Brand

Producer

History

Vintage quality

Scheduled re-scores

Liquidity

Critic score

Provenance Certification

Drinking window

Market trends

Comparative price analysis

Availability

Historical price performance

Vintage production

Our five stages to portfolio management

Macro analysis

Context is important. Before any investment decision, we consider the broad economic climate - global markets, various asset types.

Wine market analysis

Zoom into the fine wine market. We look at regional trends in the context of global demand. For producers, we’ve identified 14 key metrics that play a role in picking investment-worthy wines.

Forecast

Based on data, experience and technology, we predict trends, assess risks and identify opportunities for the long term.

We invest in regions that respect a strict set of rules and have a potential for appreciation.

Targeted Returns

We use a top down approach across our portfolios to best set them up to deliver the results you are targeting.

Strategic allocation

Diversification across regions, vintages and producers is critical.

Performance review

We periodically revisit the markets to identify the newest developments.

Tactical allocation

We adjust your portfolio to respond to the latest research, with the aim of maximising your returns.

Research & analytics

Over time, we've developed and refined proprietary algorithms to identify wines that give superior returns.

Management

Our active portfolio management means regular portfolio rebalancing so that you can reach the desired return objectives.

Meet the Cult Wines Investment Committee

The Committee combines the knowledge of our most experienced wine experts. They meet regularly to review strategy, risk parameters and portfolio performance.

Our active approach to investing

Act from the head

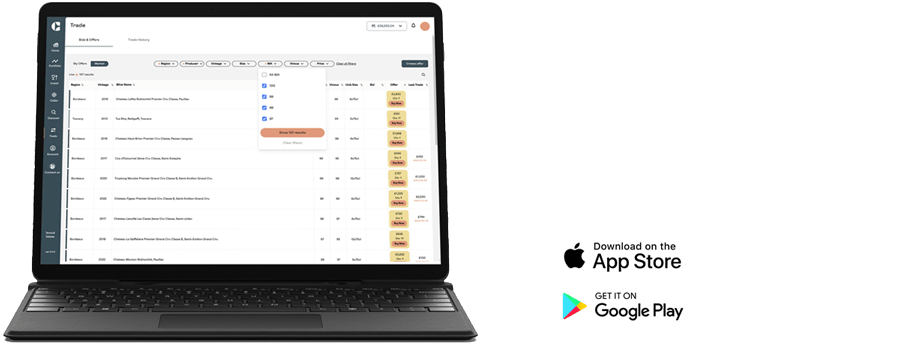

Trade

We have access to the biggest marketplaces in the world to enable effective asset acquisition and liquidation for our investors.

Manage

We build balanced portfolios, and actively monitor and rebalance them for the best returns.

Passionate Experts

Passion

We love wine. So much so, that we have dedicated ourselves to learning as much as we can about it. To share in our journey, you can visit the Wine Academy, where we document and share everything we have discovered.

Support

We are here to help, always on hand to support you throughout your investment journey.

Where is your wine

Storage influences wine quality and hence value and ease of sale