Fine Wine in 2025: Repricing, Liquidity & Clearer 2026

In 2025, the fine wine market engaged in the kind of work that rarely makes for dramatic headlines but often matters most in the years that follow: prices moved closer to credible clearing levels, and liquidity began to return in a more measurable way after a 2-year correction.

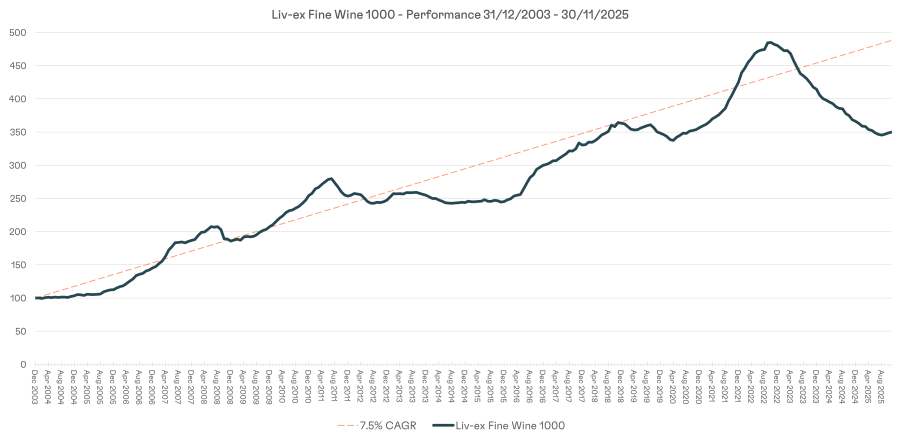

That longer frame is important. Over the past two decades, the Liv-ex 1000 has delivered a strong long-term performance profile, even while reminding investors that fine wine is cyclical, particularly after periods of unusually rapid appreciation.

Liv-ex Fine Wine 1000: 20-year Performance

Against that backdrop, 2025 began with a market that had arguably over-corrected. Valuations across many leading names appeared more grounded than in the prior cycle, yet confidence remained fragile.

The first half of the year reflected that balance. Tariff uncertainty resurfaced and weighed on decision-making, while the Bordeaux En Primeur campaign failed to provide a meaningful lift to secondary-market sentiment.

The result was a market that remained selective and price-led, in which sellers were often required to meet the bid rather than wait for demand to follow the offer.

Fine Wine Market Cycles: What History Tells Us

Liquidity, Bid Depth & Tightening Spreads

Where Recovery Expressed Itself First

Selective Confidence Returning?

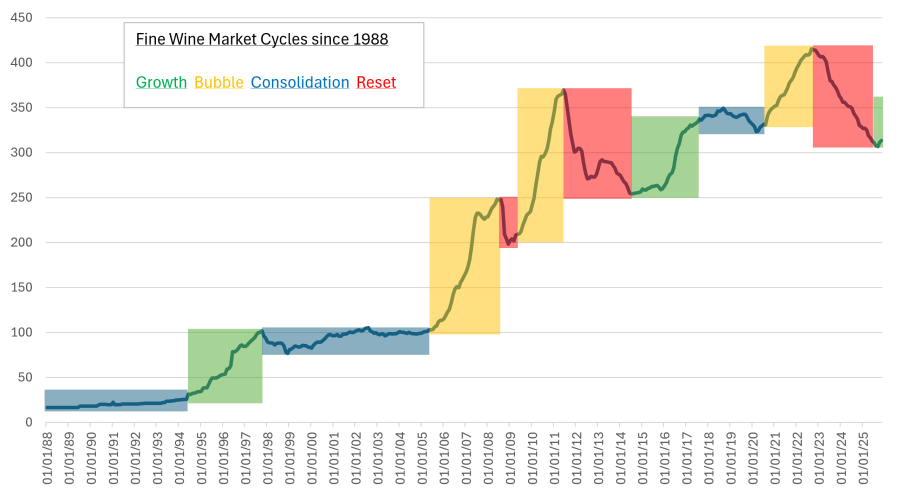

Fine Wine Market Cycles: What History Tells Us

Liv-ex Investables Index Since 1988

This chart shows how the fine wine market has moved in repeating cycles since 1988. While prices fluctuate in the short term, the long-term pattern is consistent.

Each colour represents a typical phase of the cycle:

- Green, Growth

- Demand increases, confidence returns, and prices rise steadily.

- Demand increases, confidence returns, and prices rise steadily.

- Yellow, Bubble

- Strong momentum turns into exuberance. Prices accelerate quickly as more buyers rush in.

- Strong momentum turns into exuberance. Prices accelerate quickly as more buyers rush in.

- Blue, Consolidation

- The market pauses. Prices move sideways as buyers become more selective and gains are absorbed.

