although its price has softened slightly, this appears to have boosted market appetite rather than dampened it.

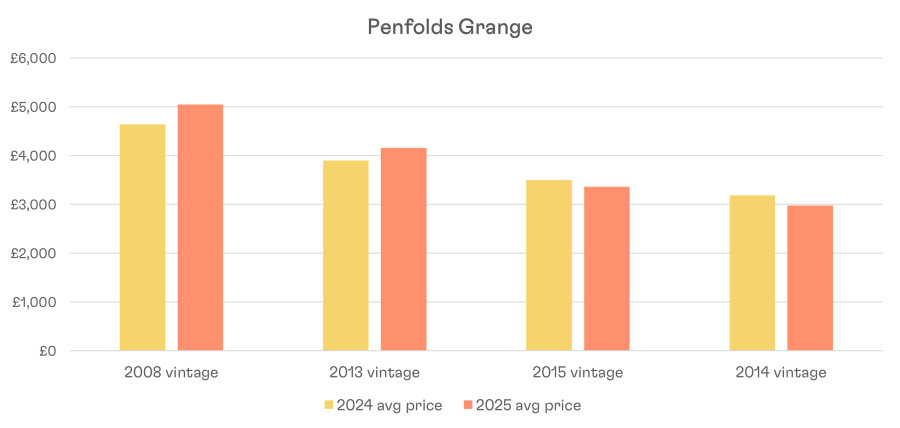

Spotlight: Penfolds

On 29 March 2024, Australian winemakers finally had reason to celebrate when China’s Ministry of Commerce removed the heavy tariffs on their wine, ending a three-year trade dispute. The news was particularly significant for Treasury Wine Estates, owner of Penfolds, as China had previously accounted for around 30% of the group’s revenues, with Penfolds as its lead brand.

Although an immediate rebound was unlikely given the challenging conditions in the Chinese market through 2024 and into 2025, the first half of this year shows early signs of recovery in pricing. Of the four vintages that traded in both periods, the 2008 and 2013 vintages posted average price gains of 8.7% and 6.6% respectively.

The younger 2014 and 2015 vintages have slipped slightly in value, illustrating that Grange still faces similar headwinds to the wider fine wine market. Even so, the reopening of the Chinese market has left Penfolds in a stronger position than it might otherwise be.

Grange and other Penfolds icons remain closely linked to Chinese demand. While the brand has worked hard to build its presence in other regions, particularly the Middle East, these markets cannot yet match China’s potential scale.

For investors seeking a value play tied to a potential Chinese rebound, the younger, more affordable vintages of Penfolds could offer long-term upside, especially given their current 30% discount.

Market Outlook & Closing Thoughts

The first half of 2025 has been shaped by a market still adjusting to the correction that began in 2023, but there are clear signs of resilience and opportunity across certain regions, producers, and individual wines. While the prices wines are trading at are on the whole below what they were selling for in 2025, trading data shows that buyers are becoming increasingly selective, rewarding value, quality, and scarcity.

Furthermore, where there have been price declines, we are seeing a proportional increase in trading, which is a good sign. It would be a lot less positive if wines trading at a further 5-10% lower than 2024 were not finding buyers. This trend does give us some optimism as we enter the second half of 2025.

In Burgundy, the pace of price declines has eased, with top-tier producers beginning to stabilise. Bordeaux has maintained a steady flow of trades. First growths are all trading more actively, albeit at lower prices, and older high-quality vintages seem to be performing the best in 2025 so far. Italy’s top names have consolidated their dominance by growing their share of total trades.

Prices have softened, but as we have seen with Bordeaux, this is driving more activity. Champagne has faced softer demand, though prestige cuvées retain loyal followings. The US market remains polarised, the impact of the tariffs in the short-term seems to have weakened demand for US wines, and prices for top producers such as Screaming Eagle have continued to come under pressure. The Rest of World category has delivered some of the most interesting stories of the year so far, from Vega Sicilia’s portfolio strength to early signs of a Penfolds revival.

Liquidity remains a defining theme. Wines with active, global secondary markets and broad collector appeal have fared better than those dependent on a narrow buyer base. This pattern is likely to persist through the second half of the year, making trading volumes as important to monitor as price movements.

Looking ahead, the key question is whether the market has found its new price floors. For some wines, notably those with strong brand equity and proven long-term demand, current levels could represent attractive entry points. For others, further adjustment may be needed before stability returns.

The next six months will be critical in shaping sentiment for 2026. Macro conditions, currency movements, and the health of major buying regions such as the US and China will all play important roles. In the meantime, the data underscores a simple truth: in a cautious market, informed, data-led buying decisions will be rewarded.

Download the H1 2025 Price & Trading Analysis Dataset

Access over 10,000 lines of data covering 3,330 unique wines, including trading volumes, total traded value, and average trade prices from 2022 to 2025, showing performance shifts across all metrics.

An exclusive dataset compiled by Cult Wines for fine wine investors and trade professionals.