February 2021 Fine Wine Market Snapshot

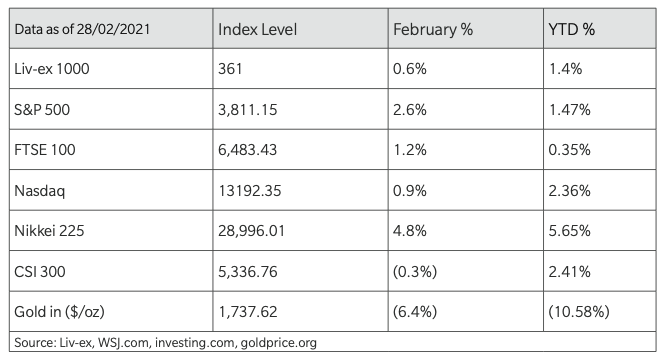

Fine wine markets posted positive returns in February with the Liv-ex 1000 index climbing 0.6% on the month, pushing its year-to-date gains to 1.4%. Optimism regarding coronavirus vaccine rollouts and an improving economic outlook supported sentiment, resulting in the most active month of trade ever, according to Liv-ex. Enthusiasm for the Burgundy 2019 en primeurs also fuelled the monthly activity and propped up the Burgundy 150 regional index, the top performing region in February.

Most global stock markets ended the month higher. The first half of the month saw a steady recovery as sentiment stabilised in the wake of January’s retail investor ‘short squeeze’ volatility. Vaccine rollouts, although uneven and still in early stages, added to the supportive backdrop.

However, equities came under pressure at the end of February. The volatility stemmed from rising inflation concerns due to the growing economic recovery, led by China, exerting upward pressure on commodity prices. This triggered a selloff in sovereign bond markets which began to price in a higher inflationary outlook and potential tighter monetary policies from major central banks. The 10-year US Treasury yield touched 1.50% for the first time in nearly a year. The curve steepened with the 30-year Treasury ending close to 2.20% after beginning the month around 1.85%.

The US dollar weakened amid the favourable backdrop earlier in the month when currencies of EM commodity producing countries showed strength. The greenback clawed back some of the losses late in the month. The British pound enjoyed a sustained rally, helped by the country’s quick start to its vaccine rollout.

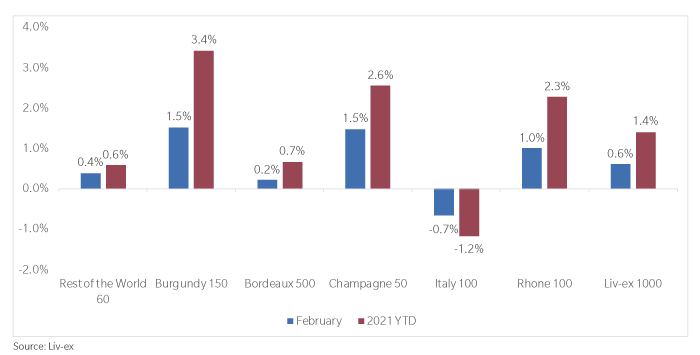

Fine wine regional breakdown

Burgundy continued its run of success. After rebounding in Q4 2020, the iconic region has seen two strong months to open the year after rising 1.5% in February. The 2019 en primeur campaign is undoubtedly a factor as most opinions view it as a high-quality vintage with relatively low volumes. Buyers could also be returning to the region following a period of price consolidation over the previous two years.

Champagne 50 also rose by 1.5% in February. The sparkling wine’s exemption from US tariffs could be a contributing factor to its recent success. The continued diversification of the global fine wine market is also bringing more investment interest to the region.

This diversification trend is also helping Rhone, which has jumped by 2.3% year-to-date. The region’s acclaimed recent vintages have generated increased trading activity.

Italy remains the only region in negative territory with two months of price declines to start 2021. Italy’s strong performance in 2020 is likely causing some short-term consolidation. The UK release of Tignanello 2018 and Biondi Santi 2015 and riserva 2013 could spur improvement in the coming weeks.

A major theme over the past month, and indeed the past year, has been the ongoing broadening of the fine wine market. Liv-ex reported that the Rest of the World 60 index has seen a near 200% year-on-year growth in value of its bids. Rhone and Champagne enjoyed notable rises as well with Australia, Germany and Spain also growing. We think this helps the fine wine market’s stability and growth potential as investors uncover new, often attractively valued, opportunities in smaller regions. The ROW 60 posted a 0.4% monthly price return in February.

Burgundy and Champagne maintain strong starts

Liv-ex 1000 and regional indices’ monthly returns