- The market pauses. Prices move sideways as buyers become more selective and gains are absorbed.

- Red, Reset

- A correction phase where prices fall back, excess speculation is cleared, and value re-emerges.

What Stands Out?

- Every major bubble has been followed by a market reset. Prices correct sharply, but crucially, the market never falls back to pre-bubble levels.

- After each reset, a new growth cycle emerges from a higher base, reinforcing the long-term upward trend.

- Growth periods are typically followed by consolidation phases, during which the market digests gains and builds stability.

Looking at the latest cycle (2020–2025), the market has come off a bubble and reset phase. If the pattern continues, we could now be on the verge of the next growth cycle.

This cyclical resilience is one reason fine wine continues to attract long-term capital. The asset class corrects, consolidates, and then compounds.

A Turn From Drift to Stabilisation, Then Early Growth

By the second half of the year, the market began to show a clearer rhythm. The most liquid benchmarks stopped slipping, then began to firm with greater consistency.

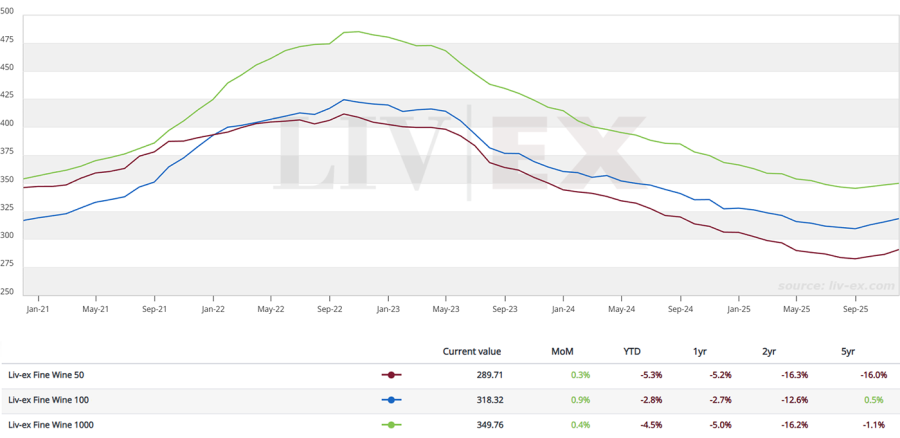

Liv-ex Fine Wine 50, 100 and 1000: 5-year Performance

The headline numbers are modest, but meaningful in context. Over the last four months of 2025, the Liv-ex Fine Wine 50 and Fine Wine 100 rose around 2.5%, while the Liv-ex Fine Wine 1000 rose around 1%. The caveat matters as much as the advance: the market remained roughly 25% to 30% below its previous peak.

This was not a return to the old regime. It was in the early stage of recovery, when sentiment improved gradually, and performance became more reliable, before sentiment became more pronounced.

That is also why the six-month pattern matters. A market that moves from stabilisation into growth is not simply “up”, it is re-establishing depth. The quality of the move becomes as important as the magnitude.

