Monthly Market Review: The Journey to Recovery - January 2024

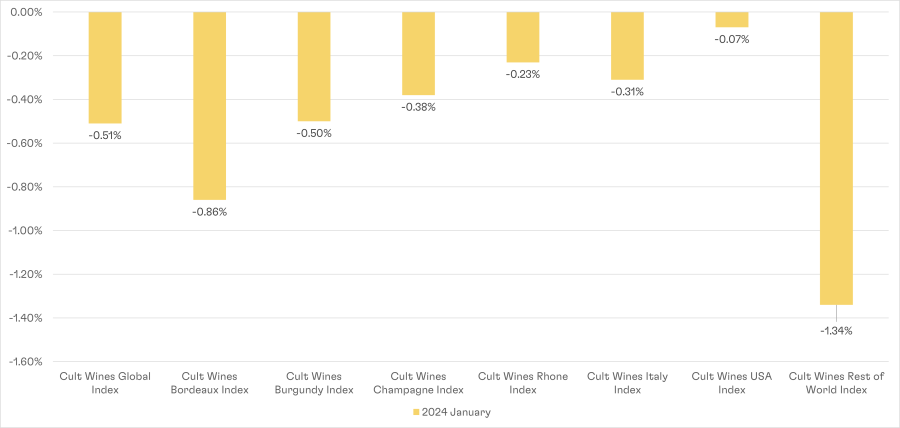

Cult Wines Indices – Returns as of 31 January 2024

Source: Pricing data as of 31 Jan 2024. Cult Wines Indices are are an objective measure of the global fine wine market based on Wine-Searcher pricing data and rebalanced annually based on strict liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

CW Global Index experienced a slight decline of -0.51% in January. Overall, January 2024 showed some improvement compared to the previous quarter, with most indices experiencing smaller declines.

The CW Burgundy (-0.5%) and CW Bordeaux (-0.86%) indices, while still negative, have shown signs of stabilisation with smaller losses in January compared to the previous quarter.

CW Champagne Index saw a marginal dip of -0.38%, while the CW Rest of World Index faced significant headwinds, dropping by -1.34%.

CW Rest of World Index continues to face challenges, experiencing a larger decline in January compared to other indices.

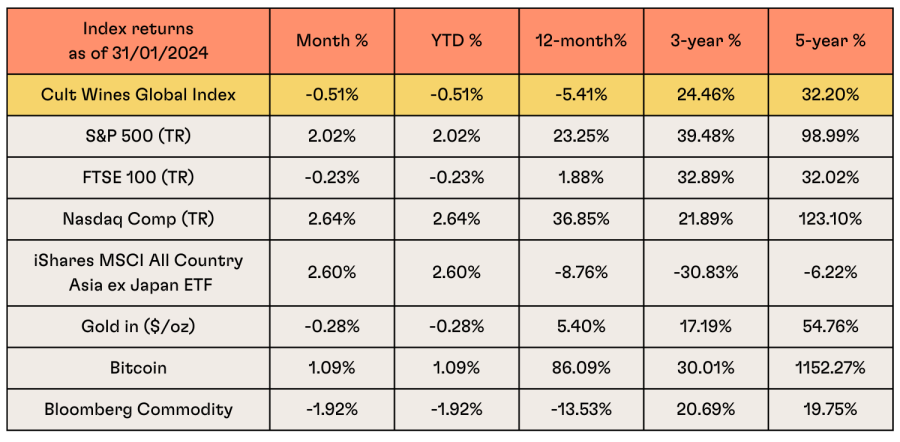

Macro Market Summary

Source: Investing.com, Wine-Searcher as of 31 Jan. 2024. Past performance is not indicative of future returns.

S&P 500 reached record highs in early January, driven by optimism surrounding a 'soft landing' scenario.

UK equities, represented by the FTSE 1000 (TR), experienced a 0.23% decline in January despite positive indicators such as a rise in flash composite PMI to 52.5 and consumer confidence reaching a two-year peak.

Global government bonds declined by 1.8% in the month, with UK Gilts performing notably poorly due to persistent services inflation and high wage growth, diminishing prospects of imminent rate cuts by the Bank of England (BoE).

In China, economic struggles persisted, with disappointing retail sales and housing activity; despite stimulus measures by PBOC, market expectations for economic revival remained unmet.

The broad Bloomberg Commodity Index experienced a 0.4% increase in January, indicating a positive performance in commodities; Oil prices surged due to escalating tensions in the Middle East and ongoing disruptions in shipping through the Suez Canal.

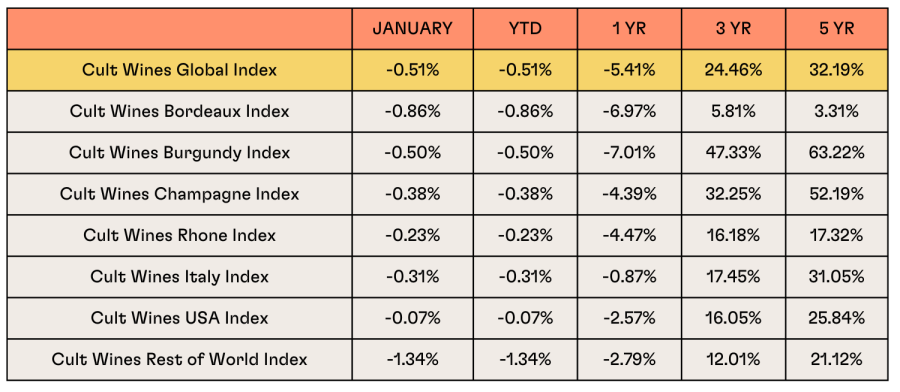

Regional Wine Market Performance

Source: Pricing data as of 31 January 2024. Cult Wines Indices are an objective measure of the global fine wine market based on Wine-Searcher pricing data and rebalanced annually based on strict liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