Liquidity, Bid Depth & Tightening Spreads

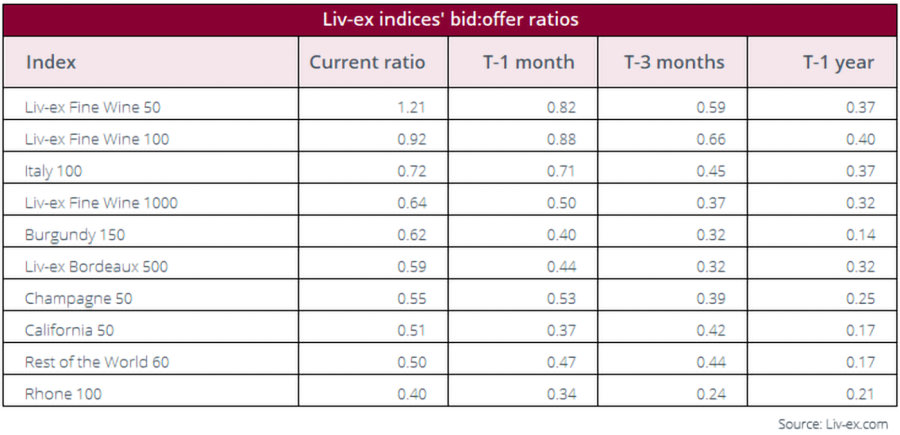

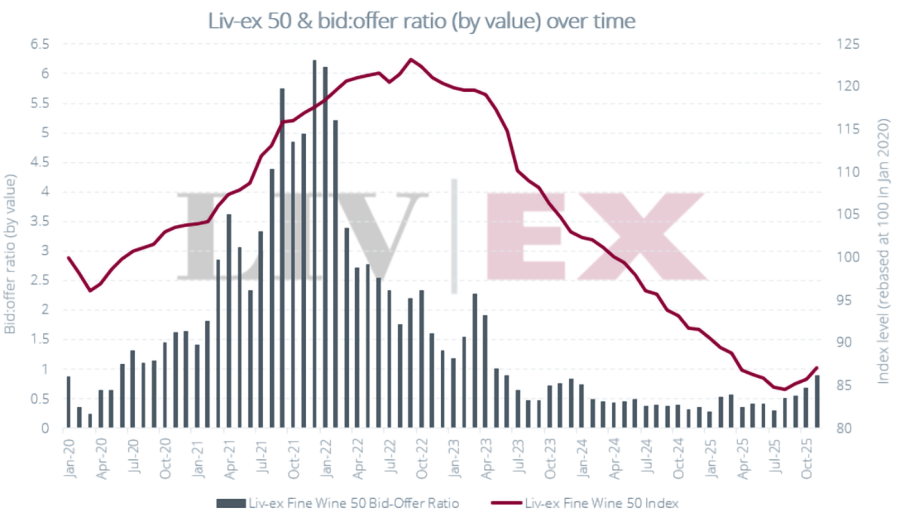

Turning points in fine wine tend to be confirmed by behaviour, not by commentary. The clearest behavioural evidence in late 2025 was the improvement in liquidity, particularly in the bid side of the market.

One of the best indicators of market sentiment is Liv-ex's bid:offer ratio, defined as the total value of bids for the total value of offers. These ratios began to rise in 2025, as shown below, and, as a result, we’ve observed increases in both indices and trading prices for a larger cohort of wines (see case studies below).

Source: Liv-ex.com

The headline numbers are modest, but meaningful in context. Over the last four months of 2025, the Liv-ex Fine Wine 50 and Fine Wine 100 rose around 2.5%, while the Liv-ex Fine Wine 1000 rose around 1%. The caveat matters as much as the advance: the market remained roughly 25% to 30% below its previous peak.

This was not a return to the old regime. It was in the early stage of recovery, when sentiment improved gradually, and performance became more reliable, before sentiment became more pronounced.

That is also why the six-month pattern matters. A market that moves from stabilisation into growth is not simply “up”, it is re-establishing depth. The quality of the move becomes as important as the magnitude.

Who Returned to the Market?

The recovery in the second half was supported by the return of buyers who tend to require clearer entry points.

Trade restocking became more visible, including activity from restaurant and hotel groups, retailers and merchants. Larger, more valuation-led participants also began to re-engage as the over-correction created opportunities that were harder to ignore.

Geography reinforced this shift. Hong Kong stood out, supported by renewed wealth creation and a stronger equity backdrop. European participation strengthened. US activity improved through Q3 and Q4, although overall involvement remained down relative to 2024.

Macro conditions helped at the margin. As rates ease gradually, cash returns appear less compelling, and the opportunity cost of deploying capital into alternatives changes. Greater tariff clarity also reduced friction, particularly for decision-making at the trade level.

Where Recovery Expressed Itself First

The late-2025 improvement was evident in benchmarks. It appeared in transaction behaviour, particularly in wines that tend to move early as liquidity improves.

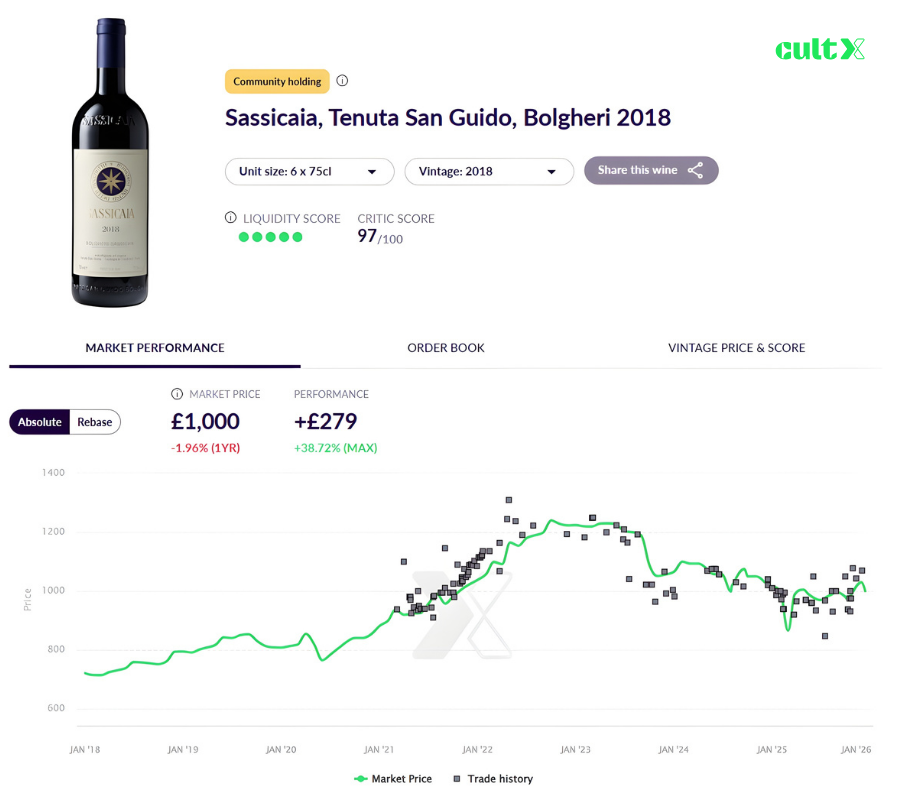

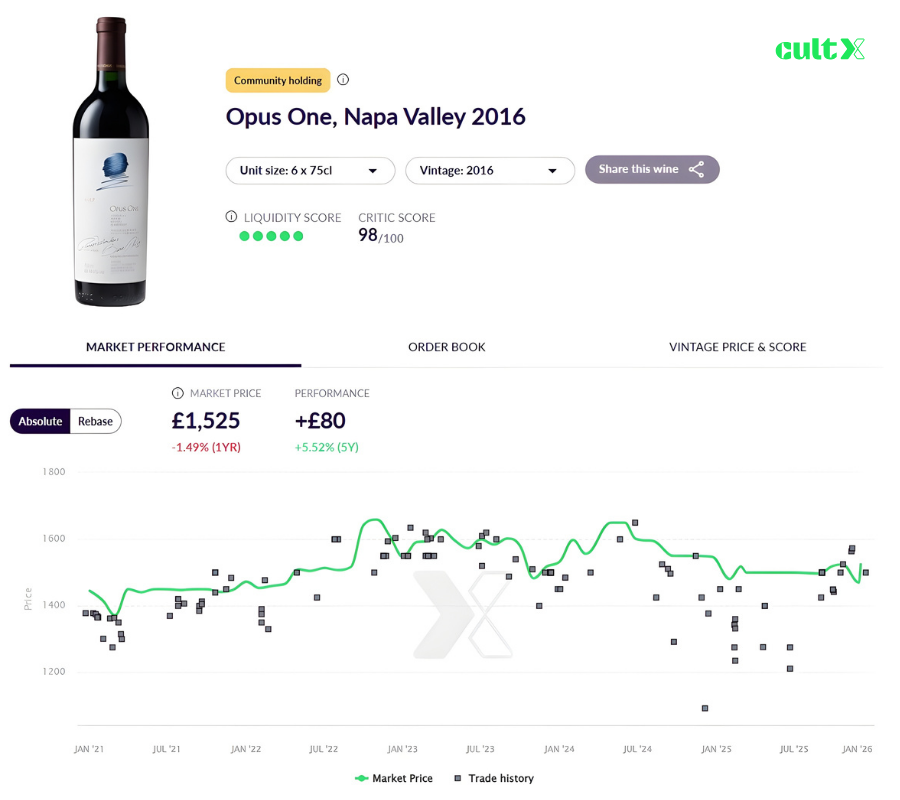

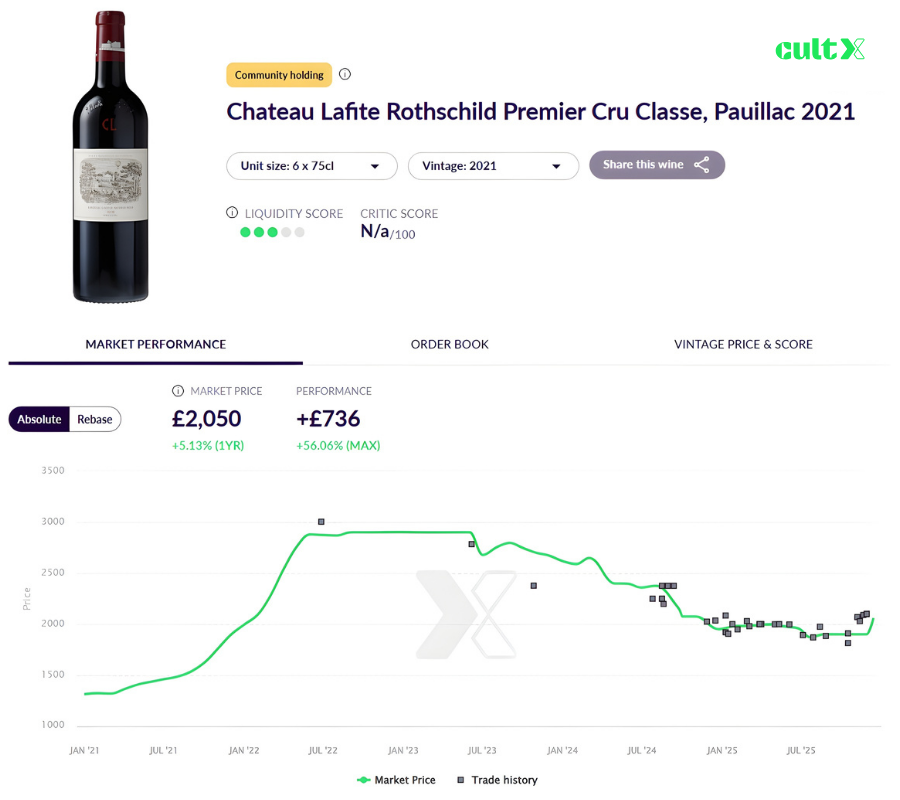

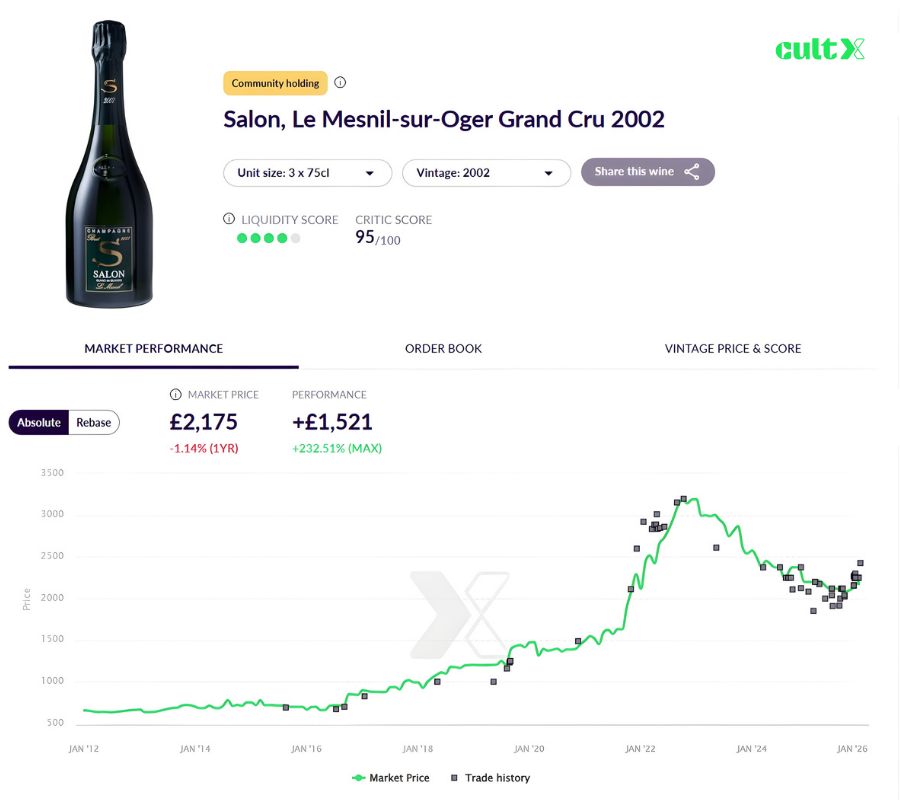

Several wines were highlighted as examples of strengthening tone, including Opus One 2016, Sassicaia 2018, Salon 2002 and Lafite 2021. The common theme is not that every bottle rose, but that demand reasserted itself in liquid names and pricing began to firm with repeatability.

Recent trading activity for Sassicaia 2018 shows multiple trades above £1,070 per 6x75cl, well ahead of the current market valuation of £1,000. The vintage has rebounded by 11.5% from its 2025 low trading price of £960 per 6x75cl.

Opus One 2016 offered one of the clearest examples. It returned to levels not seen since early 2023, trading consistently above £1,500 per 6x75cl since the summer. It also recorded a trade at £1,750 per 6x75cl in the last 30 days, close to a record high of £1,795 per 6x75cl.

The more important detail is consistency. Firmer pricing supported by repeat volume tends to be a better indicator of improving market health than a single standout print.

Lafite 2021 also reflected the late-year tone. The trade price was cited as rising around 15%, moving from a low of £1,815 per 6 to around £2,100 per 6x75cl in recent weeks.

Lafite remained among the most traded wines, with multiple vintages displaying a similar pattern of bouncing from summer lows and moving back towards, and in some cases above, market levels.

After a three-year low of £1,852 per 3x75cl in February, prices have rebounded by 17.4$ and are now stabilising around £2,200. Liquidity is returning, with six transactions in the last month at £2,250 or better.