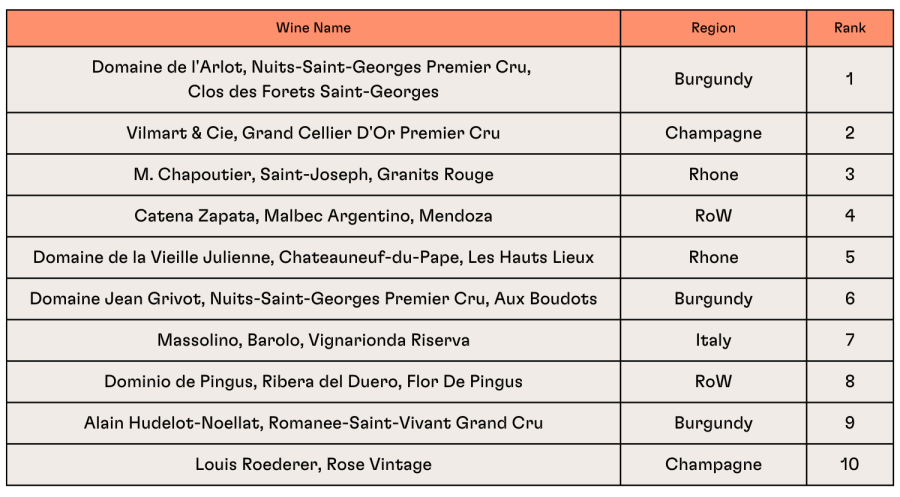

The Burgundy wine market experienced varied performances in the past month, showcasing both notable gains and losses among its top producers. Among the best performers were Alain Hudelot-Noellat's Romanee-Saint-Vivant Grand Cru vintages of 2017 and 2018, marking increases of 19% and 15% respectively. Additionally, Domaine Comte Georges de Vogue's Chambolle-Musigny Premier Cru vintages of 2015 and 2018 saw gains of 24% and 17%, along with Joseph Drouhin's Grands Echezeaux Grand Cru 2016, which surged by 30%. However, some producers faced declines, notably Domaine Leflaive's Puligny-Montrachet Premier Cru Les Pucelles 2010, which decreased by 30%, and Domaine Dujac's Charmes-Chambertin Grand Cru 2012, experiencing a decline of 25%.

Moving to Bordeaux, Rauza Segla's 2017 and 2014 vintages soared by 19% and 14%, signalling strong demand. Smith Haut Lafitte's 2015 vintage also impressed with a solid 10% increase. On the flip side, Le Petit Mouton 2008 took a 15% hit, while Carruades de Lafite 2015 and Leoville Barton 2018 dropped by 5% and 10% respectively. Overall, the Bordeaux market displayed a nuanced performance, reflecting varying sentiments across different producers and vintages.

Champagne witnessed a decline of 0.38% in Jan. Among the winners, Louis Roederer, Vintage Rosé demonstrated strong performance across multiple vintages (e.g., 2013 & 2008), registering positive gains throughout the year 2023. The returns across these vintages showcased the consistent appeal and market demand for the Louis Roederer brand. Similar to Louis Roederer, Egly-Ouriet, one of the fast-growing producers among the Grower Champagne category exhibited positive gains across its recent vintages, reflecting the enduring popularity of this producer in the market. Unfortunately, Dom Perignon faced challenges, with multiple vintages of its Rosé experiencing a notable decline of over 5% in Jan.

In January, the performance of the CW Italy Index remained relatively stable despite a slight dip of -0.31%. Noteworthy performers included Biondi-Santi's Brunello di Montalcino vintage 2008 & Vietti's Barolo Villero Riserva 2013, marking a 15% and 20% increase, respectively. Giuseppe Mascarello e Figlio's Barolo Monprivato 2016 saw a respectable rise of 12%. In addition, both Tuscany and Piedmont witnessed notable increases in their trade shares by value, according to Liv-ex. The trading share of Tuscany increased significantly from 7.5% to 10.8%, propelled by transactions involving wines from Tenuta San Guido and Ornellaia. Similarly, Piedmont witnessed a rise from 3.3% to 5.1% within the week, driven by the trading activity of wines from Giuseppe Rinaldi and Giacomo Conterno.

In contrast to Italy's increased trading momentum, the CW Rest of The World index experienced a monthly decline of 1.34%, signalling a challenging period for fine wines from other regions. Among the notable worst performers were various vintages of Penfolds' Grange from South Australia, witnessing an average decrease of 7%. Additionally, Artadi's Pagos Viejos from Rioja in the vintage 2009 and 2010 saw significant declines of over 15%, further indicating the struggles faced by some Spanish wines in the market. Moreover, Sena, spanning its recent five vintages, encountered a downturn averaging 5%.

Wine Performance League Table – YTD Return % Across Vintages

Source: Pricing data from Wine-Searcher as of 31 Jan. 2024. Based on average across all vintages of wines contained in Cult Wines Indices, which are rebalanced regularly based on strict, objective liquidity criteria. Prices calculated in GBP and results may vary in other currencies. Past performance is not a guarantee of future results.

Launched in December 2022, the Cult Wines Global Index and Cult Wines Regional Indices form benchmark measurements of the global fine wine market performance with historical data, powered by Wine-Searcher, going back to the beginning of 2014. The Indices are separate from Cult Wine Investment Performance which tracks wines purchased by Cult Wine Investment.

Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves risk of partial or full loss of capital. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wine Investment customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.