Despite strong momentum, prices remain well below the October 2022 peak of £3,200 per 3x75cl, indicating clear further catch-up potential.

What Traded Most in 2025

When a market is rebuilding confidence, trading often concentrates on names that offer global recognition and reliable price discovery. The 2025 trading lists clearly show that.

Top 20 Traded Wines in 2025 by Total Value

| Rank | Wine | Region | Vintage | Liv-ex Market Price per 12 (GBP) |

|---|---|---|---|---|

| 1 | Chateau Mouton Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2016 | £5,208 |

| 2 | Chateau Lafite Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2018 | £5,000 |

| 3 | Chateau Lafite Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2019 | £4,380 |

| 4 | Chateau Lafite Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2016 | £5,200 |

| 5 | Louis Roederer, Cristal | Champagne | 2008 | £2,388 |

| 6 | Salon, Le Mesnil Grand Cru | Champagne | 2002 | £8,700 |

| 7 | Taittinger, Comtes de Champagne Blanc de Blancs Grand Cru | Champagne | 2006 | £1,020 |

| 8 | Dom Perignon | Champagne | 2008 | £1,750 |

| 9 | Dom Perignon | Champagne | 2013 | £1,390 |

| 10 | Petrus, Pomerol | Bordeaux | 2009 | £37,800 |

| 11 | Screaming Eagle, Cabernet Sauvignon, Oakville | United States | 2022 | £19,764 |

| 12 | Chateau Mouton Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2019 | £3,700 |

| 13 | Chateau Cheval Blanc, Saint-Emilion Grand Cru | Bordeaux | 2024 | £3,300 |

| 14 | Chateau Lafite Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2015 | £4,600 |

| 15 | Chateau Lafite Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2021 | £4,100 |

| 16 | Sassicaia, Tenuta San Guido, Bolgheri | Italy | 2016 | £3,397 |

| 17 | Chateau Mouton Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2005 | £4,990 |

| 18 | Chateau Haut-Brion Premier Cru Classe, Pessac-Leognan | Bordeaux | 2016 | £4,440 |

| 19 | Petrus, Pomerol | Bordeaux | 2005 | £36,161 |

| 20 | Chateau Margaux Premier Cru Classe, Margaux | Bordeaux | 2005 | £6,000 |

Top 20 Wine Trades in 2025 by Total Volume

| Rank | Wine | Region | Vintage | Liv-ex Market Price per 12 (GBP) |

|---|---|---|---|---|

| 1 | Taittinger, Comtes de Champagne Blanc de Blancs Grand Cru | Champagne | 2006 | £1,020 |

| 2 | Dom Perignon | Champagne | 2008 | £1,750 |

| 3 | Louis Roederer, Cristal | Champagne | 2008 | £2,388 |

| 4 | La Rioja Alta, 904 Gran Reserva, Rioja | Other | 2011 | £400 |

| 5 | Sena, Aconcagua Valley | Other | 2018 | £560 |

| 6 | Chateau Pontet-Canet 5eme Cru Classe, Pauillac | Bordeaux | 2019 | £562 |

| 7 | Taittinger, Comtes de Champagne Blanc de Blancs Grand Cru | Champagne | 2008 | £1,500 |

| 8 | Chateau d'Issan 3eme Cru Classe, Margaux | Bordeaux | 2016 | £375 |

| 9 | Chateau Mouton Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2016 | £5,208 |

| 10 | Chateau Pavie Premier Grand Cru Classe A, Saint-Emilion Grand Cru | Bordeaux | 2016 | £2,100 |

| 11 | Louis Roederer, Cristal | Champagne | 2012 | £1,600 |

| 12 | Biondi-Santi, Brunello di Montalcino | Italy | 2010 | £1,080 |

| 13 | Sassicaia, Tenuta San Guido, Bolgheri | Italy | 2018 | £1,940 |

| 14 | Chateau Figeac Premier Grand Cru Classe A, Saint-Emilion Grand Cru | Bordeaux | 2016 | £1,650 |

| 15 | Chateau Lafite Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2016 | £5,200 |

| 16 | Chateau Lafite Rothschild Premier Cru Classe, Pauillac | Bordeaux | 2019 | £4,380 |

| 17 | Dom Perignon | Champagne | 2013 | £1,390 |

| 18 | Chateau Pontet-Canet 5eme Cru Classe, Pauillac | Bordeaux | 2010 | £1,600 |

| 19 | Dom Perignon | Champagne | 2002 | £1,720 |

| 20 | Chateau Smith Haut Lafitte, Rouge Cru Classe, Pessac-Leognan | Bordeaux | 2019 | £680 |

By volume, Champagne occupied the top positions, with the top three wines trading well over 200 times in the last 12 months. The list also shows demand broadening beyond the traditional core, with Rioja’s presence underlining deepening interest and Seña 2018 trading frequently, a reminder that liquidity is not confined to the classic benchmarks when pricing is right.

Selective Confidence Returning?

After softer conditions in 2023 and 2024, 2025 delivered clearer evidence of renewed confidence in the auction market, particularly at the top end where provenance and scarcity carry the most weight.

Four sales captured the tone.

- Christie’s New York achieved approximately $28.8 million for The Cellar of William I. Koch, supported by strong bidding across mature Burgundy, large-format Bordeaux, and rare Champagne verticals.

- The 165th Hospices de Beaune auction reached approximately €18.75 million and was cited as the third-highest total in its history.

- Zachys’ Rare Bordeaux auction in New York achieved approximately $11.16 million, reflecting firm demand for pristine top-tier lots.

- Christie’s Hong Kong Luxury Week achieved approximately HK$72.9 million for the Joseph Lau Collection, delivering a white-glove result with every lot sold.

The takeaway is measured rather than exuberant. Buyers remained valuation-conscious, but competition returned where quality, provenance and rarity aligned.

Q4 Headline Trades & Market Signals

The final quarter of the year delivered several highly encouraging signals across the Cult Wines ecosystem, highlighting renewed engagement from investment clients, B2B partners, and private collectors across multiple regions.

Over recent months, we have seen a return of key buyers to the market, both in geographic breadth and in the calibre of wines transacted, with growing confidence at the very top end of the fine wine market.

- Seven-figure demand for Iconic Burgundy:

Aggregate sales exceeding £1.0 million in Domaine Leroy reaffirmed a sustained appetite for the most scarce and sought-after producers, particularly among long-term investment buyers. - Legendary Bordeaux moving internationally:

Two 12-bottle cases of Château Mouton Rothschild 1982 were successfully placed with collectors in the UAE, utilising our newly launched fine wine delivery service, highlighting both liquidity in blue-chip Bordeaux and growing demand from the Middle East. - New collector demand in Asia:

A mini-vertical of Domaine de la Romanée-Conti was sold to a first-time collector in mainland China, signalling continued expansion of high-end collecting in Asia and the emergence of the next generation of ultra-premium buyers.

Collectively, these transactions demonstrate not only the resilience of demand for the world’s most iconic wines, but also the increasingly global and diversified nature of fine wine buying activity across the Cult Wines ecosystem.

The Macro Backdrop

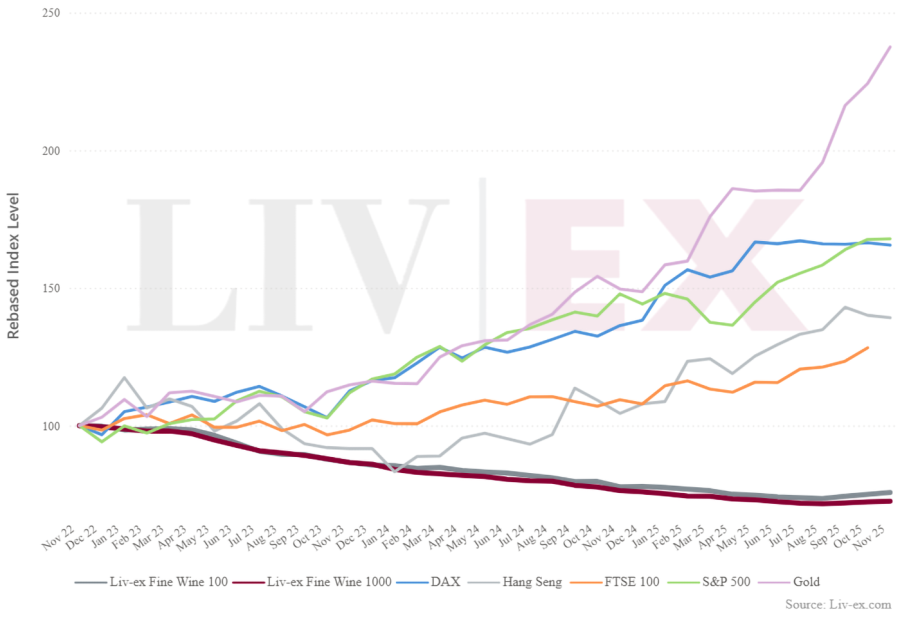

Fine wine does not trade in lockstep with equities, gold or crypto, and 2025 provided a sharp illustration of that divergence.

Liv-ex Indices vs Equities Since November 2022

While fine wine continued to work through its internal correction, equities and gold performed strongly over the period shown, while crypto remained volatile, with bitcoin’s decline erasing gains during the year.

The year also underscored how concentrated public-market leadership has become, with the “Magnificent Seven” accounting for 35.0% of the S&P 500’s total value as of 1 December 2025.

Hong Kong remained the most visible point of connection between macroeconomic strength and fine wine demand, with improved equity performance coinciding with firmer trade in top-end Burgundy and increased on-trade consumption, alongside excess regional stock beginning to deplete.

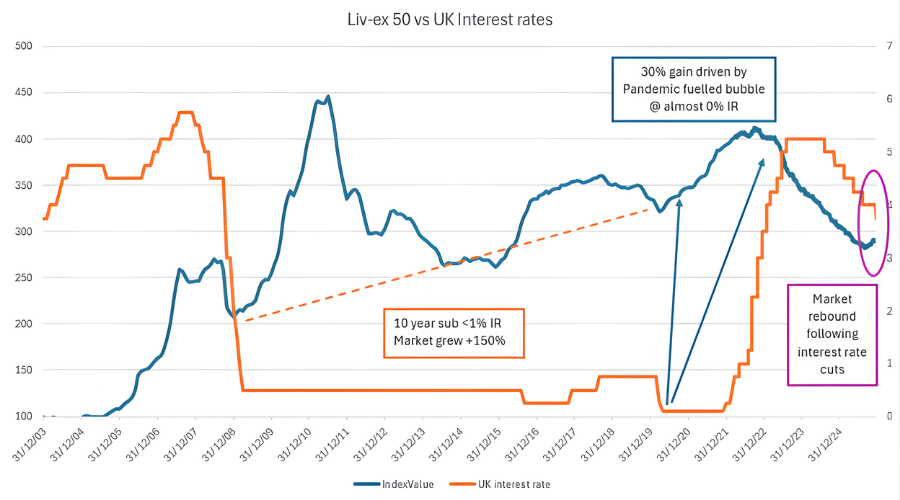

Why Falling Interest Rates Matter for Fine Wine?

With the US Federal Reserve and the Bank of England now beginning to cut interest rates, the backdrop for fine wine is becoming more supportive. In the US, the Fed recently cut the rate by a range of 3.5-3.75%, the lowest level in three years.

As rates fall, the real return on cash and savings erodes, prompting both investors and wine stockholders to redeploy capital.

This chart shows the close relationship between UK interest rates and fine wine prices (Liv-ex 50). Periods of low or falling interest rates have consistently supported strong price growth in fine wine, as investors look for real assets that preserve value when cash returns are weak.

When rates were below 1% for nearly a decade, the market rose sharply, and the pandemic-era near-zero rates fuelled a further surge. As rates increased rapidly from 2022, prices corrected. More recently, as interest rates peak and begin to ease, the market is showing early signs of stabilisation and recovery, reflecting renewed demand as cash returns come under pressure again. Read more about interest rates here.

Outlook for 2026

2025 closed with a better set of signals than it began with. Tariffs were absorbed without derailing global trading activity. Pricing levelled off, particularly in the upper tiers. Liquidity measures improved, with bid:offer ratios strengthening and spreads tightening. Transaction evidence showed more activity taking place close to, and in some cases above, market levels. Participation broadened across regions and buyer types.

From the perspective of Cult Wines, the most encouraging shift was the quality and breadth of engagement in the second half, with higher-quality enquiries, allocation requests, and first-time collector onboarding, with activity on CultX reflecting clearer price discovery in liquid names. The demand mix was broad, spanning established collectors, newer entrants, private buyers, trade accounts and digital-first investors.

The path ahead is unlikely to be linear, particularly given residual supply dynamics in parts of the market. The more relevant point is that, in 2025, the conditions that make recoveries durable were restored. Credible prices, improving liquidity, and broader participation are not guarantees of strong performance. They are, however, the foundations on which sustainable recoveries are usually built.

Opportunities & Challenges That Lie Ahead

After a prolonged correction, select areas of the fine wine market are beginning to look compellingly undervalued. Nowhere is this more evident than in Burgundy.

When scarcity is properly accounted for and viewed alongside recent pricing resilience, the region stands out as a clear opportunity. Burgundy buyers have not exited the market: prices for a broad cohort of producers have held firm into 2025, while white Burgundy has continued to outperform the broader market.

With the 2024 Burgundy En Primeur releases due in Q1, one of the world’s most important wine regions will return to centre stage. This creates a timely entry point, whether through selective participation in the 2024 campaign or by reallocating capital towards proven vintages from 2016–2020, where relative value remains attractive.

Looking ahead to the 2025 En Primeur release in Bordeaux, the vintage shows promise despite yields constrained by heat and drought. For the campaign to succeed, release pricing must be genuinely compelling, offering end consumers clear value relative to comparable back vintages already available in the market.

If broader market stability continues to return in Q1, a well-priced and disciplined EP campaign could act as a catalyst, helping move the fine wine market from stabilisation into its next phase of recovery.